UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) June 23, 2015

|

|

|

| Carnival Corporation |

|

Carnival plc |

| (Exact name of registrant as specified in its charter) |

|

(Exact name of registrant as specified in its charter) |

|

|

| Republic of Panama |

|

England and Wales |

| (State or other jurisdiction of incorporation) |

|

(State or other jurisdiction of incorporation) |

|

|

| 001-9610 |

|

001-15136 |

| (Commission File Number) |

|

(Commission File Number) |

|

|

| 59-1562976 |

|

98-0357772 |

| (IRS Employer Identification No.) |

|

(IRS Employer Identification No.) |

|

|

| 3655 N.W. 87th Avenue |

|

Carnival House, 100 Harbour Parade, |

| Miami, Florida 33178-2428 |

|

Southampton SO15 1ST, United Kingdom |

| (Address of principal executive offices) |

|

(Address of principal executive offices) |

| (Zip Code) |

|

(Zip Code) |

|

|

| (305) 599-2600 |

|

011 44 23 8065 5000 |

| (Registrant’s telephone number, including area code) |

|

(Registrant’s telephone number, including area code) |

|

|

| None |

|

None |

| (Former name or former address, if changed since last report.) |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On June 23, 2015, Carnival Corporation & plc issued a press release entitled “Carnival Corporation & plc Reports

Significantly Higher Second Quarter Earnings.” A copy of this press release is furnished as Exhibit 99.1 to this report. This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, and is not incorporated by reference into any filing of either Carnival Corporation or Carnival plc, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

99.1 Press release, dated June 23, 2015 (furnished pursuant to Item 2.02).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, each of the registrants has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

| CARNIVAL CORPORATION |

|

|

|

CARNIVAL PLC |

|

|

|

|

|

| By: |

|

/s/ Larry Freedman |

|

|

|

By: |

|

/s/ Larry Freedman |

| Name: |

|

Larry Freedman |

|

|

|

Name: |

|

Larry Freedman |

| Title: |

|

Chief Accounting Officer and Controller |

|

|

|

Title: |

|

Chief Accounting Officer and Controller |

|

|

|

|

|

| Date: |

|

June 23, 2015 |

|

|

|

Date: |

|

June 23, 2015 |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release, dated June 23, 2015 (furnished pursuant to Item 2.02) |

Exhibit 99.1

CARNIVAL CORPORATION & PLC REPORTS

SIGNIFICANTLY HIGHER SECOND QUARTER EARNINGS

MIAMI (June 23, 2015) – Carnival Corporation & plc (NYSE/LSE: CCL; NYSE: CUK) announced non-GAAP net income of $193 million, or

$0.25 diluted EPS for the second quarter of 2015 compared to non-GAAP net income for the second quarter of 2014 of $73 million, or $0.09 diluted EPS. For the second quarter of 2015, U.S. GAAP net income, which included unrealized gains on fuel

derivatives of $34 million and $7 million of restructuring expenses, was $222 million, or $0.29 diluted EPS. For the second quarter of 2014, U.S. GAAP net income was $98 million, or $0.13 diluted EPS. Revenues for the second quarter of 2015 were

$3.6 billion, in line with the prior year.

Carnival Corporation & plc President and CEO Arnold Donald noted “We more than

doubled our second quarter earnings versus the comparable period a year ago and significantly exceeded our quarterly earnings guidance. Our initiatives to create demand and leverage our scale benefited both cruise ticket prices and onboard revenues

contributing to 5% revenue yield improvement (constant currency) this quarter. While all of our North American brands enjoyed strong revenue yield improvement, our Carnival Cruise Line brand performed particularly well again this quarter. We thank

our teams around the globe for their consistent delivery of exceptional guest experiences as well as our travel agent partners for their strong support, both of which are critical to our success.”

Significant milestones during the second quarter included the launch of “fathom”, the tenth brand in the Carnival Corporation

family. Beginning in April 2016, “fathom” will introduce a new cruise category offering travelers authentic and meaningful experiences to targeted destinations, beginning with the Dominican Republic, to work alongside locals for

transformational community impact.

Additionally, Costa began year-round service from Shanghai on Costa Serena in April and

announced the deployment of Costa Fortuna to China in 2016 bringing the total to four Costa ships dedicated to Chinese guests. Princess Cruises also announced that it will expand its presence in Asia with a new ship scheduled to enter service

in mid-2017 to be based in China year-round and custom-designed specifically for Chinese guests. Already the industry leader in passenger cruise days home ported in China, these developments will further the company’s leading presence in this

rapidly expanding market and attract new cruisers to the company’s brands.

Also, earlier this month Carnival Corporation finalized a

contract with Meyer Werft shipyard to build four next-generation ships that will feature the largest guest capacity in the world as well as the first cruise ships to be powered at sea by Liquefied Natural Gas, which is the world’s

cleanest-burning fossil fuel.

“These milestones further demonstrate our ongoing focus on effective strategic actions,

technological development and innovation, laying the foundation for future growth and continued global expansion,” said Donald.

Key metrics for the

second quarter 2015 compared to the prior year were as follows:

| |

• |

|

On a constant dollar basis, net revenue yields (net revenue per available lower berth day or “ALBD”) increased 4.1 percent for 2Q 2015, which was better than the company’s guidance of up 2 to 3 percent.

