CORRECT (03/10):Talvivaara Targets Nameplate Capacity At Sotkamo

March 11 2011 - 5:43AM

Dow Jones News

Talvivaara Mining Co. (TLV1V.HE) expects its Sotkamo mine to be

operating at capacity by September, which would involve producing

nickel at a rate of around 50,000 metric tons a year, its senior

executives said Thursday.

The London and Helsinki-listed company told Dow Jones Newswires

it is in the midst of ramping up operations at the mine in eastern

Finland, and hopes to produce 30,000 tons of nickel this year, with

an expansion project planned which could eventually take output to

around 100,000 tons a year.

Chief Financial Officer Saila Miettinen-Lahde said: "We're

currently producing at roughly 20,000 tons a year and we would

clearly need to gear that up to fairly close to the

50,000-tons-a-year level by the end of this year to be able to

produce [our targeted annual level]."

Talvivaara's Sotkamo mine contains one of the largest-known

nickel-sulphide deposits in Europe, but problems at its

metals-recovery plant caused a recent bottleneck and affected

production.

Chief Executive Pekka Pera said the plant was already

sporadically able to operate at its nameplate capacity but that

further alterations and modifications mean it should be able to

achieve an annualized rate of 50,000 tons a year by September.

Talvivaara's expansion project intends to increase production to

at least 80,000 tons of nickel a year, and Miettinen-Lahde said the

working target of 100,000 tons a year would make Sotkamo "one of

the biggest nickel mines in the world."

Pera said an update on environmental permitting should be

received in the second quarter, with Talvivaara's technical

decisions slated for the third quarter.

Talvivaara recently signed long-term agreements to sell

byproduct uranium to Canadian mining-company Cameco Corp. (CCJ,

CCO.T) and is currently awaiting export and production permits from

the European Atomic Energy Community.

With a Finnish general election set for April, the company is

expecting final approval for the $60 million deal in the summer and

hopes eventually to produce more than 410 tons of yellowcake

uranium.

Pera said the agreement is "very high margin" and

Miettinen-Lahde said that potentially it could account for 5% of

the company's revenue, which would "flow all the way through to the

bottom line."

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

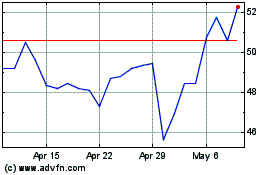

Cameco (NYSE:CCJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

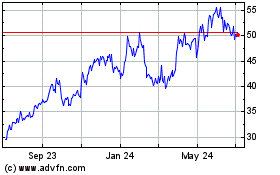

Cameco (NYSE:CCJ)

Historical Stock Chart

From Apr 2023 to Apr 2024