A.M. Best Assigns Debt Rating to Cigna Corporation’s Senior Unsecured Notes

March 12 2015 - 10:22AM

Business Wire

A.M. Best has assigned a debt rating of “bbb” to the $900

million 3.25% 10-year senior unsecured notes recently issued by

Cigna Corporation (Cigna) (Bloomfield, CT) (NYSE:CI). The

assigned outlook is positive. Cigna’s existing issuer credit and

debt ratings are unchanged.

A.M. Best expects the proceeds from the sale of the notes to be

utilized to fully redeem Cigna’s $600 million 2.75% senior notes

due 2016 and $251 million 8.50% senior notes due 2019. As Cigna

intends to call the notes, the redemption price will include a

make-whole premium of approximately $85 million.

A.M. Best notes that Cigna’s financial leverage will be

minimally impacted and is expected to remain in the 30% range in

the near to medium term. Additionally, the enterprise’s financial

flexibility remains sound and interest coverage is expected to

remain above 10 times.

Cigna’s ratings reflect its diversified business profile,

favorable strategic position within the health insurance market,

strong financial performance and good level of risk-adjusted

capital. The organization continues to strengthen its position as

one of the leading providers of health, group life and disability

benefits. Cigna’s relatively low exposure to commercial full-risk

and individual business provides a competitive advantage, as the

impact of changes and potential membership losses related to the

Patient Protection and Affordable Care Act (ACA) implementation are

significantly smaller in comparison with its peers. In addition,

Cigna’s proven ability to offer Administrative Services Only

solutions for the middle market has become an engine for growth, as

smaller employers are looking to transition to self-funded

plans.

Partially offsetting these strengths is earnings pressure in

Cigna’s Global Health Care segment due to ACA fees, increased

competition and lower Medicare Advantage reimbursement levels. In

addition, Cigna experienced unfavorable financial results in its

new individual exchange business in 2014. However, the exchange

membership remains small and is not likely to grow substantially in

2015 following pricing actions and product modifications.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- Analyzing Insurance Holding Company

Liquidity

- Insurance Holding Company and Debt

Ratings

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

A.M. Best CompanyDoniella Pliss, (908) 439-2200, ext.

5104Senior Financial

Analystdoniella.pliss@ambest.comorAndrew Edelsberg, CPA,

FLMI, (908) 439-2200, ext. 5182Vice

Presidentandrew.edelsberg@ambest.comorChristopher Sharkey,

(908) 439-2200, ext. 5159Manager, Public

Relationschristopher.sharkey@ambest.comorJim Peavy, (908)

439-2200, ext. 5644Assistant Vice President, Public

Relationsjames.peavy@ambest.com

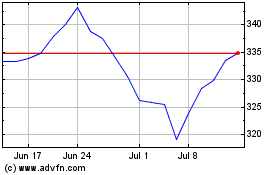

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

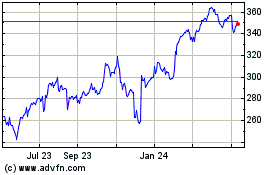

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024