SEPTEMBER 28, 2016

2016 INVESTOR &

ANALYST EVENT

PROFITABLE GROWTH AND

VALUE CREATION

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements contained herein may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our current views with respect to certain

events that could have an effect on our future financial performance, including but without limitation, statements regarding our plans, objectives,

and future success of our store concepts, the implementation of our previously announced restructuring program, and implementation of our

program to increase the sales volume and profitability of our existing brands through four previously announced focus areas. These statements

may address items such as future sales, gross margin expectations, SG&A expectations, operating margin expectations, planned store openings,

closings and expansions, future comparable sales, inventory levels, and future cash needs. These statements relate to expectations concerning

matters that are not historical fact and may include the words or phrases such as "expects," "believes," "anticipates," "plans," "estimates,"

"approximately," "our planning assumptions," "future outlook," and similar expressions. Except for historical information, matters discussed in such

oral and written statements are forward-looking statements. These forward-looking statements are based largely on information currently available

to our management and on our current expectations, assumptions, plans, estimates, judgments and projections about our business and our

industry, and are subject to various risks and uncertainties that could cause actual results to differ materially from historical results or those

currently anticipated. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of

performance and there are a number of known and unknown risks, uncertainties, contingencies, and other factors (many of which are outside our

control) that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, there

is no assurance that our expectations will, in fact, occur or that our estimates or assumptions will be correct, and we caution investors and all

others not to place undue reliance on such forward-looking statements. Factors that could cause or contribute to such differences include, but are

not limited to, general economic and business conditions, conditions in the specialty retail industry, the availability of quality store sites, the ability

to successfully execute our business strategies, the ability to achieve the results of our restructuring program, the ability to achieve the results of

our four focus areas, the integration of our new management team, and those described in Item 1A, “Risk Factors” and in the “Forward-Looking

Statements” disclosure in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K.

There can be no assurance that the actual future results, performance, or achievements expressed or implied by such forward-looking statements

will occur. Investors using forward-looking statements are encouraged to review the Company's latest annual report on Form 10-K, its filings on

Form 10-Q, management's discussion and analysis in the Company's latest annual report to stockholders, the Company's filings on Form 8-K, and

other federal securities law filings for a description of other important factors that may affect the Company's business, results of operations and

financial condition. All written or oral forward-looking statements that are made or attributable to us are expressly qualified in their entirety by this

cautionary notice. The Company does not undertake to publicly update or revise its forward looking statements even if experience or future

changes make it clear that projected results expressed or implied in such statements will not be realized.

2

Safe Harbor

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

3

Today’s Speakers

Todd Vogensen

Chief Financial Officer

Shelley Broader

Chief Executive Officer

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

4

Discussion Agenda

Welcome / Introduction

(Shelley Broader) I

We are Well-Positioned for Profitable Growth and Value Creation

(Shelley Broader) II

Sharpening Our Financial Principles

(Todd Vogensen) III

Wrap-Up

(Shelley Broader) IV

Q&A V

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

$1,358m

53%

$871m

34%

$332m

13%

5

602 boutiques across the U.S.,

Canada and Puerto Rico2

118 outlets2

47 Chico’s franchise locations in Mexico2

432 boutiques across the U.S.,

Canada and Puerto Rico2

72 outlets2

274 boutiques across the U.S.

and Puerto Rico2

19 outlets2

31 franchise locations in Mexico2

Intimate apparel

brand that caters to a

vastly underserved

intimates market

focusing on women

35+ years

Aspirational and

sophisticated

styles fill a niche for

fashionable women

35+ years

Chico’s FAS Has a Powerful Portfolio of Brands, Providing a

Platform for Profitable Growth and Value Creation

Iconic brand

with a cult-like

following of

loyal customers

of women 45+

years

1 FY2015 Sales. % of total sales excludes Boston Proper

2 Store count as of Q2 2016

1

1

1

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

0-4 10-1420-2430-3440-4450-5460-6470-7480-8490-94

2000 2015

6

1 Source: US Department of Commerce, Goldman Sachs Global Investment Research.

2 Source: Department of Labor, Goldman Sachs Global Investment Research.

Our Target Customers Represent the Largest Age Cohorts

and Have Significantly More Wealth

48 %

94 %

123 % 124 %

111 %

84 %

58 %

0.0 %

20 %

40 %

60 %

80 %

100 %

120 %

140 %

<25 25-34 35-44 45-54 55-64 65-74 75+

Share of Population by Age1 % of Average Income by Age2

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We Are Addressing the Needs of a New Consumer…

Access to

Information

Shopping

from

Anywhere

Instant

Gratification

Spending

on

Experiences

The New

Consumer

Consumers are less likely

to wait for an out-of-stock

item, preferring to pay a

premium for instant

gratification

Culture of immediate access to information, driven

by new technologies and platforms designed to

bring consumer convenience to new heights

Easy access to

information, higher

guarantee of availability

and, most importantly,

convenience have all

contributed to the rise of

shopping from anywhere

7

Prioritization of

personal

experiences has led

to increased focus

on improving the

shopping

experience

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

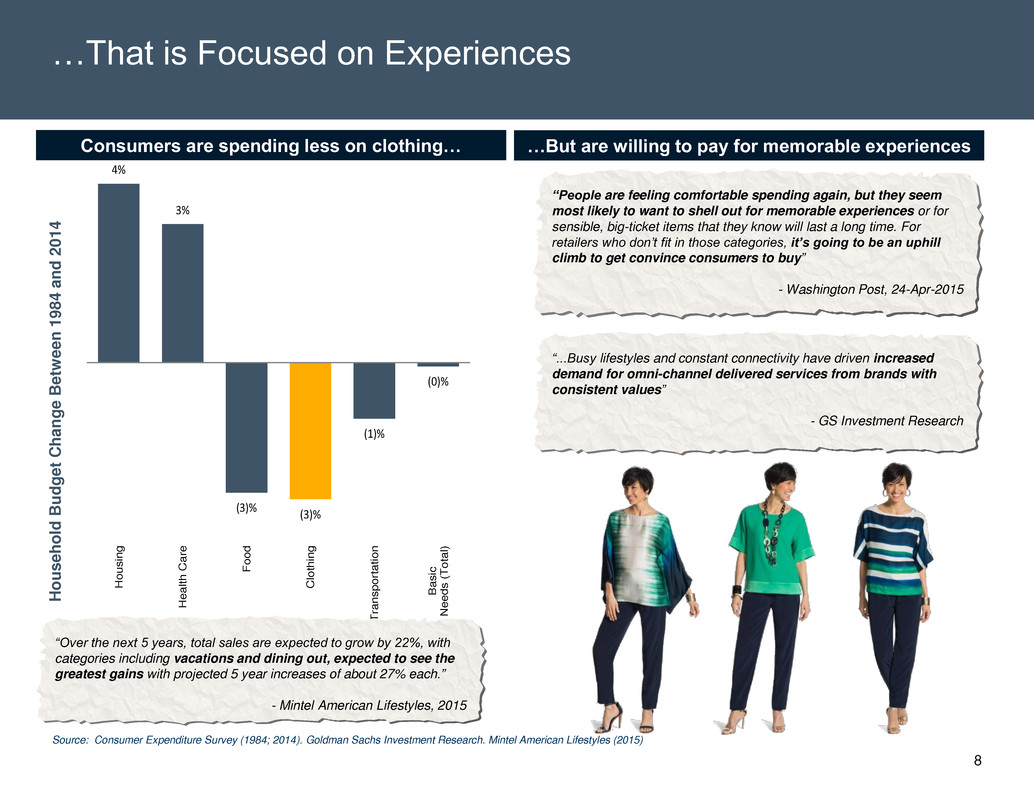

4%

3%

(3)%

(3)%

(1)%

(0)%

Ho

u

s

in

g

He

a

lt

h

C

a

re

F

o

o

d

Cl

o

th

in

g

Tr

a

n

s

p

o

rt

a

ti

o

n

B

a

s

ic

Ne

e

d

s

(

T

o

ta

l)

Consumers are spending less on clothing…

Source: Consumer Expenditure Survey (1984; 2014). Goldman Sachs Investment Research. Mintel American Lifestyles (2015)

8

H

o

u

s

e

h

o

ld

B

u

d

get

C

han

g

e

B

et

w

e

en

1

9

8

4

and

2

0

1

4

“People are feeling comfortable spending again, but they seem

most likely to want to shell out for memorable experiences or for

sensible, big-ticket items that they know will last a long time. For

retailers who don’t fit in those categories, it’s going to be an uphill

climb to get convince consumers to buy”

- Washington Post, 24-Apr-2015

“...Busy lifestyles and constant connectivity have driven increased

demand for omni-channel delivered services from brands with

consistent values”

- GS Investment Research

…That is Focused on Experiences

“Over the next 5 years, total sales are expected to grow by 22%, with

categories including vacations and dining out, expected to see the

greatest gains with projected 5 year increases of about 27% each.”

