UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 30, 2015

CROWN HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

|

| | | | |

Pennsylvania | | 0-50189 | | 75-3099507 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Crown Way

Philadelphia, Pennsylvania 19154-4599

(215) 698-5100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 30, 2015, Crown Holdings, Inc. (the “Company”) entered into an employment agreement with its President and Chief Operating Officer Timothy J. Donahue (the “Employment Agreement”) in connection with Mr. Donahue’s promotion to Chief Executive Officer of the Company. The material terms of the Employment Agreement, which became effective on January 1, 2016, are summarized below.

Term. Mr. Donahue’s initial term shall be for a period of one year and shall automatically renew for one year terms unless either party gives written notice at least thirty days prior to any automatic renewal.

Base Salary and Bonus. Mr. Donahue’s starting annual base salary will be $915,000. Mr. Donahue’s base salary will be reviewed and adjusted as appropriate in accordance with the Company’s regular compensation review practices. Additionally, Mr. Donahue will be eligible for a cash bonus in an amount to be determined in accordance with the Company’s existing annual cash incentive bonus plan or any successor bonus plan. Mr. Donahue is also eligible to participate in the Company’s Senior Executive Retirement Plan and the Company’s equity-based incentive plans.

Other Benefits. Mr. Donahue will be eligible to participate in the Company’s employee benefit plans and programs on the same terms and conditions as apply to the Company’s executive officers generally, as in effect from time to time.

Severance Terms. Upon termination of Mr. Donahue’s employment by the Company without “cause” or by Mr. Donahue for “good reason,” he will be entitled to any base salary earned through the date of termination; a pro-rata incentive bonus for the year of termination determined based on the actual bonus, if any, he would have been paid for such year absent such termination; a lump-sum payment equal to three times his base salary and target incentive bonus payment for the year of such termination; and such retirement and other benefits earned and vested as of the date of his termination.

The foregoing description of the Employment Agreement is qualified in its entirety by reference to the full text of the Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

|

| | | |

Item 9.01. | Financial Statements and Exhibits. | |

|

Exhibit | | Description |

10.1 | | Employment Agreement, dated December 30, 2015, between Crown Holdings, Inc. and Timothy J. Donahue. |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

Dated: January 5, 2016 | CROWN HOLDINGS, INC. |

|

| | |

| | |

| | |

| | |

| By: | /s/ David A. Beaver |

| | David A. Beaver |

| | Vice President and Corporate Controller |

3

EXHIBIT INDEX

(d) Exhibits:

|

| | |

| | |

Exhibit 10.1 | | Employment Agreement, dated December 30, 2015, between Crown Holdings, Inc. and Timothy J. Donahue. |

4

EXHIBIT 10.1

SENIOR EXECUTIVE EMPLOYMENT AGREEMENT

THIS IS AN EMPLOYMENT AGREEMENT (“Agreement”), dated as of December 30, 2015, between Crown Holdings, Inc., (the “Company”), and Timothy J. Donahue (the “Executive”).

Background

WHEREAS, the Executive is currently employed by the Company pursuant to an employment Agreement dated May 3, 2007, as amended (the “Prior Agreement”).

WHEREAS, the Company desires to assure itself of the continued employment of the Executive with the Company and to encourage his continued attention and dedication to the best interests of the Company.

WHEREAS, the Executive desires to remain and continue in the employment of the Company in accordance with the terms of this Agreement.

WHEREAS, as of January 1, 2016 (the “Effective Date”), the Prior Agreement shall be replaced in its entirety and shall be of no further force and effect.

NOW, THEREFORE, in consideration of the promises and mutual covenants contained herein and intending to be legally bound hereby, the parties agree as follows:

Terms

| |

1. | Definitions. As used in this Agreement, the following terms shall have the meanings set forth below: |

1.1. “Board” shall mean the Board of Directors of the Company.

1.2. “Cause” shall mean the termination of the Executive’s employment with the Company as a result of:

(a)the Executive’s willful failure to perform such services as may be reasonably delegated or assigned to the Executive by the Board;

(b)the continued failure by the Executive to devote his full-time best effort to the performance of his duties under the Agreement (other than any such failure resulting from the Executive’s incapacity due to physical or mental illness);

(c)the breach by the Executive of any provision of Sections 6, 7, 8 and 9 hereof;

(d)the willful engaging by the Executive in misconduct which is materially injurious to the Company, monetarily or otherwise; or

(e)the Executive’s conviction of, or a plea of nolo contendere to, a felony or a crime involving moral turpitude;

in any case as approved by the Board upon the vote of not less than a majority of the Board members then in office, after reasonable notice to the Executive specifying in writing the basis or bases for the proposed termination for Cause and after the Executive, together with counsel, has been provided an opportunity to be heard before a meeting of the Board held upon reasonable notice to all Board members and the Executive. For purposes of this Section 1.2, no act, or failure to act, on the Executive’s part shall be considered “willful” unless done, or omitted to be done, by him in bad faith and without reasonable belief that his action or omission was in the best interests of the Company. Any act or omission to act by the Executive in reliance upon an opinion of counsel to the Company shall not be deemed to be willful.

