TIP SHEET: Goldman Rolls Out Income Fund Targeting 10% Dividend Growth

March 07 2012 - 8:05AM

Dow Jones News

Goldman Sachs Asset Management rolled out the newly named

Goldman Sachs Rising Dividend Growth Fund (GSRAX) on Feb. 27 after

completing its acquisition of the mutual fund management business

of Dividend Growth Advisors.

The $195 million fund targets 80% of its investments in stocks

of U.S. and non-U.S. companies with market capitalizations over

$500 million that have increased their dividends 10% a year over 10

years. Stocks of companies that cut their dividends get sold from

the fund.

Goldman took over the fund but Dividend Growth Advisors, based

in Ridgeland, S.C., will sub-advise.

C. Troy Shaver, the co-manager of the fund and a former chief

executive of John Hancock Funds Inc. (JOHNHF.XX), says the

investment philosophy is based on what investors would need to do

in a high interest rate environment. To protect against inflation,

investors would need to invest in dividend stocks that kept pace

with it. Of course, the gains also help in a low-rate

environment.

Currently the fund is overweighted in industrials and consumer

discretionary stocks, including TJX Co.s (TJX), parent of discount

retailing chain T.J. Maxx, and Church & Dwight Co. (CHD), maker

of household products like Arm & Hammer baking soda and Oxi

Clean.

The fund's biggest holding is Denmark-based Novo Nordisk A/S

(NVO, NOVO-B.KO), a pharmaceutical company that is the leader in

diabetic care products, at 4% of the portfolio. Another top-five

holding is McDonald's Corp. (MCD), at 3.7%.

The fund also invests approximately 20% of its assets in 12 oil

and gas pipeline projects, called master limited partnerships.

Morningstar dividend fund analyst Christopher Davis doesn't

track this particular fund but says dividend investing has been a

hot segment. Last year, $3 billion poured into dividend-oriented

stock funds, according to Davis.

Companies in this category tend to be high-quality blue chips

with sustainable competitive advantages and growing profitability,

Davis noted. And they are shareholder-friendly, "all good

attributes."

As of March 1, the fund was up 6.1% year-to-date, 6.91% over one

year and 5.41% over five years, according to investment site

Morningstar.com.

Goldman acquired the business to fill in a gap in its roster of

mutual fund offerings, the firm said in December when the deal was

announced.

-By Liz Moyer, Dow Jones Newswires; 212-416-2512;

liz.moyer@dowjones.com

(TALK BACK: We invite readers to send us comments on this or

other financial news topics. Please email us at

TalkbackAmericas@dowjones.com. Readers should include their full

names, work or home addresses and telephone numbers for

verification purposes. We reserve the right to edit and publish

your comments along with your name; we reserve the right not to

publish reader comments.)

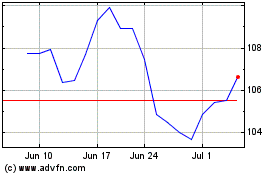

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Church and Dwight (NYSE:CHD)

Historical Stock Chart

From Apr 2023 to Apr 2024