UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): May 27, 2015

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction

of Incorporation)

|

| | |

| | |

001-16435 | | 59-2389435 |

(Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

| | |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition

On May 27, 2015, Chico’s FAS, Inc. (the “Company”) held a conference call with the investment community to discuss its financial results for the first quarter ended May 2, 2015. A copy of the transcript of the conference call is attached hereto as Exhibit 99.1.

The information presented herein shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject the Company to liability pursuant to that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly stated by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

|

| | |

| | |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on May 27, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | |

| | | | | | |

| | | | CHICO’S FAS, INC. |

| | | |

Date: May 28, 2015 | | | | By: | | |

| | | | /s/ Todd E. Vogensen |

| | | | Todd E. Vogensen, Executive Vice President, |

| | | | Chief Financial Officer and Corporate Secretary |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| |

Exhibit 99.1 | | Transcript of conference call held by Chico’s FAS, Inc. on May 27, 2015 |

Exhibit 99.1

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

PARTICIPANTS

Corporate Participants

Jennifer Powers Adkins – Vice President of Investor Relations, Chico’s FAS, Inc.

David F. Dyer – President, Chief Executive Officer & Director, Chico’s FAS, Inc.

Todd Vogensen – Executive Vice President - Chief Financial Officer, Chico’s FAS, Inc.

Other Participants

Edward J. Yruma – Analyst, KeyBanc Capital Markets, Inc.

Gene Vladimirov – Analyst, Nomura Securities International, Inc.

Anna Andreeva – Analyst, Oppenheimer & Co., Inc. (Broker)

Janet J. Kloppenburg – Analyst, JJK Research

Liz O. Pierce – Analyst, Brean Capital LLC

Susan K. Anderson – Analyst, FBR Capital Markets & Co.

Kayla R. Berg – Analyst, Piper Jaffray & Co (Broker)

Betty Chen – Analyst, Mizuho Securities USA, Inc.

Marni Shapiro – Managing Director, The Retail Tracker LLC

Brian Jay Tunick – Analyst, RBC Capital Markets LLC

Adrienne Eugenia Yih-Tennant – Analyst, Janney Montgomery Scott LLC

MANAGEMENT DISCUSSION SECTION

Operator: Good morning and welcome to the Chico’s FAS first quarter earnings conference call. All participants will be in a listen-only mode. [Operator Instructions]

Please note this event is being recorded. I’d now like to turn the conference over to Jennifer Powers Adkins, Vice President, Investor Relations. Please go ahead.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

Thanks, Emily, and good morning everyone. Welcome to Chico’s FAS first quarter earnings conference call and webcast. Joining me today at our National Store Support Center in Fort Myers are Dave Dyer, our CEO, and Todd Vogensen, our CFO. Before Dave begins his executive overview, we would like to remind you that our discussion this morning includes forward-looking statements and quarter-to-date data points, which are subject to and protected by the Safe Harbor statement found in our SEC filings and in today’s earnings release. These forward-looking statements are subject to a number of factors and uncertainties that could cause actual results to differ materially. Also, our current and prior-year results discussed on this call exclude cost reduction and restructuring initiatives charges. A reconciliation to GAAP results is included today in our press release for your reference.

1

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

E

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And with that, I’ll turn it over to Dave.

David F. Dyer, President, Chief Executive Officer & Director

Thanks, Jennifer, and good morning to everyone. I’m pleased to report that the initiatives we announced last quarter; disciplined inventory management, cost reductions and enhancement of the customer experience drove positive results across the board. In the first quarter, we delivered an increase in adjusted earnings per share to $0.28 from $0.26 last year. We had gross margin improvement of 90 basis points, and SG&A growth of less than 3%, and inventory per selling square foot down by about 3%. As a direct result of our inventory management initiatives, we were able to decrease liquidations and increase our overall average unit retail by 2%. This was the first quarter of AUR improvement and gross margin improvement since 2012.

During the first quarter, total sales were up 1.7% and comparable sales were approximately flat to last year. Similar to last quarter, disruption from labor issues at the West Coast ports delayed our merchandise flow, with a total sales impact of over 1%, and incremental air freight cost of approximately $2.5 million or about 40 basis points. While we have now routed the majority of our shipments to the East Coast ports, this has added about a week to our transit time, which will pressure in-transit inventory levels.

Now, I’d like to give you some more details on our performance by brand. Soma delivered a comparable sales increase of 6.5%, representing the 24th consecutive quarter of positive comps. The Enhancing Shape bra, supported by a sizable television campaign has been a very successful new bra launch. Overall, bras, sleepwear and loungewear showed strong sales gains year-over-year.

White House | Black Market is winning with balanced assortments, reflecting the more traditional mix of price points, collections and lifestyles. Comparable sales remain on a positive trend, up 1.7% this quarter. Our customers are responding very well to the brand’s new renewed emphasis on the WORKKIT, as well as its trend-right silhouettes in tops, denims, jackets, all of which drove strong sales results for the quarter.