1.3. “Change in Control” shall mean any of the following events:

(a) a “person” (as such term is used in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than a trustee or other fiduciary holding securities under an employee benefit plan of the Company or a corporation owned, directly or indirectly, by the stockholders of the Company in substantially the same proportions as their ownership of stock of the Company, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company’s then outstanding securities; or

(b) during any period of 2 consecutive years, individuals who at the beginning of such period constitute the Board and any new director (other than a director designated by a person who has entered into an agreement with the Company to effect a transaction described in Section 1.3(a), Section 1.3(c) or Section 1.3(d) hereof) whose election by the Board or nomination for election by the Company’s stockholders was approved by a vote of at least two-thirds of the directors then still in office who either were directors at the beginning of the period or whose election or nomination for election was previously so approved, cease for any reason to constitute a majority thereof; or

(c) the Company merges or consolidates with any other corporation, other than in a merger or consolidation that would result in the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 75% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation; or

(d) the stockholders of the Company approve a plan of complete liquidation of the Company or the Company sells or otherwise disposes of all or substantially all of the Company’s assets.

1.4. “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

1.5. “Good Reason” shall mean:

(a) the assignment to the Executive, without the Executive’s express written approval, of duties or responsibilities, inconsistent, in a material respect, with the Executive’s title and position as set forth and described in Section 2 of this Agreement, or the reduction in the Executive’s duties, responsibilities or authority;

(b) a reduction by the Company in the Executive’s Base Salary (as defined in Section 4.1 below) or in the other compensation and benefits, in the aggregate, payable to the Executive hereunder, or a material adverse change in the terms or conditions on which any such compensation or benefits are payable;

(c) the Company’s failure, without the express consent of the Executive, to pay the Executive any amounts otherwise vested and due hereunder or under any plan or policy of the Company;

(d) a relocation of the Executive’s primary place of employment, without the Executive’s express written approval, to a location more than 20 miles from the location at which the Executive performs his duties; or

(e) the failure or refusal of the Company’s Successor (as defined in Section 15 below) to expressly assume this Agreement in writing, and all of the duties and obligations of the Company hereunder in accordance with Section 15.

1.6. “Short-Term Disability” shall mean the temporary incapacity of the Executive that, as determined by the Board in a uniformly-applied manner, renders the Executive temporarily incapable of engaging in his usual executive function and as a result, the Executive is under the direct care and treatment of a physician who certifies to such incapacity.

1.7. “Total Disability” shall mean that a qualified physician designated by the Company has determined that the Executive:

(a) is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, or

(b) is, by reason of any medically determinable physical or mental impairment which can be expected to result in death or can be expected to last for a continuous period of not less than 12 months, receiving income replacement benefits for a period of not less than three months under an accident and health plan covering employees of the Company.

2.Position and Duties. The Company agrees to continue to employ the Executive and the Executive hereby agrees to continue to be employed by the Company, upon the terms, conditions and limitations set forth in this Agreement. As of the Effective Date, the Executive shall serve as the Company’s Chief Executive Officer, with the customary duties, authorities and responsibility of such position of a publicly-traded corporation and such other duties, authorities and responsibility (a) as have been agreed upon by the Company

and the Executive or (b) as may from time to time be delegated to the Executive by the Board as are consistent with such position. The Executive agrees to perform the duties and responsibilities called for hereunder to the best of his ability and to devote his full time, energies and skills to such duties, with the understanding that he may participate in charitable and similar activities and may have business interests in passive investments which may, from time to time, require portions of his time, but such activities shall be done in a manner consistent with his obligations hereunder.

3.Term. The Executive’s employment under this Agreement shall commence on the Effective Date and unless sooner terminated as provided in Article 5 shall continue for a period of one year (the “Initial Term”). Except as otherwise provided herein, unless either party gives written notice to the other party at least 30 days before any anniversary of the Effective Date that the term hereunder and the Executive’s employment with the Company shall not be extended beyond the then current term (a “Nonrenewal Notice”), the term of the Agreement and the Executive’s employment with the Company shall automatically be extended for an additional one year period from each anniversary, subject to the same terms, conditions and limitations as applicable to the Initial Term unless amended or terminated as provided herein (the “Renewal Term”). For purposes of this Agreement, the Initial Term and all subsequent Renewal Terms shall be collectively referred to as the “Term” of the Agreement.

