Williams Swings to Unexpected Loss

February 17 2016 - 6:20PM

Dow Jones News

Williams Cos. swung to an unexpected fourth-quarter loss as the

pipeline giant posted a big write-down, mostly related to low

commodities prices and weaker market values for affiliate Williams

Partners LP and its peers.

The Tulsa, Okla., company also said the write-downs reflected

Williams' 2014 acquisition of Access Midstream Partners.

Shares of the Tulsa, Okla., company, which have skidded 68% in

the past 12 months, fell 4% to $15.07 in recent after-hours trading

as per-share earnings, excluding certain one-time items, missed

expectations.

Williams is being acquired by Energy Transfer Equity LP in a

$32.6 billion deal reached in September. The September deal price

was below Energy Transfer's $48 billion offer that Williams had

rejected in June.

Many pipeline companies had said they were mostly insulated from

low energy prices because most of their revenue is based on fixed

fees. However, in recent quarters, signs that the pipeline industry

isn't immune to the commodities rout has slammed the sector's

stocks and added to concerns about whether the Williams-Energy

Transfer deal would close.

Adding to concerns about the pending tie-up, Chesapeake Energy

Corp, which has been struggling under a heavy debt load and is one

of Williams's largest clients, recently denied reports about

planning to file for bankruptcy protection. Meanwhile, Energy

Transfer announced the departure of finance chief Jamie Welch. CFOs

rarely leave companies while a merger is pending.

In its earnings release Wednesday, Williams said its board is

unanimously committed to the completion of the merger with Energy

Transfer. Williams also said integration planning is under way.

The deal requires the approval of Williams shareholders.

Over all, Williams reported a loss of $701 million, or 94 cents

a share, compared with a profit of $193 million, or 26 cents a

share, a year earlier. The latest period included pretax

write-downs totaling $2.1 billion. Excluding such one-time items,

adjusted earnings from continuing operations were flat at a penny a

share.

Revenue decreased 6.3% to $2.01 billion.

Analysts polled by Thomson Reuters expected per-share profit of

22 cents and revenue of $1.95 billion.

(END) Dow Jones Newswires

February 17, 2016 18:05 ET (23:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

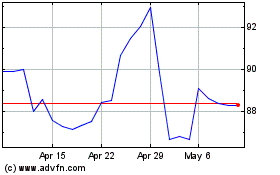

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

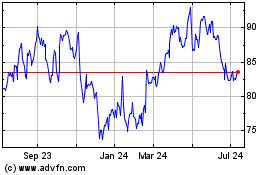

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024