2015 Credit Suisse Annual Health Care

Conference Joseph Swedish Chief Executive Officer Wayne DeVeydt Chief Financial Officer Doug Simpson Vice President, Investor Relations Filed by Anthem, Inc. (Commission File No. 001-16751) pursuant to Rule 425 under the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-6(b) under the Securities Exchange Act of 1934 Subject Company: Cigna Corporation Commission File No. 001-08323 Commission File No. for Registration Statement on Form S-4 filed by Anthem, Inc.: 333-207218

Safe Harbor Statement Under The Private

Securities Litigation Reform Act of 1995: The statements made during this presentation that are not historical facts are forward-looking statements within the meaning of the Federal securities laws, and may involve a number of risks and

uncertainties. Factors that could cause actual results to differ materially from expectations include, but are not limited to, the risks discussed in our most recent filings with the SEC, including our Annual Report on Form 10-K for the year ended

December 31, 2014. Non-GAAP Measures: This presentation references certain Non-GAAP measures. These Non-GAAP measures are intended to aid investors when comparing our financial results among periods. Reconciliations of these Non-GAAP measures to the

most directly comparable measures calculated in accordance with GAAP are available at www.antheminc.com. Safe Harbor Statement & Non-GAAP Measures

AGENDA Consumer Benefits of Cigna

Acquisition 2015 Financial Outlook Diversified Growth Focused on Affordability & Choice 3 Pillars – Focus on Strategic Imperatives

Commercial Government Commercial Government

Other Percentages calculated as a percent of total operating revenue. Anthem Business Continues to Diversify

Innovative Solutions Driving Affordability

& Choice Leadership position in advancing provider collaboration and new payment models Proven health and wellness programs Local focus advancing affordability Technology centric investments across industry’s largest base of membership

Enhanced administrative efficiency Comprehensive product and funding offerings Serving employer-sponsored, individual, state and federal government customers Breadth of served segments addresses evolving needs of consumers over their lifetime

Diverse value based specialty products Affordability Choice

3 Pillars – Focus on Strategic

Imperatives Provider Collaboration Managing Total Cost of Care Consumer Centricity

Assessing Excess Health Care Costs Category

Sources Estimate of Excess Costs Unnecessary Services Overuse—beyond evidence-established levels Unnecessary choice of higher-cost services $210 billion Inefficiently Delivered Services Mistakes—errors, preventable complications Care

fragmentation Unnecessary use of higher-cost providers $130 billion Excess Administrative Costs Insurers’ administrative inefficiencies Inefficiencies due to care documentation requirements $190 billion Prices That Are Too High Service prices

beyond competitive benchmarks Product prices beyond competitive benchmarks $105 billion Missed Prevention Opportunities Primary prevention Secondary prevention $55 billion Fraud All sources—payers, clinicians, patients $75 billion Source:

Institute of Medicine; “Better Care at Lower Cost: The Path to Continuously Learning Health Care in America”

Increasing Provider Collaboration to Drive

Affordability 2,250 designations Blue Distinction Centers of Excellence 796 hospitals >75% of Commercial inpatient admissions Hospital Payment for Quality and Safety 4.2 million members Attributed to Anthem’s Enhanced Personal Health Care

Program 55,000 providers In Enhanced Personal Health Care Program and Comprehensive Primary Care Initiative Contracts 150 health systems Accountable Care Organizations All value-based contracts $50B; 53% of total medical spend Data as of October

2015

fewer acute inpatient admits per 1,000 7.8%

fewer inpatient days per 1,000 5.7% PMPM decrease in outpatient surgery costs 5.1% decrease in ER costs, and a 1.6% decrease In ER utilization 3.5% $9.51 PMPM GROSS SAVINGS OVER THE FIRST YEAR (3.3%) NET SAVINGS $6.62 PMPM $36M IN SHARED SAVINGS