4.Compensation and Benefits.

4.1. Base Salary. During the Term, the Company shall pay to the Executive for the performance of his duties under this Agreement an annual base salary of $915,000 per year (the “Base Salary”), payable in accordance with the Company’s normal payroll practices. The rate of the Executive’s Base Salary will be reviewed and adjusted as appropriate in accordance with the Company’s regular compensation review practices. Effective as of the date of any such adjustment, the Base Salary as so adjusted shall be considered the new Base Salary for all purposes of this Agreement.

4.2. Incentive Bonus. During the Term, in addition to Base Salary, for each fiscal year of the Company, the Executive shall participate in, and shall have the opportunity to receive a cash bonus in an amount to be determined in accordance with, the Company’s existing annual cash incentive bonus plan or any successor bonus plan, program or arrangement established by the Company for the benefit of its executive officers (the “Incentive Bonus Payment”).

4.3. Employee Benefits. During the Term, the Executive shall be entitled to participate in all of the Company’s employee benefit plans, programs and policies, including any retirement benefits or plans, group life, hospitalization or disability insurance plans, health programs, fringe benefit programs and similar plans, programs and policies, that are now or hereafter made available to the Company’s salaried personnel generally, as such plans, programs and policies may be in effect from time to time, in each case to the extent that the Executive is eligible under the terms of such plans, programs and policies. Without limiting the generality of the foregoing, the Executive shall also be eligible to participate in the Company’s Senior Executive Retirement Plan (the “SERP”) and the Company’s equity-based incentive plans as maintained by the Company from time to time for the benefit of senior executives.

4.4. Vacation. The Executive shall be entitled to vacation in accordance with the Company’s vacation policy.

4.5. Automobile. During the Term, the Company shall make an automobile available to the Executive in accordance with and subject to the conditions of the Company’s standard automobile policy or practices as in effect from time to time.

4.6. Reimbursement of Expenses. During the Term, the Company will reimburse the Executive in accordance with the Company’s expense reimbursement policy as in effect from time to time for expenses reasonably and properly incurred by him in performing his duties, provided that such expenses are incurred and accounted for in accordance with the policies and procedures presently or hereinafter established by the Company.

4.7. Short-Term Disability. In the event that the Executive incurs a Short-Term Disability, the Executive shall be entitled to six months of Base Salary and incentive payments, payable in accordance with the Company’s normal payroll practices, provided that all payments under this provision shall be reduced dollar-for-dollar by any other short-term disability benefits the Executive is entitled to under any other Company-sponsored short-term disability plan or arrangement and shall cease as of the earliest of the Executive’s cessation of Short-Term Disability, the occurrence of Total Disability, death or attainment of his Normal Retirement Date.

4.8. Medical Examination Benefit. During the Term, the Executive shall be entitled to reimbursement for actual costs incurred, up to $2,500 per calendar year, for medical examinations.

5. Termination.

5.1. Death. The Executive’s employment under this Agreement shall terminate immediately upon the Executive’s death, and the Company shall have no further obligations under this Agreement, except to pay to the Executive’s estate (or his beneficiary, as may be appropriate) (a) any Base Salary earned through his date of death, to the extent theretofore unpaid, payable in the normal course, (b) a pro-rated Incentive Bonus Payment equal to the product of (i) the actual Incentive Bonus Payment for the year of death multiplied by (ii) a fraction, the numerator of which is the number of completed days in the year of termination during which the Executive was employed by the Company and the denominator of which is 365, and provided that such amount will be paid in the normal course and shall only be paid if the Executive would have become entitled to such amount if he had not terminated his employment, and (c) such retirement and other benefits earned and vested (if applicable) by the Executive as of the date of his death under any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans, all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans.

5.2. Disability. If the Executive is unable to perform his duties under this Agreement because of a Total Disability, the Company may terminate the Executive’s employment by giving written notice to the Executive. Such termination shall be effective as of the date of such notice and the Company shall have no further obligations under this Agreement, except to pay to the Executive (a) any Base Salary earned through the date of such termination, to the extent theretofore unpaid, payable in the normal course, (b) Total Disability benefits as described below, and (c) such retirement and other benefits earned and vested (if applicable) by the Executive as of the date of his termination under any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans, all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans. In the event that the Executive’s employment is terminated by the Company due to Total Disability, the Executive shall be entitled to an annual disability benefit equal to 100% of his Base Salary and a bonus equal to the average Annual Bonus Payment paid or payable to the Executive for the three completed years prior to the year the Executive’s employment is terminated by the Company due to such Total Disability, payable in accordance with the Company’s normal payroll practices, provided that all payments under this provision shall be reduced dollar-for-dollar by Social Security disability benefits and any other long-term disability benefits the Executive is entitled to under any other Company-sponsored long-term disability plan or arrangements and shall cease as of the earliest of the Executive’s cessation of Total Disability, death or attainment of his Normal Retirement Date.