- Mintel American Lifestyles, 2015

…But are willing to pay for memorable experiences

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

9

Phase I

Development of four focus areas to drive profitable growth

and value creation

Phase II

Executing on cost savings initiatives and preparing Chico’s

FAS for the third phase

Phase III

Defining and igniting new sources of revenue for our iconic

brands

We Are Transforming Our Company to Win in the Future in

Three Phases

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

…And Are Making Progress on Our New Strategy

We are executing on our cost reduction and operating efficiency initiatives

We have redesigned our organizational structure to make us more nimble and responsive to our

customers’ needs

We are laying the groundwork for Phase III, defining and igniting new sources of revenue

10

We Are Well Positioned for Profitable Growth and Value

Creation…

We are confident in our future and pleased with our progress

Shareholder value creation through capital return

Intensified financial discipline

Leading omni-channel capabilities

Three powerful, differentiated brands that

serve attractive consumer segments with moderate to

high income levels

Loyal customer base we know well through

capturing customer information on over 90% of our

transactions

Commitment to service that we believe is unique

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

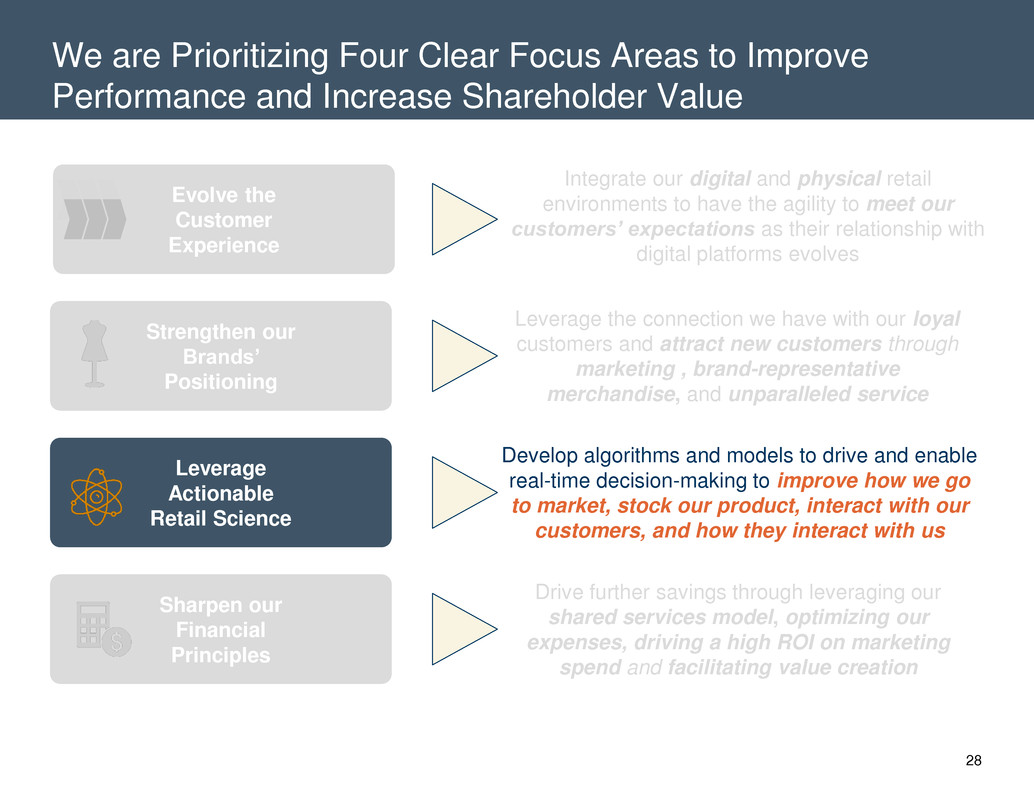

We Have Prioritized Four Clear Focus Areas to Improve

Performance and Increase Shareholder Value

11

Evolve the

Customer

Experience

Integrate our digital and physical retail

environments to have the agility to meet our

customers’ expectations as their relationship

with digital platforms evolves

Strengthen our

Brands’

Positioning

Leverage the connection we have with our loyal

customers and attract new customers through

marketing, brand-representative merchandise,

and unparalleled service

Leverage

Actionable

Retail Science

Develop algorithms and models to drive and enable

real-time decision-making to improve how we go

to market, stock our product, interact with our

customers and how they interact with us

Sharpen our

Financial

Principles

Drive further savings through leveraging our

shared services model, optimizing our

expenses, driving a high ROI on marketing

spend and facilitating value creation

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

12

Discussion Agenda

Welcome / Introduction

(Shelley Broader) I

We are Well-Positioned for Profitable Growth and Value Creation

(Shelley Broader) II

Sharpening Our Financial Principles

(Todd Vogensen) III

Wrap-Up

(Shelley Broader) IV

Q&A V

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We are Prioritizing Four Clear Focus Areas to Improve

Performance and Increase Shareholder Value

13

Evolve the

Customer

Experience

Integrate our digital and physical retail

environments to have the agility to meet our

customers’ expectations as their relationship with

digital platforms evolves

Strengthen our

Brands’

Positioning

Leverage the connection we have with our loyal

customers and attract new customers through

marketing , brand-representative

merchandise, and unparalleled service

Leverage

Actionable

Retail Science

Develop algorithms and models to drive and enable

real-time decision-making to improve how we go

to market, stock our product, interact with our

customers, and how they interact with us

Sharpen our

Financial

Principles

Drive further savings through leveraging our

shared services model, optimizing our

expenses, driving a high ROI on marketing

spend and facilitating value creation

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

14

At Chico’s FAS, We Are Focused on Delivering the

Amazing Experience That Sets our Brands Apart

Unique

Fashion

Differentiated

Service

Value

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

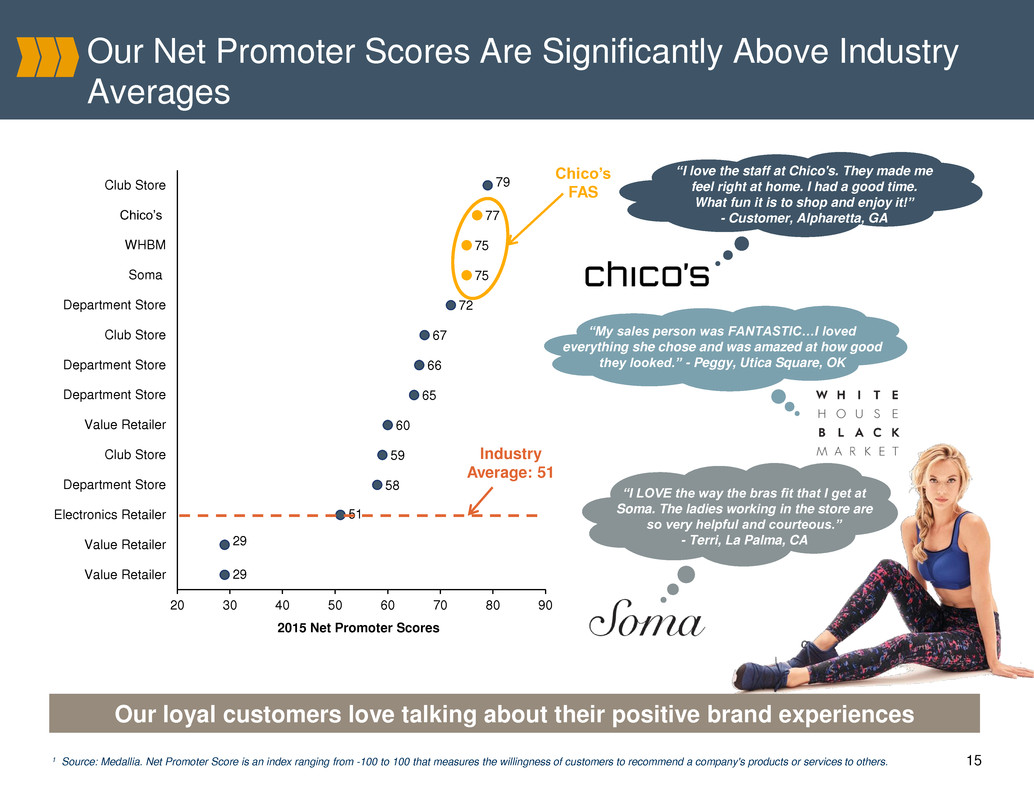

15

Our loyal customers love talking about their positive brand experiences

79

77

75

75

72

67

66

65

60

59

58

51

29

29

20 30 40 50 60 70 80 90

Club Store

Chico’s

WHBM

Soma

Department Store

Club Store

Department Store

Department Store

Value Retailer

Club Store

Department Store

Electronics Retailer

Value Retailer

Value Retailer

2015 Net Promoter Scores

1 Source: Medallia. Net Promoter Score is an index ranging from -100 to 100 that measures the willingness of customers to recommend a company's products or services to others.

Our Net Promoter Scores Are Significantly Above Industry

Averages

Industry

Average: 51

Chico’s

FAS

“I love the staff at Chico's. They made me

feel right at home. I had a good time.

What fun it is to shop and enjoy it!”

