UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: (Date of earliest event reported): March 27, 2015

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

Florida

(State or Other Jurisdiction of Incorporation)

|

| | |

| | |

| | |

001-16435 | | 59-2389435 |

| | |

(Commission File Number) | | (IRS Employer Identification No.) |

| | |

11215 Metro Parkway, Fort Myers, Florida | | 33966 |

| | |

(Address of Principal Executive Offices) | | (Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| | |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| | |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| | |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 27, 2015, Chico’s FAS, Inc. (the “Company”) entered into an indemnification agreement with Todd E. Vogensen, the Company's Executive Vice President, Chief Financial Officer and Corporate Secretary. The indemnification agreement provides, among other things, that the Company will indemnify him against all costs, claims, losses, damages and expenses which may be incurred or suffered by him that are related to acts, omissions, events or occurrences that arise from or are related to the fact that he is or was an officer, employee, independent contractor, stockholder or otherwise serving in another capacity at the Company’s request, subject to certain specified exceptions. The foregoing description of the form of indemnification agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the form of the indemnification agreement which is attached as Exhibit 10.1 hereto and which is incorporated by reference herein.

On March 27, 2015, the Company also entered into a Participation Agreement, commonly referred to as a “clawback” agreement, with Todd E. Vogensen. Subject to the terms of the Participation Agreement, Mr. Vogensen is required to reimburse the Company for incentive compensation previously paid to him under any of the Company’s executive bonus programs if within two years from the date of payment of such incentive compensation, the Company is required to prepare an accounting restatement due to material noncompliance of the Company with any then applicable financial reporting requirement under the securities laws as a result of misconduct by Mr. Vogensen and/or gross negligence by him in failing to prevent the misconduct or if he is otherwise subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002.

The foregoing description of the Participation Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

| | | |

| Exhibit 10.1 | | Indemnification Agreement between the Company and Todd E. Vogensen |

| Exhibit 10.2 | | Participation Agreement between the Company and Todd E. Vogensen |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | |

| | CHICO’S FAS, INC. | |

| | | |

| | By: | |

Date: April 1, 2015 | | /s/ Todd E. Vogensen | |

| | Todd E. Vogensen, Executive Vice President, Chief Financial Officer and Corporate Secretary | |

INDEX TO EXHIBITS

|

| | |

| | |

Exhibit Number | | Description |

| | |

Exhibit 10.1 | | Indemnification Agreement between the Company and Todd E. Vogensen |

Exhibit 10.2 | | Participation Agreement between the Company and Todd E. Vogensen |

INDEMNIFICATION AGREEMENT

THIS INDEMNIFICATION AGREEMENT (this “Agreement”) is made and entered into this 27th day of March, 2015, by and between Todd E. Vogensen (the “Indemnified Party”) and CHICO’S FAS, INC., a Florida corporation (the “Corporation”).

WITNESSETH

WHEREAS, it is essential to the Corporation to retain and attract as Directors and/or Executive Officers the most capable persons available; and

WHEREAS, the substantial increase in corporate litigation subjects directors and officers to expensive litigation risks at the same time that the availability of directors’ and officers’ liability insurance has been severely limited; and

WHEREAS, in addition, the statutory indemnification provisions of the Florida Business Corporation Act and Article VII of the bylaws of the Corporation (the “Article”) expressly provide that they are non-exclusive; and

WHEREAS, the Indemnified Party does not regard the protection available under the Article and insurance, if any, as adequate in the present circumstances, and considers it necessary and desirable to his service as a Director and/or Executive Officer to have adequate protection, and the Corporation desires the Indemnified Party to serve in such capacity and have such protection; and

WHEREAS, the Florida Business Corporation Act and the Article provide that indemnification of Directors and Executive Officers of the Corporation may be authorized by agreement, and thereby contemplates that contracts of this nature may be entered into between the Corporation and the Indemnified Party with respect to indemnification of the Indemnified Party as a Director and/or Executive Officer of the Corporation.