5.3. Retirement. The Executive’s voluntary termination of employment without Good Reason at a time when he is eligible to begin receiving early or normal retirement benefits under the Crown Cork & Seal Company, Inc. Pension Plan shall be treated as a retirement termination under this Agreement. Upon such termination, the Company shall have no further obligations under this Agreement, except to pay to the Executive (a) any Base Salary earned through the date of the Executive’s retirement, to the extent theretofore unpaid, payable in the normal course, (b) a pro-rated Incentive Bonus Payment equal to the product of (i) the actual Incentive Bonus Payment for the year of retirement multiplied by (ii) a fraction, the numerator of which is the number of completed days in the year of termination during which the Executive was employed by the Company and the denominator of which is 365, and provided that such amount will be paid in the normal course and shall only be paid if the Executive would have become entitled to such amount if he had not terminated his employment, and (c) such retirement and other benefits earned and vested (if applicable) by the Executive as of the date of his retirement under any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans, all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans.

5.4. Voluntary Termination. At any time during the Term, upon 30 days’ written notice to the Company, the Executive may voluntarily terminate his employment with the Company (including, without limitation, by delivery to the Company of a Nonrenewal Notice in accordance with Section 3). Upon such termination, the Company shall have no further obligations under this Agreement except to pay to the Executive (a) any Base Salary earned through the date of the Executive’s termination of employment, to the extent theretofore unpaid, payable in the normal course, (b) a pro-rated Incentive Bonus Payment equal to the product of (i) the actual Incentive Bonus Payment for the year of termination multiplied by (ii) a fraction, the numerator of which is the number of completed days in the year of termination during which the Executive was employed by the Company and the denominator of which is 365, and provided that such amount will be paid in the normal course and shall only be paid if the Executive would have become entitled to such amount if he had not terminated his employment, and (c) such retirement and other benefits earned by the Executive

and vested (if applicable) as of the date of his termination under the terms of any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans, all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans.

5.5. Termination For Cause. The Board may terminate the Executive’s employment and the Company’s obligations under this Agreement at any time for Cause by giving written notice to the Executive. The Company’s required notice of termination shall specify the event or circumstances that constitute Cause. Except as specified below, the Executive’s termination shall be effective as of the date of such notice. If the event or circumstances specified in the Company’s notice of termination constitute Cause under Sections 1.2(a), 1.2(b), or 1.2(c) (or at the discretion of the Board under Section 1.2(d)), the Executive will have 30 days to correct or eliminate such Cause provided the Executive is taking reasonable and demonstrable action to do so during such period. If the Executive has not corrected or eliminated such Cause by the end of such 30-day period, the Executive’s employment shall then terminate. Upon termination of the Executive’s employment for Cause, the obligations of the Company under this Agreement shall terminate, except for the obligation to pay to the Executive (a) any Base Salary earned through the date of such termination, to the extent theretofore unpaid, payable in the normal course, and (b) such retirement and other benefits earned and vested (if applicable) by the Executive as of such termination under any employee benefit plan of the Company in which the Executive participates (but excluding all payments due under the SERP, which shall be forfeited), all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans.

5.6. Involuntary Termination by the Company or by the Executive for Good Reason. The Company may terminate the Executive’s employment without Cause (including, without limitation, by delivery to the Executive of a Nonrenewal Notice in accordance with Section 3) and the Executive may terminate his employment for Good Reason at any time during the Term, upon thirty (30) days’ written notice; provided that during such notice period, the Board, in its absolute discretion, may relieve the Executive of all his duties, responsibilities and authority with respect to the Company and restrict the Executive’s access to Company property. If the Company so terminates the Executive’s employment without Cause or the Executive terminates for Good Reason, at any time other than the 12-month period following a Change in Control, the Company’s obligations under this Agreement shall terminate except for the Company’s obligation to pay to the Executive the following: (a) any Base Salary earned through the date of the Executive’s termination of employment, to the extent theretofore unpaid, payable in the normal course, (b) a pro-rated Incentive Bonus Payment equal to the product of (i) the actual Incentive Bonus Payment for the year of termination multiplied by (ii) a fraction, the numerator of which is the number of completed days in the year of termination during which the Executive was employed by the Company and the denominator of which is 365, and provided that such amount will be paid in the normal course and shall only be paid if the Executive would have become entitled to such amount if he had not terminated his employment, (c) a lump-sum payment equal to three times the sum of the Executive’s Base Salary and target Incentive Bonus Payment for the year of such termination, and (d) such retirement and other benefits earned by the Executive and vested (if applicable) as of the date of his termination under the terms of any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans. The payment described in clause (c) above shall be made within 90 days of the Executive’s termination of employment; provided, however that if the Executive is a “Specified Employee,” as that term is defined in section 409A of the Code, such payments, if so required, shall be made on the date that is six months and one day after the date of the Executive’s termination hereunder. In no event shall the payment