- Customer, Alpharetta, GA

“My sales person was FANTASTIC…I loved

everything she chose and was amazed at how good

they looked.” - Peggy, Utica Square, OK

“I LOVE the way the bras fit that I get at

Soma. The ladies working in the store are

so very helpful and courteous.”

- Terri, La Palma, CA

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

16

The Future is the Intersection of Physical and Digital

Capture

Order

Optimize Source

Fulfill Support

Omni-Channel

Order Cycle

Continually Optimize

Omni-Channel Opportunities

Change algorithms to

drive revenue and margin

Optimizing operational

costs and inventory

Capture a customer’s order through

the store, web or contact center

Customer’s Order

May Require Support

Exchange, return, inquiry

Support from store and/or

contact center

Source the order

for fulfillment

Fulfill from the lowest-cost

location

Consider the fastest way

to get the customer her

order

Pick, Pack &

Ship the Order

From the DC, Stores, or

Ready for in-store pick-up

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

17

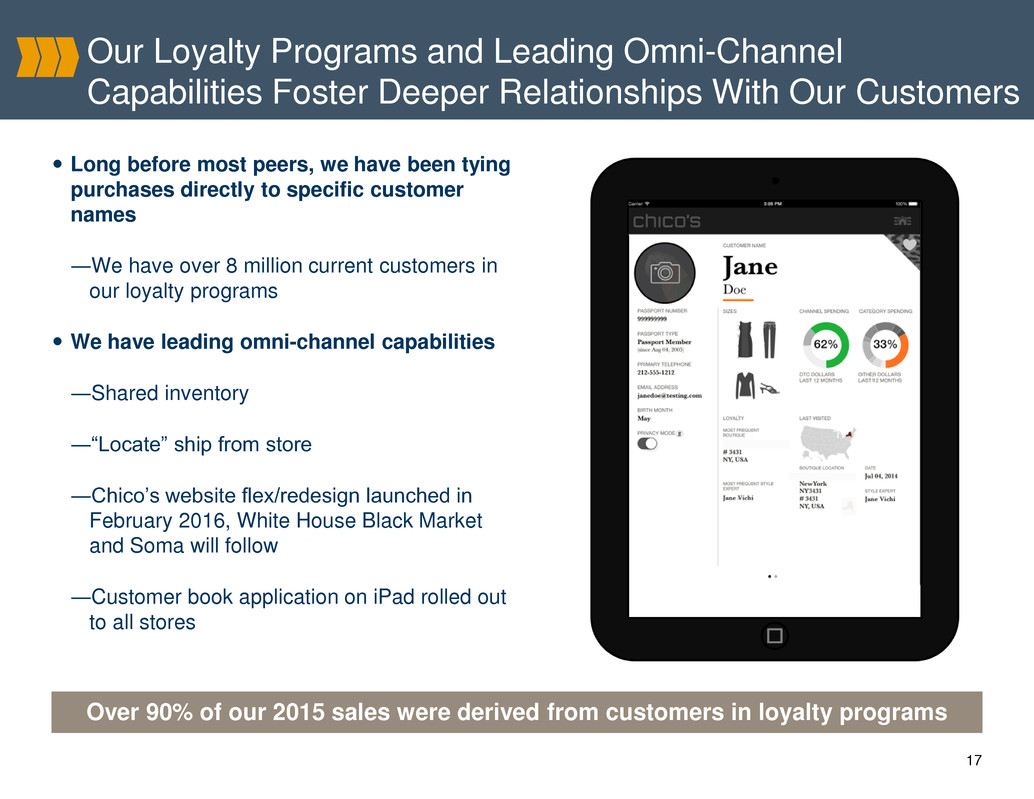

Our Loyalty Programs and Leading Omni-Channel

Capabilities Foster Deeper Relationships With Our Customers

Long before most peers, we have been tying

purchases directly to specific customer

names

―We have over 8 million current customers in

our loyalty programs

We have leading omni-channel capabilities

―Shared inventory

―“Locate” ship from store

―Chico’s website flex/redesign launched in

February 2016, White House Black Market

and Soma will follow

―Customer book application on iPad rolled out

to all stores

Over 90% of our 2015 sales were derived from customers in loyalty programs

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

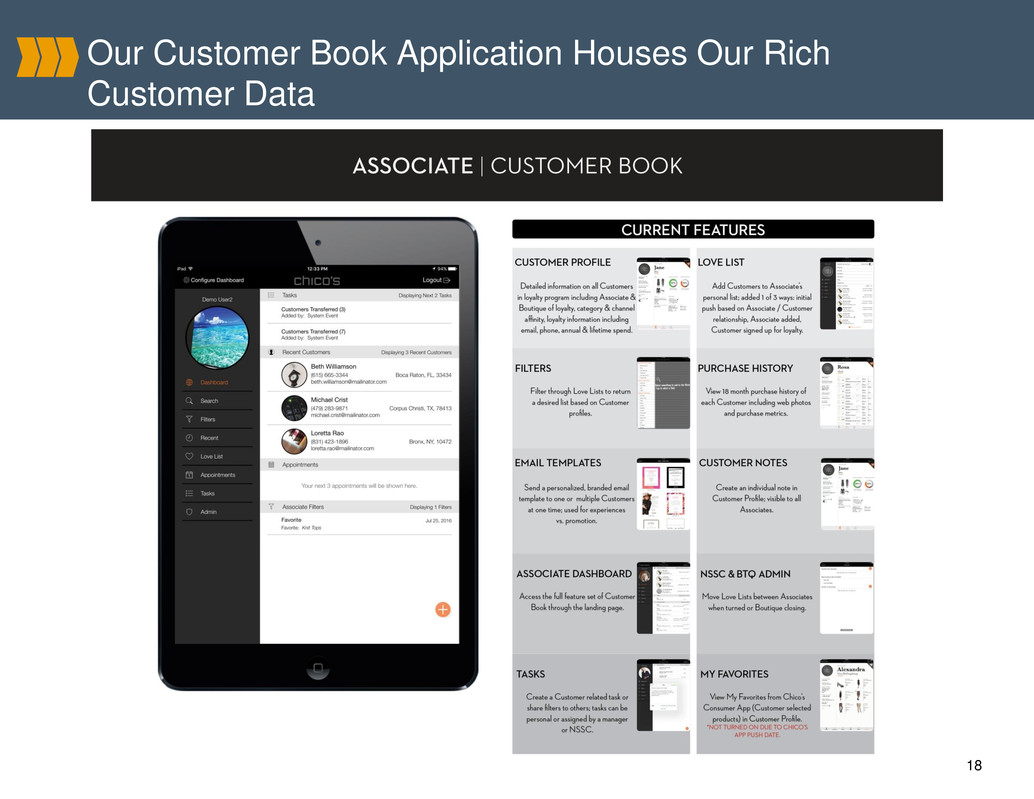

Our Customer Book Application Houses Our Rich

Customer Data

18

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

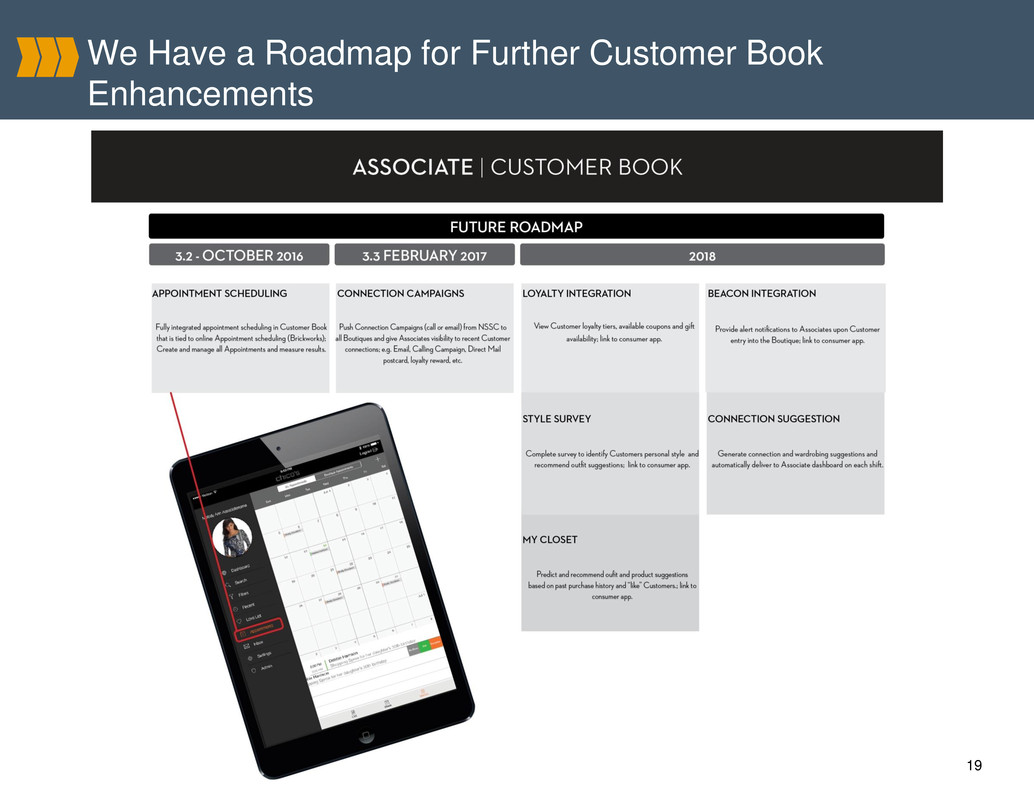

We Have a Roadmap for Further Customer Book

Enhancements

19

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We Are Continuously Taking Action to Expand Our Omni-

Channel Capabilities

Omni-Channel Fulfillment

20

Source: Shopatron Consumer Survey, Forrester Research).

