By Ryan Dezember and Kevin Helliker

Duke University made a claim on the estate of oil magnate Aubrey

McClendon, saying the Chesapeake Energy Corp. co-founder died

before he could make good on roughly $10 million of pledges.

Mr. McClendon, who graduated from Duke in 1981, became a major

benefactor of the North Carolina college after he struck riches in

the oil patch. When he died in March in a car crash in Oklahoma

City, Mr. McClendon had unfunded commitments to Duke totaling

$9,942,000, the university said in a probate court filing that

became public late Tuesday.

That figure represents roughly half of the $18.75 million that

Mr. McClendon pledged to Duke in recent years for athletics funds,

scholarships and campus- improvement projects, according to the

filing.

A Duke spokesman declined to comment. Tom Blalock, a longtime

associate of Mr. McClendon who is administering his estate, didn't

respond to requests for comment.

Mr. McClendon's creditors, which so far range from Wall Street

banks to a former employee to an agricultural-equipment maker, have

until Sept. 16 to file claims against the estate, which is being

unwound in an Oklahoma City district court.

The famous wildcatter left behind a vast tangle of assets and

liabilities when his speeding Chevy Tahoe crashed into a concrete

underpass the morning of March 2. He had been ousted from

Chesapeake over corporate-governance issues three years earlier and

had leveraged many of his personal holdings to finance a comeback

bid.

Collapsing oil prices in late 2014 strained the new oil-and-gas

empire he had assembled, and he struggled in his final year to

raise more cash to keep it afloat.

Oklahoma records show he had pledged assets as collateral for

loans including his roughly 20% stake of the Oklahoma City Thunder

basketball team, fine wine, investments in tech startups and

antique boats.

Lawyers for Mr. McClendon's creditors have said they think Mr.

McClendon, who during his Chesapeake heyday was a billionaire, left

behind more debt than assets.

"Based on information we have thus far, we believe this is an

insolvent estate," Arthur Hoge III, a lawyer representing

Wilmington Trust Corp., said in a May hearing in Oklahoma City. Mr.

Hoge said Mr. McClendon died owing his client, a unit of M&T

Bank Corp., more than $465 million.

Martin Stringer, a lawyer for Mr. McClendon's estate, said

claiming it

is insolvent is "incorrect" because "nobody has the facts,"

according

to a transcript of the hearing. The value of many assets

"depends on

commodity prices," he added. He said that the estate

includes

interests in more than 180 companies and other business

ventures.

Duke's claim is unique in that it is the only one yet tied to

the oilman's charitable giving, for which he was well known in his

hometown and at his alma mater.

At Duke, Mr. McClendon met his wife, Kathleen McClendon, who

graduated in 1980. The couple sent each of their three children

there. He built Chesapeake's Oklahoma City headquarters, with rows

of redbrick Georgian buildings, in the image of Duke's Durham,

N.C., campus.

Mr. McClendon's largess was well known at Duke. McClendon

Commons is adjacent to an admissions office. The McClendons gave at

least $1.2 million for the restoration of a massive pipe organ in

the university's chapel now known as the Kathleen Upton Byrns

McClendon organ. The university in 2002 tried to memorialize the

couple with a pair of gargoyles carved in their likenesses and

installed above an entrance to McClendon Tower, a dormitory, but

the couple insisted they be removed, according to local news

reports at the time.

Mr. McClendon's gifts to Duke exceed $20 million, according to a

person familiar with his giving.

It is unclear whether Duke will be able to collect the

outstanding pledges. Besides the estate's solvency, there will be a

question whether there was a contract between Duke and the donor,

said Richard Marker, a professor of philanthropy at the University

of Pennsylvania and New York University, who added that he knows

nothing about Mr. McClendon's pledge to Duke. "If there's a signed

letter of commitment," he said, "generally speaking, that's

considered legally binding."

But even if Duke's legal position is strong, pursuing it

aggressively might be counterproductive, said Doug White, former

director of the nonprofit management program at Columbia University

and an author of books on philanthropy. "How positive is it to see

a university sue a donor?" he asks. "The attorneys at Duke aren't

going to take that into account. But the fundraising office or

president's office ought to take that into account."

Write to Ryan Dezember at ryan.dezember@wsj.com and Kevin

Helliker at kevin.helliker@wsj.com

(END) Dow Jones Newswires

August 24, 2016 05:44 ET (09:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

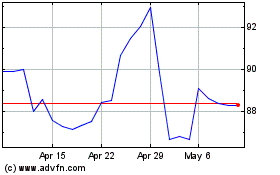

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

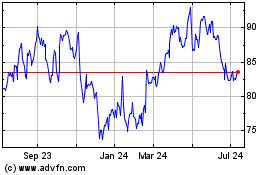

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024