Chico’s brand first quarter comparable sales were down 2.3%. As planned, the brand pulled back significantly on promotional intensity during the first quarter. While the reduction in promotions and clearance units dampened the comparable sales the quarter, I’m pleased to report that the Chico’s brand was successful in improving both AUR and the gross margin dollars. As a positive indicator for the future, product-wise, Chico’s continues to see momentum in the all-important knit tops and bottoms categories.

As an interesting side-note, Chico’s was the title sponsor once again for the second annual Chico’s Patty Berg Memorial Golf Tournament this April, here in Fort Myers. This year we broadened our message, linking up the up and coming Symetra Tour players with the LPGA Golf Tour legends. The Golf Channel broadcast over 8.5 hours of live coverage generating over 10 million impressions.

Our work to improve Boston Proper is continuing, while the sales for the quarter decreased 2% compared to last year, Boston Proper delivered positive trends in customer response rate and the sales increases in several categories, including tops and printed leggings. We continue to evaluate the brand’s performance to identify opportunities for future improvement. Overall, the apparel retail environment remains choppy. Through yesterday, our unaudited daily flash sales reports of total company comparable sales were down 1.7%, and total sales were down about 0.7%.

2

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Though at times painful, we know that ripping off the promotional band-aid leads to improved profitability as our first quarter results show. We also know that our most valuable customers respond to newness, and they’re willing to pay full price for it. Continuing to leverage our significant customer database and our technology will allow us to increase the level of personalization and drive a more effective promotional strategy over time. We may give up some sales in the short term, but we will generate improved profits and a healthier business in the long term.

In addition to controlling our inventory and expenses, our 2015 priorities are focused on the customer experience. We have achieved several milestones this year. First, our latest version of the customer book iPad application is fully operational in all of our Chico’s stores. We’re rolling it out to our other brands as part of our ongoing POS implementation over the next six months. Our store teams use the app to access customer shopping patterns and preferences, enabling them to extend our amazing personal service in a number of ways. Now associates can view recent customer purchases to aid in suggestive selling. Associates can research and order online merchandise from the selling floor. And soon, they can communicate special events and set styling appointments directly with customers via email.

Next, our new POS systems implementation which started at the beginning of the quarter is on track to be rolled out to all of our stores this year. Among the many enhancements, the systems will enable mobile checkout capabilities, providing even more efficient and seamless customer service. We successfully launched our digital mailer experience, allowing our customers to shop and purchase directly from the pages of digital version of our printed catalog. In addition, our digital commerce exclusives are driving an increasingly important portion of our assortments. Dcom exclusive provides sizes and product extensions not available in stores such as petites, long and short pant lengths and swimwear. The Dcom exclusives are leading to an increase in multi channel shoppers, which again, are our most valuable customers.

And finally, the Soma brand continues to develop innovative solutions to attract new customers. This quarter, Soma successfully launched the fit predictor for bras, which builds customer trust and confidence where they can find the correct size for them online. The customer simply clicks the bra fit guide link and answers a two-question survey and we calculate her size for her.

Now I’m going to turn the call over to Todd and I’ll be back in a moment with a wrap-up.

With that, here’s Todd.

Todd Vogensen, Executive Vice President – Chief Financial Officer

All right, thanks, Dave, and good morning, everyone. Now, I’ll provide additional details on our first quarter financial results.

Net sales for the quarter were $693 million, an increase of 1.7%, compared to $682 million in last year’s first quarter, primarily reflecting 56 net new stores, for a square footage increase of 3.3%, and comparable sales that were approximately flat to last year.

As Dave mentioned, shipping delays resulting from issues at the West Coast ports persisted throughout the quarter and negatively impacted our top line by over 1%.

Our logistics and sourcing teams have worked diligently to mitigate the merchandise delays caused by these issues. We’ve adjusted our shipping dates to ensure merchandise is received timely going forward and to mitigate future sales risk.

3

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

As Dave has reviewed comp sales by brand, we’ll move down the P&L now. Gross margin in the quarter increased by over 3% to $396 million, compared to $383 million in last year’s first quarter. Gross margin rate for the quarter was 57.1% of net sales, a 90 basis point increase from last year, primarily reflecting our conservative inventory planning and strategic use of promotions. These results reinforce our belief that we are on the right track with inventory control and AUR recovery. We’re pleased to report that we’re still able to leverage our gross margin rate, despite the 40 basis point impact related to the West Coast ports.

SG&A expenses for the first quarter were $328 million, compared to $319 million last year. SG&A was 47.4% of net sales, deleveraging by 60 basis points from last year. As we expected, SG&A was impacted by increased occupancy costs, due to the 109 new stores opened last year, and a return to targeted levels of incentive compensation, both of which were partially offset by the realization of savings resulting from the organizational realignment, which occurred mid first quarter.

