UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 16, 2015

CROWN HOLDINGS, INC.

(Exact name of Registrant as specified in its charter)

|

| | | | |

Pennsylvania | | 0-50189 | | 75-3099507 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Crown Way

Philadelphia, Pennsylvania 19154-4599

(215) 698-5100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

Item 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

Item 9.01. FINANCIAL STATEMENTS AND EXHIBITS

SIGNATURE

INDEX TO EXHIBITS

EX-99 PRESS RELEASE

2

Item 2.02. Results of Operations and Financial Condition

On April 16, 2015 Crown Holdings, Inc. issued a press release announcing its earnings for the first quarter ended March 31, 2015. A copy of the press release is attached hereto as Exhibit 99 and incorporated herein by reference.

The information in this Report shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the "Exchange Act") or otherwise subject to the liability of that section, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(c) Exhibits.

The following is furnished as an exhibit to this report.

99. Crown Holdings, Inc. press release dated April 16, 2015.

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

| | |

| | |

| By: | /s/ David A. Beaver |

| | David A. Beaver |

| | Vice President and Corporate Controller |

Dated: April 16, 2015

4

INDEX TO EXHIBITS

|

| | |

Exhibit Number | | Description |

| | |

99 | | Press release, dated April 16, 2015, issued by Crown Holdings, Inc. |

5

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

CROWN HOLDINGS, INC. REPORTS FIRST QUARTER 2015 RESULTS

Philadelphia, PA - April 16, 2015. Crown Holdings, Inc. (NYSE: CCK) today announced its financial results for the first quarter ended March 31, 2015.

First Quarter Highlights

| |

• | Income per diluted share $0.32; Before Certain Items $0.53, including $0.06 of unfavorable currency translation impact |

| |

• | Global beverage can volumes grew 4% versus 2014; food can volumes grew 17% |

| |

• | Empaque acquisition completed on February 18, 2015 |

| |

• | Mivisa and Empaque integrations progressing as planned |

Net sales in the first quarter grew to $1,997 million over the $1,993 million in the first quarter of 2014, primarily due to the impact of the Mivisa and Empaque acquisitions offset by $172 million of unfavorable currency translation impact.

Segment income (a non-GAAP measure defined by the Company as gross profit excluding the impact of fair value adjustments to inventory acquired in an acquisition and timing impact of hedge ineffectiveness, less selling and administrative expense) was $192 million in the first quarter compared to $200 million in the first quarter of 2014, and included $16 million of unfavorable currency translation impact primarily due to the strength of the U.S. dollar against the euro.

Commenting on the quarter, John W. Conway, Chairman and Chief Executive Officer, stated, “We started off the year as expected, and the fundamentals underlying our businesses remain strong. On a currency neutral basis, the Company’s segment income for the first quarter increased by 4% over 2014, despite significantly elevated aluminum premiums in Europe and political conflict in parts of the Middle East, which resulted in lower regional sales volumes.

“On February 18, we completed our acquisition of Empaque, a leading Mexican manufacturer of aluminum cans and ends, bottle caps and glass bottles for the beverage industry. We are pleased that Empaque’s excellent management team and highly efficient manufacturing facilities are integrating smoothly into the Crown organization. Also on February 18, we announced the construction of a new beverage can plant in Monterrey, Mexico to meet the growing demand for both beer and non-alcoholic beverages in the market surrounding this metropolitan area of more than four million people.

“The integration of Mivisa, a leading Spanish producer of two- and three-piece food cans and ends which we acquired during the second quarter of 2014, is proceeding as planned, as demonstrated in our first quarter European Food results.”

Interest expense increased to $65 million in the first quarter of 2015 over the $58 million in 2014 primarily due to increased borrowings to fund the Empaque and Mivisa acquisitions.

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

Net income attributable to Crown Holdings in the first quarter was $44 million compared to $24 million in the first quarter of 2014. Reported earnings per diluted share were $0.32 in the first quarter of 2015 compared to $0.17 in the 2014 first quarter. Net income per diluted share before certain items was $0.53 compared to $0.57 in 2014.

A reconciliation from net income and income per diluted share to net income before certain items and income per diluted share before certain items is provided below.

Non-GAAP Measures

Segment income and free cash flow are not defined terms under U.S. generally accepted accounting principles (non-GAAP measures). In addition, the information presented excluding the impact of currency translation, regarding net income before certain items and regarding income before certain items per diluted share does not conform to GAAP and includes non-GAAP measures. Non-GAAP measures should not be considered in isolation or as a substitute for net income, income per diluted share or cash flow data prepared in accordance with U.S. GAAP and may not be comparable to calculations of similarly titled measures by other companies.