Gross revenue yields decreased 3.5 percent in current dollars due to changes in currency exchange rates. |

| |

• |

|

Net cruise costs excluding fuel per ALBD increased 6.1 percent in constant dollars, primarily due to an increase in dry-dock days. Costs were better than March guidance, up 6.5 to 7.5 percent due to the timing of

expenses between quarters. Gross cruise costs including fuel per ALBD in current dollars decreased 8.0 percent due to changes in fuel prices and currency exchange rates. |

| |

• |

|

Fuel prices declined 37 percent to $411 per metric ton for 2Q 2015 from $657 per metric ton in 2Q 2014 but were higher than March guidance of $402 per metric ton. |

| |

• |

|

Changes in currency exchange rates reduced earnings by $0.10 per share (constant currency). |

2015

Outlook

During the last thirteen weeks, fleetwide booking volumes for the next three quarters were running well ahead of last year

at slightly lower prices due to transactional currency impacts. At this time, cumulative advance bookings for the next three quarters are well ahead of the prior year at slightly lower prices again due to transactional currency impacts.

Donald noted “Current strength in booking volumes clearly demonstrates strong consumer demand for our brands, leaving less inventory

remaining for sale and building confidence in achieving significant revenue yield improvement this year. We are stepping up our marketing investment for the remainder of the year to further solidify our base of business for 2016 and drive continued

yield improvement as we progress on our path toward double digit return on invested capital.”

The company continues to expect full

year 2015 net revenue yields on a constant currency basis to be up 3 to 4 percent, which excludes translational and transactional currency impacts, compared to the prior year (up 2 to 3 percent on a constant dollar basis compared to the prior year).

The company now expects full year 2015 net cruise costs excluding fuel per ALBD to be up approximately 3 percent compared to the prior year on a constant dollar basis, which is slightly higher than had been anticipated in the March guidance mainly

due to increased investment in advertising.

Taking the above factors into consideration, the company has increased its full year 2015

non-GAAP diluted earnings per share guidance to be in the range of $2.35 to $2.50, compared to 2014 non-GAAP diluted earnings of $1.93 per share.

Third Quarter 2015 Outlook

Third

quarter constant currency net revenue yields are expected to be up 3 to 4 percent compared to the prior year (up 2 to 3 percent in constant dollars). Net cruise costs excluding fuel per ALBD for the third quarter are expected to be 2 to 3 percent

higher on a constant dollar basis compared to the prior year. Changes in fuel prices net of derivatives, and currency is expected to reduce third quarter earnings by $0.06 per share.

Based on the above factors, the company expects non-GAAP diluted earnings for the third quarter 2015 to be in the range of $1.56 to $1.60 per

share versus 2014 non-GAAP earnings of $1.58 per share.

Selected Key Forecast Metrics

|

|

|

|

|

|

|

|

|

| |

|

Full Year 2015 |

|

Third Quarter 2015 |

| Year over year change: |

|

Current

Dollars |

|

Constant

Dollars |

|

Current

Dollars |

|

Constant

Dollars |

|

|

|

|

|

| Net revenue yields |

|

(2.0) to (3.0)% |

|

2.0 to 3.0% |

|

(3.0) to (4.0)% |

|

2.0 to 3.0% |

|

|

|

|

|

| Net cruise costs excl. fuel / ALBD |

|

(1.5) to (2.5)% |

|

2.5 to 3.5% |

|

(2.5) to (3.5)% |

|

2.0 to 3.0% |

|

|

|

|

|

| |

|

Full Year 2015 |

|

Third Quarter 2015 |

| Fuel price per metric ton |

|

444 |

|

492 |

| Fuel consumption (metric tons in thousands) |

|

3,190 |

|

790 |

| Currency: Euro |

|

$1.13 to €1 |

|

$1.13 to €1 |

| Sterling |

|

$1.53 to £1 |

|

$1.54 to £1 |

| Australian dollar |

|

$0.78 to A$1 |

|

$0.77 to A$1 |

| Canadian dollar |

|

$0.81 to C$1 |

|

$0.80 to C$1 |

Conference Call

The company has scheduled a conference call with analysts at 10:00 a.m. EDT (3:00 p.m. BST) today to discuss its 2015 second quarter results.

This call can be listened to live, and additional information can be obtained, via Carnival Corporation & plc’s Web site at www.carnivalcorp.com and www.carnivalplc.com.

Carnival Corporation & plc is the largest cruise company in the world, with a portfolio of 10 cruise brands in North America, Europe,

Australia and Asia, comprised of Carnival Cruise Line, Holland America Line, Princess Cruises, Seabourn, AIDA Cruises, Costa Cruises, Cunard, P&O Cruises ( Australia), P&O Cruises (UK) and fathom.

Together, these brands will operate 100 ships in 2015 totaling 219,000 lower berths with eight new ships scheduled to be delivered between

2016 and 2018, along with four additional new ships on

order between 2019 through 2022. Carnival Corporation & plc also operates Holland America Princess Alaska Tours, the leading tour companies in Alaska and the Canadian Yukon. Traded

on both the New York and London Stock Exchanges, Carnival Corporation & plc is the only group in the world to be included in both the S&P 500 and the FTSE 100 indices.

Additional information can be found on www.carnival.com, www.hollandamerica.com, www.princess.com,

www.seabourn.com, www.aida.de, www.costacruise.com, www.cunard.com, www.pocruises.com.au, www.pocruises.com and www.fathom.org.

|

|

|

| MEDIA CONTACT |

|

INVESTOR RELATIONS CONTACT |

| Roger Frizzell 1 305 406 7862 |

|

Beth Roberts 1 305 406 4832 |

Cautionary Note Concerning Factors That May Affect Future Results

Carnival Corporation and Carnival plc and their respective subsidiaries are referred to collectively in this release as “Carnival Corporation &

plc,” “our,” “us” and “we.” Some of the statements, estimates or projections contained in this release are “forward-looking statements” that involve risks, uncertainties and assumptions with respect to

us, including some statements concerning future results, outlooks, plans, goals and other events which have not yet occurred. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical facts are statements that could be deemed forward-looking. These statements are based on current expectations, estimates,

forecasts and projections about our business and the industry in which we operate and the beliefs and assumptions of our management. We have tried, whenever possible, to identify these statements by using words like “will,”

“may,” “could,” “should,” “would,” “believe,” “depends,” “expect,” “goal,” “anticipate,” “forecast,” “project,” “future,”

“intend,” “plan,” “estimate,” “target,” “indicate” and similar expressions of future intent or the negative of such terms.

