UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of May, 2015

Cameco

Corporation

(Commission file No. 1-14228)

2121-11th Street West

Saskatoon, Saskatchewan, Canada S7M 1J3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

Exhibit Index

|

|

|

|

|

| Exhibit

No. |

|

Description |

|

Page No. |

|

|

|

| 1. |

|

Press Release dated May 22, 2015 |

|

|

|

|

|

| 2. |

|

Cameco Corporation Annual Meeting – May 22, 2015 – Report of Voting Results |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

| Date: May 26, 2015 |

|

|

|

Cameco Corporation |

|

|

|

|

By: |

|

|

|

|

|

|

|

“Sean A. Quinn” |

|

|

|

|

Sean A. Quinn |

|

|

|

|

Senior Vice-President, Chief Legal Officer and Corporate Secretary |

Page 2

|

|

|

|

|

| TSX: CCO NYSE:

CCJ |

|

|

|

website: cameco.com

currency: Cdn (unless noted) |

| |

|

|

|

|

|

|

|

|

2121 – 11th Street West, Saskatoon, Saskatchewan, S7M

1J3 Canada Tel: (306) 956-6200 Fax: (306) 956-6201 |

|

|

Cameco Announces Election of Directors and Achievement of Commercial Production at Cigar Lake at Annual

General Meeting

Saskatoon, Saskatchewan, Canada, May 22,

2015 . . . . . . . . .

. . . .

Cameco (TSX: CCO; NYSE: CCJ) announced election of directors and

the start of commercial production at the Cigar Lake operation at its annual general meeting today.

Commercial production signals a transition in the

accounting treatment for costs incurred at the mine. During May, Cameco met all of the criteria for commercial production, including cycle time and process specifications. Therefore, effective May 1, 2015, all production costs, including

depreciation, will be charged to inventory and subsequently recognized in cost of sales as the product is sold as disclosed in our first quarter management discussion and analysis.

Mining at Cigar Lake began in March 2014, with the first packaged uranium concentrate available in October 2014. The operation remains on track to achieve in

2015 the annual production target of 6 million to 8 million packaged pounds (100% basis). Cameco expects Cigar Lake to ramp up to its full annual production rate of 18 million pounds (100% basis) by 2018 (Cameco’s share

9 million pounds). The mine employs more than 600 highly-skilled workers, with the majority being residents of Saskatchewan’s north.

The Cigar

Lake operation is owned by Cameco (50.025%), AREVA Resources Canada Inc. (AREVA) (37.1%), Idemitsu Canada Resources Ltd. (7.875%) and TEPCO Resources Inc. (5.0%) and is operated by Cameco.

Also at the meeting held on May 22, 2015, 11 board members were elected. Shareholders elected board members Ian Bruce, Daniel Camus, John Clappison,

James Curtiss, Donald Deranger, Catherine Gignac, Tim Gitzel, James Gowans, Nancy Hopkins, Anne McLellan, and Neil McMillan. (Voting results are available below)

Voting Results for Cameco Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Votes For |

