Chesapeake Energy to Exit Barnett Shale -- Update

August 10 2016 - 6:52PM

Dow Jones News

By Erin Ailworth and Josh Beckerman

Chesapeake Energy Corp. is paying nearly $340 million to exit

the Barnett Shale in Texas as the Oklahoma City-based energy

producer tries to clean up its finances.

The deal will help rid Chesapeake of nearly $1.9 billion in

financial commitments it had to Williams Partners LP, a pipeline

company that moved to market the natural gas Chesapeake pumped in

the Barnett. Chesapeake was on the hook to pay Williams $170

million this year and $230 million next year, the company said

Wednesday.

Instead, Chesapeake has agreed to pay Williams $334 million in

cash that will get the oil and gas producer out of its pipeline

contract in the Barnett. In addition, Chesapeake will transfer its

interests in the Barnett field to Saddle Barnett Resources LLC, a

private equity-backed company based in Dallas.

In addition, Saddle will pay Williams $420 million as part of

the deal, giving it 2,800 operated wells and about 215,000 acres of

land in the area.

Chesapeake Chief Executive Doug Lawler said the company hasn't

invested significantly in the acreage for several years, so selling

it improves Chesapeake's finances while giving another company the

opportunity to drill there.

"We are essentially divesting an asset that is a very

significant cash-flow drain on the company every single year," he

said. "This is just another step in strengthening Chesapeake."

Williams Partners said in statement that it expects to receive

$820 million of upfront cash payments, and said the transactions

would reduce customer concentration risk.

"These agreements will create a win-win commitment that results

in both short- and long-term benefits for Williams," said Alan

Armstrong, CEO of Williams Partners' general partner.

Saddle Resources couldn't immediately be reached for

comment.

Chesapeake will also pay Williams $66 million after

renegotiating a separate gas-transportation contract the two have

for moving gas out of fields in Oklahoma.

The Barnett Shale was once a prolific gas field near Fort Worth

in North Texas, but in recent years drilling for new wells has

waned amid low natural gas prices. There are currently four rigs

drilling in the Barnett, compared with 177 rigs drilling in the

Permian Basin of West Texas, according to data from Baker Hughes

Inc., an oil-field service company in Houston.

The three-way Chesapeake arrangement is unusual, but the company

has been strained in recent years by so-called minimum volume

commitments on pipelines, which require it to move a high volume of

fuel or pay a penalty. Chesapeake needed to shed those commitments

and said the deal will improve its operating income by $200 million

to $300 million each year through 2019.

Chesapeake's stock price, which settled at $4.80 Wednesday,

gained nearly 6% in after-hours trading to $5.07 a share.

Write to Erin Ailworth at Erin.Ailworth@wsj.com and Josh

Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

August 10, 2016 18:37 ET (22:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

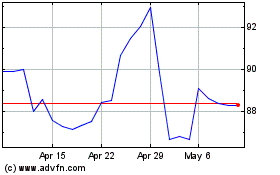

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

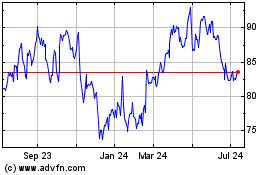

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024