Raises Full Year Organic Sales and Gross

Margin Outlook

Maintains Full Year EPS Outlook, Despite

Incremental F/X Headwinds

Church & Dwight Co., Inc:

2015 First Quarter

Results

- Organic sales growth of 3.6%, Reported growth 3.9%

- Gross Margin expansion of 40 basis points

- Reported EPS growth 9.6%: FX Neutral growth 13.6%

- Cash from Operations $144MM, up 40%

2015 Full Year

Outlook

- Organic sales growth of approximately 3%

- Gross Margin expansion of 25 to 35 basis points

- EPS growth of 7-9%, excluding pension charge

- Cash from operations, in excess of $570MM

Church & Dwight Co., Inc. (NYSE:CHD) today

announced first quarter 2015 reported EPS of $0.80 per share, a

9.6% increase over the prior year first quarter, driven by strong

organic sales growth and gross margin expansion. This equates to

13.6% currency neutral EPS growth.

First quarter 2015 reported net sales increased

$30 million or 3.9% to $812.3 million. Organic sales growth for

first quarter 2015 was 3.6%. Organic results were driven by volume

growth of 3.2%, and 0.4% favorable product mix and pricing.

James Craigie, Chairman and Chief Executive

Officer, commented, “We are extremely pleased with the sales and

earnings growth. The strong momentum we ended 2014 with has

continued in early 2015. This year, we launched innovative new

products in many of our major categories as we believe that

innovation is the key to increasing our market share and reviving

category growth in this challenging economy. The results to date

are promising, as three out of four megabrands achieved share

growth in the first quarter.”

First Quarter

Review

Consumer Domestic net sales were $614.6

million, a $21.3 million or 3.6% increase over the prior year first

quarter sales. First quarter organic sales increased by 1.6%,

primarily due to continued success of the ARM & HAMMER CLUMP

& SEAL cat litter franchise, including a new lightweight

variant, and higher sales of ARM & HAMMER liquid laundry

detergent and VITAFUSION vitamins, partially offset by lower sales

of XTRA laundry detergent, TROJAN condoms and OXICLEAN laundry

detergent. Volume growth contributed approximately 1.2% to organic

sales, while favorable product mix and pricing contributed

0.4%.

Consumer International net sales were

$120.4 million, a $3.4 million or 2.8% decrease compared to the

prior year first quarter sales. Organic sales increased 9.5%,

driven by higher sales in France, the UK and Mexico. Volume

increased 10.5%, partially offset by a 1.0% unfavorable product mix

and pricing.

Specialty Products net sales were $77.3

million, a $12.4 million or 19.2% increase from the prior year

first quarter sales. First quarter organic sales increased by

10.8%. The animal nutrition business was the largest driver of the

division’s 7.7% volume increase, and favorable product mix and

pricing contributed 3.1%. The animal nutrition business’s strong

performance is primarily related to the relative good health of the

U.S. dairy industry.

Gross margin increased 40 basis points

to 43.8% in the first quarter compared to 43.4% in the prior year

first quarter. The gross margin benefited from the higher margin

businesses acquired in late 2014 and early 2015, productivity

programs, and lower slotting. These factors were partially offset

by foreign exchange, higher manufacturing costs, and incremental

costs associated with the new vitamin capacity in our York

manufacturing facility. The 40 basis point improvement versus the

Company’s prior Q1 flat gross margin outlook was due to higher than

expected volumes, lower than expected commodity costs, and the

timing of startup expenses associated with the new vitamin

plant.

Marketing expense was $88.8 million, a

$1.0 million or 1.1% increase compared to the prior year first

quarter. Marketing expense as a percentage of net sales was 10.9%,

a 30 basis point decrease from the prior year first quarter.

Selling, general, and administrative expense

(SG&A) was $94.6 million, a $5.0 million increase from the

prior year first quarter. SG&A as a percentage of net sales was

11.7%, a 20 basis point increase from the prior year first quarter

primarily due to higher intangible amortization expense and higher

R&D expense.

Income from Operations was $172.1

million, a $10.1 million or 6.2% increase compared to the prior

year first quarter. Operating income as a percentage of net sales

was 21.2%, a 50 basis point increase from the prior year first

quarter.

The effective tax rate in the first

quarter was 35.1%, compared to 34.5% in the first quarter of 2014.

The Company continues to expect the full year effective tax rate to

be approximately 34.5%.