PAID TO PROVIDERS (year 1 and early adopters) Encouraging Results from Enhanced Personal Health Care Program Quality driven Coordinated Knowledge exchange Value-based reimbursement Membership experience

EPHC Drives Differentiated Member

Experience Patients get appointments for urgent care right away Physicians and staff are attentive, thorough and available Patients feel more respected and satisfied CAHPS-PCMH is utilized for patient experience Change in member experience scores,

2013-2014 Comparative member experience scores 2013-2014

Managing Total Cost of Care Emerging

technology Fraud & waste Specialty drugs ER utilization Imaging High-cost conditions Social/ behavioral

Understanding Consumer Preferences

experiences customers value most experience enhancements most impactful at critical interactions interactions that impact those experiences the most 1 2 Experiences Interactions Feeling confident you are covered and will be taken care of in the

event of a health issue Understanding your costs and coverage so there aren’t any negative surprises when you need to use your benefits Minimal interaction with your insurer, except when you have a question or an issue arises – then high

engagement through personalized, effortless service is demanded We are focused on the primary drivers of great experiences Top drivers Top touchpoints Top concepts Confidence in coverage Clarity in coverage Ease of getting help Innovations 3

Acquisition of Cigna Brings Together

Complementary Businesses Affordability: Most recognizable brand Local focus A leading Commercial franchise Strong Public Exchange execution A leading and growing Medicaid franchise A leading Medicare Supplement and improving Medicare Advantage

business Well-positioned for Dual Eligible opportunity Choice: Anthem Cigna Strong Commercial player with broad geographic coverage Middle Market ASO/Stop Loss solutions A leading Specialty capability (Behavioral Health, Dental, Pharmacy, Disability

& Life) Proven wellness programs Medicare position with leading physician-engagement model Differentiated International businesses Diversified and Complementary Platforms

Acquisition Advances Affordability,

Quality and Choice Affordability Quality Choice / Personalization Provider Collaboration Managing Total Cost of Care Consumer Centricity Data and Insights Talent

2015 Shaping Up to be Another Strong

Year Adjusted EPS** of a range of $10.10 - $10.20 Operating cash flow >$3.5 billion 38.3 – 38.5 million members by 12/31/15 Benefit expense ratio of 82.9% +/- 30 bps Continued strong Commercial & Government segment results Solid

membership growth Robust Medicaid performance *Estimated based on projections as of 10/28/15. **Adjusted EPS is a non-GAAP measure. Refer to slide 17 for a reconciliation to the most directly comparable measure calculated in accordance with GAAP.

FY15 Outlook* Solid 3Q15 Results

We have referenced "Adjusted Net Income

Per Diluted Share" (or “Adjusted EPS”), a non-GAAP measure, in this document. This non-GAAP measure is intended to aid investors and analysts when comparing our financial results among periods. Management also uses this measure as a

basis for evaluating performance, allocating resources, forecasting future operating periods and setting incentive compensation targets. A reconciliation of this measure to the most directly comparable measure calculated in accordance with GAAP is

presented below. For additional details, refer to our earnings results press releases and SEC filings, including but not limited to our Annual Report on Form 10-K for the year ended December 31, 2014, and our Quarterly Report on Form 10-Q for the

three months ended September 30, 2015, available at www.antheminc.com. *Estimated based on projections as of 10/28/15. GAAP Reconciliation Full Year 2015 Outlook Net income per diluted

share $9.53 - $9.63 Add / (Subtract) - net of related tax effects: Net realized gains on investments ($0.30) Other-than-temporary impairment losses on investments $0.13 (Gain)/Loss on

extinguishment of debt $0.00 Transaction related costs ~$0.20 Amortization of other intangible assets ~$0.54 Net adjustment items ~$0.57 Adjusted net income per diluted share