NOW THEREFORE, in consideration of the premises and the mutual covenants and agreements contained in this Agreement, it is hereby agreed as follows:

| |

1. | INDEMNIFICATION GENERALLY. |

(a) Grant of Indemnity. (i) Subject to and upon the terms and conditions of this Agreement, the Corporation shall indemnify and hold harmless the Indemnified party in respect of any and all costs, claims, losses, damages and expenses which may be incurred or suffered by the Indemnified Party as a result of or arising out of prosecuting, defending, settling or investigating:

(1) any threatened, pending, or completed claim, demand, inquiry, investigation, action , suit or proceeding, whether formal or informal or brought by or in the right of the Corporation or otherwise and whether of a civil, criminal, administrative or investigative nature, in which the Indemnified Party may be or may have been involved as a party or otherwise, arising out of the fact that the Indemnified Party is or was a director, officer, employee, independent contractor or stockholder of the Corporation or any of its “Affiliates” (as such term is defined in the rules and

regulations promulgated by the Securities and Exchange Commission under the Securities Act of 1933), or served as a director, officer, employee, independent contractor or stockholder in or for any person, firm, partnership, corporation or other entity at the request of the Corporation (including without limitation service in any capacity for or in connection with any employee benefit plan maintained by the Corporation or on behalf of the Corporation’s employees);

(2) any attempt (regardless of its success) by any person to charge or cause the Indemnified Party to be charged with wrongdoing or with financial responsibility for damages arising out of or incurred in connection with the matters indemnified against in this Agreement; or

(3) any expense, interest, assessment, fine, tax, judgment or settlement payment arising out of or incident to any of the matters indemnified against in this Agreement including reasonable fees and disbursements of legal counsel, experts, accountants, consultants and investigators (before and at trial and in appellate proceedings).

(ii) The obligation of the Corporation under this Agreement is not conditioned in any way on any attempt by the Indemnified Party to collect from an insurer any amount under a liability insurance policy.

(iii) In no case shall any indemnification be provided under this Agreement to the Indemnified Party by the Corporation in:

(1)Any action or proceeding brought by or in the name or interest of the Indemnified Party against the Corporation; or

(2)Any action or proceeding brought by the Corporation against the Indemnified Party, which action is initiated at the direction of the Board of Directors of the Corporation.

(b) Claims for Indemnification. (i) Whenever any claims shall arise for indemnification under this Agreement, the Indemnified Party shall notify the Corporation promptly and in any event within 30 days after the Indemnified Party has actual knowledge of the facts constituting the basis for such claim. The notice shall specify all facts known to the Indemnified Party giving rise to such indemnification right and the amount or an estimate of the amount of liability (including estimated expenses) arising therefrom.

(ii) Any indemnification under this Agreement shall be made no later than 30 days after receipt by the Corporation of the written notification specified in Section 1(b)(i), unless a determination is made within such 30 day period by (X) the Board of Directors by a majority vote of a quorum consisting of directors who were not parties to the mater described in the notice of (Y) independent legal counsel, agreed to by the Corporation, in a written opinion (which counsel shall be appointed if such a quorum is not obtainable), that the Indemnified Party has not met the relevant standards for indemnification under this Agreement.

(c) Rights to Defend or Settle; Third Party Claims, etc. (i) If the facts giving rise to any indemnification right under this Agreement shall involve any actual or threatened claim or demand against the Indemnified Party, or any possible claim by the Indemnified Party against any third party, such claim shall be referred to as a “Third Party Claim.” If the Corporation provides the Indemnified Party with an agreement in writing in form and substance satisfactory to the Indemnified Party and his counsel, agreeing to indemnify, defend or prosecute and hold the Indemnified Party harmless from all costs and liability arising from any Third Party Claim (an “Agreement of Indemnity”), and demonstrating to the satisfaction of the Indemnified Party the financial wherewithal to accomplish such indemnification, the Corporation may at its own expense undertake full responsibility for the defense or prosecution of such Third Party Claim. The Corporation may contest or settle any such Third Party Claim for money damages on such terms and conditions as it deems appropriate but shall be obligated to consult in good faith with the Indemnified Party and not to contest or settle any Third Party Claim involving injunctive or equitable relief against or affecting the Indemnified Party of his properties or assets without the prior written consent of the Indemnified Party, such consent not to be withheld unreasonably. The Indemnified Party may participate at his own expense and with his own counsel in defense or prosecution of a Third Party Claim pursuant to this Section 1(c)(i), and such participation shall not relieve the Corporation of its obligation to indemnify the Indemnified Party under this Agreement.