in clause (c) be included for purposes of the SERP in Executive’s “Compensation,” as that term is defined therein. Notwithstanding anything herein to the contrary, the payment described in clause (c) shall be contingent on the Executive’s prior execution and non-revocation of a release of claims in favor of the Company and its affiliates in the form attached as Exhibit A (the “Release”) within 60 days following his termination date and shall be paid as specified above or such later date as may be required to comply with Section 409A of the Code.

5.7. Involuntary Termination by the Company or by the Executive for Good Reason Following a Change of Control. If the Company terminates the Executive’s employment without Cause (including, without limitation, by delivery to the Executive of a Nonrenewal Notice in accordance with Section 3) during the 12-month period following a Change in Control, or the Executive voluntarily terminates his employment for Good Reason during the 12 months following a Change in Control, the Company’s obligations under this Agreement shall terminate except for the Company’s obligation to pay to the Executive the following: (a) any Base Salary earned through the date of the Executive’s termination of employment, to the extent theretofore unpaid, payable in the normal course, (b) a lump-sum payment equal to three times the sum of the Executive’s Base Salary and average Incentive Bonus Payment paid or payable to the Executive for the three completed years prior to the year of such termination, (c) such retirement and other benefits earned by the Executive and vested (if applicable) as of the date of his termination under the terms of any employee benefit plan of the Company in which the Executive participates, including without limitation all payments due under the SERP and other retirement plans, all of the foregoing to be paid in the normal course for such payments and in accordance with the terms of such plans, and (d) all outstanding stock options and restricted stock or other equity awards held by the Executive shall become immediately vested and, if applicable, exercisable. The payment described in (b) above shall be made within 90 days of the Executive’s termination of employment; provided, however that if the Executive is a Specified Employee, such payments, if so required, shall be made on the date that is six months and one day after the date of the Executive’s termination hereunder. In no event shall the payment in clause (b) be included for purposes of the SERP in Executive’s “Compensation,” as that term is defined therein. Notwithstanding anything herein to the contrary, the payment described in clause (b) shall be contingent on the Executive’s prior execution and non-revocation of the Release within 60 days following his termination date and shall be paid as specified above or such later date as may be required to comply with Section 409A of the Code.

5.8. Mitigation. The Executive shall not be required to mitigate the amount of any payment provided for in this Agreement by seeking other employment or otherwise, nor shall any profits, income or earnings or other benefits from any source whatsoever create any mitigation, offset, reduction or any other obligation on the part of Executive hereunder.

5.9. Taxes.

(a)Notwithstanding anything to the contrary in this Agreement or any other agreement between the Company and the Executive, the Executive shall not be entitled to receive any gross-up payment with respect to any Federal income or excise taxes incurred by the Executive in respect of any compensation, including the accelerated payment of any compensation, paid to the Executive in connection with a Change in Control of the Company, and the payment of such taxes shall be the sole responsibility of the Executive, his spouse or other beneficiary, as applicable.

(b)If any payment or benefit, or the acceleration of any payment or benefit, the Executive would receive from the Company under this Agreement or otherwise in connection with a Change in Control of the Company (collectively, the “Payments”) would be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), then either (i) such Payments will be reduced or delayed by the minimum amount necessary such that no portion of the Payments is subject to the Excise Tax, or (ii) the full amount of the Payments shall be made, whichever, after taking into account all applicable taxes, including the Excise Tax, results in the Executive’s receipt, on an after-tax basis, of the greater amount. If a reduction or delay in the Payments is necessary, such reduction or delay will occur in the following order: (1) cancellation of accelerated vesting of stock and option awards (reduced from the most recent awards to the oldest awards) with the understanding that such awards may be replaced with the right to an equivalent cash payment at such future time because of the delisting of the underlying stock; (2) reduction or delay of cash payments (reduced from the latest payment to the earliest payment); and (3) reduction of other benefits payable to the Executive (reduced from the lowest value to the highest value under Section 280G of the Code). The Company will select a reputable third party professional firm to make all determinations required to be made under this provision. The Company will bear all reasonable expenses with respect to the determinations by such firm required to be made hereunder.