Despite the impact of increased occupancy costs and normalized incentive compensation, we effectively controlled our expenses this quarter. For the quarter, total SG&A increased by 2.9% from the prior year period, less than our square footage growth of 3.3% over the same timeframe. Capital expenditures totaled $20 million in the first quarter, primarily related to new stores, reinvestment in existing stores and our new POS system. We opened 13 stores in the quarter, and importantly, our POS project is on track both from a budget and timing perspective. We continue to expect capital expenditures of approximately $100 million in fiscal 2015, which includes $30 million from the POS rollout.

As announced earlier this month, we entered into a new five-year unsecured $200 million credit facility comprised of $100 million revolver and our first $100 million term loan A. The new agreement gives us more available liquidity and has improved pricing and other terms. Currently, we have $24 million drawn on the revolver and $100 million drawn on the term loan.

Dave discussed the company’s 2015 priorities a few minutes ago. I’d also like to emphasize that thoughtful and strategic capital allocation and expense control will remain a focus for us. Our path to double-digit operating income will be paved by managing inventory more tightly and recovering AUR, controlling expenses, and enhancing the customer experience to drive sales.

Additionally, we are committed to returning excess cash to our shareholders. As previously announced, we demonstrated this commitment by entering into a $250 million accelerated stock repurchase plan in March, funded with cash on hand and the debt I just mentioned. We received our initial settlement of 10.7 million shares at that time, with the final settlement expected by October. In addition to reinforcing our commitment to enhancing shareholder value, the significant buyback demonstrates our confidence in the company’s long-term growth potential. Together, we believe that our customer experience, inventory, cost and capital initiatives will improve the quality of our earnings and position us for sustainable growth in sales, operating margin and earnings over time.

As we look forward to the remainder of 2015, we continue to expect a modestly positive increase in comparable sales, through a recovery in our average unit retail. We would expect the spread between our overall sales and comparable sales growth to be between 1% to 2%. We continue to expect improvements in gross margin rate over last year, and for the year, we expect slight deleverage in SG&A costs, driven primarily by the 109 new stores opened in fiscal 2014, approximately 40 new stores in fiscal 2015, and a return to the targeted level of incentive compensation.

4

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

On our fourth quarter call, we discussed the planned closure of 120 stores over the next three years, and annualized expense savings of $55 million at the completion of those closures. As part of our focus on rationalizing our cost structure and maximizing expense savings, we have continued to analyze the fleet performance and upcoming lease actions, and have identified approximately 15 to 20 more stores that we intend to close over the next three years, bringing our total expected closures to 135 stores to 140 stores over that timeframe. Of that total, we are now expecting to close approximately 45 stores to 50 stores in 2015 versus the 35 stores that we discussed with you last quarter.

We anticipate that the closure of the additional stores over the three years will yield an incremental $10 million in expense savings and bring our overall expected savings to $65 million upon completion. Our tightly managed inventory should continue to produce on-hand inventory growth less than sales growth. As Dave mentioned, please note that we may see an increase in in-transit inventories through the remainder of 2015, as a result of pulling product shipping dates forward to ensure merchandise arrives timely in the stores.

For your modeling purposes, we expect our weighted average diluted shares outstanding to be approximately 140 million for the second quarter, and 140 million for the full year of 2015, assuming no further share repurchases beyond our ASR. Our priorities remain centered on strategies and actions designed to deliver long-term value creation for our company and its shareholders. We’re pleased with our progress and looking forward to keeping you updated on our continued success as we march forward with our strategies.

And with that, I’ll turn the call back over to Dave.

David F. Dyer, President, Chief Executive Officer & Director

Thank you, Todd. And as we enter the second quarter with leaner inventories, we intend to promote strategically to drive higher gross margin dollars. We will also continue to look for opportunities to streamline operations and reduce expenses. And we have additional initiatives underway to improve our customer experience.

In this changing retail landscape, the winners of tomorrow will be those who are customer centric and who can meet customers’ expectations for a differentiated and consistent experience between stores and online. As a result of the work and investments we have undertaken, we are well positioned to deliver on this expectation. We benefit from great brands, personalized customer service, and a robust omni-channel platform and infrastructure.

On another note, as many of you may have noticed, we announced my intention to retire as President and CEO in the spring of 2016, or when my successor is appointed. To ensure a smooth transition, I’ll remain on the board in the newly-created role of Vice Chairman at least through my current term, which ends at the company’s annual meeting in June of 2016. It has been an honor to lead Chico’s FAS over the last 6.5 years. I’m very proud of our people and our accomplishments since 2009.

We have added over $1 billion in sales to the top line, improved profitability from a loss in 2008 to the profitable, financially-sound company we are today, and have returned over $1 billion to shareholders through dividends and share repurchases. We have focused on operational execution and investments in international, infrastructure, systems, store growth and digital commerce to better enable customer engagement and position the company to compete in a rapidly-changing retail environment.