(ii) If the Corporation fails to deliver a satisfactory Agreement of Indemnity and evidence of financial wherewithal within 10 days after receipt of notice pursuant to Section 1(b), the Indemnified Party may contest or settle the Third Party Claim on such terms as it sees fit but shall not reach a settlement with respect to the payment of money damages without consulting in good faith with the Corporation. The Corporation may participate at its own expense and with its own counsel in defense or prosecution of a Third Party Claim pursuant to this Section 1(c)(ii), but any such participation shall not relieve the Corporation of its obligations to indemnify the Indemnified Party under this Agreement. All expenses (including attorneys’ fees) incurred in defending or prosecuting any Third Party Claim shall be paid promptly by the Corporation as the suit or other matter is proceeding, upon the submission of bills therefore or other satisfactory evidence of such expenditures during the pendency of any matter as to which indemnification is available under this Agreement. The failure to make such payments within 10 days after submission of evidence of those expenses shall constitute a breach of a material obligation of the Corporation under this Agreement.

(iii) If by reason of any Third Party Claim a lien, attachment, garnishment or execution is placed upon any of the property or assets of the Indemnified Party, the Corporation shall promptly furnish a satisfactory indemnity bond to obtain the prompt release of such lien, attachment, garnishment or execution.

(iv) The Indemnified Party shall cooperate in the defense of any Third Party Claim which is controlled by the Corporation, but the Indemnified Party shall continue to be entitled to indemnification and reimbursement for all costs and expenses incurred by him in connection therewith as provided in this Agreement.

(d) Cooperation. The parties to this Agreement shall execute such powers of attorney as may be necessary or appropriate to permit participation of counsel selected by any party hereto and, as may be reasonably related to any such claim or action, shall provide to the counsel, accountants and other representatives of each party access during normal business hours to all

properties, personnel, books, records, contracts, commitments and all other business records of such other party and will furnish to such other party copies of all such documents as may be reasonably requested (certified, if requested).

(e) Choice of Counsel. In all matters as to which indemnification is available to the Indemnified Party under this Agreement, the Indemnified Party shall be free to choose and retain counsel, provided the Indemnified Party shall secure the prior written consent of the Corporation as to such selection, which consent shall not be unreasonably withheld.

(f) Consultation. If the Indemnified Party desires to retain the services of an attorney prior to the determination by the Corporation as to whether it will undertake the defense or prosecution of the Third Party Claim as provided in Section 1(c), the Indemnified Party shall notify the Corporation of such desire in the notice delivered pursuant to Section 1(b)(i), and such notice shall identify the counsel to be retained. The Corporation shall then have 10 days within which to advise the Indemnified Party whether it will assume the defense or prosecution of the Third Party Claim in accordance with Section 1(c)(i). If the Indemnified Party does not receive an affirmative response within such 10-day period, he shall be free to retain counsel of his choice, and the indemnity provided in Section 1(a) shall apply to the reasonable fees and disbursements of such counsel incurred after the expiration of such 10-day period. Any fees or disbursements incurred prior to the expiration of such 10-day period shall not be covered by the indemnity of Section 1(a).

(g) Repayment. (i) Notwithstanding the other provisions of this Agreement to the contrary, if the Corporation has incurred any cost, damage or expense under this Agreement paid to or for the benefit of the Indemnified Party and it is determined by a court of competent jurisdiction from which no appeal may be taken that the Indemnified Party’s actions or omissions constitute “Nonindemnifiable Conduct” as that term is defined in Section 1(g)(ii), the Indemnified Party shall and does hereby undertake in such circumstances to reimburse the Corporation for any and all such amounts previously paid to or for the benefit of the Indemnified Party.

(ii) For these purposes, “Nonindemnifiable Conduct” shall mean actions or omissions of the Indemnified Party material to the cause of action to which the indemnification under this Agreement related is determined to involve:

(1) a violation of the criminal law, unless the Indemnified Party had reasonable cause to believe his conduct was lawful and had no reasonable cause to believe his conduct was unlawful;

(2) a transaction in which the Indemnified Party derived an improper personal benefit;

(3) if the Indemnified Party is a director of the Corporation, a circumstance under which the liability provisions of Section 607.0834 (or any successor or similar statute) are applicable;

(4) willful misconduct or a conscious disregard for the best interests of the Corporation (when indemnification is sought in a proceeding by or in the right

of the Corporation to procure a judgment in favor of the Corporation or when indemnification is sought in a proceeding by or in the right of a stockholder); or

(5) conduct pursuant to then applicable law that prohibits such indemnification.

