UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of January, 2015

Cameco

Corporation

(Commission file No. 1-14228)

2121-11th Street West

Saskatoon, Saskatchewan, Canada S7M 1J3

(Address of Principal Executive Offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F þ

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No

þ

If “Yes” is marked, indicate below the file number assigned to the registrant in

connection with Rule 12g3-2(b):

Exhibit Index

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

|

Page No. |

|

|

|

|

| 1. |

|

Press Release dated January 13, 2015 |

|

|

3 |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

| Date: January 14, 2015 |

|

|

|

Cameco Corporation |

|

|

|

|

|

|

|

|

By: |

|

“Sean A. Quinn” |

|

|

|

|

|

|

Sean A. Quinn |

|

|

|

|

|

|

Senior Vice-President, Chief Legal Officer and Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

| TSX: CCO |

|

|

website: cameco.com |

| NYSE: CCJ |

|

|

currency: Cdn (unless noted) |

|

|

|

|

|

|

|

|

|

|

|

|

2121 – 11th Street West, Saskatoon, Saskatchewan, S7M

1J3 Canada

Tel: (306) 956-6200 Fax: (306) 956-6201

Cameco provides production update for the Cigar Lake mine

Saskatoon, Saskatchewan, Canada, January 13, 2015 . . . . . . . . . . . . .

Cameco (TSX: CCO; NYSE: CCJ) today announced that 0.34 million pounds (100% basis) of uranium concentrate was produced from milling Cigar Lake ore

in 2014, in line with its most recent expectations. Packaged production is expected to be 6 to 8 million pounds (100% basis) in 2015.

Ore mined at

Cigar Lake is transported by truck to the McClean Lake mill, operated by AREVA Resources Canada Inc., where it is processed to uranium concentrate. The McClean Lake mill is located approximately 70 kilometres northeast of the minesite in northern

Saskatchewan, Canada. Mining at Cigar Lake began in March 2014 and the first uranium concentrate was packaged at McClean Lake in October 2014.

Cameco

continues to expect Cigar Lake to ramp up to its full annual production rate of 18 million pounds (100% basis) by 2018 (Cameco’s share 9 million pounds). The annual production rates during rampup will be adjusted as necessary based

upon operating experience.

The Cigar Lake mine is owned by Cameco (50.025%), AREVA Resources Canada Inc. (AREVA) (37.1%), Idemitsu Canada Resources Ltd.

(7.875%) and TEPCO Resources Inc. (5.0%) and is operated by Cameco. The McClean Lake mill is owned by AREVA Resources Canada Inc. (70%), Denison Mines Inc. (22.5%) and OURD Canada Co. Ltd. (7.5%), and is operated by AREVA.

Cameco is providing its 2015 forecast for Cigar Lake production in order to co-ordinate with the disclosure of information by Denison Mines Corp. Cameco will

report its 2014 annual results, including 2014 production and 2015 outlook information for all other operations, after markets close on February 6, 2015.

Profile

Cameco is one of the world’s largest

uranium producers, a significant supplier of conversion services and one of two Candu fuel manufacturers in Canada. Our competitive position is based on our controlling ownership of the world’s largest high-grade reserves and low-cost

operations. Our uranium products are used to generate clean electricity in nuclear power plants around the world. We also explore for uranium in the Americas, Australia and Asia. Our shares trade on the Toronto and New York stock exchanges. Our head

office is in Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and Statements

Certain information contained in this news release constitutes “forward-looking information” or “forward-looking statements” within the

meaning of Canadian and U.S. securities laws. These include statements that packaged production is expected to be 6 to 8 million pounds (100% basis) in 2015 and Cameco continues to expect Cigar Lake to ramp up to its full production rate of

18 million pounds (100% basis) by 2018. This information is based upon a number of assumptions that, while considered reasonable by management, are subject to significant uncertainties and contingencies. We have assumed that: our Cigar Lake

mining and production plans succeed; there is no material delay or disruption in our plans as a result of ground movements, cave-ins, additional water inflows, a failure of seals or plugs used for previous water inflows, natural phenomena, delay in

acquiring critical equipment, equipment failure or other causes; there are no labour disputes or shortages; our bulk ground freezing program progresses fast enough to deliver sufficient frozen ore to meet production targets; our expectation that the

jet boring mining method will be successful and that we will be able to solve technical challenges as they arise in a timely manner; our expectation that we will be able to obtain the additional jet boring system unit we require on schedule; we and

AREVA obtain contractors, equipment, operating parts, supplies, regulatory permits and approvals when needed; modifications to the McClean Lake mill are completed as planned, and the mill is able to process Cigar Lake ore, and ramp up to its full

production rate, as expected, AREVA will be able to solve technical challenges as they arise in a timely manner, and sufficient tailings capacity is available; our mineral reserves estimate and the assumptions it is based on are reliable. This

forward-looking information also involves known and unknown risks, uncertainties, and other factors that may cause actual results and developments to differ materially from those expressed or implied. They include risks: that an unexpected

geological, hydrological or underground condition or an additional water inflow delays or disrupts our plans; of ground movements and cave-ins; that we or AREVA cannot obtain or maintain the necessary regulatory permits or approvals; of natural

phenomena, labour disputes, equipment failure, delay in obtaining the required contractors, equipment, operating parts and supplies or other reasons cause a material delay or disruption in our plans; that sufficient tailings capacity is not

available; that our mineral reserves estimate is not reliable; that our mining or production plans for Cigar Lake are delayed or do not succeed for any reason, including technical difficulties with the jet boring mining method or freezing the

deposit to meet production targets, technical difficulties with McClean Lake mill or ramping up its production rate or milling Cigar Lake ore, or our inability to acquire any of the required jet boring equipment. Please also see our most recent

annual information form, annual MD&A and quarterly MD&A for other risks and assumptions relevant to the forward-looking information in this news release. We are providing this forward-looking information to help you understand

management’s views regarding Cigar Lake uranium production and it may not be appropriate for other purposes. Cameco does not undertake any obligation to update or revise forward-looking information, whether as a result of new information,

future events or otherwise, except to the extent legally required.

Qualified Person

The above scientific and technical information related to the Cigar Lake mine was approved by Scott Bishop, manager, technical services for Cameco, who is a

qualified person for the purpose of National Instrument 43-101.

- End -

|

|

|

|

|

| Investor inquiries: |

|

Rachelle Girard |

|

(306) 956-6403 |

|

|

|

| Media inquiries: |

|

Rob Gereghty |

|

(306) 956-6190 |

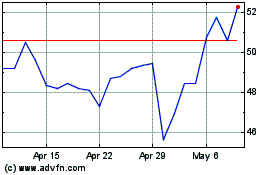

Cameco (NYSE:CCJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

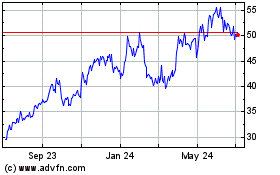

Cameco (NYSE:CCJ)

Historical Stock Chart

From Apr 2023 to Apr 2024