Anthem Revenue Grows on Government Business

January 27 2016 - 8:10AM

Dow Jones News

Health insurer Anthem Inc. on Wednesday posted a

better-than-expected increase in revenue in the final quarter of

the year, driven in part by strong performance in its

government-business segments.

The company also said it expects revenue for the 2016 year in

the range of $80 billion to $81 billion. Analysts polled by Thomson

Reuters were expecting $82.98 billion.

In the latest quarter, medical enrollment grew 2.9% from a year

earlier to about 38.6 million as of Dec. 31. Revenue in the

government-business segment jumped 17.4% to $10.6 million.

Anthem said the increase was driven by improved medical cost

performance in the Medicare business and enrollment increases in

the Medicaid business.

Enrollment in its commercial and specialty business edged up

1.1% from a year earlier to 29.68 million members, while members in

its government business grew 9.7% to 8.9 million.

Overall, the company posted a profit of $180.9 million, or 68

cents a share, down from $506.7 million, or $1.80 a share, a year

earlier. Anthem said results in the quarter included a net negative

adjustment of 46 cents a share, compared with six cents a share in

the same quarter last year. On an adjusted basis, earnings were

$1.14, down from $1.86. Revenue climbed 6.3% to $20.19 billion.

Analysts surveyed by Thomson Reuters forecast per-share earnings

of $1.22 on revenue of $19.90 billion.

Medicaid membership jumped 13.9% from the prior-year period to

5.91 million in the quarter. Revenue from premiums grew 6.6% to

$18.75 billion.

Anthem's medical benefit ratio—the amount of premiums used to

pay patient medical costs—was 87% in the fourth quarter, up from

84.5% a year earlier. The climb was largely driven by an increase

in the individual and local group businesses.

In July, Anthem agreed to buy Cigna Corp. for $48 billion,

capping months of merger frenzy among top U.S. health insurers that

is set to reshape the industry. The deal combines the second- and

fifth-largest health insurers by revenue and would create a company

with a huge footprint in commercial insurance, the type of coverage

provided to employers and consumers. Last month, Cigna shareholders

voted to approve the merger.

The biggest companies in the field are seeking more cost

efficiency and scale as the health-care landscape changes because

of the Affordable Care Act and other factors.

Shares of Anthem, which have fallen 4.8% over the past three

months, were inactive premarket at $137.76.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 27, 2016 07:55 ET (12:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

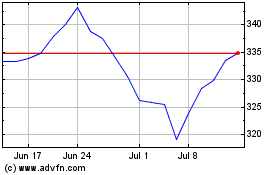

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

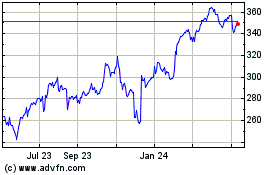

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024