This Agreement shall be effective upon its execution by all parties and shall continue in full force and effect until the date seven years after the date of this Agreement, or seven years after the termination of the Indemnified Party’s employment or term of office, whichever is later, provided that such term shall be extended by any period of time during which the Corporation is in breach of a material obligation to the Indemnified Party, plus ninety days. Such term shall also be extended with respect to each Third Party Claim then pending and as to which notice under Section 1(b) has theretofore been given by the Indemnified Party to the Corporation, and this Agreement shall continue to be applicable to each such Third Party Claim.

| |

3. | REPRESENTATIONS AND AGREEMENTS OF THE CORPORATION. |

(a) Authority. The Corporation represents, covenants and agrees that it has the corporate power and authority to enter into this Agreement and to carry out its obligations under this Agreement. The execution, delivery and performance of this Agreement and the consummation of the transactions contemplated by this Agreement have been duly authorized by the Board of Directors of the Corporation. This Agreement is a valid and binding obligation of the Corporation and is enforceable against the Corporation in accordance with its terms.

(b) Noncontestability. The Corporation represents, covenants and agrees that it will not initiate, and that it will use its best efforts to cause any of its Affiliates not to initiate, any action, suit or proceeding challenging the validity or enforceability of this Agreement.

(c) Good Faith Judgment. The Corporation represents, covenants and agrees that it will exercise good faith judgment in determining the entitlement of the Indemnified Party to indemnification under this Agreement.

| |

4. | RELATIONSHIP OF THIS AGREEMENT TO OTHER INDEMNITIES. |

(a) Nonexclusivity. (i) This Agreement and all rights granted to the Indemnified Party under this Agreement are in addition to and are not deemed to be exclusive with or of any other rights that may be available to the Indemnified Party under any Articles of Incorporation, bylaw, statute, agreement, or otherwise.

(ii) The rights, duties and obligations of the Corporation and the Indemnified Party under this Agreement do no limit, diminish or supersede the rights, duties and obligations of the Corporation and the Indemnified Party with respect to the indemnification afforded to the Indemnified Party under any liability insurance, the Florida Business Corporation Act, or under the bylaws or the Articles of Incorporation of the Corporation. In addition, the Indemnified Party’s rights under this

Agreement will not be limited or diminished in any respect by any amendment to the bylaws or the Articles of Incorporation of the Corporation.

(b) Availability, Contribution, etc. (i) The availability or nonavailability of indemnification by way of insurance policy, Articles of Incorporation, bylaw, vote of stockholders, or otherwise from the Corporation to the Indemnified Party shall not affect the right of the Indemnified Party to indemnification under this Agreement, provided that all rights under this Agreement shall be subject to applicable statutory provisions in effect from time to time.

(ii) Any funds received by the Indemnified Party by way of indemnification or payment from any source other than from the Corporation under this Agreement shall reduce any amount otherwise payable to the Indemnified Party under this Agreement.

(iii) If the Indemnified Party is entitled under any provision of this Agreement to indemnification by the Corporation for some claims, issues or matters, but not as to other claims, issues or matters, or for some or a portion of the expenses, judgments, fines or penalties actually and reasonably incurred by him or amounts actually and reasonably paid in settlement by him in the investigation, defense, appeal or settlement of any matter for which indemnification is sought under this Agreement, but not for the total amount thereof, the Corporation shall nevertheless indemnify the Indemnified Party for the portion of such claims, issues or matters or expenses, judgments, fines, penalties or amounts paid in settlement to which the Indemnified Party is entitled.

(iv) If for any reason a court of competent jurisdiction from which no appeal can be taken rules than the indemnity provided under this Agreement is unavailable, or if for any reason the indemnity under this Agreement is insufficient to hold the Indemnified Party harmless as provided in this Agreement, then in either event, the Corporation shall contribute to the amounts paid or payable by the Indemnified Party in such proportion as equitably reflects the relative benefits received by, and fault of the Indemnified Party and the Corporation and its Affiliates.

(c) Allowance for Compliance with SEC Requirements. The Indemnified Party acknowledges that the Securities and Exchange Commission (“SEC”) has expressed the opinion that indemnification of directors and officers from liabilities under the Securities Act of 1933 (the “1933 Act”) is against public policy as expressed in the 1933 Act and, is therefore, unenforceable. The Indemnified Party hereby agrees that it will not be a breach of this Agreement for the Corporation to undertake with the SEC in connection with the registration for sale of any stock or other securities of the Corporation from time to time that, in the event a claim for indemnification against such liabilities (other than the payment by the Corporation of expenses incurred or paid by a director of officer of the Corporation in the successful defense of any action, suit or proceeding) is asserted in connection with such stock or other securities being registered, the Corporation will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of competent jurisdiction on the question of whether or not such indemnification by it is against public policy as expressed in the 1933 Act and will be governed by the final adjudication of such issue. The Indemnified Party further agrees that such submission to a court of competent jurisdiction shall not be a breach of this Agreement.

