Uranium Companies, Hit By Market Drop, Defend Nuclear Industry

March 14 2011 - 5:49PM

Dow Jones News

Uranium company executives defended the nuclear-power industry's

growth plans Monday after overheating at nuclear reactors in Japan

caused a rout in their share prices.

Most of the major uranium-miner stocks dropped more than 10%

Monday as investors feared Japan's reactor problems could endanger

the world-wide "nuclear renaissance"--a resurgence in uranium

commodities and stocks due to expectations of low future uranium

supply and increasing demand from new reactors.

Jerry Grandey, chief executive of Cameco Corp. (CCJ), the

world's largest publicly owned uranium company, said Monday that

the selloff in uranium shares was "largely driven by emotion." He

said that Cameco, which gets 18% to 20% of its revenue from Japan,

didn't expect any significant effect on its business now or in the

future.

Even if the 11 reactors that were in the earthquake and tsunami

zone were to defer part of their uranium purchases, Cameco would be

"well within" its guidance for the year, he said.

Of the world's 442 nuclear power plants, 54 are in Japan. The

Japanese government said Monday that the fuel rods in one of three

overheating reactors have fused together in a partial meltdown. A

partial meltdown occurs when uranium fuel begins to melt under high

temperatures, but still remains contained within the reactor. The

1979 Three Mile Island accident in the U.S. was a partial meltdown.

In a full meltdown, such as the 1986 Chernobyl disaster in the

Soviet Union, the rods melt completely and the release of energy

causes an explosion that contaminates the surrounding area with

radioactive material.

Despite Japan's problems, Grandey said Cameco's customers in

India, China, South Korea and other Asian nations, where the bulk

of the about 60 nuclear reactors are under construction or

refurbishment, have said they remain committed to their nuclear

program.

"Some voices have questioned whether the nuclear renaissance

will survive this disaster," Grandey said. "Looking beyond the

events of recent days, we at Cameco don't see a dramatic effect on

the fundamentals of our uranium business. Growth of nuclear

capacity in China, India, Korea and elsewhere ... has tremendous

momentum and we expect it will continue."

Amir Adnani, Chief Executive of Uranium Energy Corp. (UEC), said

Monday that it is too early for politicians or the media to begin

"writing the obituary of the nuclear renaissance." In retrospect,

the nuclear incidents in Japan may prove the ability of the nuclear

industry to respond to disasters, he said.

"The oil infrastructure went up in flames. The only

infrastructure left standing that was built in the 1970s were these

reactors. There wasn't a significant radiation release and so far

they've demonstrated that the safety systems for the most part have

worked."

Adnani and Cameco executives also said that despite the

incident, spot prices for uranium still reflected short supplies

and high demand.

Adnani said the rout in equity prices--his own company closed

down 19.2% on the American Stock Exchange Monday--was "completely

unjustified, due to the fact that you've got current demand from

440 operating nuclear reactors that will need uranium to generate

18% of the world's electricity," while supply hasn't kept up with

the growth in demand for decades.

The rout in equity prices will make it harder for

development-stage uranium companies to get financing, companies may

reconsider commissioning new projects and there may even be

softness in the spot uranium price, Adnani said.

"The capital markets, responding to this news over the weekend,

are putting a lot of pressure on a sector that was just starting to

get some life," he said.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

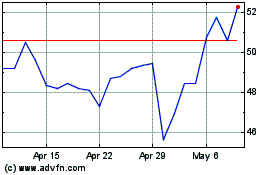

Cameco (NYSE:CCJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

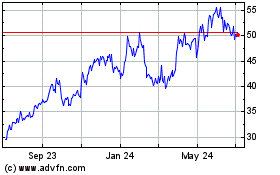

Cameco (NYSE:CCJ)

Historical Stock Chart

From Apr 2023 to Apr 2024