Operating Cash

Flow

For the first three months of 2015, net cash

from operating activities was $144.2 million, a $41.8 million

increase from the prior year primarily due to lower working capital

and higher net income. Capital expenditures for the first three

months were $21.9 million, a $15.6 million increase from the prior

year first quarter. The Company’s full year outlook for capital

expenditures remains $70 million.

At March 31, 2015, cash on hand was $300

million, while total debt was $1,227 million. The Company continues

to have significant financial flexibility for acquisitions.

New

Products

Mr. Craigie stated, “2015 is expected to be an

exciting year for Church & Dwight as we have launched a number

of innovative new products across every one of our megabrands and

continue to support our 2014 launches.

“Innovation has been a key driver of our past

success as shown by the fact that over 1/3 of our net sales in 2014

came from new products launched since 2007.

“We continue to believe that innovation is the

key to driving both improved category growth and our share results.

A recent example of this is our new ARM & HAMMER CLUMP &

SEAL lightweight cat litter, whose success with consumers has led

to a double digit increase in sales and consumption that drove the

total brand’s share up 1.4pts. to 23.8% in the first quarter to

become the # 2 brand in the category. Most importantly, this new

product innovation drove category sales up over 8%, the strongest

growth of any of our categories.”

Gummy Vitamin

Expansion

“We have substantially completed construction

of our new gummy vitamin manufacturing facility in York,

Pennsylvania. This significant $60MM investment is expected to

expand our production capacity by 75%.The gummy vitamin business is

strategically important to Church & Dwight and is expected to

be a significant contributor to the future growth of sales,

earnings, and cash flows,” said James R. Craigie, Chairman and

Chief Executive Officer. “We believe the future prospects of the

gummy vitamin category are strong as more adults switch from

traditional vitamin pills to gummy vitamins, as evidenced by the

continued double-digit growth of the category.”

Outlook for

2015

Mr. Craigie said, “2015 is off to a strong

start with solid first quarter results. We continue to believe that

we are positioned to deliver strong sales and earnings growth with

our balanced portfolio of value and premium products, the launch of

innovative new products, aggressive productivity programs and tight

management of overhead costs. Despite continued headwinds from weak

U.S. consumer demand, foreign currency, and aggressive competition,

we feel confident in achieving our 2015 business targets.”

With regard to 2015, Mr. Craigie said, “We now

expect organic sales growth of approximately 3% in 2015 (previously

2-3%) behind new product introductions on our core business. We now

expect gross margin to expand by approximately 25 to 35 basis

points (previously 25 basis points) from reduced slotting fees,

lower trade spending as pricing competition in the value laundry

category has begun to normalize, and expected lower commodity costs

in the second half of 2015. We intend to continue to heavily invest

in the OXICLEAN brand as 2015 will mark the second year of our

quest to establish it as our next megabrand across multiple

categories. Marketing spending is expected to be approximately

12.5% of sales, comparable to the 2014 and 2013 rate of investment.

To the extent the Company over-delivers on gross margin expansion,

we expect to incrementally invest in marketing spending behind our

mega brands. We now expect to achieve approximately 50 to 60 basis

points of operating margin expansion, excluding a previously

disclosed pension termination charge, or operating margin expansion

of 25 to 35 basis points on a reported basis.”

In conclusion, Mr. Craigie said, “Based on our

current growth momentum, continued focus on innovation, and

confidence in gross margin expansion, and despite the F/X

headwinds, we expect to achieve 7-9% EPS growth in 2015. This

excludes the previously disclosed pension termination charge of

approximately $0.05, which results in 5-7% reported EPS growth. The

midpoint of our 7-9% 2015 outlook now equates to 11.0% currency

neutral EPS growth excluding an estimated 3.0% (previously 2.5%)

EPS negative impact from foreign exchange. This EPS growth is top

tier within the consumer packaged goods industry. This earnings

forecast does not include any benefit from potential acquisitions,

which we continue to aggressively pursue.”

“For the second quarter, we expect organic

sales growth of approximately 3 to 4%. Gross margin is expected to

be flat versus year ago as we continue to invest behind OXICLEAN,

experience unfavorable currency impacts, and absorb incremental

costs for our new gummy vitamin manufacturing facility. We expect

second quarter earnings per share to increase 8% to approximately

$0.70, excluding the $0.05 pension termination charge.”

Church & Dwight Co., Inc. will host a

conference call to discuss first quarter 2015 results on May 7,

2015 at 10:00 a.m. (ET). To participate, dial in at 877-322-9846,

access code: 24334757 (International: 631-291-4539, same

access code: 24334757). A replay will be available two hours

after the call at 855-859-2056 or 404-537-3406 (same access code:

24334757. You also can participate via webcast by visiting

the Investor Relations section of the Company’s website at

www.churchdwight.com.

