Retail Stocks Are Showing Rise For 1Q, But Momentum Is Waning

March 31 2011 - 4:01PM

Dow Jones News

Reflecting continued optimism about the U.S. economy, retail

stocks are on pace to mark their third quarterly gain in a row.

The advance would contribute to their almost doubling in price

since a low at the end of 2008 as retailers licked their wounds

from a terrible holiday selling season.

But the stocks' momentum is slowing, with the Standard &

Poor' Retail Index up 1.4% for the first quarter, after an 11% rise

in the prior quarter and a 19% advance in the last year's third

quarter. The retail index is also lagging the 5.6% first quarter

advance being seen by the broader market Standard & Poor's 500

Index. The first quarter ends at the close of trading Thursday.

Still, the upward move by retail stocks reflects how investors

are feeling about conditions in the U.S. since retailers' own

fortunes are so closely tied to consumer spending.

The stocks' trajectory "speaks well for sentiment against a

double-dip recession," said Sahk Manuelian, managing director of

trading at Wedbush Securities. "The economy is trying to get well

and people are starting to spend again, especially on the high

end."

Lower-end retailers' shares have also been elevated, by takeover

chatter, which is another positive indicator, Manuelian said.

"People feel that things are still priced inappropriately low and

that is why you are seeing private equity come in."

Retailers have recovered sharply from the worst recession in

over a generation, with many posting very strong results last year

that were reflected in reports issued during the current

quarter.

The first quarter's big gainer is Big Lots Inc. (BIG), up 42%

amid ongoing takeover speculation during the period. 99 Cents Only

Stores (NDN), another takeover candidate, rose 23% during the first

quarter.

Chico's FAS Inc. (CHS), Jos. A Bank Clothiers Inc. (JOSB) and

Tractor Supply Co. (TSCO) were also double digit percentage risers

in the first quarter.

Target Corp. (TGT), Barnes & Noble, OfficeMax Inc. (OMX) and

RadioShack Corp. (RSH) all fell 16% or more over the period.

Wal-Mart Stores Inc. (WMT), which is not in the index, but is

the biggest retailer in the U.S., dropped roughly 3.5% in the first

quarter. The retailer is trying to bring domestic operations back

up to speed after U.S. same-store sales have fallen seven quarters

in a row.

As the quarter wraps up on Thursday, the S&P Retail Index is

finishing the session to the downside, off 0.6%. Barnes & Noble

Inc. (BKS), J.C. Penney Co. (JCP) and Best Buy Co. (BBY) are all

down more than 2%. Zumiez Inc. (ZUMZ), Abercrombie & Fitch Co.

(ANF) and Williams-Sonoma Inc. (WSN) lead the advancers with gains

of at least 1.5% on Thursday.

-By Karen Talley, Dow Jones Newswires; 212-416-2196;

karen.talley@dowjones.com

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

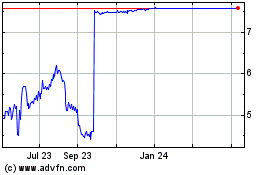

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024