Junk Bonds Rebound After Sharp Selloff

December 15 2015 - 10:00AM

Dow Jones News

Junk bonds traded mostly higher Tuesday, reversing some of the

deep losses seen in recent days as investors fretted over low oil

prices and the closure of a junk-bond fund.

Bonds from Frontier Communications Corp., Ally Financial Inc.

and Energy Transfer Equity LP posted small gains Tuesday, with some

trades about 1 cent on the dollar higher, according to data from

MarketAxess Holdings Inc.

The increase is in line with global markets Tuesday, as

investors look to a decision from the Federal Reserve on raising

benchmark interest rates after its policy meeting this week.

The iShares iBoxx USD High Yield Corporate Bond exchange-traded

fund, the largest junk-bond ETF by assets, was up roughly 1.2% in

premarket trading, to $79.74 a share.

Prices in the junk-bond market have declined steeply in recent

days, as investors worried that prolonged low oil and commodity

prices would push many junk-rated energy and mining firms into

default. Negativity also swept the market after Third Avenue

Management LLC said it would close its $789 million Focused Credit

Fund and that investors may not get their money back for

months.

Through Monday, U.S. junk bonds have returned a negative 5.8% on

the year, a figure that reflects price changes and interest

payments, according to Barclays data. In contrast, the total return

on the S&P 500 stock index is a positive 0.21%, according to

S&P Dow Jones Indices.

Investors will be closely watching debt from Chesapeake Energy

Corp., which set a Tuesday deadline for a debt swap and could

announce its results later in the day.

The company, viewed as a benchmark in the junk-bond energy

sector due to its heavy debt load, is seeking to push out

maturities and lower its overall debt burden with the exchange, but

it remains unclear how many investors will participate. The new

bonds will give investors a stronger claim on the company's assets

in exchange for a principal reduction on their old bonds.

The Wall Street Journal reported Monday that Chesapeake is

working with restructuring advisers at Evercore Partners Inc. Some

Chesapeake bonds fell to 30 cents on the dollar or lower in trading

on Monday.

Brian Gibbons Jr., senior oil and gas analyst at research firm

CreditSights, said investors would be better off exchanging their

bonds, though the outlook is still bleak if energy prices don't

recover.

"This company is going to have to file [for bankruptcy] at some

point or do a major out-of-court restructuring," he said. "This is

just the first step here."

Write to Mike Cherney at mike.cherney@wsj.com

(END) Dow Jones Newswires

December 15, 2015 09:45 ET (14:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

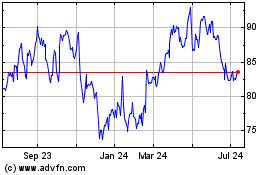

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

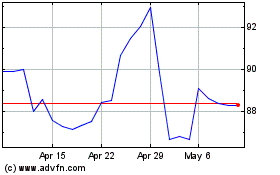

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024