5

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

With that, I’m going to turn it back over to Jennifer.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

Thank you, Dave. That concludes our prepared comments. At this time, we’d be happy to take your questions. In the interest of time and consideration to others, please limit yourself to one question.

And with that, I’ll turn the call back over to Emily.

6

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

QUESTION AND ANSWER SECTION

Operator: Thank you. We will now begin the question-and-answer session. [Operator instructions] Our first question is from Ed Yruma of KeyBanc Capital. Please go ahead.

<Q – Ed Yruma – KeyBanc Capital Markets, Inc.>: Hi, good morning. Thanks for taking my question, and Dave, congratulations on your forthcoming retirement. I guess given all the puts and takes in the weak environment and some of the port delays, as you think about your reduced promos in first quarter, how was it relative to your plan? And I guess, as we think about your ability to kind of continue to strategically reduce promos in 2Q, how much of that may be offset by some product delays given some of the port issues?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, I think it’s very strategic in the way that we’re looking at our promotions and prices. We have pulled back significantly from last year and the leaner inventory levels that we have creates less liquidations. As you remember, going into second quarter, we had lots of liquidations last year that we had to take care of, and that resulted in some margin, somewhat – I should say, more than somewhat short of expectations. We don’t feel that we’re going to face that at all this year. The port delays have certainly at the beginning of the quarter and I would say are getting better as we get towards the end of the quarter and it made the shifts, but the port delays have caused some timing issues and we have a floor set probably at the beginning of the quarter, we were only getting in 75% to 80% of the floor set on time as we had the drop of our marketing materials. As we’re getting into the latter half of the quarter, we’re getting about 95% of it in on time. So I would say that our shift to the East Coast ports certainly have paid off in delivery.

I think it’s caused us maybe some additional liquidations, but not significant. One of the things that our brands have worked very hard on this year as well is to make sure that our color flow and patterns flow from delivery to delivery. So if you have something that’s late it can work in with a new delivery, rather than looking obsolete because it’s totally out of character with what’s flowing in. So I think you’ll see that color and product flow work a lot better as we go forward.

<Q – Ed Yruma – KeyBanc Capital Markets, Inc.>: Great. Thanks so much.

Operator: Our next question is from Simeon Siegel of Nomura Securities. Please go ahead.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Hey, guys, this is Gene Vladimirov on for Simeon. Good morning.

<A – Dave Dyer – Chico’s FAS, Inc.>: Good morning.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: So, given the pick-up in GM, I’m wondering if that increase was fairly even across the different concepts and maybe how we should think about the gross margin cadence for the remainder of the year, whether we might see increases of similar magnitude. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Sure. So while we don’t go through the details of gross margin by brand, I could tell you that generally the concept of buying inventory more conservatively is something that certainly goes across the company and we certainly are looking for opportunities to be less promotional wherever we can. So especially for the two biggest brands, the focus on improving AUR, the focus on improving gross margin is very high, and I think it should be for the entire year.

7

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

So we look out across the year, we do expect gross margin improvement. I would say last year, looking at it our biggest declines were in Q2 and Q4. So those are probably – as we said last quarter, those are probably the quarters we’re going to look to see the largest improvement in rate, but really we’re looking for improvements across the entire year.

<Q – Gene Vladimirov – Nomura Securities International, Inc.>: Thanks, very helpful.

Operator: Our next question is from Anna Andreeva of Oppenheimer. Please go ahead.

<Q – Anna Andreeva – Oppenheimer & Co., Inc. (Broker)>: Great. Thanks. Good morning and congrats to Dave. I was hoping to follow up on the monthly comp cadence in 1Q. Did you guys see softer results in April to get to that slightly negative comp, and was there any variability either by region or by channel in 1Q?

And then just on the quarter-to-date trend, slightly negative comp, should we think this is largely driven by the pull-back on promotional activity and are you seeing similar results by division? Thanks.

<A – Dave Dyer – Chico’s FAS, Inc.>: Let me take a little bit of it. I would say that as we look at the trends going back to the first quarter, obviously, February and the first week of March were tough for most everyone due to some unusual weather conditions. I think most people had it. I would say that, that was the biggest impact to the quarter. March was actually a little better, and then April was about consistent with our results at the end of the quarter. So...

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, a lot of people, Anna, look at the March-April combined just given the shifts in Easter, and when we look at March-April combined, it was roughly flat. So we started out with February about flat and the comps combined for March-April was about flat, which is where we ended.

<A – Dave Dyer – Chico’s FAS, Inc.>: We have seen a little bit stronger trends on the West Coast than in the rest of the company.

