Williams & Chesapeake Energy Execute Expansion of Gas Gathering Services & Acreage Dedication in the Dry Utica, Consolidate H...

September 08 2015 - 7:00AM

Business Wire

- Win-Win Contract Restructure Aligns

Interests of Both Companies, Optimizes Production

Opportunities

Williams (NYSE:WMB) today announced an expansion of gas

gathering services for Chesapeake Energy (NYSE:CHK) in growing dry

gas production areas of the Utica Shale in eastern Ohio and a

consolidation of contracts in the Haynesville Shale in northwestern

Louisiana to optimize production opportunities, streamline fee

structures and restructure commitments to incentivize long-term

development of the fields. The agreements with Chesapeake were

entered into by subsidiaries of Williams Partners L.P. (NYSE:WPZ),

of which Williams own 60 percent, including the general partner

interest.

“This demonstrates our commitment to working with Chesapeake to

align our interests on mutual growth while sustaining the financial

support of our investments,” said Alan Armstrong, chief executive

officer of Williams. “These new fee structures are designed to

promote production in the best locations across a wider footprint

in these great basins, which improves the economics on both the

drilling and midstream side. We’ve also increased certainty around

fees and volumes to support our strategy of creating long-term,

durable value for shareholders.”

In the Utica, Williams and Chesapeake executed a long-term,

fee-based contract that gained a new area of dedication in the dry

gas zone where Chesapeake and others are targeting production

growth. The agreement extends the length of the Chesapeake acreage

dedication to 2035, increases the area of dedication by 50,000

acres from 140,000 acres to 190,000 net acres in a strategic area

adjacent to Williams’ existing assets and converts the

cost-of-service mechanism to a fixed-fee structure with minimum

volume commitments (MVCs). This change to a fixed-fee contract

enhances Williams’ ability to gather third-party volumes and build

scale in Utica’s dry gas areas. Williams expects this will provide

the opportunity to invest more than $600 million over five years to

install more than 200 miles of pipeline and related facilities as

this prolific area of the basin grows with up to 800 million cubic

feet per day of capacity to serve the development.

The companies also executed a new Haynesville contract that

consolidates the Springridge and Mansfield contracts into a single

agreement with a fixed-fee structure and a contract term to 2035.

The consolidated contract is supported by MVCs and a drilling

commitment to turn 140 equivalent wells online before the end of

2017. This commitment is projected to result in significant

production growth in the Haynesville Shale asset over the next two

years. The combined contract also better aligns producer-midstream

interests, simplifies contract administration, optimizes

development of the resource across both Springridge and Mansfield

areas and extends the Springridge dedication 15 years to 2035.

Williams expects positive impact to EBITDA in both the Utica and

the Haynesville areas due to near-term higher volumes and drilling

commitments.

About Williams

Williams (NYSE: WMB) is a premier provider of large-scale

infrastructure connecting North American natural gas and natural

gas products to growing demand for cleaner fuel and feedstocks.

Headquartered in Tulsa, Okla., Williams owns approximately 60

percent of Williams Partners L.P. (NYSE: WPZ), including all of the

2 percent general-partner interest. Williams Partners is an

industry-leading, large-cap master limited partnership with

operations across the natural gas value chain from gathering,

processing and interstate transportation of natural gas and natural

gas liquids to petchem production of ethylene, propylene and other

olefins. With major positions in top U.S. supply basins and also in

Canada, Williams Partners owns and operates more than 33,000 miles

of pipelines system wide – including the nation’s largest volume

and fastest growing pipeline – providing natural gas for

clean-power generation, heating and industrial use. Williams

Partners’ operations touch approximately 30 percent of U.S. natural

gas. www.williams.com

Portions of this document may constitute “forward-looking

statements” as defined by federal law. Although the company

believes any such statements are based on reasonable assumptions,

there is no assurance that actual outcomes will not be materially

different. Any such statements are made in reliance on the “safe

harbor” protections provided under the Private Securities Reform

Act of 1995. Additional information about issues that could lead to

material changes in performance is contained in the company’s

annual reports filed with the Securities and Exchange

Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150908005608/en/

WilliamsMedia Contact:Tom Droege,

918-573-4034orInvestor Contacts:John Porter,

918-573-0797orBrett Krieg, 918-573-4614

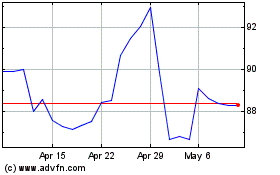

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

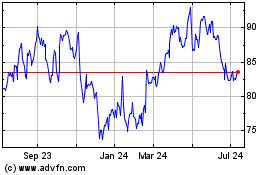

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024