By Liz Hoffman

Shares of some high-profile takeover targets are trading at

steep discounts to the prices of deals they signed, showing

fissures may lurk in the current deal boom.

Take Office Depot Inc. The company's stock trades 29% below the

price Staples Inc. agreed in February to pay for its smaller rival.

The gap has doubled since April, reflecting growing investor

worries that antitrust regulators will block a deal to combine the

country's two biggest office-supply chains.

Cigna Corp.'s stock is 22% below the value of Anthem Inc.'s $48

billion offer, while oil-field-services provider Baker Hughes Inc.

trades 17% cheaper than the price of its pending $35 billion sale

to Halliburton Co.

A few percentage points is a more typical discount.

These yawning gaps indicate investors think the transactions,

which have helped drive mergers-and-acquisitions volume to a record

pace, will be blocked or recut under pressure from regulators--or

take longer than expected to close.

Whether they are right is unclear. Investor sentiment isn't a

surefire proxy for a deal's chances of success, and indeed, fewer

agreed-upon deals have failed in 2015 than in any year since 1996,

according to Dealogic. There is also scant evidence that antitrust

regulators are challenging an abnormally high number of

mergers.

But investors who bet on mergers, known as arbitragers, have had

some high-profile setbacks.

After a merger is announced, arbs, as they are known on Wall

Street, typically buy shares of the target company and

simultaneously bet against the acquirer's stock, hoping to profit

as the discount narrows.

The funds can get stung in several ways. They can wager that an

announced deal will close, only to see antitrust officials reject

it. They also suffer paper losses when the discount on a deal they

are betting on widens.

These investors have seen their fair share of both lately.

Event-driven funds, which bet on mergers, spinoffs and other

corporate shake-ups, fell 1.4% on average through October, putting

them on track for their first losing year since 2011, according to

research firm HFR.

Many funds piled into a three-way takeover battle with Teva

Pharmaceutical Industries Ltd., Mylan NV and Perrigo Co., only to

see neither potential transaction materialize. Others wagered on

Yahoo Inc.'s spinoff of its stake in Alibaba Group Holding Ltd., a

bet that ran into trouble when regulators signaled they may not

give it the tax treatment the companies seek. Yahoo is moving ahead

with the spinoff.

Meanwhile, there have been signs that regulators take a dim view

of some of the big pending deals.

They are closely reviewing both Anthem's deal for Cigna and the

$34 billion proposed tie-up of Aetna Inc. and Humana Inc. Together,

the two deals would trim the number of big health insurers from

five to three.

Antitrust officials have also spent longer than expected

reviewing Halliburton's proposed deal for Baker Hughes, which would

combine two of the three largest providers of oil-field services.

The Federal Trade Commission has delayed its ruling on

Staples-Office Depot as it seeks sworn testimony from others in

that market, The Wall Street Journal has reported.

There may be more than just antitrust concerns at play. Arbs

lately have had a lot of deals to choose from, with roughly $4

trillion struck world-wide this year, according to Dealogic. There

has been a particular surfeit of takeovers valued at more than $10

billion. That has caused the investors to stay away from some

deals, widening their discounts. The upshot is that investors are

taking the view that certain trades aren't worth the risk.

And some funds are shedding riskier investments like deal bets

amid broader market turmoil.

"It's ironic. This is the best arbitrage environment that's

existed in years, with so many big deals to choose from," said Ira

Gorsky, an analyst at research firm Elevation LLC. "But some things

haven't played out, and that's been devastating."

It is possible most or all of the deals in question will close

on their original terms and if so, arbitragers who brave the

current trend and pick the right ones stand to profit handsomely.

If, however, too many of them come undone, it could cause

executives contemplating deals to reconsider and threaten the

red-hot M&A market.

Regulators blocked Sysco Corp.'s purchase of US Foods Inc.

earlier this year, and are suing to stop Electrolux AB's deal for

General Electric Co.'s appliance unit. Takeovers of Time Warner

Cable Inc. and T-Mobile US Inc. fell apart amid pushback from

regulators.

That has stoked fear of a coming crackdown by competition

officials among arbs, said Beau Buffier, who heads the antitrust

group at law firm Shearman & Sterling LLP.

"We have seen some very prominent deals challenged or abandoned,

and that sticks in people's minds," he said.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 18, 2015 19:47 ET (00:47 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

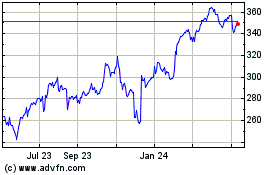

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

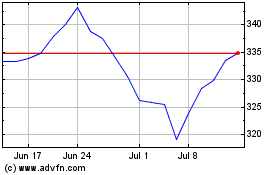

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024