$10.10 - $10.20

This communication does not constitute

an offer to sell or a solicitation of an offer to sell or a solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended, and otherwise in accordance with applicable law. The proposed transaction between Anthem, Inc. (“Anthem”) and Cigna Corporation (“Cigna”) will be submitted to Anthem’s and Cigna's shareholders for

their consideration. In connection with the transaction, Anthem has filed with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, including Amendment No. 1 thereto, containing a joint proxy

statement of Anthem and Cigna that also constitutes a prospectus of Anthem. The registration statement was declared effective by the SEC on October 26, 2015. Each of Anthem and Cigna will commence mailing the definitive joint proxy

statement/prospectus to its shareholders on or about October 28, 2015. This communication is not a substitute for the registration statement, definitive joint proxy statement/prospectus or any other document that Anthem and/or Cigna have filed or

may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF ANTHEM AND CIGNA ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR

ENTIRETY AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the registration statement containing the definitive joint proxy statement/prospectus and other

documents filed with the SEC by Anthem or Cigna through the web site maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Anthem are available free of charge on Anthem’s internet website at

http://www.antheminc.com or by contacting Anthem’s Investor Relations Department at (317) 488-6390. Copies of the documents filed with the SEC by Cigna are available free of charge on Cigna’s internet website at http://www.cigna.com or

by contacting Cigna’s Investor Relations Department at (215) 761-4198. Anthem, Cigna and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of

proxies in respect of the proposed transaction. You can find information about Anthem’s executive officers and directors in Anthem’s annual report on Form 10-K for the year ended December 31, 2014 and its definitive proxy statement filed

with the SEC on April 1, 2015. You can find information about Cigna’s executive officers and directors in Cigna’s annual report on Form 10-K for the year ended December 31, 2014 and its definitive proxy statement filed with the SEC on

March 13, 2015. Additional information regarding the interests of such potential participants is contained in the definitive joint proxy statement/prospectus of Anthem and Cigna filed with the SEC. You may obtain free copies of these documents using

the sources indicated above. Important Information for Investors and Shareholders

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995 This document, and oral statements made with respect to information contained in this communication, contain certain forward-looking information about Anthem, Inc. (“Anthem”), Cigna Corporation

(“Cigna”) and the combined businesses of Anthem and Cigna that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. Forward-looking

statements are statements that are not generally historical facts. Words such as “expect(s),” “feel(s),” “believe(s),” “will,” “may,” “anticipate(s),” “intend,”

“estimate,” “project” and similar expressions (including the negative thereof) are intended to identify forward-looking statements, which generally are not historical in nature. These statements include, but are not limited

to, statements regarding the merger between Anthem and Cigna; Anthem’s financing of the proposed transaction; the combined company’s expected future performance (including expected results of operations and financial guidance); the

combined company’s future financial condition, operating results, strategy and plans; statements about regulatory and other approvals; synergies from the proposed transaction; the combined company’s expected debt-to-capital ratio and

ability to retain investment grade ratings; the closing date for the proposed transaction; financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future

operations, products and services; and statements regarding future performance. Such statements are subject to certain known and unknown risks and uncertainties, many of which are difficult to predict and generally beyond Anthem’s and

Cigna’s control, that could cause actual results and other future events to differ materially from those expressed in, or implied or projected by, the forward-looking information and statements. These risks and uncertainties include: those

discussed and identified in Anthem’s and Cigna’s public filings with the U.S. Securities and Exchange Commission (the “SEC”); those relating to the proposed transaction, as detailed from time to time in Anthem’s and

Cigna’s filings with the SEC; increased government participation in, or regulation or taxation of health benefits and managed care operations, including, but not limited to, the impact of the Patient Protection and Affordable Care Act and the