5.Confidential Information. Except as required in the performance of his duties to the Company under this Agreement, the Executive shall not, during or after the Term, use for himself or others, or disclose to others, any confidential information including without limitation, trade secrets, data, know-how, design, developmental or experimental work, Company relationships, computer programs, proprietary information bases and systems, databases, customer lists, business plans, financial information of or about the Company or any of its affiliates, customers or clients, unless authorized in writing to do so by the Board, but excluding any information generally available to the public or information (except information related to the Company) which the Executive possessed prior to his employment with the Company. The Executive understands that this undertaking applies to information of either a technical or commercial or other nature and that any information not made available to the general public is to be considered confidential. The Executive acknowledges that such confidential information as is acquired and used by the Company or its affiliates is a special, valuable and unique asset. All records, files, materials and confidential information obtained by the Executive in the course of his employment with the Company are confidential and proprietary and shall remain the exclusive property of the Company or its affiliates, as the case may be.

7. Return of Documents and Property. Upon the termination of the Executive’s employment from the Company, or at any time upon the request of the Company, the Executive (or his heirs or personal representative) shall deliver to the Company (a) all documents and materials containing confidential information relating to the business or affairs of the Company or any of its affiliates, customers or clients, and (b) all other documents, materials and other property belonging to the Company or its affiliates, customers or clients that are in the possession or under the control of the Executive.

8. Noncompetition. By and in consideration of the salary and benefits to be provided by the Company hereunder, including the severance arrangements set forth herein, and further in consideration of the Executive’s exposure to the proprietary information of the Company, the Executive agrees, unless the Executive requests in writing to the Board, and is thereafter authorized in writing to do so by the Board, that (a) during his employment under this Agreement, and (b) for the two year period following his termination of employment, the Executive shall not, directly or indirectly, own, manage, operate, join, control or participate in the ownership, management, operation or control of, or be employed or otherwise connected in any manner with, including without limitation as a consultant, any business which at any relevant time during said period directly or indirectly competes with the Company or any of its affiliates in any country in which the Company does business. Notwithstanding the foregoing, the Executive shall not be prohibited during the non-competition period described above from being a passive investor where he owns not more than five percent of the issued and outstanding capital stock of any publicly-held company. The Executive further agrees that during said period, the Executive shall not, directly or indirectly, solicit or induce, or attempt to solicit or induce, any employee of the Company to terminate employment with the Company or hire any employee of the Company.

9. Nondisparagement. The Executive shall not, whether in writing or orally, in any forum, malign, denigrate or disparage the Company, its affiliates or any of their respective predecessors or successors, or any of the current or former directors, officers, employees, shareholders, partners, members, agents or representatives of any of the foregoing, with respect to any of their respective past or present activities, or otherwise publish (whether in writing or orally) in any forum statements that tend to portray any of the aforementioned parties in an unfavorable light. Disclosure of information that the Executive is required to disclose pursuant to any applicable law, court order, subpoena, compulsory process of law or governmental decree shall not constitute a violation or breach of this Section; provided that the Executive delivers written notice of such required disclosure to the Company or its designee promptly before making such disclosure if such notice is not prohibited by applicable law, court order, subpoena, compulsory process of law or governmental decree.

10. Enforcement. The Executive acknowledges that (a) the Executive’s work for the Company has given and will continue to give him access to the confidential affairs and proprietary information of the Company; (b) the covenants and agreements of the Executive contained in Sections 6, 7, 8 and 9 are essential to the business and goodwill of the Company; and (c) the Company would not have entered into this Agreement but for the covenants and agreements set forth in Sections 6, 7, 8 and 9. The Executive further acknowledges that in the event of his breach or threat of breach of Sections 6, 7, 8 or 9 of this Agreement, the Company, in addition to any other legal remedies which may be available to it, shall be entitled to appropriate injunctive relief and/or specific performance in order to enforce or prevent any violations of such provisions, and the Executive and the Company hereby confer jurisdiction to enforce such provisions upon the courts of any jurisdiction within the geographical scope of such provisions.

11. Notices. All notices and other communications provided for herein that one party intends to give to the other party shall be in writing and shall be considered given when mailed or couriered, return receipt requested, or personally delivered, either to the party or at the addresses set forth below (or to such other address as a party shall designate by notice hereunder):

If to the Company:

Crown Holdings, Inc.

One Crown Way

Philadelphia, PA 19154

Attention: General Counsel

If to the Executive, at his home address most recently filed with the Company.

