SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

ý

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

¨

Definitive Proxy Statement

¨

Definitive Additional Materials

ý

Soliciting material Pursuant to Rule 14a-11(c) or Rule 14a-12

Chico’s FAS, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

PAYMENT OF FILING FEE

(Check the appropriate box):

ý

No fee required.

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

The following materials may be provided to stockholders of Chico’s FAS, Inc.:

Dear Chico’s FAS Associates,

I am pleased to announce that the Chico’s FAS, Inc. Board of Directors has nominated Bonnie Brooks, Vice Chairman of Hudson’s Bay Company, and Bill Simon, former President and Chief Executive Officer of Walmart U.S., to stand for election to the Board at the Company’s upcoming 2016 Annual Meeting on July 21, 2016.

Great companies have strong, experienced Boards of Directors and we believe Bonnie and Bill will make stellar additions to our Board. Bonnie brings more than 30 years of global leadership experience in retail and merchandising, including having led three major international department store turnarounds. Bill is a seasoned executive with a proven track record leading large, complex global retailers with best-in-class cost structures and premier consumer brands. We believe Bonnie’s and Bill’s impressive skill sets and experience perfectly align with the Company’s goals and four focus areas:

evolving our customer experience, leveraging actionable retail science, strengthening our brands’ positions, and sharpening our financial principles to improve performance and increase stakeholder value.

Today, we also announced that current directors, David Dyer and Verna Gibson, will retire from the Board upon the completion of their current terms in 2016. Dave served on the Board for nine years, helping guide our Company during an important time in the history of Chico’s FAS. Verna, an apparel industry legend, served on the Board for 23 years. We thank Dave and Verna for their innumerable contributions and dedication to our Company and wish them all the best in their retirements.

In our announcement, we also confirmed that one of our shareholders, Barington Companies Equity Partners, has nominated two of its own candidates to stand for election to our Board. More and more commonly, shareholders are engaging publicly with management teams and Boards of Directors. We value the views of our shareholders and have had dialogue with Barington, as we do with other shareholders. Our Board considered Barington’s candidates as well as a field of other candidates prior to nominating Bonnie and Bill. Following this review, the Board unanimously determined that Bonnie and Bill have the most current and relevant expertise and experience to support the Company at this time, and that they are best qualified to serve as the Company’s new independent director nominees. Barington has nonetheless chosen to proceed with a proxy fight by offering a competing director slate.

I want to emphasize that these developments should have no impact on Chico’s FAS or our day-to-day operations. Barington’s nominations may lead to increased attention and media reports about the Company. Consistent with our usual policy, please refer all calls from the media, analysts or other third parties to Jennifer Powers, Vice President of Investor Relations, at (239) 346-4199.

We have three powerful and iconic brands, one of the most loyal customer bases in the industry and a remarkable team of associates. We need to continue to do what we do every day – focus on our priorities and provide our customers with the amazing experiences they’ve come to expect.

I will keep you informed. Thank you for your passion and commitment as we continue to propel our Company and incredible brands forward.

Sincerely,

Shelley

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements contained herein may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our current views with respect to certain events that could have an effect on our future financial performance, including but without limitation, statements regarding our plans, objectives, and future success of our store concepts, the implementation of our previously announced restructuring program, and implementation of our program to increase the sales volume and profitability of our existing brands through four previously announced focus areas. These statements may address items such as future sales, gross margin expectations, SG&A expectations, operating margin expectations, planned store openings, closings and expansions, future comparable sales, inventory levels, and future cash needs. These statements relate to expectations concerning matters that are not historical fact and may include the words or phrases such as "expects," "believes," "anticipates," "plans," "estimates," "approximately," "our planning assumptions," "future outlook," and similar expressions. Except for historical information, matters discussed in such oral and written statements are forward-looking statements. These forward-looking statements are based largely on information currently available to our management and on our current expectations, assumptions, plans, estimates, judgments and projections about our business and our industry, and are subject to various risks and uncertainties that could cause actual results to differ materially from historical results or those currently anticipated. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of performance and there are a number of known and unknown risks, uncertainties, contingencies, and other factors (many of which are outside our control) that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, there is no assurance that our expectations will, in fact, occur or that our estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, general economic and business conditions, conditions in the specialty retail industry, the availability of quality store sites, the ability to successfully execute our business strategies, the ability to achieve the results of our restructuring program, the ability to achieve the results of our four focus areas, the integration of our new management team, and

those described in Item 1A, “Risk Factors” and in the “Forward-Looking Statements” disclosure in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Form 10-K. There can be no assurance that the actual future results, performance, or achievements expressed or implied by such forward-looking statements will occur. Investors using forward-looking statements are encouraged to review the Company's latest annual report on Form 10-K, its filings on Form 10-Q, management's discussion and analysis in the Company's latest annual report to stockholders, the Company's filings on Form 8-K, and other federal securities law filings for a description of other important factors that may affect the Company's business, results of operations and financial condition. All written or oral forward-looking statements that are made or attributable to us are expressly qualified in their entirety by this cautionary notice. The Company does not undertake to publicly update or revise its forward looking statements even if experience or future changes make it clear that projected results expressed or implied in such statements will not be realized.

Additional Information

Chico’s FAS, its directors and certain of its executive officers may be deemed to be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the Company’s 2016 Annual Meeting. The Company intends to file a proxy statement and WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with any such solicitation of proxies from Company shareholders. COMPANY SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ ANY SUCH PROXY STATEMENT AND ACCOMPANYING WHITE PROXY CARD WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION. Information regarding the ownership of the Company’s directors and executive officers in Company stock, restricted stock and options is included in their SEC filings on Forms 3, 4, and 5, which can be found through the Company’s website (www.chicosfas.com) in the section “Investors” or through the SEC’s website at www.sec.gov. Information can also be found in the Company’s other SEC filings, including the Company’s Annual Report on Form 10-K for the year ended January 30, 2016. More detailed and updated information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the Company’s 2016 Annual Meeting. Shareholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies will also be available at no charge at the Company’s website at www.chicosfas.com, by writing to Chico’s FAS at 11215 Metro Parkway, Fort Myers, FL 33966, or by calling the Company’s proxy solicitor, Innisfree, toll-free at (877) 825-8971.

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

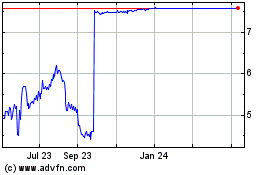

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024