Forward-looking statements include those statements that may impact, among other things, the forecasting of our non-GAAP earnings per share; net revenue

yields; booking levels; pricing; occupancy; operating, financing and tax costs, including fuel expenses; net cruise costs per available lower berth day; estimates of ship depreciable lives and residual values; liquidity; goodwill, ship and trademark

fair values and outlook. Because forward-looking statements involve risks and uncertainties, there are many factors that could cause our actual results, performance or achievements to differ materially from those expressed or implied in this

release. This note contains important cautionary statements of the known factors that we consider could materially affect the accuracy of our forward-looking statements and adversely affect our business, results of operations and financial

position. It is not possible to predict or identify all such risks. There may be additional risks that we consider immaterial or which are unknown. These factors include, but are not limited to, the following:

| |

• |

|

general economic and business conditions; |

| |

• |

|

increases in fuel prices; |

| |

• |

|

incidents, the spread of contagious diseases and threats thereof, adverse weather conditions or other natural disasters and other incidents affecting the health, safety, security and satisfaction of guests and crew;

|

| |

• |

|

the international political climate, armed conflicts, terrorist and pirate attacks, vessel seizures, and threats thereof, and other world events affecting the safety and security of travel; |

| |

• |

|

negative publicity concerning the cruise industry in general or us in particular, including any adverse environmental impacts of cruising; |

| |

• |

|

geographic regions in which we try to expand our business may be slow to develop and ultimately not develop how we expect; |

| |

• |

|

economic, market and political factors that are beyond our control, which could increase our operating, financing and other costs; |

| |

• |

|

changes in and compliance with laws and regulations relating to the protection of persons with disabilities, employment, environment, health, safety, security, tax and other regulations under which we operate;

|

| |

• |

|

our inability to implement our shipbuilding programs and ship repairs, maintenance and refurbishments on terms that are favorable or consistent with our expectations; |

| |

• |

|

increases to our repairs and maintenance expenses and refurbishment costs as our fleet ages; |

| |

• |

|

lack of continuing availability of attractive, convenient and safe port destinations on terms that are favorable or consistent with our expectations; |

| |

• |

|

continuing financial viability of our travel agent distribution system, air service providers and other key vendors in our supply chain and reductions in the availability of, and increases in the prices for, the

services and products provided by these vendors; |

| |

• |

|

disruptions and other damages to our information technology and other networks and operations, and breaches in data security; |

| |

• |

|

failure to keep pace with developments in technology; |

| |

• |

|

competition from and overcapacity in the cruise ship and land-based vacation industry; |

| |

• |

|

loss of key personnel or our ability to recruit or retain qualified personnel; |

| |

• |

|

union disputes and other employee relationship issues; |

| |

• |

|

disruptions in the global financial markets or other events that may negatively affect the ability of our counterparties and others to perform their obligations to us; |

| |

• |

|

the continued strength of our cruise brands and our ability to implement our strategies; |

| |

• |

|

additional risks to our international operations not generally applicable to our U.S. operations; |

| |

• |

|

our decisions to self-insure against various risks or our inability to obtain insurance for certain risks at reasonable rates; |

| |

• |

|

litigation, enforcement actions, fines or penalties; |

| |

• |

|

fluctuations in foreign currency exchange rates; |

| |

• |

|

whether our future operating cash flow will be sufficient to fund future obligations and whether we will be able to obtain financing, if necessary, in sufficient amounts and on terms that are favorable or consistent

with our expectations; |

| |

• |

|

risks associated with our DLC arrangement; |

| |

• |

|

uncertainties of a foreign legal system as Carnival Corporation and Carnival plc are not U.S. corporations and |

| |

• |

|

the ability of a small group of shareholders to effectively control the outcome of shareholder voting. |

Forward-looking statements should not be relied upon as a prediction of actual results. Subject to any continuing obligations under applicable law or any

relevant stock exchange rules, we expressly disclaim any obligation to disseminate, after the date of this release, any updates or revisions to any such forward-looking statements to reflect any change in expectations or events, conditions or

circumstances on which any such statements are based.

CARNIVAL CORPORATION & PLC

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(in millions,

except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

May 31, |

|

|

Six Months Ended

May 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cruise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Passenger tickets |

|

$ |

2,628 |

|

|

$ |

2,698 |

|

|

$ |

5,260 |

|

|

$ |

5,425 |

|

| Onboard and other |

|

|

927 |

|

|

|

905 |

|

|

|

1,816 |

|

|

|

1,755 |

|

| Tour and other |

|

|

35 |

|

|

|

30 |

|

|

|

44 |

|

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,590 |

|

|

|

3,633 |

|

|

|

7,120 |

|

|

|

7,218 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Costs and Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cruise |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commissions, transportation and other |