Enterprise-Wide Inventory Visibility

• Expand on our Shared Inventory advantage

• Allow our customers to view SKU-level inventory visibility to store inventory

• This inventory visibility will also be leveraged to enable Locate, Ship from

Store and BOPIS

Order In Store

• Replaces our legacy Locate functionality

• Currently ~$85M business for Chico’s FAS

DCOM Ship from Store

• 1,500 available points of distribution to use in a strategic manner

• Optimize inventory at all locations

Buy Online Pickup In Store -OR- Reserve Online Purchase in Store

• New functionality to Chico’s FAS

• ~30% of BOPIS/ROPIS orders result in at least 1 additional unit being sold at

pick-up

Phase 1A

Roll out starting

in 2017,

Full roll-out in FY18

Phase 1B

Implement Q3 17

Phase 2

Pilot Q4 17,

Full roll-out in FY18

Phase 3

Pilot FY18,

Full roll-out in FY19

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We are Prioritizing Four Clear Focus Areas to Improve

Performance and Increase Shareholder Value

21

Evolve the

Customer

Experience

Integrate our digital and physical retail

environments to have the agility to meet our

customers’ expectations as their relationship with

digital platforms evolves

Strengthen our

Brands’

Positioning

Leverage the connection we have with our loyal

customers and attract new customers through

marketing, brand-representative merchandise,

and unparalleled service

Leverage

Actionable

Retail Science

Sharpen our

Financial

Principles

Drive further savings through leveraging our

shared services model, optimizing our

expenses, driving a high ROI on marketing

spend and facilitating value creation

Develop algorithms and models to drive and enable

real-time decision-making to improve how we go

to market, stock our product, interact with our

customers, and how they interact with us

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

How We Position Our Brand at Chico’s

22

Our Mission:

Give Women Confidence

in Their Style and Self-Expression

Our Promise:

Superior fit, comfort, and ease

Exceptional quality at an incredible value

Most amazing personal service,

everywhere, always

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

Our Initiatives and Product Strategy at Chico’s

23

Athleisure launch through

our Zenergy line

Revitalized

Traveler’s collection

Expansion of petite offerings

through 55 stores

Introduced our signature

Ultimate Fit Juliet ankle pant

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

How We Position Our Brand at White House Black Market

24

Our Mission:

Make Luxury Fashion Affordable

Our Promise:

Elevated, unique designs and curated

products that address the modern woman’s

multi-faceted lifestyle needs

Remarkable quality and fit at surprising

prices

Best-in-class, personalized service and

delighting, meaningful experiences

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

Our Initiatives and Product Strategy at White House Black

Market

25

Emphasizing design

element of brand

Expanding breadth and

versatility to increase

customer value

Re-claiming dress and special

occasion business

Known for affordable

designer denim

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

How We Position Our Brand at Soma

26

Our Mission:

At Soma, We Know That Beautiful

Begins Underneath

Our Promise:

Beautiful and sensual lingerie, loungewear

and beauty

Warm, personal service

Luxuriously soft fabrics, innovative fashion,

and an always perfect fit

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

Our Initiatives and Product Strategy at Soma

27

Launched sport collection to

capture athletic category

Expanded swim to all stores

Elevated and expanded dressy

sleepwear

Frequent new product launches

Balconet, Memorable, Sport and

Bralettes

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We are Prioritizing Four Clear Focus Areas to Improve

Performance and Increase Shareholder Value

28

Evolve the

Customer

Experience

Integrate our digital and physical retail

environments to have the agility to meet our

customers’ expectations as their relationship with

digital platforms evolves

Strengthen our

Brands’

Positioning

Leverage the connection we have with our loyal

customers and attract new customers through

marketing , brand-representative

merchandise, and unparalleled service

Leverage

Actionable

Retail Science

Develop algorithms and models to drive and enable

real-time decision-making to improve how we go

to market, stock our product, interact with our

customers, and how they interact with us

Sharpen our

Financial

Principles

Drive further savings through leveraging our

shared services model, optimizing our

expenses, driving a high ROI on marketing

spend and facilitating value creation

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

$0

$20

$40

$60

0 7 14 21 28 35 42 49 56 63 70 77 84 91 98 105 112 119 126

Number of days between each customer visit

$140

29

Customer Shopping Frequency

(Majority shopping every 5 – 8

weeks)

$0

$100

$200

$300

$400

$500

$600

Number of days between each customer visit

High Margin

Low Margin

Most Desirable

Customers Visit

once Every 7-10

Weeks

We Are Leveraging Rich Customer Shopping Data to

Define the Frequency of Fashion

$ Sale

s

($

in

millio

n

s

)

A

v

erage

$ Sale

s

($

in

millio

n

s

)

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

Our Segmentation Strategy Has Been Continuously Refined

and Made More Sophisticated with New Techniques…

30

As our strategy has evolved, informative uses have grown to encompass

product, pricing, promotions, positioning, media plans and more

Determine customer response

based on understanding

preference and motivation

Identify cross-sell opportunities

Attract, retain and grow most

valuable customers

Customers ranked on quarterly

spend, recency & frequency

Begin influencing product,

pricing & channel

Customers ranked on

annual spend

10 equally sized

“segments”

Directionally focusing

marketing spend

Customers grouped by sales/product

history & demographics

Enriched with psychographic

information

Influence sales by targeted messaging

with product, price, channel

and media plan differentiation

Future Goals Past Refinements

Our Segmentation Strategy Evolution:

The most amazing personal service starts with her!

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

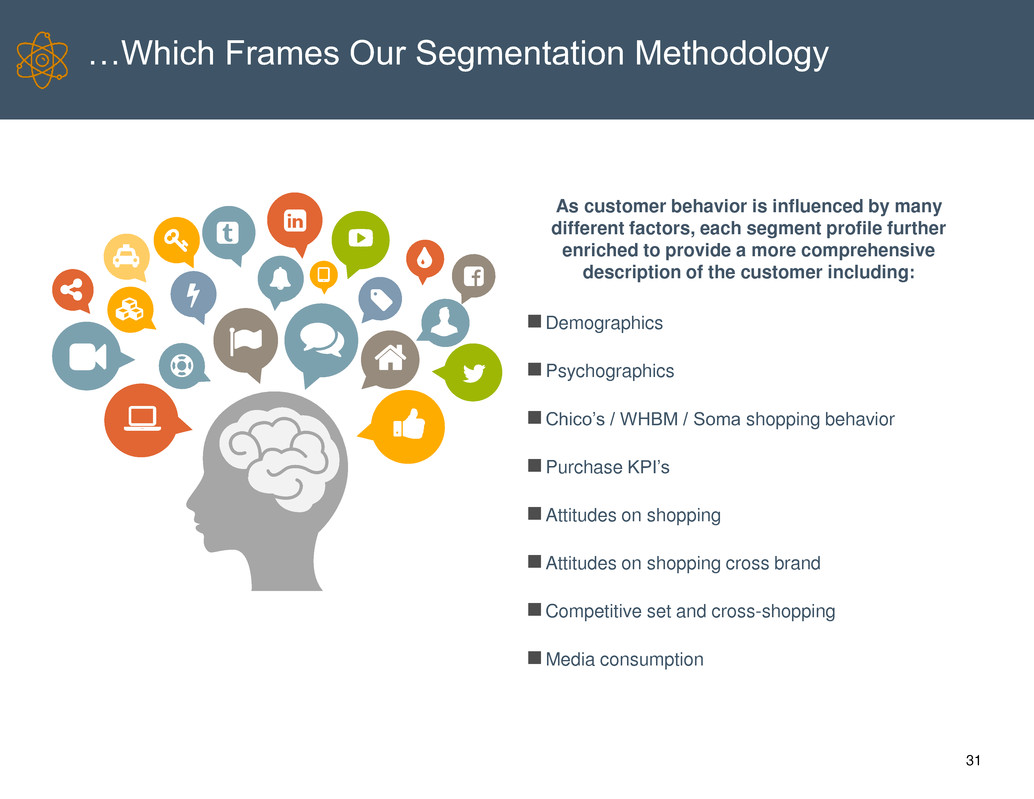

…Which Frames Our Segmentation Methodology

31

As customer behavior is influenced by many

different factors, each segment profile further

enriched to provide a more comprehensive

description of the customer including:

Demographics

Psychographics

Chico’s / WHBM / Soma shopping behavior

Purchase KPI’s

Attitudes on shopping

Attitudes on shopping cross brand

Competitive set and cross-shopping

Media consumption

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

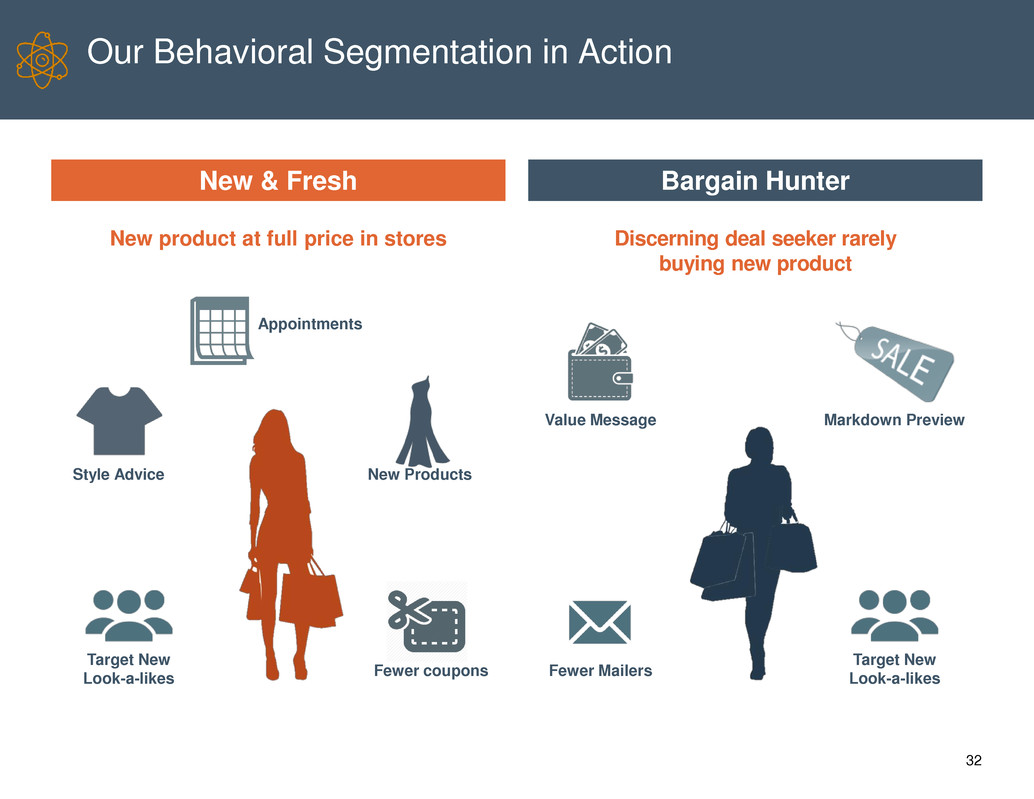

Our Behavioral Segmentation in Action

32

Discerning deal seeker rarely

buying new product

New product at full price in stores

New & Fresh Bargain Hunter

Appointments

Style Advice

Target New

Look-a-likes

Fewer coupons

Target New

Look-a-likes

Value Message

Fewer Mailers

Markdown Preview

New Products

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

33

Discussion Agenda

Welcome / Introduction

(Shelley Broader) I

We are Well Positioned for Profitable Growth and Value Creation

(Shelley Broader) II

Sharpening Our Financial Principles

(Todd Vogensen) III

Wrap-Up

(Shelley Broader) IV

Q&A V

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We are Prioritizing Four Focus Areas to Improve

Performance and Increase Shareholder Value

34

Evolve the

Customer

Experience

Integrate our digital and physical retail

environments to have the agility to meet our

customers’ expectations as their relationship with

digital platforms evolves

Strengthen our

Brands’

Positioning

Leverage the connection we have with our loyal

customers and attract new customers through

marketing , brand-representative

merchandise, and unparalleled service

Leverage

Actionable

Retail Science

Sharpen our

Financial

Principles

Drive further savings through leveraging our

shared services model, optimizing our

expenses, driving a high ROI on marketing

spend and facilitating value creation

Develop algorithms and models to drive and enable

real-time decision-making to improve how we go

to market, stock our product, interact with our

customers, and how they interact with us

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

Our Strong Inventory Management and Disciplined Capital

Expenditures

35

Focus on Inventory Management Chico’s FAS Capital Expenditures

Source: Company filings and Capital IQ

Note: $ in millions. Figures may not sum to total due to rounding.

$ 120

$ 85

$ 60

2014 2015 Estimated

2016

Capital expenditures have declined from 5% of sales

to approximately 2% in the second quarter of 2016

Despite a choppy macroeconomic environment,

inventory levels year over year continue to fall

$269

$238

$294

$235

$270

$239

$269

$234

$268

$236

Q1 Q2 Q3 Q4

2014 2015 2016

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

36

Our unique selling proposition makes the physical manifestation of our brands

important to us and our customers

Our customers are also interacting with us more through our online offerings, and thus,

we are investing more in our digital capabilities

―Total company DCOM penetration is approximately 19%

We are reducing and improving our overall store footprint to best serve our customers:

―Slowing square footage growth, including announcing plans to close

approximately 175 stores through 2017. These actions are expected to result in $65

million of cost savings, with approximately 84 stores closed to date, and

improved store productivity over time

Improving Our Store Productivity

Our loyal customers and ability to connect with them allows us to transfer around

50% of our sales from closed stores to other stores or channels 1 —

significantly higher than the 20-30% industry average

Source: based on APT customer analysis.

1 Stores closed 2015 through Q1’16

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

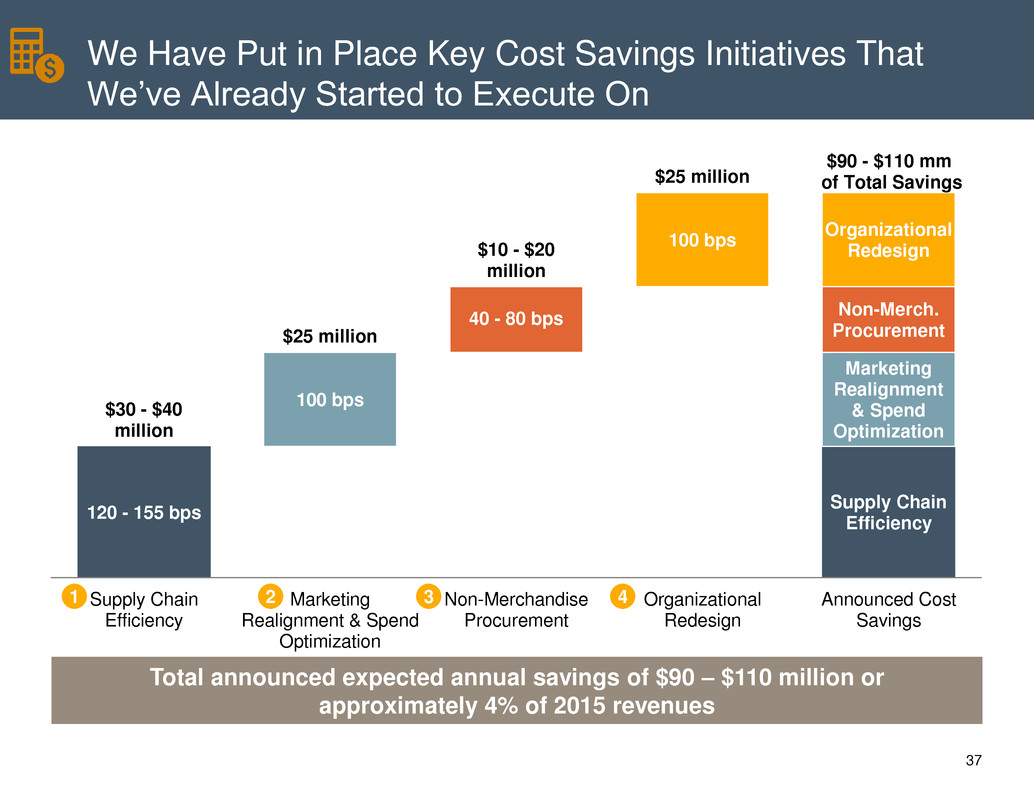

We Have Put in Place Key Cost Savings Initiatives That

We’ve Already Started to Execute On

Total announced expected annual savings of $90 – $110 million or

approximately 4% of 2015 revenues

37

1 2 3 4

120 - 155 bps

Supply Chain

Efficiency

$30 - $40

million

100 bps

40 - 80 bps

100 bps

Marketing

Realignment

& Spend

Optimization

Non-Merch.