12. Legal Fees. The Company shall pay, at least monthly, all costs and expenses, including attorneys’ fees and disbursements, of the Company and the Executive relating to the interpretation or enforcement of any provision of this Agreement; provided that (i) if the Executive institutes the proceeding and the judge or other individual presiding over the proceeding affirmatively finds that the Executive instituted the proceeding in bad faith, or (ii) if at issue is whether or not the Executive was discharged by the Company for Cause and such judge or other decision-maker finds that the Executive was so discharged for Cause, then the Executive shall pay his own costs and expenses and promptly (and in no event more than 60 days after demand therefore by the Company) return to the Company any such amounts previously paid by the Company under this Section 12.

13. Amendments. This Agreement may be amended, modified or superseded only by a written instrument executed by both of the parties hereto.

14. Binding Effect. This Agreement shall inure to the benefit of and shall be binding upon the Company and the Executive and their respective heirs, executors, personal representatives, successors and permitted assigns.

15. Assignability. This Agreement shall not be assignable, in whole or in part, by either party, without the prior written consent of the other party, provided that (a) this Agreement shall be binding upon and shall be assigned by the Company to any person, firm or corporation with which the Company may be merged or consolidated or which may acquire all or substantially all of the assets of the Company, or its successor (the “Company’s Successor”), (b) the Company shall require the Company’s Successor to expressly assume in writing all of the Company’s obligations under this Agreement and (c) the Company’s Successor shall be deemed substituted for the Company for all purposes of this Agreement.

16. Arbitration. Except as provided in Section 10 of this Agreement, any controversy or claim arising out of or relating to this Agreement or the breach thereof shall be settled by arbitration in Philadelphia, Pennsylvania in accordance with the rules of the American Arbitration Association, and judgment upon any award so rendered may be entered in any court having jurisdiction thereof. The determination of the arbitrator(s) shall be conclusive and binding on the Company and the Executive, and judgment may be entered on the arbitrator(s)’ award in any court having jurisdiction.

17. Governing Law. Except to the extent such laws are superseded by Federal laws, this Agreement shall be governed by the laws of the Commonwealth of Pennsylvania without reference to principles of conflict of laws.

18. Entire Agreement. As of the Effective Date, this Agreement contains the entire Agreement between the parties relative to its subject matter, superseding all prior agreements or understandings of the parties relating thereto (it being understood that the Prior Agreement shall continue to be in full force and effect until the Effective Date, except for Section 5.10 of the Prior Agreement, which shall be replaced by Section 5.9 of this Agreement as of the date hereof). In the event of any conflict between this Agreement and the terms of any benefit plan or any other agreement, the terms of this Agreement will control.

19. Waiver. Any term or provision of this Agreement may be waived in writing at any time by the party entitled to the benefit thereof. The failure of either party at any time to require performance of any provision of this Agreement shall not affect such party’s right at a later time to enforce such provision. No consent or waiver by either party to any default or to any breach of a condition or term in this Agreement shall be deemed or construed to be a consent or waiver to any other breach or default.

20. Withholding of Taxes. All payments made by the Company to the Executive under this Agreement shall be subject to the withholding of such amounts, if any, relating to tax, and other payroll deductions as the Company may reasonably determine it should withhold pursuant to any applicable law or regulation.

21. Indemnification. During and after the Term, the Company shall indemnify the Executive and hold the Executive harmless from and against any claim, loss or cause of action arising from or out of the Executive’s performance as an officer, director or employee of the Company or any of its subsidiaries or in any other capacity, including any fiduciary capacity, in which the Executive serves at the request of the Company to the maximum extent permitted by applicable law and the Company’s Articles of Incorporation and By-Laws, provided that in no event shall the protection afforded to the Executive hereunder be less than that afforded under the Articles of Incorporation and By-Laws or policies of the Company as in effect immediately prior to the date hereof.

22. Survival. Anything contained in this Agreement to the contrary notwithstanding, the provisions of Sections 6, 7, 8, 9, 10, 12, 15, 16, 19 and 21 (and the other provisions of this Agreement to the extent necessary to effectuate the survival of Sections 6, 7, 8, 9, 10, 12, 15, 16, 19 and 21), shall survive termination of this Agreement and any termination of the Executive’s employment hereunder.

23. Invalidity of Portion of Agreement. If any provision of this Agreement or the application thereof to either party shall be invalid or unenforceable to any extent, the remainder of this Agreement shall not be affected thereby and shall be enforceable to the fullest extent of the law. If any clause or provision hereof is determined by any court of competent jurisdiction to be unenforceable because of its scope or duration, the parties expressly agree that such court shall have the power to reduce the duration and/or restrict the scope of such clause or provision to the extent necessary to permit enforcement of such clause or provision in reduced or restricted form.

24. Compliance with Code Section 409A. Notwithstanding anything else to the contrary in this Agreement, all reimbursements, including, without limitation, for medical related expenses, business expenses, legal fees and/or taxes shall be paid to the Executive as soon as practicable after submission of proper documentation of claims, but no later than December 31 of the year following the year during which the expense or fee was incurred.

