Aetna, Anthem Defend Insurance Deals

September 22 2015 - 12:50PM

Dow Jones News

The chief executives of Aetna Inc. and Anthem Inc. defended

their planned deals before a Senate subcommittee, facing sharply

critical testimony that raised questions about the impact of

health-insurance consolidation.

Aetna is seeking to acquire Humana Inc., in a $34 billion

transaction focused largely on the private Medicare plans known as

Medicare Advantage. Anthem is aiming to take over Cigna Corp. in a

$48 billion deal. The two mergers together would have the effect of

shrinking the top five health insurers to a big three, each with

annual revenue of more than $100 billion. The third player would be

UnitedHealth Group Inc.

In their own testimony before the Senate Judiciary antitrust

subcommittee, Mark T. Bertolini of Aetna and Joseph R. Swedish of

Anthem emphasized that health care is delivered largely on a local

basis, and they argued markets would remain competitive if their

deals closed. Both also said their deals would benefit consumers

and encourage new forms of payment to health-care providers.

Mr. Bertolini said only 8% of Medicare beneficiaries would get

coverage from the combined Aetna-Humana and "robust competition

will remain in the Medicare market." Mr. Swedish said Anthem and

Cigna had "very limited and in most cases no market overlap."

But other witnesses were skeptical about the benefits of the

deals. Leemore Dafny, a professor at Northwestern University's

Kellogg School of Management, said consumers are "paying a premium

on our premium" because of lack of competition among insurers.

Richard J. Pollack, the chief executive of the American Hospital

Association, said the group was concerned the insurance deals would

lead to fewer choices and higher costs for consumers.

Sen. Al Franken of Minnesota, a Democrat, grilled the two

insurance CEOs on whether they would commit to passing along the

savings their deals achieve to consumers, asking repeatedly for a

pledge. After the question was repeated three times, Mr. Bertolini

said the "savings will be passed along in the price of our

products." Mr. Swedish also promised savings. But Sen. Franken

noted that he ran out of time to continue, and said, "We could have

gone quicker if those answers were yes."

Quizzed about rules tied to its status as a Blue Cross and Blue

Shield license holder, Mr. Swedish said that the combined company

would maintain the Cigna brand in competing for national employer

business, and in markets other than the 14 states where it is a

Blue plan. The deal "would in fact make the Cigna brand stronger

nationally," he said.

Mr. Pollack of the hospital association argued the Cigna deal

would "add to Blue dominance." Ms. Dafny said Anthem and Cigna

would be "the same entity" and she didn't "see how that would be

competition."

Sen. Amy Klobuchar, a Minnesota Democrat, asked the two CEOs to

explain "why you have to have these mergers to get to where you

want to be?" Aetna's Mr. Bertolini acknowledged that his company

could eventually reach its goals without the merger, but said it

would take years longer. Mr. Swedish emphasized the cost savings

and synergies his deal would bring.

Sen. Orrin Hatch (R., Utah) asked about statistical data showing

the insurance markets would be more concentrated after the merger.

Mr. Bertolini said market concentration was just one measure. As he

looked at markets where Aetna and Humana compete, "we see plenty of

competition, we see plenty of entrants," he said.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Brent

Kendall at brent.kendall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 22, 2015 12:35 ET (16:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

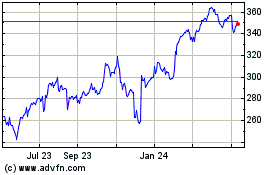

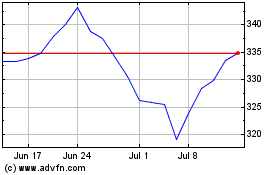

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024