Procurement

Organizational

Redesign

$25 million

$10 - $20

million

$25 million

Supply Chain

Efficiency

Marketing

Realignment & Spend

Optimization

Non-Merchandise

Procurement

Organizational

Redesign

Announced Cost

Savings

$90 - $110 mm

of Total Savings

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

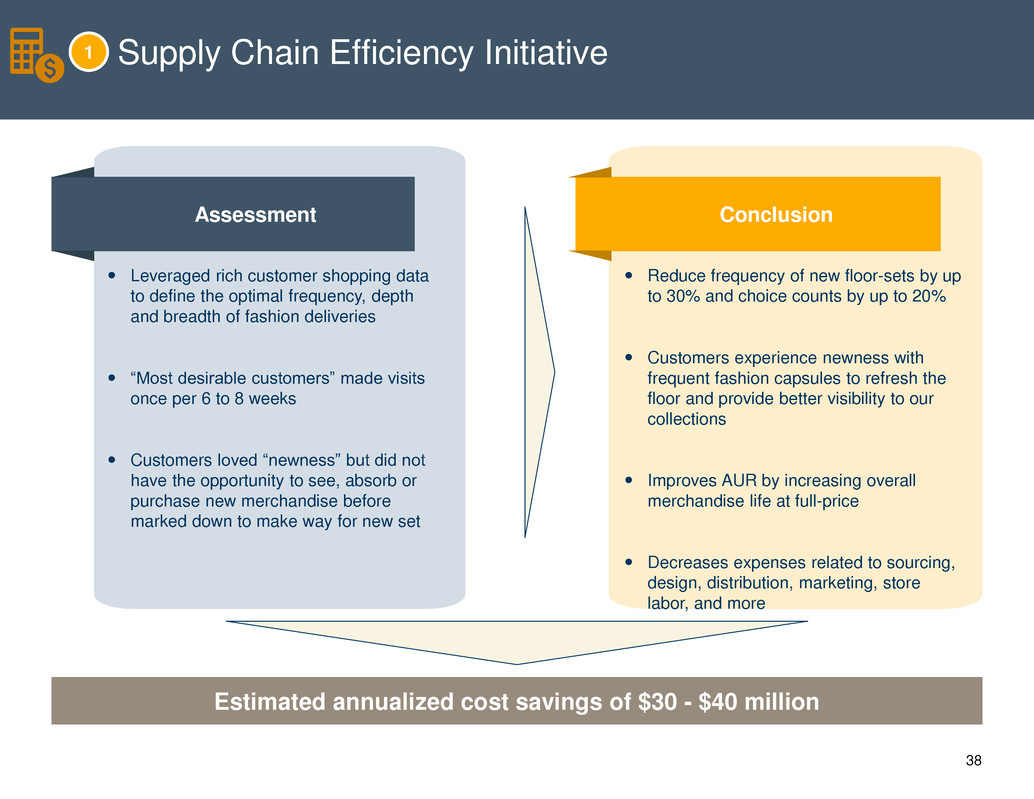

38

Estimated annualized cost savings of $30 - $40 million

Assessment

Leveraged rich customer shopping data

to define the optimal frequency, depth

and breadth of fashion deliveries

“Most desirable customers” made visits

once per 6 to 8 weeks

Customers loved “newness” but did not

have the opportunity to see, absorb or

purchase new merchandise before

marked down to make way for new set

Conclusion

Reduce frequency of new floor-sets by up

to 30% and choice counts by up to 20%

Customers experience newness with

frequent fashion capsules to refresh the

floor and provide better visibility to our

collections

Improves AUR by increasing overall

merchandise life at full-price

Decreases expenses related to sourcing,

design, distribution, marketing, store

labor, and more

Supply Chain Efficiency Initiative 1

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

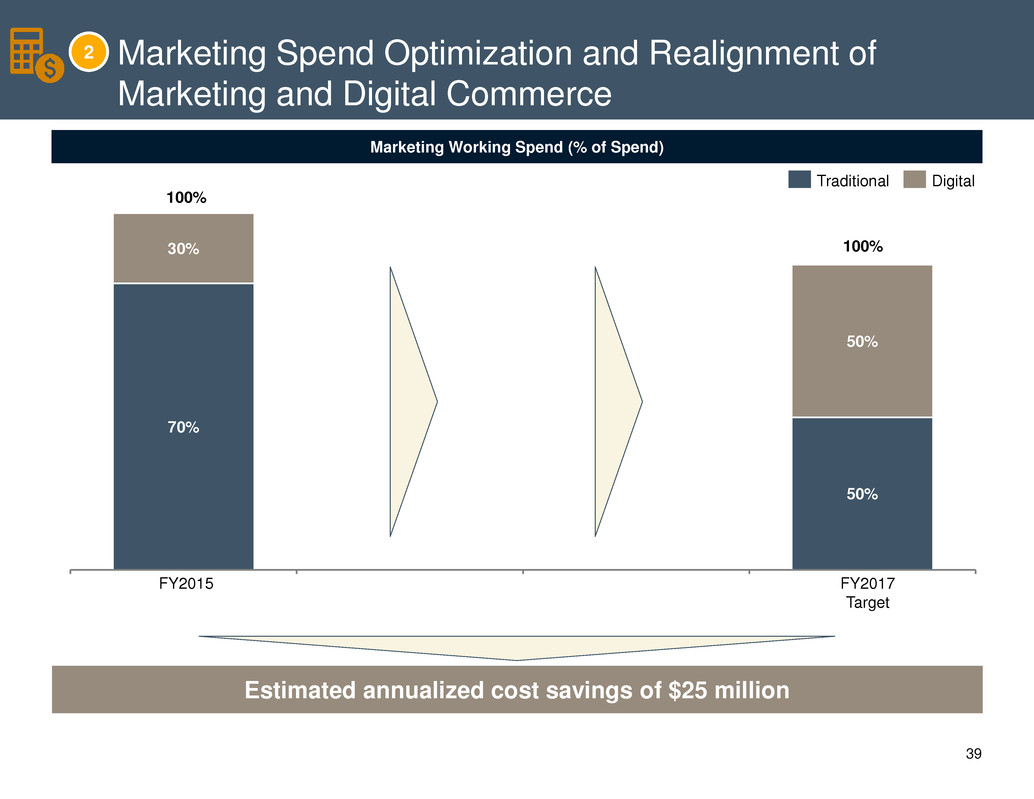

Marketing Spend Optimization and Realignment of

Marketing and Digital Commerce

39

Marketing Working Spend (% of Spend)