The Company views segment income and free cash flow as the principal measures of performance of its operations and for the allocation of resources. Free cash flow has certain limitations, however, including that it does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The amount of mandatory versus discretionary expenditures can vary significantly between periods. The Company believes that net income before certain items and income before certain items per diluted share are useful in evaluating the Company’s operations. Segment income, free cash flow, net income before certain items and income before certain items per diluted share are derived from the Company’s Consolidated Statements of Operations and Cash Flows and Consolidated Balance Sheets, as applicable, and reconciliations to segment income, free cash flow, net income before certain items and income before certain items per diluted share can be found within this release.

Conference Call

The Company will hold a conference call tomorrow, April 17, 2015 at 9:00 a.m. (EDT) to discuss this news release. Forward-looking and other material information may be discussed on the conference call. The dial-in numbers for the conference call are (517) 308-9237 or toll-free (888) 469-0976 and the access password is “packaging.” A live webcast of the call will be made available to the public on the internet at the Company’s web site, www.crowncork.com. A replay of the conference call will be available for a one-week period ending at midnight on April 24. The telephone numbers for the replay are (203) 369-1026 or toll free (866) 435-5406.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all other information in this press release consists of forward-looking statements. These forward-looking statements involve a number of risks, uncertainties and other factors, including the future impact of currency translation, aluminum premiums in Europe and political conflicts in the Middle East on the Company’s operations, the level of demand for the Company’s products in 2015 and beyond, the Company’s ability to successfully integrate the operations of Mivisa and Empaque, the ability of Empaque’s management team to continue to operate its operations efficiently and to successfully complete the construction of a new plant in Monterrey, and the level of future demand for beverage cans in Monterrey that may cause actual results to be materially different from those expressed or implied in the forward-looking

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

statements. Important factors that could cause the statements made in this press release or the actual results of operations or financial condition of the Company to differ are discussed under the caption "Forward Looking Statements" in the Company's Form 10-K Annual Report for the year ended December 31, 2014 and in subsequent filings made prior to or after the date hereof. The Company does not intend to review or revise any particular forward-looking statement in light of future events.

Crown Holdings, Inc., through its subsidiaries, is a leading supplier of packaging products to consumer marketing companies around the world. World headquarters are located in Philadelphia, Pennsylvania.

For more information, contact:

Thomas A. Kelly, Senior Vice President and Chief Financial Officer, (215) 698-5341

Thomas T. Fischer, Vice President, Investor Relations and Corporate Affairs, (215) 552-3720

Edward Bisno, Bisno Communications, (212) 717-7578

Unaudited Consolidated Statements of Operations, Balance Sheets, Statements of Cash Flows, Segment Information and Supplemental Data follow.

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

Consolidated Statements of Operations (Unaudited)

(in millions, except share and per share data)

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

Net sales | $ | 1,997 |

| | $ | 1,993 |

|

| | | |

Cost of products sold | 1,660 |

| | 1,661 |

|

Depreciation and amortization | 51 |

| | 35 |

|

Gross profit (1) | 286 |

| | 297 |

|

Selling and administrative expense | 98 |

| | 104 |

|

Restructuring and other | 20 |

| | 52 |

|

Foreign exchange | 6 |

| | 6 |

|

Interest expense | 65 |

| | 58 |

|

Interest income | (2 | ) | | (2 | ) |

Income before income taxes | 99 |

| | 79 |

|

| | | |

Provision for income taxes | 37 |

| | 33 |

|

Net income | 62 |

| | 46 |

|

| | | |

Net income attributable to noncontrolling interests | (18 | ) | | (22 | ) |

Net income attributable to Crown Holdings | $ | 44 |

| | $ | 24 |

|

Earnings per share attributable to Crown Holdings common shareholders: |

| | |

Basic | $ | 0.32 |

| | $ | 0.18 |

|

Diluted | $ | 0.32 |

| | $ | 0.17 |

|

|

| | |

Weighted average common shares outstanding: |

| | |

Basic | 137,697,898 |

| | 136,819,400 |

|

Diluted | 138,953,440 |

| | 137,910,635 |

|

Actual common shares outstanding | 139,194,766 |

| | 138,431,312 |

|

| |

(1) | A reconciliation from gross profit to segment income follows. |

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

Consolidated Supplemental Financial Data (Unaudited)

(in millions)

Reconciliation from Gross Profit to Segment Income

The Company views segment income, as defined below, as a principal measure of performance of its operations and for the allocation of resources. Segment income is defined by the Company as gross profit excluding the impact of fair value adjustments to inventory acquired in an acquisition and timing impact of hedge ineffectiveness, less selling and administrative expense.