|

|

% Votes For |

|

|

Withheld |

|

|

% Votes Withheld |

|

| Ian Bruce |

|

|

137,549,160 |

|

|

|

90.13 |

% |

|

|

15,054,747 |

|

|

|

9.87 |

% |

| Daniel Camus |

|

|

136,693,554 |

|

|

|

89.57 |

% |

|

|

15,910,352 |

|

|

|

10.43 |

% |

| John Clappison |

|

|

151,031,875 |

|

|

|

98.97 |

% |

|

|

1,571,367 |

|

|

|

1.03 |

% |

| James Curtiss |

|

|

137,061,991 |

|

|

|

89.82 |

% |

|

|

15,541,916 |

|

|

|

10.18 |

% |

| Donald Deranger |

|

|

149,853,275 |

|

|

|

98.20 |

% |

|

|

2,750,631 |

|

|

|

1.80 |

% |

| Catherine Gignac |

|

|

151,311,771 |

|

|

|

99.15 |

% |

|

|

1,292,135 |

|

|

|

0.85 |

% |

| Tim Gitzel |

|

|

150,647,345 |

|

|

|

98.72 |

% |

|

|

1,956,562 |

|

|

|

1.28 |

% |

| James Gowans |

|

|

151,291,693 |

|

|

|

99.14 |

% |

|

|

1,312,213 |

|

|

|

0.86 |

% |

| Nancy Hopkins |

|

|

150,464,812 |

|

|

|

98.60 |

% |

|

|

2,139,094 |

|

|

|

1.40 |

% |

| Anne McLellan |

|

|

137,844,507 |

|

|

|

90.33 |

% |

|

|

14,759,399 |

|

|

|

9.67 |

% |

| Neil McMillan |

|

|

150,618,597 |

|

|

|

98.70 |

% |

|

|

1,985,310 |

|

|

|

1.30 |

% |

Profile

Cameco is one of the world’s largest uranium producers, a significant supplier of conversion services and one of two Candu fuel manufacturers in Canada.

Our competitive position is based on our controlling ownership of the world’s largest high-grade reserves and low-cost operations. Our uranium products are used to generate clean electricity in nuclear power plants around the world. We also

explore for uranium in the Americas, Australia and Asia. Our shares trade on the Toronto and New York stock exchanges. Our head office is in Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and Statements

Certain information contained in this news release constitutes “forward-looking information” or “forward-looking statements” within the

meaning of Canadian and U.S. securities laws. These include statements that: We look forward to Cigar Lake contributing to our growth as it ramps up to full production capacity; the operation remains on track to achieve in 2015 the annual production

target of 6 million to 8 million packaged pounds (100% basis); and Cameco expects Cigar Lake to ramp up to its full annual production rate of 18 million pounds (100% basis) by 2018. This information is based upon a number of

assumptions that, while considered reasonable by management, are subject to significant uncertainties and contingencies. We have assumed that: our Cigar Lake development, mining and production plans succeed; there is no material delay or disruption

in our plans as a result of ground movements, cave-ins, additional water inflows, a failure of seals or plugs used for previous water inflows, natural phenomena, delay in acquiring critical equipment, equipment failure or other causes; there are no

labour disputes or shortages; our bulk ground freezing program progresses fast enough to deliver sufficient frozen ore to meet production targets; our expectation that the jet boring mining method will be successful; our expectation that the third

jet boring system machine goes into operation on schedule in 2015 and operates as expected; we and AREVA obtain contractors, equipment, operating parts, supplies, regulatory permits and approvals when needed; modification and expansion of the

McClean Lake mill are completed as planned, the mill is able to process Cigar Lake ore as expected and sufficient tailings capacity is available; and our mineral reserves estimate and the assumptions it is based on are reliable. This forward-looking

information also involves known and unknown risks, uncertainties, and other factors that may cause actual results and developments to differ materially from those expressed or implied. They include risks: that an unexpected geological, hydrological

or underground condition or an additional water inflow, further delays our progress; of ground movements and cave-ins; that we or AREVA cannot obtain or maintain the necessary regulatory permits or approvals; of natural phenomena, labour disputes,

equipment failure, delay in obtaining the required contractors, equipment, operating parts and supplies or other reasons cause a material delay or disruption in our plans; that sufficient tailings facility capacity is not available; that our mineral

reserves estimate is not reliable; that our development, mining or production plans for Cigar Lake are delayed or do not succeed for any reason, including as a result of any difficulties with the jet boring mining method or freezing the deposit to

meet production targets, the third jet boring machine does not go into operation on schedule in 2015 or operate as expected, or any difficulties with the McClean Lake mill modifications or expansion or milling Cigar Lake ore. Please also see our

most recent annual information form, annual MD&A and quarterly MD&A for other risks and assumptions relevant to the forward-looking information in this news release. We are providing this forward-looking information to help you understand

management’s views regarding Cigar Lake uranium production and it may not be appropriate for other purposes. Cameco does not undertake any obligation to update or revise forward-looking information, whether as a result of new information,

future events or otherwise, except to the extent legally required.

Qualified Person

The above scientific and technical information related to the Cigar Lake mining operation was approved by Les Yesnik, general manager, Cigar Lake, who is a

qualified person for the purpose of National Instrument 43-101.