<A – Todd Vogensen – Chico’s FAS, Inc.>: And to answer your question about any particular types of format are seeing better sales or not. We’re really seeing consistent traffic across all the different types of stores, be it in an enclosed mall, a lifestyle center or an outlet center even. So, no real meaningful difference there. And, yeah, for the month-to-date sales, I think it really has been a function of pulling back on the promotions, especially going through a very promotional holiday like Memorial Day, but something that we believe positions us for a much healthier business over the long term. Thanks, Anna.

Operator: Our next question is from Janet Kloppenburg of JJK Research. Please go ahead.

<Q – Janet Kloppenburg – JJK Research>: Good morning, everyone, and congratulations to Dave. I just had two questions. Should we look for SG&A deleverage to moderate and even turn into SG&A leverage going forward because of the cost saving initiatives, which I think take effect in the second quarter.

And secondly, I was just wondering if you could talk about any merchandising missteps or execution errors beyond the port strike delays and promotional – year-over-year promotional declines that you think may be affecting the comp trend. Thanks so much.

8

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Todd Vogensen – Chico’s FAS, Inc.>: I’ll start with the SG&A deleverage question and hand it over to Dave for merchandising.

<Q – Janet Kloppenburg – JJK Research>: Great. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: So for SG&A, really, yes, the way we expect SG&A to flow is we will have more pressure on leverage earlier in the year and then as more of the cost savings take effect, as we wrap around on the new stores from last year, we should start seeing ourselves turn towards more of a leveraging situation as we get towards the back half. So it’ll be a gradual improvement as we move through the year.

<Q – Janet Kloppenburg – JJK Research>: Thank you. Thanks, Todd.

<A – Dave Dyer – Chico’s FAS, Inc.>: I would say in product, I’m very pleased with the assortments across all of our brands. If there’s any categories which didn’t perform as expected, that would be dresses. We had very large dress businesses in some of our businesses, particularly White House | Black Market and it’s been for the last well over a year, the dress category has been less than we would like, and so that’s probably the – if we had to look at anything, I would say that’s probably one of our biggest misses. The good news in the categories is that in White House, we returned to focus on the WORKKIT and the Workwear and I think that that is doing very strong. And also, we are seeing, again, as you know, we were in a woven cycle for the last couple of years and now knit tops are kicking in. When you’ve got knit tops and bottoms both working, that generally kind of leads to a much improved business. The new customer acquisition, the categories that they generally first try a brand in are knit tops. And when you get bottoms, you start getting loyalty. So to see both of those categories trending positive, I think, is very good for the future.

<Q – Janet Kloppenburg – JJK Research>: Thank you, Dave.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Janet.

Operator: Our next question is from Liz Pierce of Brean Capital. Please go ahead.

<A – Dave Dyer – Chico’s FAS, Inc.>: Liz, do we have you?

<Q – Liz Pierce – Brean Capital LLC>: Can you hear me now?

<A – Dave Dyer – Chico’s FAS, Inc.>: Yes, we can hear you now.

<Q – Liz Pierce – Brean Capital LLC>: Sorry about that. So, Dave, best of luck to you. I’m curious on the additional stores that you put into the bucket, in terms of store closures, what kind of was the tipping point or what was the variation or difference when you went back and looked at the second round, and are you done now or do you think that this will be an ongoing kind of process? Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: I think looking at our store real estate portfolio is something that we will continue to evaluate as we go forward, on both sides, openings and closures. I think as we get – the economy clearly is – and the overall retail environment is changing fairly rapidly. So as we get more information, certain centers tend to be trending up, and certain centers we see more potential issues in the future and we try to react to that pretty quickly. The other thing is as we do have more stores that pop up on the closure list, we get a lot better data around our ability to transfer sales from a closed store to other stores that are in the market or to online or a variety of other options. So, as we gather more information on that, that’ll just help inform the decisions around how much closures we actually end up doing.

9

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<Q – Liz Pierce – Brean Capital LLC>: Okay.

<A – Dave Dyer – Chico’s FAS, Inc.>: And I think another thing that we look at is obviously some of the occupancy cost increases that landlords are requesting certainly don’t work with us. And if we can’t get an occupancy cost upon renewal, that works and lets us achieve the profitability that we need, then we won’t do that store. And I think that certainly when you see occupancy cost increases in light of all the traffic decreases, it really doesn’t make much sense what’s going on right now. And I think there will be some fall-out in occupancy cost over time. Certainly, we have opportunities that maybe others don’t. We are very successful in strip centers and street locations where many people are based pretty much in malls and outlet malls. But we’ve been successful in other locations.

<Q – Liz Pierce – Brean Capital LLC>: Okay. That was helpful. Thank you. And good luck.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Liz.

Operator: Our next question is from Susan Anderson of FBR Capital Markets. Please go ahead.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Good morning, everyone. Let me add my congrats to Dave also.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thanks.

