Permian Resources Draws Strong Interest From Debt Investors

July 12 2016 - 1:40PM

Dow Jones News

Wall Street debt investors have encircled a beleaguered oil

producer founded by the late Aubrey McClendon and are in early

talks to take control of it in a deal that could also take the

company public, according to people familiar with the matter.

Such a deal, for Permian Resources LLC, w ould come in a hot

market for shares of companies that drill in the Permian Basin

region of West Texas and potentially head off a more contentious

restructuring of the company, which credit-rating firms have said

is likely to run out of cash by early next year barring a big rise

in oil prices.

Among the firms that have gobbled up Permian Resources'

discounted debt are Apollo Global Management LLC, Oaktree Capital

Group LP, EIG Global Energy Partners, Ares Management LP and WL

Ross & Co., the people said.

They are in talks with Permian Resources' owners, which include

energy-focused private-equity firms Energy & Minerals Group and

First Reserve Corp. as well as the estate of Mr. McClendon, t he

energy titan who died in an early March car wreck in Oklahoma

City.

The talks are nascent, the people cautioned, and may not lead to

a deal.

A deal for Permian Resources would represent one of the first

instances in the current commodities bust in which creditors gained

control of a significant oil and gas producer. The talks also come

as creditors tussle in Oklahoma City probate court over the web of

assets and liabilities that Mr. McClendon left behind.

Among the possibilities discussed for Permian Resources, the

people said, are swapping debt for equity and pursuing a public

listing through a merger, potentially with a blank-check company,

entities without assets that sell shares to raise cash for future

acquisitions. A deal could also include an cash infusion from the

company's current owners, creditors or someone else, they said.

The biggest oil bust in decades has made buying debt of

distressed energy companies popular with big investors. Such

situations often play out in one of two ways. If the indebted

company rebounds, its bond prices rise. If it fails, the debt

holder often has a claim on the company's assets.

So far, though, many companies have staved off serious

entanglements with creditors by selling assets and new shares to

raise cash.

Most of the more than 80 North American energy producers that

have filed for bankruptcy since 2014 didn't have the prime drilling

fields that Permian Resources owns, making it difficult for them to

raise cash and making them less attractive to investors maneuvering

to take over assets.

Mr. McClendon launched Permian Resources in 2014 after he was

ousted from Chesapeake Energy Corp., the oil and gas giant he

co-founded. Originally called American Energy-Permian Basin LLC, it

was one of several oil and gas ventures the oilman started with

Houston private investment firm Energy & Minerals Group.

EMG, which is led by John Raymond, the son of former Exxon Mobil

Corp. chief Lee Raymond, and other investors bet big on Mr.

McClendon's comeback, backing several new energy companies,

including Permian Resources. Fueled by more than $15 billion of

cash and debt raised from his backers, Mr. McClendon quickly got to

work buying up swaths of drilling land around the country.

Permian Resources spent more than $3.6 billion acquiring

properties in West Texas before oil prices plunged in late 2014,

mostly with borrowed money, according to its public

disclosures.

Though the company has nearly tripled its production, to the

equivalent of about 28,000 barrels a day, oil's fall to about the

half the $100 a barrel range at which it traded when Permian

Resources got started has crimped the firm. It has restructured

some debt, though it had to agree to a higher interest rate to do

so, and said it bought back more than $200 million of bonds for 10

cents on the dollar earlier this year.

"Despite the debt reduction, we continue to view Permian

Resources' leverage as unsustainable, and believe the company could

face a liquidity shortfall next year, absent additional asset sales

or an equity infusion," S&P Global Ratings analyst Carin

Dehne-Kiley said in a May report.

Permian Resources carries about $2.4 billion of debt, some of

which has recently traded at about 55 cents on the dollar,

according to FactSet.

Fire-sale prices like that have enabled Wall Street firms to

stake claim to drilling fields in the country's most prolific

drilling region on the cheap. Stacked layers of energy-bearing rock

help many Permian Basin wells produce oil in enough volume to make

drilling worth the expense, even amid low crude prices.

EIG last year told investors that it had spent roughly $150

million buying Permian Resources' bonds at about 70% of their face

value and had earmarked about $250 million more to keep buying

them, according to documents from the Alaska Retirement Management

Board, which invests with the firm.

(END) Dow Jones Newswires

July 12, 2016 13:25 ET (17:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

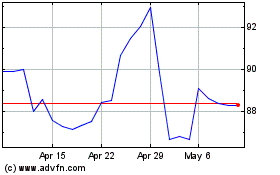

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

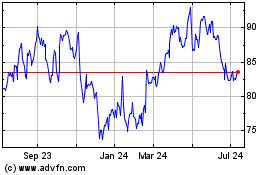

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024