IN WITNESS WHEREOF, the parties hereto have duly executed this Agreement as of the date first written above.

|

| |

| Crown Holdings, Inc. |

| |

| /s/ John W. Conway |

| John W. Conway |

| |

| |

| Executive |

| |

| /s/ Timothy J. Donahue |

| Timothy J. Donahue |

| |

Exhibit A

GENERAL RELEASE

NOTICE

This is a very important document and you should thoroughly review and understand the terms and effect of this document before signing it. By signing this General Release you will be releasing the Company from all liability to you. Therefore, you should consult with an attorney before signing the General Release. You have 21 days to consider this document. If you have not returned a signed copy of the General Release by that time, we will assume that you have elected not to sign the General Release. If you choose to sign the General Release, you will have an additional 7 days following the date of your signature to revoke the agreement and the agreement shall not become effective or enforceable until the revocation period has expired.

RELEASE

In consideration of pay and benefits to which I would not otherwise be entitled provided to me by Crown Holdings, Inc. as set forth in my Employment Agreement, dated December 30, 2015, I, Timothy J. Donahue, on behalf of myself, my heirs, assigns, executors, agents and representatives, hereby release and discharge Crown Holdings, Inc. and its affiliates, parents, subsidiaries, successors, and predecessors, and all of their shareholders, employees, agents, officers and directors (hereinafter collectively referred to as the “Company”) from any and all claims and/or causes of action, known or unknown, which I may have or could claim to have against the Company up to and including the date of my signing of this General Release. This General Release includes, but is not limited to, all claims arising from or during my employment or as a result of the termination of my employment and all claims arising under federal, state or local laws prohibiting employment discrimination based upon age, race, sex, religion, disability, handicap, national origin or any other protected characteristic, including, but not limited to any and all claims arising under the Age Discrimination in Employment Act, as amended, Title VII of the Civil Rights Act, as amended, the Americans with Disabilities Act, and/or any claims arising out of any legal restrictions, expressed or implied, on the Company’s right to control or terminate the employment of its employees. Notwithstanding the foregoing, this General Release does not apply to claims for (i) amounts payable to me under Sections 5, 12 or 21 of my Employment Agreement or (ii) payments due to me under any outstanding stock option, restricted stock or other equity award agreement between me and the Company.

I further agree that I will not file (or join, or accept any relief in) a lawsuit against the Company pleading or asserting any claims released in this General Release. If I breach this promise, and the action is found to be barred in whole or in part by this General Release, I agree to pay the attorneys’ fees and costs, or the proportions thereof, incurred by the Company in defending against those claims that are found to be barred by this General Release. Nothing in this paragraph precludes me from challenging the validity of this General Release under the requirements of the Age Discrimination in Employment Act, and I shall not be responsible for reimbursing the attorneys’ fees and costs of the Company in connection with such a challenge to the validity of the release. However, I acknowledge that this General Release applies to all claims I have under the Age Discrimination in Employment Act, and that, unless this General Release is held to be invalid, all of my claims under that Act shall be extinguished.

By signing below, I acknowledge that I have carefully read and fully understand the provisions of this General Release. I further acknowledge that I am signing this General Release knowingly and voluntarily and without duress, coercion or undue influence. This General Release constitutes the total and complete understanding between me and the Company relating to the subject matter covered by this General Release, and all other prior or contemporaneous written or oral agreements or representations, if any, relating to the subject matter covered by this General Release are null and void. Neither the Company nor its agents, representatives or attorneys have made any representations to me concerning the terms or effects of this General Release other than those contained herein. It is also expressly understood and agreed that the terms of this General Release may not be altered except in a writing signed by both me and the Company.

I agree and acknowledge that I have carefully read and understand this General Release, including the Section labeled “Notice” on the top of the first page; that I understand, in particular that I am agreeing to release all legal claims against the Company; that I sign this General Release knowingly and voluntarily; that I have been advised to consult with an attorney before signing it; and that this General Release shall not be subject to claims of fraud, duress and/or mistake.

INTENDING TO BE LEGALLY BOUND, I hereby set my hand below:

SIGNED BY:

|

| | |

| | |

Timothy J. Donahue | | Date |

| | |

| | |

WITNESSED BY: | | |

| | |

| | |

Witness signature | | Date |

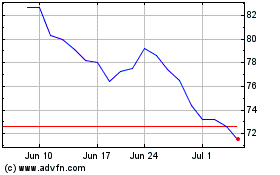

Crown (NYSE:CCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crown (NYSE:CCK)

Historical Stock Chart

From Apr 2023 to Apr 2024