<Q – Susan Anderson – FBR Capital Markets & Co.>: So, on the inventory it sounds like you guys feel pretty good and I think the stores look really clean, too. I was wondering, can we expect it to get even leaner as we kind of head throughout the year? And then, maybe if you can comment on just the units versus dollars in the first quarter? And then, also how much of the in-transit inventory added to that amount?

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes, so I’ll start with your last question on in-transit inventories. It’s going to be a more significant impact as we go further into the year, but it certainly had an impact in Q1. So we’ll probably be breaking that out as we go forward. For Q1, our total inventory per foot was down about 3%. If we’d excluded in-transits it would’ve been down closer to 6%. So it did have an impact. Our buys, we are planning our buys down. So that would reflect both units and dollars, and that will be just part of the ongoing plan as we go through the rest of the year.

<Q – Susan Anderson – FBR Capital Markets & Co.>: Got it. Thanks. That’s really helpful.

<A – Todd Vogensen – Chico’s FAS, Inc.>: You bet.

Operator: Our next question is from Neely Tamminga of Piper Jaffray. Please go ahead.

<Q – Kayla Berg – Piper Jaffray & Co (Broker)>: Great. Thank you. This is Kayla Berg on for Neely. Seeing obviously gross margin was up and we’re starting to see some significant progress here with your promotion strategy. So, congratulations on that. Just kind of curious, from a customer behavior perspective, what you’re seeing from your most loyal customers and responses? Are they buying more? Are they buying less? And just kind of any updated thoughts you’re seeing there. Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: Our most loyal customers’ shopping patterns are pretty consistent year-over-year. What we find when we do our research is that these customers really

10

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

and look at the data from their purchase history, these customers don’t really purchase clearance material, clearance products. So what’s happening is when you send them promotional message, you find that the marketing that you’re doing just doesn’t work. What these customers want is they want new fashion and freshness. These are the guys that are shopping with us every month, that are in. They want to see something new. And that’s what they respond to. And as a matter of fact, in testing emails, announcing new arrivals and showing the new collections and giving an early preview, are actually more effective than promotional messages.

So, the question is really not new customers. I think you attract with a promotional cadence. You may attract the customer that is not as loyal to the brand, who is there just because it’s the buy or a bargain. And I think that we’ll probably may lose a few of those, but our loyal customers and those customers that really are looking for fashion, we will continue to attract in big numbers.

<Q – Kayla Berg – Piper Jaffray & Co (Broker)>: Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: All right, thank you.

Operator: Our next question is from Lindsay Drucker Mann of Goldman Sachs. Please go ahead.

<A – Dave Dyer – Chico’s FAS, Inc.>: Hello?

<Q>: Hi, good morning.

<A – Dave Dyer – Chico’s FAS, Inc.>: Good morning.

<Q>: This is [ph] Eddie (34:22) on for Lindsay. I have a question on the AUC declines you saw in the first quarter. Can you quantify anything around that and what you saw on like-for-like items, and what you would expect for the remainder of the year? And what, if any, you’re planning to put back and to make or what’s being offset by other inflationary pressures?

<A – Dave Dyer – Chico’s FAS, Inc.>: Let me just say one thing, we haven’t taken anything out of make. The one thing that we won’t do is to take quality out of the product to hit a price point. So...

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah. And what you’re seeing in inventory in the AUC is really mostly related to some of the things we talked about last year with White House | Black Market. And so, with White House last year, the assortment had tilted a little bit more towards those, I would call them higher price point or couture-like items, and so that naturally increased the average unit cost. As they’ve gotten back to a much more balanced assortment this year, that just has the opposite effect. It gets them back to a much more normalized AUC.

<A – Dave Dyer – Chico’s FAS, Inc.>: It’s really a mix that’s driving it.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, that’s right.

<Q>: Okay. Thanks.

<A – Todd Vogensen – Chico’s FAS, Inc.>: And if I could just add on, a lot of people look to raw material costs. For us, the single biggest driver of AUC is going to be more labor, just because of the amount of make that goes into our products, the amount of needle. And so raw material changes don’t tend to have nearly as significant an impact to us as you might see at some other retailers.

<Q>: Okay. Got it.

11

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Operator: Our next question is from Betty Chen of Mizuho Securities. Please go ahead.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Thank you. Good morning. Congrats to Dave as well. It’s been a pleasure. My question is...

<A – Dave Dyer – Chico’s FAS, Inc.>: I’m still here for a year.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: I know.

<A – Dave Dyer – Chico’s FAS, Inc.>: I’m not dead yet.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: So my question was regarding the cost savings. It sounds like in the first quarter we saw a little bit of the benefit from the head count rationalization program. Is there – is it possible for you to help us quantify the amount and how we should think about the cadence of that for the balance of the year? And then my second question was, in terms of the incentive comp, can you just remind us, like, how that is split in terms of gross profit versus SG&A? It sounds like both line items saw some slight impact from incentive comps. Thank you.