|

|

481 |

|

|

|

520 |

|

|

|

1,067 |

|

|

|

1,141 |

|

| Onboard and other |

|

|

114 |

|

|

|

115 |

|

|

|

225 |

|

|

|

228 |

|

| Payroll and related |

|

|

469 |

|

|

|

485 |

|

|

|

936 |

|

|

|

965 |

|

| Fuel |

|

|

333 |

|

|

|

527 |

|

|

|

650 |

|

|

|

1,050 |

|

| Food |

|

|

242 |

|

|

|

251 |

|

|

|

482 |

|

|

|

496 |

|

| Other ship operating |

|

|

734 |

|

|

|

642 |

(a) |

|

|

1,332 |

|

|

|

1,238 |

(a) |

| Tour and other |

|

|

31 |

|

|

|

32 |

|

|

|

47 |

|

|

|

46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,404 |

|

|

|

2,572 |

|

|

|

4,739 |

|

|

|

5,164 |

|

| Selling and administrative |

|

|

491 |

|

|

|

504 |

|

|

|

1,020 |

|

|

|

1,025 |

|

| Depreciation and amortization |

|

|

406 |

|

|

|

410 |

(a) |

|

|

807 |

|

|

|

815 |

(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,301 |

|

|

|

3,486 |

|

|

|

6,566 |

|

|

|

7,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Income |

|

|

289 |

|

|

|

147 |

|

|

|

554 |

|

|

|

214 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nonoperating (Expense) Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

2 |

|

|

|

2 |

|

|

|

4 |

|

|

|

4 |

|

| Interest expense, net of capitalized interest |

|

|

(57 |

) |

|

|

(72 |

) |

|

|

(114 |

) |

|

|

(143 |

) |

| (Losses) gains on fuel derivatives, net (b) |

|

|

(13 |

) |

|

|

11 |

|

|

|

(181 |

) |

|

|

(6 |

) |

| Other income, net |

|

|

5 |

|

|

|

11 |

|

|

|

15 |

|

|

|

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(63 |

) |

|

|

(48 |

) |

|

|

(276 |

) |

|

|

(134 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes |

|

|

226 |

|

|

|

99 |

|

|

|

278 |

|

|

|

80 |

|

|

|

|

|

|

| Income Tax Expense, Net |

|

|

(4 |

) |

|

|

(1 |

) |

|

|

(7 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

222 |

|

|

$ |

98 |

|

|

$ |

271 |

|

|

$ |

78 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.29 |

|

|

$ |

0.13 |

|

|

$ |

0.35 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.29 |

|

|

$ |

0.13 |

|

|

$ |

0.35 |

|

|

$ |

0.10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP Earnings Per Share-Diluted (c) |

|

$ |

0.25 |

|

|

$ |

0.09 |

|

|

$ |

0.45 |

|

|

$ |

0.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends Declared Per Share |

|

$ |

0.25 |

|

|

$ |

0.25 |

|

|

$ |

0.50 |

|

|

$ |

0.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-Average Shares Outstanding – Basic |

|

|

778 |

|

|

|

776 |

|

|

|

777 |

|

|

|

776 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-Average Shares Outstanding – Diluted |

|

|

780 |

|

|

|

778 |

|

|

|

780 |

|

|

|

778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

In the first quarter of 2015, we revised and corrected the accounting for one of our brands’ marine and technical spare parts in order to consistently expense them fleetwide. Had we not revised, this accounting may

have resulted in material inconsistencies to our financial statements in the future. Accordingly, we will revise other previously reported results in future filings. This revision increased our three and six months ended May 31, 2014 other ship

operating and depreciation expenses by $7 million and $1 million and $12 million and $1 million, respectively. |

| (b) |

During the three months ended May 31, 2015 and 2014, our losses on fuel derivatives, net include net unrealized gains of $34 million and $10 million and realized (losses) gains of $(47) million and $1 million,

respectively. During the six months ended May 31, 2015 and 2014, our losses on fuel derivatives, net include net unrealized losses of $(78) million and $(7) million and realized (losses) gains of $(103) million and $1 million, respectively.

|

| (c) |

See the U.S. GAAP net income to non-GAAP net income reconciliations in the Non-GAAP Financial Measures included herein. |

CARNIVAL CORPORATION & PLC

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(in millions,

except par values)

|

|

|

|

|

|

|

|

|

| |

|

May 31,

2015 |

|

|

November 30,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

298 |

|

|

$ |

331 |

|

| Trade and other receivables, net |

|

|

380 |

|

|

|

332 |

|

| Insurance recoverables |

|

|

176 |

|

|

|

154 |

|

| Inventories |

|

|

327 |

|

|

|

349 |

|

| Prepaid expenses and other |

|

|

298 |

|

|

|

322 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,479 |

|

|

|

1,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property and Equipment, Net |

|

|

32,179 |

|

|

|

32,819 |

|

|

|

|

| Goodwill |

|

|

3,041 |

|

|

|

3,127 |

|

|

|

|

| Other Intangibles |

|

|

1,247 |

|

|

|

1,270 |

|

|

|

|

| Other Assets |

|

|

665 |

|

|

|

744 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

38,611 |

|

|

$ |

39,448 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Short-term borrowings |

|

$ |

305 |

|

|

$ |

666 |

|

| Current portion of long-term debt |

|

|

1,316 |

|

|

|

1,059 |

|

| Accounts payable |

|

|

637 |

|

|

|

626 |

|

| Claims reserve |

|

|

295 |

|

|

|

262 |

|

| Accrued liabilities and other |

|

|

1,223 |

|

|

|

1,276 |

|

| Customer deposits |

|

|

3,907 |

|

|

|

3,032 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

7,683 |

|

|

|

6,921 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-Term Debt |

|

|

6,648 |

|

|

|

7,363 |

|

|

|

|

| Other Long-Term Liabilities |

|

|

1,028 |

|

|

|

960 |

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Common stock of Carnival Corporation, $0.01 par value; 1,960 shares authorized; 653 shares at 2015 and 652 shares at 2014