Church & Dwight Co., Inc. manufactures and

markets a wide range of personal care, household and specialty

products under the ARM & HAMMER brand name and other well-known

trademarks.

This release contains forward-looking

statements, including, among others, statements relating to

expected future financial and operating results, including earnings

per share, reported net sales growth and organic sales growth,

volume growth, including the effects of new product launches into

new and existing categories, gross margin, operating margin and net

cash from operating activities; category trends; the effect of

product mix; impairments and other charges; consumer demand and

spending, including consumer response to new product launches; the

effects of competition; earnings per share; gross margin changes;

trade and marketing spending; marketing expense as a percentage of

net sales; cost savings programs; the impact of foreign exchange

and commodity price fluctuations; the impact of a pension

settlement charge; the impact of acquisitions; capital

expenditures; the effective tax rate; the effect of the credit

environment on the Company’s liquidity and capital expenditures;

the Company’s fixed rate debt; sufficiency of cash flows from

operations; payment of dividends; and category trends. These

statements represent the intentions, plans, expectations and

beliefs of the Company, and are based on assumptions that the

Company believes are reasonable but may prove to be incorrect.

In addition, these statements are subject to risks,

uncertainties and other factors, many of which are outside the

Company’s control and could cause actual results to differ

materially from such forward-looking statements. Factors

that might cause such differences include a decline in market

growth, retailer distribution and consumer demand ( as a result of,

among other things, political, economic and marketplace conditions

and events ); unanticipated increases in raw material and energy

prices; adverse developments affecting the financial condition of

major customers and suppliers; competition, including The Procter

& Gamble Company’s participation in the value laundry detergent

category; changes in marketing and promotional spending; growth or

declines in various product categories and the impact of customer

actions in response to changes in consumer demand and the economy,

including increasing shelf space of private label products;

consumer and competitor reaction to, and customer acceptance of new

product introductions and features; disruptions in the banking

system and financial markets; foreign currency exchange rate

fluctuations; the impact of natural disasters on the Company and

its customers and suppliers, including third party information

technology service providers; the acquisition or divestiture of

assets; the outcome of contingencies, including litigation, pending

regulatory proceedings and environmental matters; and changes in

the regulatory environment.

For a description of additional factors that

could cause actual results to differ materially from the forward

looking statements, please see Item 1A, “Risk Factors” in the

Company’s annual report on Form 10-K.

CHURCH & DWIGHT CO., INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Income (Unaudited)

Three Months Ended

(In millions, except per share data)

Mar. 31,

2015 Mar. 31, 2014

Net Sales

$ 812.3 $ 782.0

Cost of sales

456.8 442.6

Gross

profit 355.5 339.4 Marketing expenses

88.8 87.8

Selling, general and administrative expenses

94.6

89.6

Income from Operations 172.1 162.0 Equity

in earnings (losses) of affiliates

2.3 1.6 Other income

(expense), net

(9.1 ) (6.9 ) Income before

income taxes

165.3 156.7 Income taxes

58.1

54.1

Net Income

$ 107.2 $ 102.6

Net Income per share - Basic $ 0.81 $ 0.74

Net Income per share - Diluted

$ 0.80 $ 0.73

Dividends per share

$ 0.335 $ 0.31 Weighted

average shares outstanding - Basic

132.0 138.0 Weighted

average shares outstanding - Diluted

134.6 140.6

CHURCH & DWIGHT CO., INC. AND

SUBSIDIARIES

Condensed Consolidated Balance Sheets

(Unaudited)

(Dollars in millions)

Mar. 31, 2015

Dec. 31, 2014

Assets Current Assets

Cash and Cash

Equivalents

$ 299.7 $ 423.0 Accounts Receivable

337.1 322.9 Inventories

256.8 245.9 Other Current

Assets

38.4 40.7

Total

Current Assets 932.0

1,032.5 Property, Plant and Equipment (Net)

617.8 616.2

Equity Investment in Affiliates

24.9 24.8 Tradenames and

Other Intangibles

1,299.6 1,272.4 Goodwill

1,354.6

1,325.0 Other Long-Term Assets

115.8

110.4

Total Assets $ 4,344.7

$ 4,381.3

Liabilities and Stockholders’