<A – Todd Vogensen – Chico’s FAS, Inc.>: You bet. So in terms of the cost savings, the organizational realignment, it did take place, it was roughly at the end of February. So cost savings from that would’ve been across the course of March and April. It’s fair to say that about half of the impact was in gross margin, half of the benefit was in gross margin from the savings, and half in SG&A. And so, we’ll get a full quarter of that going forward. We gave the amount of the total annualized number last quarter, so that should give you a guideline going forward.

And the other question was on incentive comp. So for incentive comp, overall, probably about 40% of our total incentive comp is up in gross margin. That’s where all of our merchandising and design and sourcing costs are. So all the people related to that are flowing into the gross margin line, and that’s where the incentive comp for those folks will go. The rest is down in SG&A.

<Q – Betty Chen – Mizuho Securities USA, Inc.>: Great. Thank you so much for the help. Thank you.

<A – Todd Vogensen – Chico’s FAS, Inc.>: You bet.

Operator: Our next question is from Marni Shapiro of The Retail Tracker. Please go ahead.

<Q – Marni Shapiro – The Retail Tracker LLC>: Hey, guys.

<A – Dave Dyer – Chico’s FAS, Inc.>: Hey.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Hey, Marni.

<Q – Marni Shapiro – The Retail Tracker LLC>: Dave, congrats and you sounded a little bit like Letterman there with his whole, I’m not dead, save some for my funeral thing. So, can we talk a little bit about, I’m just curious, on the shipments. Through the quarter, I believe when we entered into the first quarter, you said White House was more impacted than Chico’s by some of these shipments. Is this some of the choppiness that we saw through the first quarter? From my vantage point, when I walked into the store, sometimes it felt like a full group wasn’t set, and then more pieces would arrive. And are we still seeing this or is it pretty clean at this point?

12

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

And then, if you can just also, are you seeing digital traffic up across all the brands? And are you seeing any connection to that driving traffic into the store, even if it’s for returns and things like that?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, let’s say digital traffic is up across all the brands. As a matter of fact, if you look at total traffic counts, digital and stores traffic counts, which are negative and digital traffic counts, which are up significantly. If you look at the two together, the total traffic is up. The problem is, if you don’t convert digital traffic as well as you convert store traffic. So that is the real issue and what we’re working on through a lot of the tools is how in the customer experience is how you convert more digital traffic to sales. The other question was?

<Q – Marni Shapiro – The Retail Tracker LLC>: Just on White House.

<A – Dave Dyer – Chico’s FAS, Inc.>: White House, yeah, I would say that as we talked about in the beginning of the quarter, perhaps they were getting 70%-75% of their assortments in on time for the floor sets. As we got towards the end of the quarter, we were getting about 95% of the assortments in on time for the floor sets. So that would explain the choppiness that you saw throughout the quarter

<Q – Marni Shapiro – The Retail Tracker LLC>: Okay and those numbers were specific to White House or across the board?

<A – Dave Dyer – Chico’s FAS, Inc.>: Well, it was more specific to White House | Black Market. They had some specific countries that they were sourcing with that had some other issues, but White House had more problems than Chico’s did, but I should say right now from the last time I heard about it, it’s in the 95%, which is probably about normal for shipments and floor sets.

<Q – Marni Shapiro – The Retail Tracker LLC>: Great.

<A – Dave Dyer – Chico’s FAS, Inc.>: So, it looks like that we’re finally through it. But, again, I think that that’s largely because we moved everything to the East Coast ports. There’s still disruption in the West Coast ports and I don’t think that that’s going to [ph] clear (41:02) for some time.

<Q – Marni Shapiro – The Retail Tracker LLC>: Yeah, all right. Well, thank you guys. Best of luck for the summer.

<A – Dave Dyer – Chico’s FAS, Inc.>: Okay. Thanks.

Operator: Our next question is from Brian Tunick of RBC Capital. Please go ahead.

<Q – Brian Tunick – RBC Capital Markets LLC>: Thanks very much. And, Dave, I’ll add my congrats as well on your announced retirement. I guess two questions; as you guys pull back on promotions, can you talk about other marketing plans, use of the loyalty data to drive traffic? What are you doing differently this year versus last year to excite the customer? And then the second question, I guess on the emerging brands, I guess Soma and Boston Proper, what’s driving your thoughts on the pace of store openings, and how does that play into your thoughts on getting to your double-digit operating margin goals? Thanks very much.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yes, so on driving traffic; we are doing an awful lot. And, yes, very much leveraging the loyalty database. I think that’s the advantage we have strategically as we do capture customer information on well over 90% of our sales and have that database of over 9 million active customers. So we know who she is. We know what she responds to, and that allows us to be much more personalized in how we reach out to her. We know what

13

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

she’s going to respond to and so whether it’s through email or figuring out unique ways to reach out to her through paper circulation, we are really going after all of those, and in addition, really looking at the customer experience that she gets when she comes to the store. And making sure that that is exactly what she’s looking for and that we can convert at a higher and higher rate. And I’m sorry; your other question was on...