Health Care and Education Reconciliation Act of 2010, or Health Care Reform; trends in health care costs and utilization rates; our ability to secure sufficient premium rates including regulatory approval for and implementation of such rates; our

participation in the federal and state health insurance exchanges under Health Care Reform, which have experienced and continue to experience challenges due to implementation of initial and phased-in provisions of Health Care Reform, and which

entail uncertainties associated with the mix and volume of business, particularly in Individual and Small Group markets, that could negatively impact the adequacy of our premium rates and which may not be sufficiently offset by the risk

apportionment provisions of Health Care Reform; our ability to contract with providers consistent with past practice; competitor pricing below market trends of increasing costs; reduced enrollment, as well as a negative change in our health care

product mix; risks and uncertainties regarding Medicare and Medicaid programs, including those related to non-compliance with the complex regulations imposed thereon and funding risks with respect to revenue received from participation therein; our

projected consolidated revenue growth and global medical customer growth; a downgrade in our financial strength ratings; litigation and investigations targeted at our industry and our ability to resolve litigation and investigations within

estimates; medical malpractice or professional liability claims or other risks related to health care services provided by our subsidiaries; our ability to repurchase shares of its common stock and pay dividends on its common stock due to the

adequacy of its cash flow and earnings and other considerations; non- compliance by any party with the Express Scripts, Inc. pharmacy benefit management services agreement, which could result in financial penalties; our inability to meet customer

demands, and sanctions imposed by governmental entities, including the Centers for Medicare and Medicaid Services;

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995 events that result in negative publicity for us or the health benefits industry; failure to effectively maintain and modernize our information systems and e-business organization and to maintain good

relationships with third party vendors for information system resources; events that may negatively affect Anthem’s licenses with the Blue Cross and Blue Shield Association; possible impairment of the value of our intangible assets if future

results do not adequately support goodwill and other intangible assets; intense competition to attract and retain employees; unauthorized disclosure of member or employee sensitive or confidential information, including the impact and outcome of

investigations, inquiries, claims and litigation related to the cyber attack Anthem reported in February 2015; changes in the economic and market conditions, as well as regulations that may negatively affect our investment portfolios and liquidity;

possible restrictions in the payment of dividends by our subsidiaries and increases in required minimum levels of capital and the potential negative effect from our substantial amount of outstanding indebtedness; general risks associated with

mergers and acquisitions; various laws and provisions in Anthem’s governing documents that may prevent or discourage takeovers and business combinations; future public health epidemics and catastrophes; and general economic downturns.

Important factors that could cause actual results and other future events to differ materially from the forward-looking statements made in this communication are set forth in other reports or documents that Anthem and/or Cigna may file from time to

time with the SEC, and include, but are not limited to: (i) the ultimate outcome of the proposed transaction, including the ability to achieve the synergies and value creation contemplated by the proposed transaction, (ii) the ultimate outcome and

results of integrating the operations of Anthem and Cigna, (iii) disruption from the merger making it more difficult to maintain businesses and operational relationships, (iv) the risk that unexpected costs will be incurred in connection with the

proposed transaction, (v) the timing to consummate the proposed transaction, (vi) the possibility that the proposed transaction does not close, including, but not limited to, due to the failure to satisfy the closing conditions, including the

receipt of required regulatory approvals and the receipt of approval of both Anthem’s and Cigna’s shareholders, and (viii) the risks and uncertainties detailed by Cigna with respect to its business as described in its reports and

documents filed with the SEC. All forward-looking statements attributable to Anthem, Cigna or any person acting on behalf of Anthem and/or Cigna are expressly qualified in their entirety by this cautionary statement. Readers are cautioned not to

place undue reliance on these forward- looking statements that speak only as of the date hereof. Except to the extent otherwise required by federal securities law, neither Anthem nor Cigna undertake any obligation to republish revised

forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events or the receipt of new information. Readers are also urged to carefully review and consider the various

disclosures in Anthem’s and Cigna’s SEC reports.

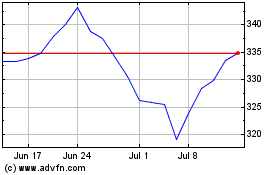

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

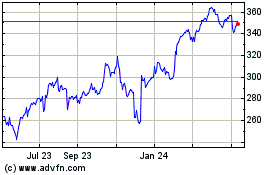

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024