|

| | | | | | | |

| Three Months Ended March 31, |

| 2015 | | 2014 |

Gross profit | $ | 286 |

| | $ | 297 |

|

Fair value adjustment to inventory (1) | 6 |

| | |

Impact of hedge ineffectiveness (1) | (2 | ) | | 7 |

|

Selling and administrative expense | (98 | ) | | (104 | ) |

| $ | 192 |

| | $ | 200 |

|

(1) Included in cost of products sold

Segment Information

|

| | | | | | | |

| Three Months Ended March 31, |

Net Sales | 2015 | | 2014 |

| | | |

Americas Beverage | $ | 617 |

| | $ | 549 |

|

North America Food | 160 |

| | 179 |

|

European Beverage | 324 |

| | 388 |

|

European Food | 431 |

| | 373 |

|

Asia Pacific | 310 |

| | 298 |

|

Total reportable segments | 1,842 |

| | 1,787 |

|

Non-reportable segments | 155 |

| | 206 |

|

Total net sales | $ | 1,997 |

| | $ | 1,993 |

|

|

| | | | | | | |

Segment Income | | | |

| | | |

Americas Beverage | $ | 85 |

| | $ | 79 |

|

North America Food | 24 |

| | 29 |

|

European Beverage | 38 |

| | 59 |

|

European Food | 42 |

| | 26 |

|

Asia Pacific | 35 |

| | 34 |

|

Total reportable segments | 224 |

| | 227 |

|

Non-reportable segments | 17 |

| | 24 |

|

Corporate and other unallocated items | (49 | ) | | (51 | ) |

Total segment income | $ | 192 |

| | $ | 200 |

|

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

Consolidated Supplemental Data (Unaudited)

(in millions, except per share data)

Reconciliation from Net Income and Income Per Diluted Common Share to Net Income before Certain Items and Income Per Diluted Common Share before Certain Items

The following table reconciles reported net income and diluted earnings per share attributable to the Company to net income before certain items and income per diluted common share before certain items, as used elsewhere in this release.

|

| | | | | | | |

| Three Months Ended |

| March 31, |

| 2015 | | 2014 |

| | | |

Net income attributable to Crown Holdings, as reported | $ | 44 |

| | $ | 24 |

|

Items: | | | |

Fair value adjustment to inventory (1) | 6 |

| | — |

|

Hedge ineffectiveness (2) | (2 | ) | | 7 |

|

Provision for restructuring and other (3) | 20 |

| | 52 |

|

Income taxes (4) | 5 |

| | (4 | ) |

Net income before the above items | $ | 73 |

| | $ | 79 |

|

| | | |

Income per diluted common share as reported | $ | 0.32 |

| | $ | 0.17 |

|

Income per diluted common share before the above items | $ | 0.53 |

| | $ | 0.57 |

|

|

| |

|

Effective tax rate as reported | 37.4 | % | | 41.8 | % |

Effective tax rate before the above items | 26.0 | % | | 26.8 | % |

Net income before certain items, income per diluted common share before certain items and the effective tax rate before certain items are non-GAAP measures and are not meant to be considered in isolation or as a substitute for net income, income per diluted common share and effective tax rates determined in accordance with U.S. generally accepted accounting principles. The Company believes these non-GAAP measures provide useful information to evaluate the performance of the Company’s ongoing business.

| |

(1) | In the first quarter of 2015, the Company recorded a charge of $6 million in cost of products sold for fair value adjustments related to the sale of inventory acquired in its acquisition of Empaque. |

| |

(2) | In the first quarter of 2015, the Company recorded a benefit of $2 million in cost of products sold related to hedge ineffectiveness caused primarily by volatility in the metal premium component of aluminum prices. In the first quarter of 2014, the Company recorded a charge of $7 million for hedge ineffectiveness. |

| |

(3) | In the first quarter of 2015, the Company recorded restructuring and other charges of $15 million primarily for costs related to its acquisition of Empaque. In the first quarter of 2014, the Company recorded restructuring and other charges of $8 million. |

In the first quarter of 2015, the Company recorded charges of $5 million primarily for asset sales and impairments related to the sale of four industrial specialty packaging plants in Europe. In the first quarter of 2014, the Company recorded charges of $44 million primarily for asset sales and impairments related to the planned divestment of the industrial specialty packaging operations and transaction costs incurred in connection with its acquisition of Mivisa.