issued |

|

|

7 |

|

|

|

7 |

|

| Ordinary shares of Carnival plc, $1.66 par value; 216 shares at 2015 and 2014 issued |

|

|

358 |

|

|

|

358 |

|

| Additional paid-in capital |

|

|

8,412 |

|

|

|

8,384 |

|

| Retained earnings |

|

|

19,041 |

|

|

|

19,158 |

|

| Accumulated other comprehensive loss |

|

|

(1,479 |

) |

|

|

(616 |

) |

| Treasury stock, 59 shares at 2015 and 2014 of Carnival Corporation and 32 shares at 2015 and 2014 of Carnival plc, at cost |

|

|

(3,087 |

) |

|

|

(3,087 |

) |

|

|

|

|

|

|

|

|

|

| Total shareholders’ equity |

|

|

23,252 |

|

|

|

24,204 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

38,611 |

|

|

$ |

39,448 |

|

|

|

|

|

|

|

|

|

|

CARNIVAL CORPORATION & PLC

OTHER INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

May 31, |

|

|

Six Months Ended

May 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| STATISTICAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALBDs (in thousands) (a) |

|

|

19,307 |

|

|

|

18,872 |

|

|

|

37,891 |

|

|

|

37,158 |

|

| Occupancy percentage (b) |

|

|

102.8 |

% |

|

|

102.2 |

% |

|

|

102.9 |

% |

|

|

102.6 |

% |

| Passengers carried (in thousands) |

|

|

2,608 |

|

|

|

2,551 |

|

|

|

5,071 |

|

|

|

4,960 |

|

| Fuel consumption in metric tons (in thousands) |

|

|

810 |

|

|

|

802 |

|

|

|

1,593 |

|

|

|

1,603 |

|

| Fuel consumption in metric tons per ALBD |

|

|

0.042 |

|

|

|

0.043 |

|

|

|

0.042 |

|

|

|

0.043 |

|

| Fuel cost per metric ton consumed |

|

$ |

411 |

|

|

$ |

657 |

|

|

$ |

408 |

|

|

$ |

655 |

|

| Currencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. dollar to €1 |

|

$ |

1.10 |

|

|

$ |

1.38 |

|

|

$ |

1.13 |

|

|

$ |

1.37 |

|

| U.S. dollar to £1 |

|

$ |

1.52 |

|

|

$ |

1.67 |

|

|

$ |

1.53 |

|

|

$ |

1.66 |

|

| U.S. dollar to Australian dollar |

|

$ |

0.78 |

|

|

$ |

0.92 |

|

|

$ |

0.79 |

|

|

$ |

0.91 |

|

| U.S. dollar to Canadian dollar |

|

$ |

0.81 |

|

|

$ |

0.91 |

|

|

$ |

0.81 |

|

|

$ |

0.91 |

|

|

|

|

|

|

| CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash from operations |

|

$ |

1,515 |

|

|

$ |

1,196 |

|

|

$ |

2,286 |

|

|

$ |

1,673 |

|

| Capital expenditures |

|

$ |

439 |

|

|

$ |

976 |

|

|

$ |

1,381 |

|

|

$ |

1,329 |

|

| Dividends paid |

|

$ |

194 |

|

|

$ |

194 |

|

|

$ |

388 |

|

|

$ |

388 |

|

| (a) |

ALBD is a standard measure of passenger capacity for the period, which we use to approximate rate and capacity variances, based on consistently applied formulas, that we use to perform analyses to determine the main

non-capacity driven factors that cause our cruise revenues and expenses to vary. ALBDs assume that each cabin we offer for sale accommodates two passengers and is computed by multiplying passenger capacity by revenue-producing ship operating days in

the period. |

| (b) |

In accordance with cruise industry practice, occupancy is calculated using a denominator of ALBDs, which assumes two passengers per cabin even though some cabins can accommodate three or more passengers. Percentages in

excess of 100% indicate that on average more than two passengers occupied some cabins. |

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES

Consolidated

gross and net revenue yields were computed by dividing the gross and net cruise revenues by ALBDs as follows (dollars in millions, except yields) (a) (b):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended May 31, |

|

|

Six Months Ended May 31, |

|

| |

|

2015 |

|

|

2015

Constant

Dollar |

|

|

2014 |

|

|

2015 |

|

|

2015

Constant

Dollar |

|

|

2014 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| Passenger ticket revenues |

|

$ |

2,628 |

|

|

$ |

2,835 |

|

|

$ |

2,698 |

|

|

$ |

5,260 |

|

|

$ |

5,609 |

|

|

$ |

5,425 |

|

| Onboard and other revenues |

|

|

927 |

|

|

|

976 |

|

|

|

905 |

|

|

|

1,816 |

|

|

|

1,897 |

|

|

|

1,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross cruise revenues |

|

|

3,555 |

|

|

|

3,811 |

|

|

|

3,603 |

|

|

|

7,076 |

|

|

|

7,506 |

|

|

|

7,180 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less cruise costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commissions, transportation and other |

|

|

(481 |

) |

|

|

(530 |

) |

|

|

(520 |

) |

|

|

(1,067 |

) |

|

|

(1,162 |

) |

|

|

(1,141 |

) |

| Onboard and other |

|

|

(114 |

) |

|

|

(121 |

) |

|

|

(115 |

) |

|

|

(225 |

) |

|

|

(236 |

) |

|

|

(228 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(595 |

) |

|

|

(651 |

) |

|

|

(635 |

) |

|

|

(1,292 |

) |

|

|

(1,398 |

) |

|

|

(1,369 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net passenger ticket revenues |

