Energy Sector's Junk Bonds Continue to Suffer

January 14 2016 - 3:41PM

Dow Jones News

By Mike Cherney

Losses are deepening in the market for low-rated energy debt, as

investors fret anew that a prolonged slump in commodity prices and

slowing economic growth will push many firms into default.

Bonds from WPX Energy Inc. and Oasis Petroleum Inc. were among

the biggest losers Thursday, shedding about 12% each, compared with

the previous day, according to data from MarketAxess Holdings Inc.

A 2019 bond from Oasis traded Thursday at 53 cents on the dollar,

and a WPX bond maturing in 2023 traded at 65.5 cents.

The losses come after many investors have already bailed out of

some larger oil-and-gas producers in the junk market. A 2023 bond

from Chesapeake Energy Corp. is trading at 28.5 cents, about where

it was in mid-December, according to MarketAxess.

Oil prices continued their slide this week and European crude

futures dropped below $30 a barrel for the first time in more than

a decade. Prices recovered some losses on Thursday and were back up

above $30, but concerns remain that a global glut in supply will

keep gains muted. Natural-gas futures fell Thursday after a

government report said stockpiles declined less than expected.

"Pricing has continued to sail south for oil," said Andrew

O'Conor, energy credit analyst at Morningstar. "Natural gas has had

a modest rebound...on account of colder weather domestically, but

overall it's my sense that weak pricing persists in the near

term."

The junk-bond market was roiled by a fierce selloff last month

as the commodity crisis came into focus, sending prices falling

across sectors as fund managers sold what they could to raise cash

and meet investor redemptions. The market stabilized at the end of

December and in the first part of this month, allowing companies

outside the energy business--including semiconductor firm Microsemi

Corp. and Pinnacle Foods Inc.--to sell new bonds.

Investors say they remain confident that modest U.S. economic

growth will continue into 2016, and that the selloff in December

dropped prices low enough that junk-bond bargains became

available.

But junk bonds have still started the year broadly in the red.

Firms tied to consumer spending, like auto makers, home builders

and retailers, are down about 0.4% in total return so far this

month, reflecting price changes and interest payments. Bonds from

communications firms, such as T-Mobile U.S. Inc. and Dish Network

Corp., are down 0.7%, according to Barclays data.

Losses in the energy sector are worse, with bonds from those

companies down nearly 4% on the year. The spread, or the difference

in yield compared with safe-haven U.S. Treasurys, hit 14 percentage

points on Wednesday, the highest level since December 2008,

according to Barclays.

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

January 14, 2016 15:26 ET (20:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

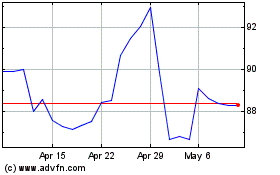

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

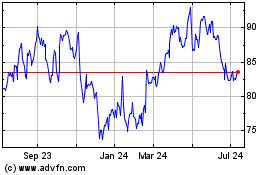

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024