Estimated annualized cost savings of $25 million

70%

50%

30%

50%

Traditional Digital

100%

100%

FY2017

Target

FY2015

2

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

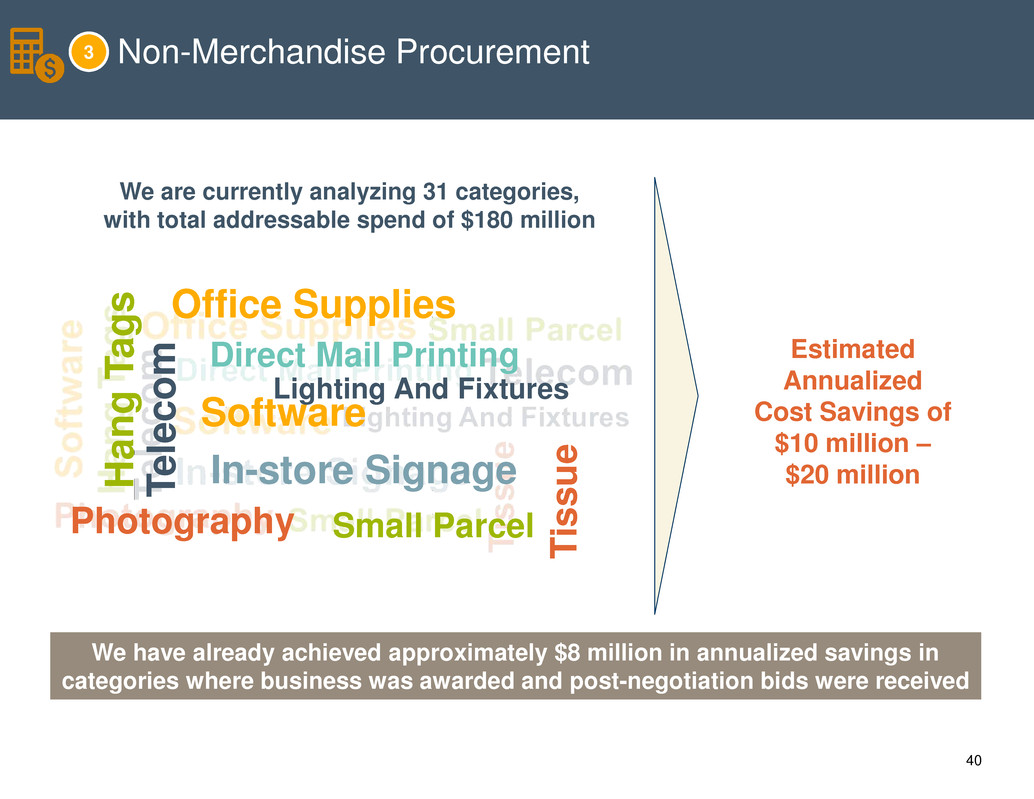

We have already achieved approximately $8 million in annualized savings in

categories where business was awarded and post-negotiation bids were received

Non-Merchandise Procurement 3

T

eleco

m

Software

T

is

s

u

e

Ha

n

g

T

ag

s

Photography

In-store Signage

Office Supplies

Small Parcel

Lighting And Fixtures

Direct Mail Printing

2016 non-merchandise spend is ~$560 million

We are currently analyzing 31 categories, with total addressable spend of $180

million

Estimated

Annualized

Cost Savings of

$10 million –

$20 million

We are currently analyzing 31 categories,

with total addressable spend of $180 million

40

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

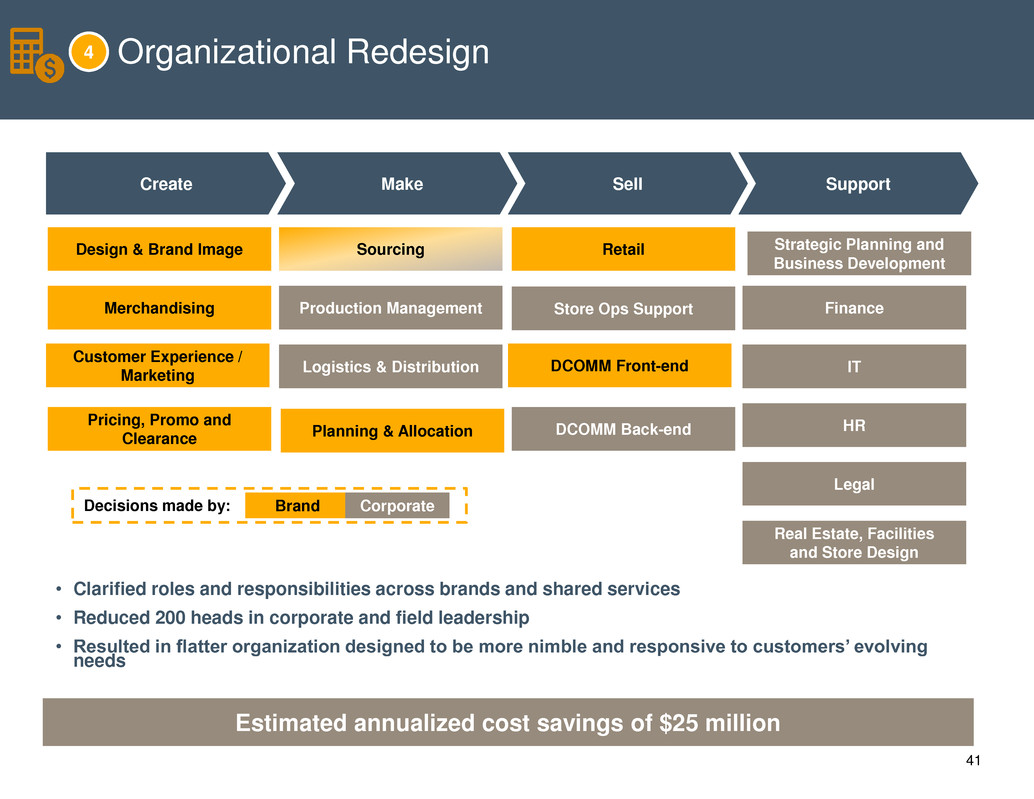

41

Finance

HR

IT

Legal

Logistics & Distribution

Real Estate, Facilities

and Store Design

Production Management

Design & Brand Image

Merchandising

Sourcing

Customer Experience /

Marketing

Retail

Planning & Allocation

DCOMM Front-end

Create Make Sell Support

Pricing, Promo and

Clearance

DCOMM Back-end

Store Ops Support

Brand Corporate Decisions made by:

Strategic Planning and

Business Development

Estimated annualized cost savings of $25 million

Organizational Redesign 4

• Clarified roles and responsibilities across brands and shared services

• Reduced 200 heads in corporate and field leadership

• Resulted in flatter organization designed to be more nimble and responsive to customers’ evolving

needs

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We Are On Track to Achieve Double Digit Operating

Margins

42

Operating Margin Bridge

5.2%¹

2.25-2.75%

2.25-2.75%

0.5 -1.0%

10% +

LTM Jul-16 Gross Margin SG&A Growth Opportunities Double Digit Margin

1 Excludes restructuring and strategic charges and goodwill and intangible impairment charges.

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

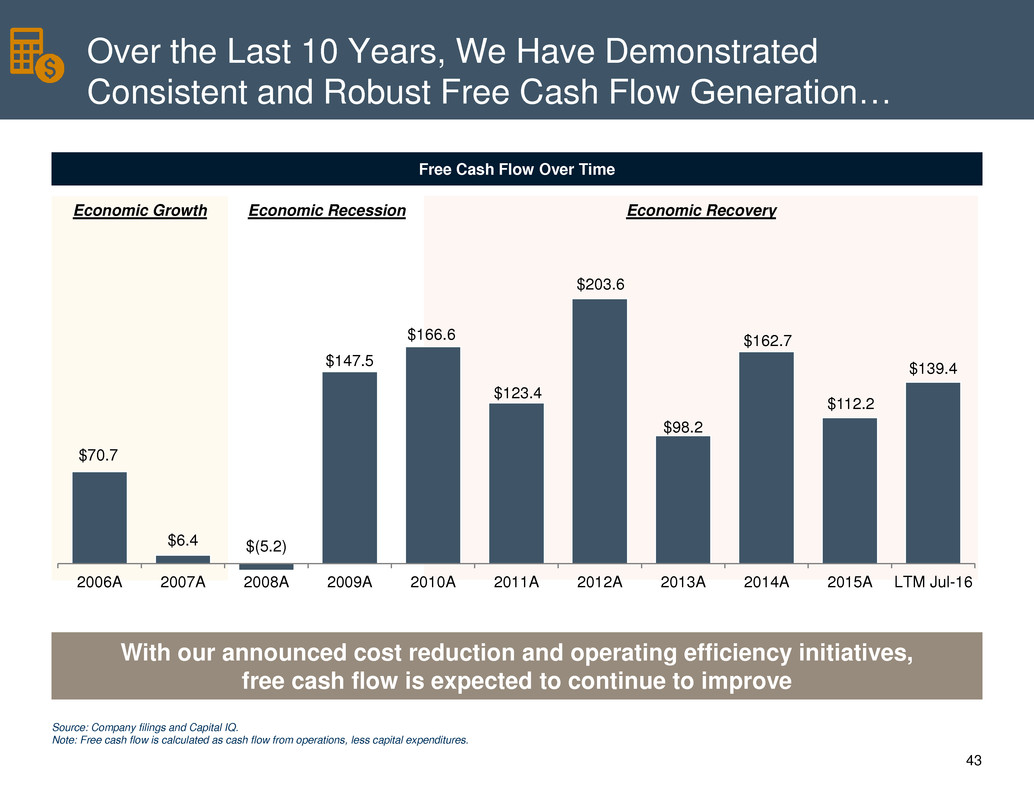

Over the Last 10 Years, We Have Demonstrated

Consistent and Robust Free Cash Flow Generation…

43

Free Cash Flow Over Time

Source: Company filings and Capital IQ.

Note: Free cash flow is calculated as cash flow from operations, less capital expenditures.

With our announced cost reduction and operating efficiency initiatives,

free cash flow is expected to continue to improve

Economic Recession Economic Recovery Economic Growth

$70.7

$6.4 $(5.2)

$147.5

$166.6

$123.4

$203.6

$98.2

$162.7

$112.2

$139.4

2006A 2007A 2008A 2009A 2010A 2011A 2012A 2013A 2014A 2015A LTM Jul-16

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

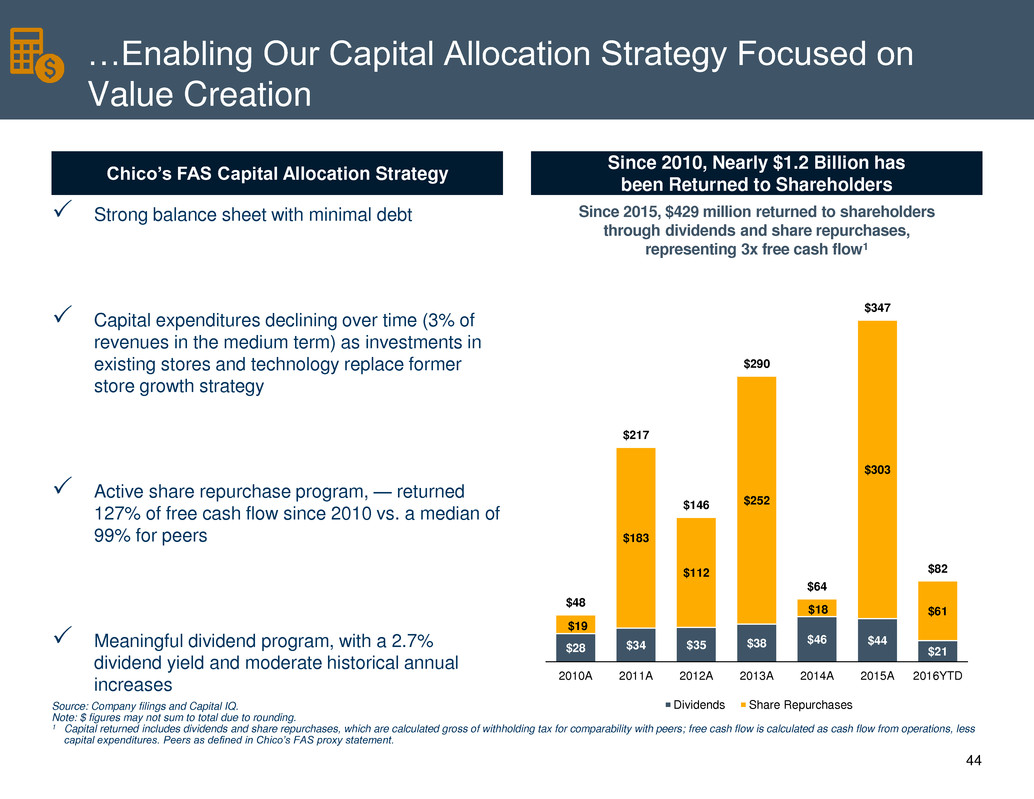

…Enabling Our Capital Allocation Strategy Focused on

Value Creation

44

Chico’s FAS Capital Allocation Strategy

Since 2010, Nearly $1.2 Billion has

been Returned to Shareholders

Source: Company filings and Capital IQ.