Equity

Short-Term Debt

$ 273.4 $ 146.7 Current portion of

Long-Term debt

249.9 249.9 Other Current Liabilities

527.1 508.7

Total Current

Liabilities 1,050.4

905.3 Long-Term Debt

703.5 698.6 Other Long-Term Liabilities

682.1 675.5 Stockholders’ Equity

1,908.7

2,101.9

Total Liabilities and

Stockholders’ Equity $ 4,344.7

$ 4,381.3

CHURCH & DWIGHT CO., INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Cash Flow (Unaudited)

Three Months Ended (Dollars in millions)

Mar. 31, 2015 Mar. 31, 2014

Net Income $ 107.2 $ 102.6 Depreciation

and amortization

26.0 22.8 Deferred income taxes

6.0

5.2 Non cash compensation

1.7 2.3 Other

3.9 1.5

Changes in assets and liabilities: Accounts receivable

(22.0 ) (13.8 ) Inventories

(15.2 )

(14.3 ) Other current assets

(1.3 ) (2.7 ) Accounts

payable and accrued expenses

(2.5 ) (27.7 ) Income

taxes payable

48.3 37.1 Excess tax benefit on stock options

exercised

(8.0 ) (6.1 ) Other

0.1

(4.5 )

Net cash from operating

activities 144.2 102.4 Capital expenditures

(21.9 ) (6.3 ) Acquisition

(74.9 ) -

Other

(1.1 ) (0.3 )

Net cash (used in) investing activities (97.9

) (6.6 ) Net change in short-term debt

127.1

(0.5 ) Payment of cash dividends

(43.7 ) (42.5 )

Stock option related

19.3 13.3 Purchase of treasury stock

(256.2 ) (260.0 ) Other

(0.4 )

(0.2 )

Net cash (used in) financing

activities (153.9 ) (289.9 )

F/X impact

on cash (15.7 ) (2.8

)

Net change in cash and cash equivalents $

(123.3 ) $ (196.9 )

2015 and 2014

Product Line Net Sales

Three Months Ended Percent

3/31/2015 3/31/2014

Change Household Products

$ 366.5 $ 352.5 4.0 %

Personal Care Products 248.1

240.8 3.0 % Consumer

Domestic $ 614.6 $ 593.3 3.6

% Consumer International 120.4

123.8 -2.8 %

Total Consumer Net Sales $ 735.0 $

717.1 2.5 % Specialty Products Division

77.3 64.9

19.2 % Total Net Sales $ 812.3

$ 782.0 3.9

%

The following discussion

addresses the non-GAAP measures used in this press release and

reconciliations of non-GAAP measures to the most directly

comparable GAAP measures:

The following non-GAAP

measures may not be the same as similar measures provided by other

companies due to differences in methods of calculation and items

and events being excluded.

Organic Sales

Growth: This press release provides information regarding

organic sales growth, namely net sales growth excluding the effect

of acquisitions and foreign exchange rate changes. Management

believes that the presentation of organic sales growth is useful to

investors because it enables them to assess, on a consistent basis,

sales trends related to products that were marketed by the Company

during the entirety of relevant periods and foreign exchange rate

changes that are out of the control of, and do not reflect the

performance of, the Company and management.

Reported EPS excluding a

pension termination charge and currency neutral reported EPS

excluding a pension termination charge:

This press release also presents reported EPS

excluding a pension termination charge, namely, earnings per share

calculated in accordance with GAAP adjusted to exclude a

significant one-time item that is not indicative of the Company’s

period to period performance. We believe that this metric provides

investors a more meaningful perspective of underlying business

trends and results and provides a more comparable measure of year

over year earnings per share growth.

Currency neutral reported EPS excluding a

pension termination charge is a measure of the Company's reported

EPS excluding a pension termination charge, further adjusted to

exclude the impact of foreign exchange. We believe that this metric

further enhances investors’ understanding of the Company’s year

over year earnings per share growth.

Church & Dwight Co., Inc.Organic Sales

Three Months Ended 3/31/2015

Total Worldwide Consumer

Consumer Specialty Company Consumer

Domestic International Products

Reported Sales Growth 3.9 % 2.5

% 3.6 % -2.8 % 19.2

% Less: Acquisitions 2.5 %

1.8 % 1.8 % 1.4 %

10.4 % Add: FX / Other

2.2 % 2.2 % -0.2 %

13.7 % 2.0 %

Organic Sales Growth 3.6

% 2.9 % 1.6 % 9.5

% 10.8 %

Church & Dwight Co., Inc.Rick Dierker,

609-806-1900VP, Corporate Finance

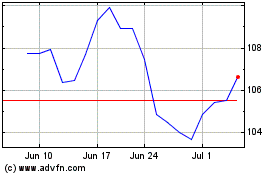

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Apr 2023 to Apr 2024