|

|

2,147 |

|

|

|

2,305 |

|

|

|

2,178 |

|

|

|

4,193 |

|

|

|

4,447 |

|

|

|

4,284 |

|

| Net onboard and other revenues |

|

|

813 |

|

|

|

855 |

|

|

|

790 |

|

|

|

1,591 |

|

|

|

1,661 |

|

|

|

1,527 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cruise revenues |

|

$ |

2,960 |

|

|

$ |

3,160 |

|

|

$ |

2,968 |

|

|

$ |

5,784 |

|

|

$ |

6,108 |

|

|

$ |

5,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALBDs |

|

|

19,306,832 |

|

|

|

19,306,832 |

|

|

|

18,872,035 |

|

|

|

37,890,712 |

|

|

|

37,890,712 |

|

|

|

37,158,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross revenue yields |

|

$ |

184.15 |

|

|

$ |

197.38 |

|

|

$ |

190.92 |

|

|

$ |

186.76 |

|

|

$ |

198.11 |

|

|

$ |

193.23 |

|

| % (decrease) increase vs. 2014 |

|

|

(3.5 |

)% |

|

|

3.4 |

% |

|

|

|

|

|

|

(3.3 |

)% |

|

|

2.5 |

% |

|

|

|

|

| |

|

|

|

|

|

|

| Net revenue yields |

|

$ |

153.29 |

|

|

$ |

163.66 |

|

|

$ |

157.27 |

|

|

$ |

152.65 |

|

|

$ |

161.20 |

|

|

$ |

156.39 |

|

| % (decrease) increase vs. 2014 |

|

|

(2.5 |

)% |

|

|

4.1 |

% |

|

|

|

|

|

|

(2.4 |

)% |

|

|

3.1 |

% |

|

|

|

|

| |

|

|

|

|

|

|

| Net passenger ticket revenue yields |

|

$ |

111.20 |

|

|

$ |

119.41 |

|

|

$ |

115.40 |

|

|

$ |

110.66 |

|

|

$ |

117.36 |

|

|

$ |

115.29 |

|

| % (decrease) increase vs. 2014 |

|

|

(3.6 |

)% |

|

|

3.5 |

% |

|

|

|

|

|

|

(4.0 |

)% |

|

|

1.8 |

% |

|

|

|

|

| |

|

|

|

|

|

|

| Net onboard and other revenue yields |

|

$ |

42.09 |

|

|

$ |

44.25 |

|

|

$ |

41.87 |

|

|

$ |

41.99 |

|

|

$ |

43.83 |

|

|

$ |

41.10 |

|

| % increase vs. 2014 |

|

|

0.5 |

% |

|

|

5.7 |

% |

|

|

|

|

|

|

2.2 |

% |

|

|

6.7 |

% |

|

|

|

|

|

| Consolidated gross and net cruise costs and net cruise costs excluding fuel per ALBD were computed by dividing the gross and net cruise costs and net cruise costs excluding fuel by ALBDs as follows (dollars in millions,

except costs per ALBD) (a) (b): |

|

|

|

|

| |

|

Three Months Ended May 31, |

|

|

Six Months Ended May 31, |

|

| |

|

2015 |

|

|

2015

Constant

Dollar |

|

|

2014 |

|

|

2015 |

|

|

2015

Constant

Dollar |

|

|

2014 |

|

| Cruise operating expenses |

|

$ |

2,373 |

|

|

$ |

2,523 |

|

|

$ |

2,540 |

|

|

$ |

4,692 |

|

|

$ |

4,951 |

|

|

$ |

5,118 |

|

| Cruise selling and administrative expenses |

|

|

489 |

|

|

|

524 |

|

|

|

502 |

|

|

|

1,016 |

|

|

|

1,074 |

|

|

|

1,021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross cruise costs |

|

|

2,862 |

|

|

|

3,047 |

|

|

|

3,042 |

|

|

|

5,708 |

|

|

|

6,025 |

|

|

|

6,139 |

|

| Less cruise costs included above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commissions, transportation and other |

|

|

(481 |

) |

|

|

(530 |

) |

|

|

(520 |

) |

|

|

(1,067 |

) |

|

|

(1,162 |

) |

|

|

(1,141 |

) |

| Onboard and other |

|

|

(114 |

) |

|

|

(121 |

) |

|

|

(115 |

) |

|

|

(225 |

) |

|

|

(236 |

) |

|

|

(228 |

) |

| Gains on ship sales and ship impairment, net |

|

|

2 |

|

|

|

2 |

|

|

|

15 |

|

|

|

4 |

|

|

|

4 |

|

|

|

15 |

|

| Restructuring expenses |

|

|

(7 |

) |

|

|

(8 |

) |

|

|

— |

|

|

|

(7 |

) |

|

|

(9 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cruise costs |

|

|

2,262 |

|

|

|

2,390 |

|

|

|

2,422 |

|

|

|

4,413 |

|

|

|

4,622 |

|

|

|

4,785 |

|

| Less fuel |

|

|

(333 |

) |

|

|

(333 |

) |

|

|

(527 |

) |

|

|

(650 |

) |

|

|

(650 |

) |

|

|

(1,050 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cruise costs excluding fuel |

|

$ |

1,929 |

|

|

$ |

2,057 |

|

|

$ |

1,895 |

|

|

$ |

3,763 |

|

|

$ |

3,972 |

|

|

$ |

3,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ALBDs |

|

|

19,306,832 |

|

|

|

19,306,832 |

|

|

|

18,872,035 |

|

|

|

37,890,712 |

|

|

|

37,890,712 |

|

|

|

37,158,340 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross cruise costs per ALBD |