<A – Dave Dyer – Chico’s FAS, Inc.>: Pace of store openings.

<Q – Brian Tunick – RBC Capital Markets LLC>: [indiscernible] (43:00) on Soma and Boston Proper. I think they’re contributors to your double-digit operating margin target. So, just sort of, what pace of store openings do you think about? How long would it take for them to contribute combined to your double-digit margin? Things like that.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah, so Boston Proper we’re at the stage right now, we have about 19 stores out there. We are really testing those stores and what works and want to make sure that we dial it in before we go any further. For Soma, we continue to see opportunity. We’re focusing ever more on opening in centers that we think will be higher volume off the bat to take advantage of improved brand awareness. And we will continue to open stores at at least the rate that you are seeing this year, if not a [indiscernible] (43:55).

<A – Dave Dyer – Chico’s FAS, Inc.>: The real issue is when we open up a Chico’s or a White House store, we get back cash in 12 months to 18 months. When you open a Soma store, it takes us about three years. And so what happens is now that we have much less White House and Chico’s stores opening, it deleverages the Soma store openings in the short term deleverage. And so that’s one of the balance of the things that we are certainly aware of.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thanks, Brian.

Operator: Our next question is from Adrienne Yih of Janney Capital. Please go ahead.

<Q – Adrienne Yih – Janney Montgomery Scott LLC>: Good morning and David, I’ll thank you for staying on another year and congratulations.

<A – Dave Dyer – Chico’s FAS, Inc.>: Thank you.

<Q – Adrienne Yih – Janney Montgomery Scott LLC>: You’re welcome. Quick question, do you perceive that you – or were you less promotional at both core Chico’s and White House | Black Market? It was pretty evident at White House. And then from an inventory perspective, clearly you talked about the greatest impact to White House | Black Market as you come into 2Q and you’re at 95%, are you at all concerned about having overages of inventory that you may have to mark down at the core Chico’s brand? Thank you.

<A – Dave Dyer – Chico’s FAS, Inc.>: The answer is, right now, I would say no. I think that we are managing the inventory very articulately, and...

<A – Todd Vogensen – Chico’s FAS, Inc.>: We do have plans for reduced receipts over last year in Q2.

<Q – Adrienne Yih – Janney Montgomery Scott LLC>: Okay.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Really across the board that should help manage the inventory. And, yeah, absolutely we are looking at being less promotional in both Chico’s and in White House | Black Market.

14

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

<A – Dave Dyer – Chico’s FAS, Inc.>: Chico’s was especially promotional online last year.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Yeah.

<A – Dave Dyer – Chico’s FAS, Inc.>: And I think to try to move through a lot of the clearance. And I think that that is where a lot of the promotional pull back is. And then, there’s some main events that they have pulled as well.

<Q – Adrienne Yih – Janney Montgomery Scott LLC>: Okay. And then my follow-up is for fall holiday, particularly holiday, it’s going to be difficult for the misses sector, what opportunities and what type of planning is to recapture share for holiday season?

<A – Todd Vogensen – Chico’s FAS, Inc.>: You may begin.

<A – Dave Dyer – Chico’s FAS, Inc.>: Strong holiday assortments. And great marketing, great marketing, and a charged up sales force.

<Q – Adrienne Yih – Janney Montgomery Scott LLC>: Fair enough. Okay, best of luck, guys.

<A – Dave Dyer – Chico’s FAS, Inc.>: Okay.

<A – Todd Vogensen – Chico’s FAS, Inc.>: Thank you.

Operator: This concludes our question-and-answer session. I’d like to turn the conference back over to Jennifer Powers Adkins for any closing remarks.

Jennifer Powers Adkins, Vice President of Investor Relations, Chico’s FAS, Inc.

Okay. Well, we apologize for any of the questions that we did not get to today in the, I guess, 45 minutes or so that we were on the call. As always, I’m available for any follow-ups if necessary. Thank you for joining us this morning and we appreciate your continued interest in Chico’s FAS.

David F. Dyer, President, Chief Executive Officer & Director

Thank you.

Operator: The conference is now concluded. Thank you for attending today’s presentation. You may now disconnect.

15

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

|

| | | |

| | | corrected transcript |

Chico's FAS, Inc. | CHS | Q1 2015 Earnings Call | May 27, 2015 |

Company▲ | Ticker▲ | Event Type▲ | Date▲ |

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2015. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

16

|

|

www.CallStreet.com • 1-877-FACTSET • Copyright © 2001-2015 CallStreet |

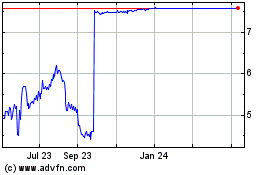

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024