MARKET SNAPSHOT: U.S. Stock Futures Extend Losses After Mixed Data

March 15 2016 - 9:14AM

Dow Jones News

By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Valeant plunges; energy companies get hit

Stock futures extended losses Tuesday, after a flurry of

economic data offered a mixed picture of the U.S. economy a day

ahead of the Federal Open Market Committee's decision on interest

rates.

Continued pressure on oil prices pulled down the shares of

energy companies, weighing on the main benchmarks.

Dow Jones Industrial Average futures fell 88 points, or 0.5%, to

17,040, while S&P 500 index futures lost 12 points, or 0.6%, to

1,998. Nasdaq-100 futures fell 17 points, or 0.4%, to 4,340.

Sales at U.S. retailers dipped in February

(http://www.marketwatch.com/story/retail-sales-in-february-fall-for-second-straight-month-2016-03-15)and

January turned out to be an even poorer month than initially

estimated, new government figures showed on Tuesday. And U.S.

wholesale prices fell 0.2% in February

(http://www.marketwatch.com/story/us-producer-prices-fall-02-in-february-2016-03-15-81033630)to

mark the fifth decline in seven months, largely because of lower

gasoline and food prices.

But a reading of New York-area manufacturing conditions

(http://www.marketwatch.com/story/empire-state-factory-index-has-first-positive-reading-in-eight-months-2016-03-15)improved

markedly in March, a sign that the factory sector could be

stabilizing after months of weakness.

Meanwhile, a rout in oil futures continued on Tuesday, with the

U.S. crude benchmark

(http://www.marketwatch.com/story/oil-prices-struggle-to-recover-from-mondays-bruising-session-2016-03-15)

falling 2.4% to trade near $36 a barrel. The decline weighed on the

stocks of energy companies, such as Chesapeake Energy Corporation

(CHK), down 4%, Marathon Oil Corporation (MRO), down 2.7%, and

Murphy Oil Corporation (MUR), down 3.9%.

In Europe, oil companies led the Stoxx Europe 600 index down

0.6%.

Also read: Buy these stocks if you are bearish on oil, Goldman

Sachs says

(http://www.marketwatch.com/story/buy-these-stocks-if-youre-bearish-on-oil-goldman-sachs-says-2016-03-14)

(http://www.marketwatch.com/story/buy-these-stocks-if-youre-bearish-on-oil-goldman-sachs-says-2016-03-14)The

Dow industrials logged a new closing high for 2016 on Monday

(http://www.marketwatch.com/story/us-stock-futures-waver-as-fed-meeting-keeps-investors-on-hold-2016-03-14).

But the S&P 500 index finished slightly lower, as energy stocks

tracked a sharp slump in oil prices.

In Asia

(http://www.marketwatch.com/story/asian-markets-fall-ahead-of-bank-of-japan-meeting-2016-03-14),

Chinese stocks rose modestly, but the Nikkei 225 index lost 0.7%.

The Bank of Japan left its monetary policy unchanged

(http://www.marketwatch.com/story/boj-stands-pat-on-rates-cuts-economic-outlook-2016-03-15),

but cut its economic view and paid more lip service to overseas

problems, such as European debt and U.S. economic issues. For some

analysts, the door is now open to more easing by Japan.

The dollar

(http://www.marketwatch.com/story/dollar-leans-on-yen-as-investors-assume-bank-of-japan-isnt-finished-easing-2016-03-15)

was down sharply against the yen in the wake of the Bank of Japan

decision. Gold prices were under pressure and Treasury yields

tumbled.

Fed in focus again

The Federal Reserve's two-day meeting kicks off Tuesday, with a

policy decision due Wednesday, followed by a news conference with

Fed Chairwoman Janet Yellen. Most expect the Fed to leave monetary

policy unchanged

(http://www.marketwatch.com/story/fed-may-have-little-reason-to-pause-but-it-will-2016-03-14),

and many economists expect just one more interest-rate increase is

coming this year, in June.

While the economic backdrop has improved, the possibility of

another rate increase makes investors wary about holding riskier

assets such as stocks, said Naeem Aslam, chief market analyst at

Ava Trade, in a note.

"Yellen may have to play hard to convince the market that

another rate increase is not possible this year and they are still

truly data dependent and at the benevolence of the world economic

health," he said.

Read:Caroline Baum says Fed officials talk themselves into a

corner

(http://www.marketwatch.com/story/fed-officials-talk-themselves-into-a-corner-2016-03-15)

At 10 a.m. Eastern, a home builders index for March and business

inventories for January are due.

Stocks to watch

Shares of Valeant Pharmaceuticals International Inc. (VRX.T)

slid 18.3% in premarket after the Canadian drugmaker cut guidance

for the current quarter and provided preliminary results for its

final quarter of the year that were short of Wall Street's

expectations

(http://www.marketwatch.com/story/valeant-pharma-slashes-quarterly-forecast-2016-03-15).

FactSet Research Systems Inc. (FDS) gained 5.9% in premarket

trade after the company's profit rose 10% in the latest quarter

(http://www.marketwatch.com/story/factset-profit-tops-views-as-sales-rise-2016-03-15),

as the financial information provider notched sales gains amid a

higher user base.

Avon Products Inc. (AVP) could be active after announcing Monday

that it would cut around 2,500 jobs and shift its corporate

headquarters to the United Kingdom

(http://www.marketwatch.com/story/avon-to-cut-2500-jobs-move-headquarters-to-uk-2016-03-14).

(END) Dow Jones Newswires

March 15, 2016 08:59 ET (12:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

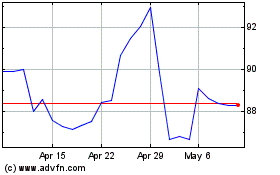

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

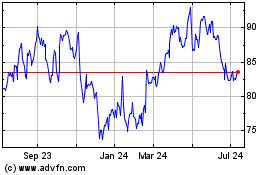

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024