(a) Notices. All notices, requests, demands and other communications which are required or may be given under this Agreement shall be in writing and shall be deemed to have been duly given when received if personally delivered; when transmitted if transmitted by telecopy, electronic telephone line facsimile transmission or other similar electronic or digital transmission method; the day after it is sent, if sent by recognized expedited delivery service; and five days after it is sent, if mailed, first class mail, postage prepaid. In each case notice shall be sent to:

If to the Indemnified Party:

Todd Vogensen

##################

##################

If to the Corporation:

Chico’s FAS, Inc.

11215 Metro Parkway

Fort Myers, FL 33912

or to such other address as either party may have specified in writing to the other using the procedures specified above in this Section 5(a).

(b) Construction and Interpretation. (i) This Agreement shall be construed pursuant to and governed by the substantive laws of the State of Florida (and any provision of Florida law shall not apply if the law of a state or jurisdiction other than Florida would otherwise apply).

(ii) The headings of the various sections in this Agreement are inserted for the convenience of the parties and shall not affect the meaning, construction or interpretation of this Agreement.

(iii) Any provision of this Agreement which is determined by a court of competent jurisdiction to be prohibited, unenforceable or not authorized in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition, unenforceability or non-authorization without invalidating the remaining provisions hereof or affecting the validity, enforceability or legality of such provision in any other jurisdiction. In any such case, such determination shall not affect any other provision of this Agreement, and the remaining provisions of this Agreement shall remain in full force and effect. If any provision or term of this Agreement is susceptible to two or more constructions or interpretations, one or more of which would render the provision or term void or unenforceable, the parties agree that a construction or interpretation which renders the term or provision valid shall be favorable.

(iv) As used in this Agreement, (1) the word “including” is always without limitation; (2) the words in the singular number include words of the plural number and vice versa; and (3) the word “person” includes a trust, corporation, association, partnership, joint venture, business trust, unincorporated organization, limited liability company, government, public body or authority and any governmental agency or department as well as a natural person.

(c) Entire Agreement. This Agreement constitutes the entire Agreement, and supersedes all prior agreements and understandings, oral and written, among the parties to this Agreement with respect to the subject matter hereof.

(d) Specific Enforcement. (i) The parties agree and acknowledge that in the event of a breach by the Corporation of its obligation promptly to indemnify the Indemnified Party as provided in this Agreement, or breach of any other material provision of this Agreement, damages at law will be an insufficient remedy to the Indemnified Party. Accordingly, the parties agree that, in addition to any other remedies or rights that may be available to the Indemnified Party, the Indemnified Party shall also be entitled, upon application to a court of competent jurisdiction, to obtain temporary or permanent injunctions to compel specific performance of the obligations of the Corporation under this Agreement.

(ii) There shall exist in such action a rebuttable presumption that the Indemnified Party has met the applicable standard(s) of conduct and is therefore entitled to indemnification pursuant to this Agreement, and the burden of proving that the relevant standards have not been met by the Indemnified Party shall be on the Corporation. Neither the failure of the corporation (including its Board of Directors or independent legal counsel) prior to the commencement of such action to have made a determination that indemnification is proper in the circumstances because the Indemnified Party has met the applicable standard of conduct, nor an actual determination by the Corporation (including its Board of Directors or independent legal counsel) that the Indemnified Party has not met such applicable standard of conduct, shall (X) constitute a defense to the action, (Y) create a presumption that the Indemnified Party has not met the applicable standard of conduct, or (Z) otherwise alter the presumption in favor of the Indemnified Party referred to in the preceding sentence.

(e) Cost of Enforcement; Interest. (i) If the Indemnified party engages the services of an attorney or any other third party or in any way initiates legal action to enforce his rights under this Agreement, including but not limited to the collection of monies due from the Corporation to the Indemnified Party, the prevailing party shall be entitled to recover all reasonable costs and expenses (including reasonable attorneys’ fees before and at trial and in appellate proceedings). Should the Indemnified Party prevail, such costs and expenses shall be in addition to monies otherwise due him under this Agreement.

(ii) If any monies shall be due the Indemnified Party from the Corporation under this Agreement and shall not be paid within 30 days from the date of written request for payment, interest shall accrue on such unpaid amount at the rate of 2% per annum in excess of the prime rate announced from time to time by Bank of America, or such lower rate as may be required to comply with applicable law from the date when due until it is paid in full.