- End -

|

|

|

|

|

| Investor inquiries: |

|

Rachelle Girard |

|

(306) 956-6403 |

|

|

|

| Media inquiries: |

|

Gord Struthers |

|

(306) 956-6593 |

- 3 -

Exhibit 2

May 22, 2015

Canadian

Securities Administrators

Cameco Corporation

Annual Meeting May 22, 2015

Report of Voting Results

Under National Instrument 51-102

In

accordance with Section 11.3 of National Instrument 51-102 – Continuous Disclosure Obligations, we advise of the results of the voting on the matters submitted to the annual meeting (the Meeting) of the shareholders (the

Shareholders) of Cameco Corporation (the Corporation) held on May 22, 2015. Each of the matters set forth below is described in greater detail in the Notice for the Meeting and Management Proxy Circular mailed to Shareholders prior to the

Meeting.

The matters voted upon at the Meeting and the results of the voting were as follows:

Item 1: Election of Directors

The following

directors were elected to hold office for the ensuing year or until their successors are elected or appointed:

|

|

|

| Ian Bruce |

|

Catherine Gignac |

| Daniel Camus |

|

Tim Gitzel |

| John Clappison |

|

James Gowans |

| James Curtiss |

|

Nancy Hopkins |

| Donald Deranger |

|

Anne McLellan |

|

|

Neil McMillan |

Canadian Securities Administrators

May 22, 2015

Page

2

If a ballot vote had been taken, based upon proxy votes by Shareholders received by the Corporation, the

voting results for the election of directors, both before and after giving effect to the twenty-five (25%) percent non-resident Shareholder voting restriction, would have been:

Vote Results Before Reduction of Non-resident Vote:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Votes For |

|

|

% Votes For |

|

|

Withheld |

|

|

% Votes Withheld |

|

| Ian Bruce |

|

|

201,330,350 |

|

|

|

92.97 |

% |

|

|

15,223,644 |

|

|

|

7.03 |

% |

| Daniel Camus |

|

|

199,422,514 |

|

|

|

92.09 |

% |

|

|

17,131,480 |

|

|

|

7.91 |

% |

| John Clappison |

|

|

214,802,171 |

|

|

|

99.19 |

% |

|

|

1,749,166 |

|

|

|

0.81 |

% |

| James Curtiss |

|

|

200,659,627 |

|

|

|

92.66 |

% |

|

|

15,894,367 |

|

|

|

7.34 |

% |

| Donald Deranger |

|

|

212,708,555 |

|

|

|

98.22 |

% |

|

|

3,845,439 |

|

|

|

1.78 |

% |

| Catherine Gignac |

|

|

215,072,291 |

|

|

|

99.32 |

% |

|

|

1,481,703 |

|

|

|

0.68 |

% |

| Tim Gitzel |

|

|

214,409,252 |

|

|

|

99.01 |

% |

|

|

2,144,742 |

|

|

|

0.99 |

% |

| James Gowans |

|

|

215,046,421 |

|

|

|

99.30 |

% |

|

|

1,507,573 |

|

|

|

0.70 |

% |

| Nancy Hopkins |

|

|

214,043,945 |

|

|

|

98.84 |

% |

|

|

2,510,049 |

|

|

|

1.16 |

% |

| Anne McLellan |

|

|

201,597,890 |

|

|

|

93.09 |

% |

|

|

14,956,104 |

|

|

|

6.91 |

% |

| Neil McMillan |

|

|

214,384,061 |

|

|

|

99.00 |

% |

|

|

2,169,933 |

|

|

|

1.00 |

% |

Vote Results After Reduction of Non-resident Vote to 25%:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nominee |