|

$ |

148.22 |

|

|

$ |

157.78 |

|

|

$ |

161.18 |

|

|

$ |

150.64 |

|

|

$ |

159.01 |

|

|

$ |

165.20 |

|

| % decrease vs. 2014 |

|

|

(8.0 |

)% |

|

|

(2.1 |

)% |

|

|

|

|

|

|

(8.8 |

)% |

|

|

(3.7 |

)% |

|

|

|

|

| |

|

|

|

|

|

|

| Net cruise costs per ALBD |

|

$ |

117.11 |

|

|

$ |

123.73 |

|

|

$ |

128.33 |

|

|

$ |

116.45 |

|

|

$ |

121.98 |

|

|

$ |

128.77 |

|

| % decrease vs. 2014 |

|

|

(8.7 |

)% |

|

|

(3.6 |

)% |

|

|

|

|

|

|

(9.6 |

)% |

|

|

(5.3 |

)% |

|

|

|

|

| |

|

|

|

|

|

|

| Net cruise costs excluding fuel per ALBD |

|

$ |

99.88 |

|

|

$ |

106.50 |

|

|

$ |

100.38 |

|

|

$ |

99.28 |

|

|

$ |

104.81 |

|

|

$ |

100.50 |

|

| % (decrease) increase vs. 2014 |

|

|

(0.5 |

)% |

|

|

6.1 |

% |

|

|

|

|

|

|

(1.2 |

)% |

|

|

4.3 |

% |

|

|

|

|

(See next page for Notes to Non-GAAP Financial Measures.)

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES (CONTINUED)

Non-GAAP fully diluted earnings per share was computed as follows (in millions, except per share data) (b):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended

May 31, |

|

|

Six Months

Ended

May 31, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net income – diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP net income |

|

$ |

222 |

|

|

$ |

98 |

|

|

$ |

271 |

|

|

$ |

78 |

|

| (Gains) on ship sales and ship impairment, net (c) |

|

|

(2 |

) |

|

|

(15 |

) |

|

|

(4 |

) |

|

|

(15 |

) |

| Restructuring expenses (c) |

|

|

7 |

|

|

|

— |

|

|

|

7 |

|

|

|

— |

|

| Unrealized (gains) losses on fuel derivatives, net (d) |

|

|

(34 |

) |

|

|

(10 |

) |

|

|

78 |

|

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

$ |

193 |

|

|

$ |

73 |

|

|

$ |

352 |

|

|

$ |

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares outstanding – diluted |

|

|

780 |

|

|

|

778 |

|

|

|

780 |

|

|

|

778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| Earnings per share – diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP earnings per share |

|

$ |

0.29 |

|

|

$ |

0.13 |

|

|

$ |

0.35 |

|

|

$ |

0.10 |

|

| (Gains) on ship sales and ship impairment, net (c) |

|

|

— |

|

|

|

(0.02 |

) |

|

|

(0.01 |

) |

|

|

(0.02 |

) |

| Restructuring expenses (c) |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

| Unrealized (gains) losses on fuel derivatives, net (d) |

|

|

(0.05 |

) |

|

|

(0.02 |

) |

|

|

0.10 |

|

|

|

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP earnings per share |

|

$ |

0.25 |

|

|

$ |

0.09 |

|

|

$ |

0.45 |

|

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Non-GAAP Financial Measures

| |

(a) |

We use net cruise revenues per ALBD (“net revenue yields”), net cruise costs per ALBD and net cruise costs excluding fuel per ALBD as significant non-GAAP financial measures of our cruise segments’

financial performance. These measures enable us to separate the impact of predictable capacity changes from the more unpredictable rate changes that affect our business; gains and losses on ship sales and ship impairments, net; and restructuring

expenses that are not part of our core operating business. We believe these non-GAAP measures provide useful information to investors and expanded insight to measure our revenue and cost performance as a supplement to our U.S. GAAP consolidated

financial statements. |

Net revenue yields are commonly used in the cruise industry to measure a company’s cruise segment

revenue performance and for revenue management purposes. We use “net cruise revenues” rather than “gross cruise revenues” to calculate net revenue yields. We believe that net cruise revenues is a more meaningful measure in

determining revenue yield than gross cruise revenues because it reflects the cruise revenues earned net of our most significant variable costs, which are travel agent commissions, cost of air and other transportation, certain other costs that are

directly associated with onboard and other revenues and credit and debit card fees. Substantially all of our remaining cruise costs are largely fixed, except for the impact of changing prices and food expenses, once our ship capacity levels have

been determined.

Net passenger ticket revenues reflect gross passenger ticket revenues, net of commissions, transportation and other

costs. Net onboard and other revenues reflect gross onboard and other revenues, net of onboard and other cruise costs. Net passenger ticket revenue yields and net onboard and other revenue yields are computed by dividing net passenger ticket

revenues and net onboard and other revenues by ALBDs.

Net cruise costs per ALBD and net cruise costs excluding fuel per ALBD are the most

significant measures we use to monitor our ability to control our cruise segments’ costs rather than gross cruise costs per ALBD. We exclude the same variable costs that are included in the calculation of net cruise revenues to calculate net

cruise costs with and without fuel to avoid duplicating these variable costs in our non-GAAP financial measures. In addition, we exclude gains and losses on ship sales and ship impairments, net and restructuring expenses from our calculation of net

cruise costs with and without fuel as they are not considered part of our core operating business.

