Seventy Seven Energy Files for Bankruptcy

June 07 2016 - 2:30PM

Dow Jones News

Oil field services company Seventy Seven Energy Inc. filed for

bankruptcy protection Tuesday with a plan to eliminate more than $1

billion in debt and hand control of the business to its

bondholders.

The Oklahoma City company, spun off from Chesapeake Energy Corp.

in 2014, is the latest victim of the downturn in oil and natural

gas prices, which has claimed dozens of companies in the oil patch

since the start of last year.

The company filed for protection in U.S. Bankruptcy Court in

Wilmington, Del., with a "prepackaged" chapter 11 plan after

garnering support from its creditors to support the restructuring

proposal. Such preapproved plans are becoming increasingly popular

with companies and investors, who want to minimize the time and

expense of chapter 11 balance sheet restructuring.

"The successful completion of the solicitation process and

today's filing represent the next step forward in our financial

restructuring," said Jerry Winchester, the company's chief

executive.

Under the terms of the previously floated plan, which eliminates

$1.1 billion, the company's 2019 unsecured bondholders will receive

at least 96.75% equity in the restructured company in exchange for

forgiveness of the $650 million they're owed. A second group of

bondholders are slated to get a 3.25% equity stake plus warrants

for 15% of the new common stock if they vote to support the

plan.

The company's term-loan lenders will receive a 2% payout of

their loan upfront and a better collateral package securing the

remaining loan, which will be carried over. The incremental

term-loan lenders will be paid at least $15 million upfront, and

the remaining $84 million balance of its loan will remain in

place.

Additionally, current equity holders will receive warrants for

20% of new common stock if all the debtholders vote for the

plan.

Seventy Seven said its trade creditors, suppliers and

contractors will be paid in the ordinary course of business. The

company's lenders, led by Wells Fargo, have agreed to provide $100

million in financing to fund the chapter 11 case, which Seventy

Seven hopes to have completed within 60 days.

Seventy Seven is an oil-field servicer that provides drilling,

hydraulic fracturing and oil field rental services to exploration

and production companies. The company had cited the shakeout in the

oil patch for its need to restructure more than $1.7 billion in

debt.

It first raised the possibility of bankruptcy in a February

regulatory filing after hiring advisers from Lazard to help it

restructure its business.

The law firm Baker Botts is handling the chapter 11 matter, and

the company has hired Alvarez & Marsal as its restructuring

adviser. The case number is 16-11409 and Judge Laurie Selber

Silverstein has been assigned the case.

Stephanie Gleason contributed to this article.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

June 07, 2016 14:15 ET (18:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

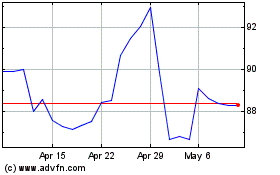

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

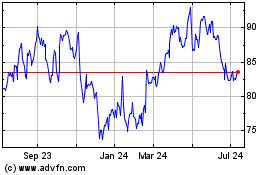

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024