|

Votes For |

|

|

% Votes For |

|

|

Withheld |

|

|

% Votes Withheld |

|

| Ian Bruce |

|

|

137,549,160 |

|

|

|

90.13 |

% |

|

|

15,054,747 |

|

|

|

9.87 |

% |

| Daniel Camus |

|

|

136,693,554 |

|

|

|

89.57 |

% |

|

|

15,910,352 |

|

|

|

10.43 |

% |

| John Clappison |

|

|

151,031,875 |

|

|

|

98.97 |

% |

|

|

1,571,367 |

|

|

|

1.03 |

% |

| James Curtiss |

|

|

137,061,991 |

|

|

|

89.82 |

% |

|

|

15,541,916 |

|

|

|

10.18 |

% |

| Donald Deranger |

|

|

149,853,275 |

|

|

|

98.20 |

% |

|

|

2,750,631 |

|

|

|

1.80 |

% |

| Catherine Gignac |

|

|

151,311,771 |

|

|

|

99.15 |

% |

|

|

1,292,135 |

|

|

|

0.85 |

% |

| Tim Gitzel |

|

|

150,647,345 |

|

|

|

98.72 |

% |

|

|

1,956,562 |

|

|

|

1.28 |

% |

| James Gowans |

|

|

151,291,693 |

|

|

|

99.14 |

% |

|

|

1,312,213 |

|

|

|

0.86 |

% |

| Nancy Hopkins |

|

|

150,464,812 |

|

|

|

98.60 |

% |

|

|

2,139,094 |

|

|

|

1.40 |

% |

| Anne McLellan |

|

|

137,844,507 |

|

|

|

90.33 |

% |

|

|

14,759,399 |

|

|

|

9.67 |

% |

| Neil McMillan |

|

|

150,618,597 |

|

|

|

98.70 |

% |

|

|

1,985,310 |

|

|

|

1.30 |

% |

Item 2: Appointment of Auditors

By a vote by way of show of hands, KPMG LLP was appointed auditors of the Corporation to hold office until the next annual meeting of Shareholders, or until

their successors are appointed.

If a ballot vote had been taken, based upon proxy votes by Shareholders received by the Corporation, the voting results

for appointment of auditors, both before and after giving effect to the twenty-five (25%) percent non-resident Shareholder voting restriction, would have been:

Vote Results Before Reduction of Non-resident Vote:

|

|

|

|

|

|

|

| Votes For |

|

% Votes For |

|

Votes Withheld |

|

% Votes Withheld |

| 236,876,044 |

|

98.18% |

|

4,379,745 |

|

1.82% |

Canadian Securities Administrators

May 22, 2015

Page

3

Vote Results After Reduction of Non-resident Vote to 25%:

|

|

|

|

|

|

|

| Votes For |

|

% Votes For |

|

Votes Withheld |

|

% Votes Withheld |

| 154,917,359 |

|

97.57% |

|

3,861,996 |

|

2.43% |

Item 3: Executive Compensation

On a vote by ballot, an advisory resolution was passed accepting the approach to executive compensation disclosed in Cameco’s Management Proxy Circular

delivered in advance of this meeting.

The outcome of the ballot vote, both before and after giving effect to the twenty-five (25%) percent

non-resident Shareholder voting restriction, was as follows:

Vote Results Before Reduction of Non-resident Vote:

|

|

|

|

|

|

|

| Votes For |

|

% Votes For |

|

Votes Against |

|

% Votes Against |

| 196,810,197 |

|

90.88% |

|

19,742,292 |

|

9.12% |

Vote Results After Reduction of Non-resident Vote to 25%:

|

|

|

|

|

|

|

| Votes For |

|

% Votes For |

|

Votes Against |

|

% Votes Against |

| 134,530,917 |

|

88.16% |

|

18,074,956 |

|

11.84% |

|

|

|

| Cameco Corporation |

|

|

| By: |

|

“Sean A. Quinn” |

|

|

Sean A. Quinn |

|

|

Senior Vice-President, Chief Legal Officer |

|

|

and Corporate Secretary |

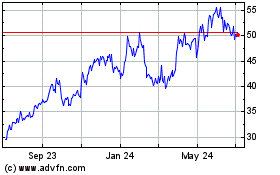

Cameco (NYSE:CCJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

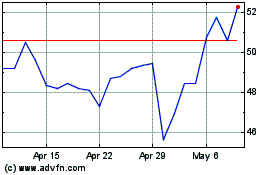

Cameco (NYSE:CCJ)

Historical Stock Chart

From Apr 2023 to Apr 2024