As a result of our revision of 2014

cruise ship operating expenses, our previously reported results changed as follows (in millions, except per ALBD data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

May 31, 2014 |

|

|

Six Months Ended

May 31, 2014 |

|

| |

|

As Previously

Reported |

|

|

As

Revised |

|

|

As Previously

Reported |

|

|

As

Revised |

|

|

|

|

|

|

| Gross cruise costs per ALBD |

|

$ |

160.80 |

|

|

$ |

161.18 |

|

|

$ |

164.89 |

|

|

$ |

165.20 |

|

| Net cruise costs per ALBD |

|

$ |

127.95 |

|

|

$ |

128.33 |

|

|

$ |

128.45 |

|

|

$ |

128.77 |

|

| Net cruise costs excluding fuel per ALBD |

|

$ |

100.00 |

|

|

$ |

100.38 |

|

|

$ |

100.18 |

|

|

$ |

100.50 |

|

| U.S. GAAP net income |

|

$ |

106 |

|

|

$ |

98 |

|

|

$ |

91 |

|

|

$ |

78 |

|

| Non-GAAP net income |

|

$ |

80 |

|

|

$ |

73 |

|

|

$ |

83 |

|

|

$ |

70 |

|

CARNIVAL CORPORATION & PLC

NON-GAAP FINANCIAL MEASURES (CONTINUED)

We have not provided estimates of future gross revenue yields or future gross cruise costs per ALBD because the quantitative reconciliations of

forecasted gross cruise revenues to forecasted net cruise revenues or forecasted gross cruise costs to forecasted net cruise costs would include a significant amount of uncertainty in projecting the costs deducted to arrive at these measures. As

such, management does not believe that this reconciling information would be meaningful.

In addition, because our Europe,

Australia & Asia (“EAA”) cruise brands utilize the euro, sterling and Australian dollar as their functional currency to measure their results and financial condition, the translation of those operations to our U.S. dollar

reporting currency results in decreases in reported U.S. dollar revenues and expenses if the U.S. dollar strengthens against these foreign currencies and increases in reported U.S. dollar revenues and expenses if the U.S. dollar weakens against

these foreign currencies. Accordingly, we also monitor and report these non-GAAP financial measures assuming the 2015 periods currency exchange rates have remained constant with the 2014 periods rates, or on a “constant dollar basis,” in

order to remove the impact of changes in exchange rates on the translation of our EAA brands. We believe that this is a useful measure since it facilitates a comparative view of the changes in our business in a fluctuating currency exchange rate

environment.

Although our constant dollar basis measure removes the foreign currency translational impact as discussed above, it does not

remove the foreign currency transactional impact from changes in exchange rates on our brands’ revenues and expenses that are denominated in a currency other than their functional currency. Historically the foreign currency transactional impact

had not been significant when measuring the periodic changes in our results of operations. However, given the continuing expansion of our global business and the heightened volatility in foreign currency exchange rates, we believe the foreign

currency transactional impact is more significant in measuring our 2015 results compared to 2014, than in previous years. Together, the foreign currency translational and transactional impacts discussed above are referred to as on the “constant

currency basis.”

| |

(b) |

Our consolidated financial statements are prepared in accordance with U.S. GAAP. The presentation of our non-GAAP financial information is not intended to be considered in isolation from, as substitute for, or superior

to the financial information prepared in accordance with U.S. GAAP. There are no specific rules for determining our non-GAAP current and constant dollar financial measures and, accordingly, they are susceptible to varying calculations, and it is

possible that they may not be exactly comparable to the like-kind information presented by other companies, which is a potential risk associated with using these measures to compare us to other companies. |

| |

(c) |

We believe that the gains on ship sales and ship impairment, net and restructuring expenses recognized in the three and six months ended May 31, 2015 and 2014 are not part of our core operating business and,

therefore, is not an indication of our future earnings performance. As such, we believe it is more meaningful for the gains on ship sales and ship impairment, net and restructuring expenses to be excluded from our net income and earnings per share

and, accordingly, we present non-GAAP net income and non-GAAP earnings per share excluding these items. |

| |

(d) |

Under U.S. GAAP, the realized and unrealized gains and losses on fuel derivatives not qualifying as fuel hedges are recognized currently in earnings. We believe that unrealized gains and losses on fuel derivatives are

not an indication of our earnings performance since they relate to future periods and may not ultimately be realized in our future earnings. Therefore, we believe it is more meaningful for the unrealized gains and losses on fuel derivatives to be

excluded from our net income and earnings per share and, accordingly, we present non-GAAP net income and non-GAAP earnings per share excluding these unrealized gains and losses. |

We have not included in our earnings guidance the impact of unrealized gains and losses on fuel derivatives because these unrealized amounts

involve a significant amount of uncertainty, and we do not believe they are an indication of our future earnings performance. Accordingly, our earnings guidance is presented on a non-GAAP basis only. As a result, we did not present a reconciliation

between forecasted non-GAAP diluted earnings per share guidance and forecasted U.S. GAAP diluted earnings per share guidance, since we do not believe that the reconciliation information would be meaningful. However, we do forecast realized gains and

losses on fuel derivatives by applying current Brent prices to the derivatives that settle in the forecast period.

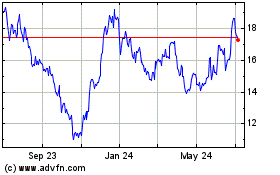

Carnival (NYSE:CCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

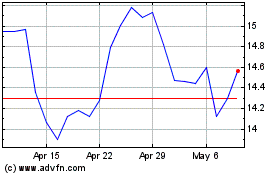

Carnival (NYSE:CCL)

Historical Stock Chart

From Apr 2023 to Apr 2024