| |

(4) | In the first quarter of 2015, the Company recorded income tax benefits of $2 million related to the items described above, and a charge of $7 million to record a potential liability arising from a recent unfavorable tax court ruling in Spain. In the first quarter of 2014, the Company recorded income tax benefits of $4 million related to the items described above. |

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

|

| | | | | | | |

Consolidated Balance Sheets (Condensed & Unaudited) |

(in millions) |

| | | |

March 31, | 2015 | | 2014 |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 280 |

| | $ | 267 |

|

Receivables, net | 1,039 |

| | 1,199 |

|

Inventories | 1,446 |

| | 1,334 |

|

Prepaid expenses and other current assets | 312 |

| | 279 |

|

Total current assets | 3,077 |

| | 3,079 |

|

|

| |

|

Goodwill | 3,746 |

| | 2,016 |

|

Property, plant and equipment, net | 2,619 |

| | 2,160 |

|

Other non-current assets | 702 |

| | 630 |

|

Total | $ | 10,144 |

| | $ | 7,885 |

|

|

| |

|

|

| |

|

Liabilities and equity |

| |

|

Current liabilities |

| |

|

Short-term debt | $ | 72 |

| | $ | 252 |

|

Current maturities of long-term debt | 172 |

| | 87 |

|

Accounts payable and accrued liabilities | 2,369 |

| | 2,222 |

|

Total current liabilities | 2,613 |

| | 2,561 |

|

|

| |

|

Long-term debt, excluding current maturities | 5,746 |

| | 3,765 |

|

Other non-current liabilities | 1,537 |

| | 1,301 |

|

|

| |

|

Noncontrolling interests | 275 |

| | 255 |

|

Crown Holdings shareholders' equity/(deficit) | (27 | ) | | 3 |

|

Total equity | 248 |

| | 258 |

|

Total | $ | 10,144 |

| | $ | 7,885 |

|

|

| | |

News Release Corporate Headquarters One Crown Way Philadelphia, PA 19154-4599 | | |

CONSOLIDATED STATEMENTS OF CASH FLOWS (Condensed & Unaudited)

(in millions)

|

| | | | | | | |

Three months ended March 31, | 2015 | | 2014 |

| | | |

Cash flows from operating activities | | | |

Net income | $ | 62 |

| | $ | 46 |

|

Depreciation and amortization | 51 |

| | 35 |

|

Provision for restructuring and other | 20 |

| | 52 |

|

Pension expense | 11 |

| | 16 |

|

Pension contributions | (17 | ) | | (22 | ) |

Stock-based compensation | 11 |

| | 9 |

|

Working capital changes and other | (428 | ) | | (631 | ) |

Net cash used for operating activities (A) | (290 | ) | | (495 | ) |

| | | |

Cash flows from investing activities | | | |

Purchase of business | (1,206 | ) | | — |

|

Capital expenditures | (52 | ) | | (84 | ) |

Proceeds from sale of business | 21 |

| | — |

|

Other | (9 | ) | | 11 |

|

Net cash used for investing activities | (1,246 | ) | | (73 | ) |

| | | |

Cash flows from financing activities | | | |

Net change in debt | 943 |

| | 259 |

|

Dividends paid to noncontrolling interests | (9 | ) | | (23 | ) |

Purchase of noncontrolling interests | — |

| | (93 | ) |

Other, net | (45 | ) | | 4 |

|

Net cash provided by financing activities | 889 |

| | 147 |

|

| | | |

Effect of exchange rate changes on cash and cash equivalents | (38 | ) | | (1 | ) |

|

| |

|

Net change in cash and cash equivalents | (685 | ) | | (422 | ) |

Cash and cash equivalents at January 1 | 965 |

| | 689 |

|

|

| |

|

Cash and cash equivalents at March 31 | $ | 280 |

| | $ | 267 |

|

| |

(A) | Free cash flow is defined by the Company as net cash used for operating activities less capital expenditures. A reconciliation from net cash used for operating activities to free cash flow for the three months ended March 31, 2015 and 2014 follows: |

|

| | | | | | | |

Three months ended March 31, | 2015 | | 2014 |

Net cash used for operating activities | $ | (290 | ) | | $ | (495 | ) |

Capital expenditures | (52 | ) | | (84 | ) |

Free cash flow | $ | (342 | ) | | $ | (579 | ) |

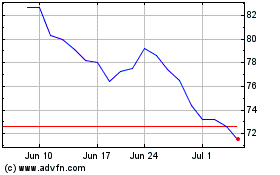

Crown (NYSE:CCK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crown (NYSE:CCK)

Historical Stock Chart

From Apr 2023 to Apr 2024