(f) Application to Third Parties, Etc. Nothing in this Agreement, whether express or implied, is intended or should be construed to confer upon, or to grant to, any person, except the Corporation, the Indemnified Party and their respective heirs, assignees and successors, any claim, right or remedy under or because of this Agreement or in any provision of it. This Agreement shall be binding upon and inure to the benefit of the successors in interest and assigns, heirs and personal representatives, as the case may be, of the parties, including any successor corporation resulting from a merger, consolidation, recapitalization, reorganization, sale of all or substantially all of the assets of

the Corporation, or any other transaction resulting in the successor corporation assuming the liabilities of the Corporation under this Agreement (by operation of law, or otherwise).

(g) Further Assurances. The parties to this Agreement will execute and deliver, or cause to be executed and delivered, such additional or further documents, agreements or instruments and shall cooperate with one another in all respects for the purpose of carrying out the transactions contemplated by this Agreement.

(h) Venue; Process. The parties to this Agreement agree that jurisdiction and venue in any action brought pursuant to this Agreement to enforce its terms or otherwise with respect to the relationships between the parties shall properly lie in the Circuit Court of the Twentieth Judicial Circuit of the State of Florida in and for Lee County or in the United States District Court for the Middle District of Florida, Tampa Division. Such jurisdiction and venue are merely permissive; jurisdiction and venue shall also continue to lie in any court where jurisdiction and venue would otherwise be proper. The parties agree that they will not object that any action commenced in the foregoing jurisdictions is commenced in a forum non conveniens. The parties further agree that the mailing by certified or registered mail, return receipt requested, of any process required by any such court shall constitute valid and lawful service of process against them, without the necessity for service by any other means provided by statute or rule of court.

(i) Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be considered an original, but all of which together shall constitute one and the same instrument.

(j) Waiver and Delay. No waiver or delay in enforcing the terms of this Agreement shall be construed as a waiver of any subsequent breach. No action taken by the Indemnified Party shall constitute a waiver of his rights under this Agreement.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first above written.

|

| | |

CHICO’S FAS, INC. |

By: | | /s/ David F. Dyer |

| | David F. Dyer |

| | President & Chief Executive Officer |

WITNESSES:

|

| | |

/s/ Laurie A. Evans | | Laurie A. Evans |

| | Print Name |

| | |

/s/ Anna Maria Lazzizzera | | Anna Maria Lazzizzera |

| | Print Name |

CHICO’S FAS, INC.

EXECUTIVE BONUS PROGRAMS

PARTICIPATION AGREEMENT

This Participation Agreement is entered into this 27th day of March, 2015, by and between Chico’s FAS, Inc. (the “Company”) and Todd E. Vogensen (the “Participant”).

WHEREAS, the Participant is a key employee of the Company selected by the Company to participate in one or more executive bonus programs (the “Programs”); and

WHEREAS, as a condition to receiving any bonus payable pursuant to any of the Programs, the Participant acknowledges and agrees to be bound by the following condition:

Repayment of Bonus. If (a) within the two-year period immediately following payment of any Bonus under any Program the Company is required to prepare an accounting restatement due to the material noncompliance of the Company, as a result of misconduct, with any financial reporting requirement under the securities laws, and (b) the Participant is subject to automatic forfeiture under Section 304 of the Sarbanes-Oxley Act of 2002 or knowingly engaged in the misconduct, was grossly negligent in engaging in the misconduct, knowingly failed to prevent the misconduct or was grossly negligent in failing to prevent the misconduct, then the Participant shall reimburse the Company for the amount of any such Bonus paid under any Program.

IN WITNESS WHEREOF, the parties have executed this Participation Agreement on the date first written above.

|

| | |

CHICO’S FAS, INC. |

By: | | /s/David F. Dyer |

Title: | | President & Chief Executive Officer |

|

| | |

PARTICIPANT: |

| | /s/ Todd E. Vogensen |

| | Participant’s Signature |

| | |

| | Todd E. Vogensen |

| | Participant’s Name – Please Print |

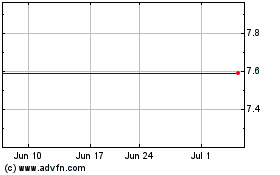

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

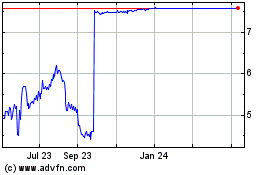

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024