Chesapeake Energy Swings to Loss on Impairments -- Update

November 04 2015 - 9:42AM

Dow Jones News

By Chelsey Dulaney

Chesapeake Energy Corp. on Wednesday warned it could

significantly cut its capital spending next year, as the U.S. shale

driller swung to a third-quarter loss amid heavy write-downs

But shares of the company rose 4.9% in premarket trading as its

loss, excluding the $4.51 billion impairment charge and other

special items, was smaller than analysts had expected.

Chesapeake is among the large U.S. energy companies that have

written down the value of their oil fields as a rout in commodities

prices has made properties across the country not worth

drilling.

Oklahoma City-based Chesapeake has also moved to cut 15% of its

workforce, reduce its capital spending and pare back its rig

operations.

The company again reduced its 2015 capital-spending plans, now

forecasting $3.4 billion to $3.9 billion. It had previously

forecast $3.5 billion to $4 billion in spending for the year.

For 2016, Chesapeake Chief Executive Doug Lawler said the

company is "prepared to execute on a significantly lower capital

program in 2016."

During the third quarter, Chesapeake cut its capital spending by

more than half, to $623 million from $1.52 billion in the

prior-year period.

Chesapeake reduced its average operated rig count to 18 in the

third quarter from 26 in the second quarter and 69 in the

prior-year period.

Chesapeake's daily production averaged around 667,000 barrels of

oil equivalent a day, an increase of 3% over the same period in

2014 adjusted for asset sales. Chesapeake has also been selling

properties to pay off its debt after years of heavy borrowing to

snap up oil and gas prospects under its former chief executive.

The company's average realized oil price for the quarter fell

26% from the prior year to $62.68 a barrel.

Overall, for the quarter ended Sept. 30, Chesapeake reported a

loss of $4.65 billion, or $7.08 a share, compared with a prior-year

profit of $662 million or 26 cents a share.

Excluding the $4.51 billion impairment charge and other items,

Chesapeake posted a per-share loss of 5 cents. Analysts had

forecast a loss of 13 cents a share.

Revenue plunged 49% to $2.89 billion, missing the $3.02 billion

analysts had forecast.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 09:27 ET (14:27 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

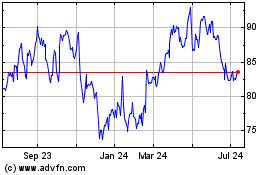

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

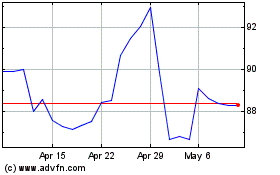

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024