February Retail Sales On Track For Solid Gain

February 29 2012 - 1:14PM

Dow Jones News

Retailers' February comparable sales are on track to have their

best finish since September, boosted by Valentine's Day and

Presidents' Day sales and warmer weather that gave shoppers

motivation to buy new spring apparel, at full price.

February sales, due to be reported Thursday, likely rose 4.8%,

above the year-earlier level of a 4% gain and the best increase

since September, according to a survey of analysts by Thomson

Reuters, which said the estimates point to "robust" demand because

a 3% reading generally signals "health among U.S. consumers."

Expectations have turned higher. A separate survey by Retail

Metrics showed February sales estimates have risen by 0.7

percentage point to a 3.5% increase from the start of the

month.

In an encouraging sign, Costco Wholesale Corp. (COST) said

Wednesday its February same-store sales rose 8%, topping Wall

Street's expectations.

Still, analysts said the big question mark is how much of the

retailers' sales were being driven at the cost of profit. Costco's

quarterly margin, for instance, narrowed more than expected.

February's industry-wide demand was boosted by Valentine's Day

sales, which the National Retail Federation said rose in the

high-single-digit, as well as by promotions over the Presidents'

Day holiday weekend, analysts said. Fresh spring merchandise,

including colored skinny denim and clothes featuring bright color

blocking or floral designs, also managed to spur shoppers to open

their wallets, analysts said.

Consumers' shopping mood also has been lifted by a string of

positive economic signals. While American Automobile Association

Inc. data showed gas prices have risen 14% to $3.67 a gallon as of

Saturday, consumer confidence has risen to its highest level in a

year with more people feeling better about the job market. The

Labor Department's most recent report showed the jobless rate fell

to 8.3%, its lowest level in almost three years.

"Precipitously rising gas prices could prove to be a fly in the

ointment as we move into the spring," said Ken Perkins, of Retail

Metrics.

Discounter Target Corp. (TGT) said last week the pace of the

company's sales has picked up and returned to a much stronger

preholiday pace in February as it also saw stronger demand in

so-called discretionary categories.

Women's apparel chain Chico's FAS Inc. (CHS) has said its

February sales got off to a solid start and were running up 7%.

T.J. Maxx parent TJX Cos. (TJX), meanwhile, raised its February

sales forecast to a 7% gain from its previous projection of a

low-single-digit rate. Victoria's Secret parent Limited Brands

Inc.(LTD) also raised its February sales outlook to a range in the

mid-to-high-single digit from a previous guidance of sales rising

in the low-single digit.

"February is off to a good start," said Barclays Capital analyst

Stacy Pak, adding the month historically averaged about 6% of

annual sales.

Analysts said the arrival of Easter about two weeks earlier this

year than last year also will help sustain the sales momentum into

March, when many colleges also begin their spring breaks.

As consumer sentiment improves and demand picks up, aggressive

promotions that were the hallmarks of most retailers' business

models during the holiday season showed some signs of easing,

analysts said.

"We noted diminishing clearance inventories throughout the month

and believe that the majority of retailers began the quarter [and

ended the month] with clean inventory positions," said Janney

Capital Markets analyst Adrienne Tennant. While she still noted

deeper year-over-year promotions thus far in the first quarter,

they are "to a far less extent" than in the fourth quarter.

February is a transitional month between spring flows and

remaining winter clearance items and represents about 25% to 30% of

retailers' fiscal first-quarter sales, she said. "New full-price

flows (are) commanding center stage throughout the mall," she

said.

Among those retailers that report their February sales,

discounters are forecast to post the biggest gain at 6.2%, Thomson

Reuters data showed. In addition to Costco, Target is on track for

a 5% gain. Apparel retailers excluding Gap Inc. (GPS) are expected

to post a 5.8% increase while Gap is estimated to have a 1.4%

decline. Discount giant Wal-Mart Stores Inc. (WMT) no longer

reports monthly sales.

Gap's "aggressive promotions across all divisions underscores

management's efforts to drive traffic and accelerate sales," said

Stifel Nicolaus & Co. analyst Richard Jaffe. "We anticipate

slightly negative (same-store sales) across all divisions, and a

modest gain at Banana. During (the first quarter), we anticipate

continued margin pressure as a result of the continued discounting

and high product costs."

The department-store group is expected to ring in a 2.8% sales

gain, led by the higher-end retailers Saks Inc. (SKS), Nordstrom

Inc. (JWN) and Bloomingdale's parent Macy's Inc. (M).

J.C. Penney Co. (JCP), which has stopped reporting monthly

sales, has said February sales were below its expectations as it

transitions to a new pricing and promotional strategy.

-Andria Cheng; 415-439-6400; AskNewswires@dowjones.com

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

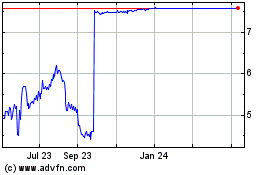

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024