Note: $ figures may not sum to total due to rounding.

1 Capital returned includes dividends and share repurchases, which are calculated gross of withholding tax for comparability with peers; free cash flow is calculated as cash flow from operations, less

capital expenditures. Peers as defined in Chico’s FAS proxy statement.

Since 2015, $429 million returned to shareholders

through dividends and share repurchases,

representing 3x free cash flow1

$28 $34 $35 $38

$46 $44

$21

$19

$183

$112

$252

$18

$303

$61

$48

$217

$146

$290

$64

$347

$82

2010A 2011A 2012A 2013A 2014A 2015A 2016YTD

Dividends Share Repurchases

Strong balance sheet with minimal debt

Capital expenditures declining over time (3% of

revenues in the medium term) as investments in

existing stores and technology replace former

store growth strategy

Active share repurchase program, — returned

127% of free cash flow since 2010 vs. a median of

99% for peers

Meaningful dividend program, with a 2.7%

dividend yield and moderate historical annual

increases

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

45

Discussion Agenda

Welcome / Introduction

(Shelley Broader) I

We are Well Positioned for Profitable Growth and Value Creation

(Shelley Broader) II

Sharpening Our Financial Principles

(Todd Vogensen) III

Wrap-Up

(Shelley Broader) IV

Q&A V

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

46

Phase I

Development of four focus areas to drive profitable growth

and value creation

Phase II

Executing on cost savings initiatives and preparing Chico’s

FAS for the third phase

Phase III

Defining and igniting new sources of revenue for our iconic

brands

We are Confident in Our Future as We Prepare to Enter Our

Third Phase of Growth

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

G

47

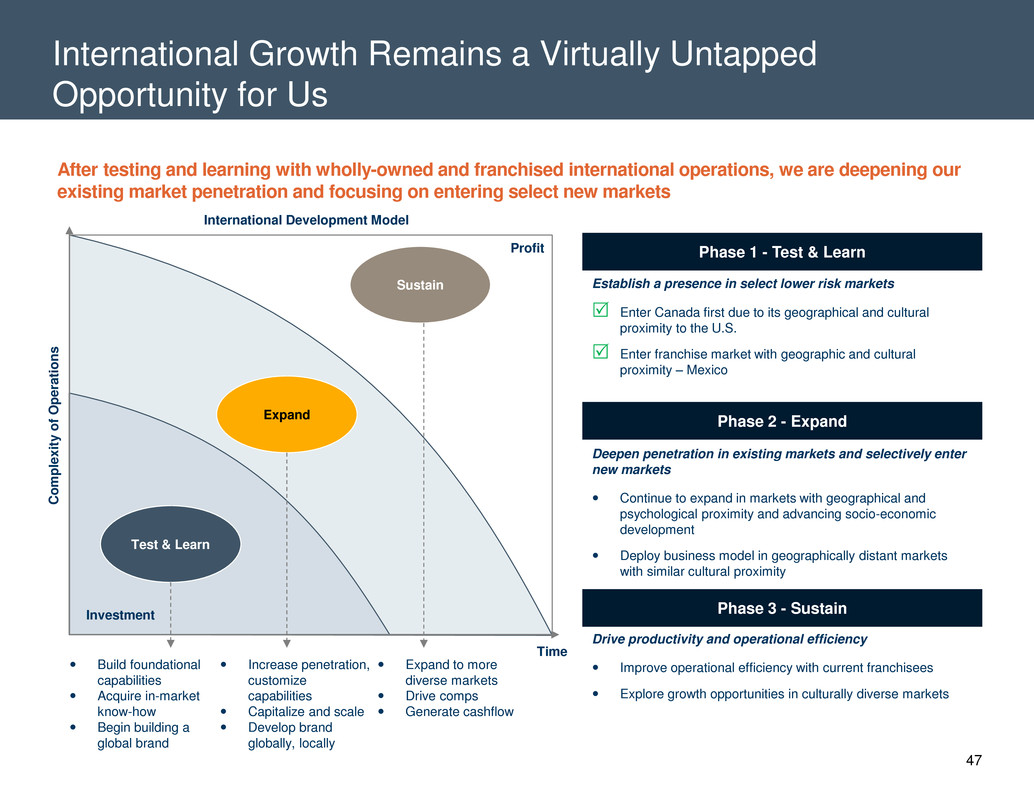

International Growth Remains a Virtually Untapped

Opportunity for Us

After testing and learning with wholly-owned and franchised international operations, we are deepening our

existing market penetration and focusing on entering select new markets

Test & Learn

Expand

Sustain

Build foundational

capabilities

Acquire in-market

know-how

Begin building a

global brand

Phase 1 - Test & Learn

Establish a presence in select lower risk markets

Enter Canada first due to its geographical and cultural

proximity to the U.S.

Enter franchise market with geographic and cultural

proximity – Mexico

Phase 2 - Expand

Deepen penetration in existing markets and selectively enter

new markets

Continue to expand in markets with geographical and

psychological proximity and advancing socio-economic

development

Deploy business model in geographically distant markets

with similar cultural proximity

Phase 3 - Sustain

Drive productivity and operational efficiency

Improve operational efficiency with current franchisees

Explore growth opportunities in culturally diverse markets

Profit

Investment

Increase penetration,

customize

capabilities

Capitalize and scale

Develop brand

globally, locally

Time

Expand to more

diverse markets

Drive comps

Generate cashflow

C

o

m

p

le

x

it

y

o

f

O

p

e

rati

o

n

s

International Development Model

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

53%

28%

22%

19% 18% 17% 16%

7%

0%

Guess Abercrombie Gap Lululemon American Eagle Children's Place Kors Lbrands Express

Median : 18%

There Are Significant Expansion Opportunities in Latin America and EMEA

48

We Can Target International Opportunities as a Lever for

Long-Term Growth

Please click on the "Save Custom Layout" button after positioning this placeholder on the slide to preserve it. Select Peer International Sales as % of Revenue1

Source: Euromonitor

1 Percentage of CY2015 total sales outside of the United States

Apparel Retail Market Growth by Region 2.1 % 2.5 % 2.2 %

10.0 % 8.5 % 7.4 % 7.6 %

1.4 % 0.1 %

3.4 % 3.7 % 3.4 %

22.5 %

11.9 %

7.1 % 7.0 %

3.0 % 2.4 %

USA Canada North America Latin America Middle East and

Africa

Asia Pacific Eastern Europe Australia Western Europe

2010 - 2015 CAGR 2016E - 2020E CAGR

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

We Also Have Opportunity For Complementary Partnerships,

As We Follow Our Loyal Customers Where Life Takes Them

49

Forming a new business development team as

part of our organizational redesign

Tasked with seeking new avenues of revenue

growth for our brands

Thoughtful and methodical approach to growth

International

Partnerships

Licensing

1

2

3

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

50

We Are Well-Positioned for Profitable Growth and Value

Creation

Powerful,

Iconic and

Differentiated

Brands

Strong

Customer

Loyalty

Leading Omni-

Channel Capabilities

Significant

Operational

Improvement

Changes

Underway

Talented and

Seasoned

Management

Team

1

2

3

4

5

IBDROOTPROJECTSIBD-NYVISOR2016587349_102 Presentations2016.09.28 Analyst Day PresentationChico's FAS 2016 Analyst Day vDRAFT.pptx

225 / 102 / 51

255 / 172 / 0

151 / 139 / 125

86 / 84 / 83

124 / 161 / 174

110 / 197 / 184

200 / 74 / 55

158 / 183 / 5

63 / 85 / 103

118 / 120 / 108

248 / 244 / 225

244/ / 138 / 32

51

Discussion Agenda

Welcome / Introduction

(Shelley Broader) I

We are Well Positioned for Profitable Growth and Value Creation

(Shelley Broader) II

Sharpening Our Financial Principles

(Todd Vogensen) III

Wrap-Up

(Shelley Broader) IV

Q&A V

Q&A