Crown Castle Announces Tax Reporting Information for 2015 Distributions

January 20 2016 - 4:15PM

Crown Castle International Corp. (NYSE:CCI) (“Crown Castle”)

announced today certain year-end tax reporting information for its

2015 distributions.

The following tables summarize, for income tax

purposes, the nature of distributions paid to holders of Crown

Castle Common Stock and holders of Crown Castle 4.50% Mandatory

Convertible Preferred Stock, respectively, presented on a per share

basis, during the calendar year ended December 31, 2015.

Stockholders are encouraged to consult with their tax advisors as

to their specific tax treatment of Crown Castle’s

distributions.

Crown Castle Common Stock

Ticker Symbol: CCI

|

Record Date |

Payable Date |

Cash Distribution (per share) |

Ordinary

TaxableDividend(per

share) |

Qualified Taxable Dividend(per

share)* |

Long-Term Capital Gain Distribution (per

share) |

|

3/20/2015 |

3/31/2015 |

$ |

0.820 |

|

|

$ |

0.227 |

|

$ |

0.035 |

|

$ |

0.593 |

|

|

6/19/2015 |

6/30/2015 |

$ |

0.820 |

|

|

$ |

0.227 |

|

$ |

0.035 |

|

$ |

0.593 |

|

|

9/18/2015 |

9/30/2015 |

$ |

0.820 |

|

|

$ |

0.227 |

|

$ |

0.035 |

|

$ |

0.593 |

|

|

12/18/2015 |

12/31/2015 |

$ |

0.885 |

|

|

$ |

0.245 |

|

$ |

0.038 |

|

$ |

0.640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Qualified taxable dividend amount included in ordinary

taxable dividend amount. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note: During the calendar year ended December 31, 2015, there

were no Unrecaptured Section 1250 Gain or Non-dividend

Distributions made with respect to Crown Castle Common Stock. Crown

Castle has determined that 0.54% of each distribution to its

shareholders consists of an alternative minimum tax

adjustment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crown Castle 4.50% Mandatory Convertible

Preferred Stock

Ticker Symbol: CCI-PRA

|

Record Date |

Payable Date |

Cash Distribution (per share)** |

Ordinary

TaxableDividend(per

share) |

Qualified Taxable Dividend(per

share)* |

Long-Term Capital Gain Distribution (per

share) |

|

1/15/2015 |

2/2/2015 |

$ |

1.125 |

|

$ |

0.312 |

|

$ |

0.048 |

|

$ |

0.813 |

|

|

4/15/2015 |

5/1/2015 |

$ |

1.125 |

|

$ |

0.312 |

|

$ |

0.048 |

|

$ |

0.813 |

|

|

7/15/2015 |

8/3/2015 |

$ |

1.125 |

|

$ |

0.312 |

|

$ |

0.048 |

|

$ |

0.813 |

|

|

10/15/2015 |

11/2/2015 |

$ |

1.125 |

|

$ |

0.312 |

|

$ |

0.048 |

|

$ |

0.813 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Qualified taxable dividend amount included in ordinary

taxable dividend amount. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ** On December 18, 2015, Crown Castle announced the

declaration of a quarterly dividend on the Crown Castle 4.50%

Mandatory Convertible Preferred Stock of $1.125 per share, which

will be paid on February 1, 2016 to holders of record as of January

15, 2016. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Note: During the calendar year ended December 31, 2015, there

were no Unrecaptured Section 1250 Gain or Non-dividend

Distributions made with respect to Crown Castle 4.50% Mandatory

Convertible Preferred Stock. Crown Castle has determined that 0.54%

of each distribution to its shareholders consists of an alternative

minimum tax adjustment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT CROWN CASTLE

Crown Castle provides wireless carriers with the

infrastructure they need to keep people connected and businesses

running. With approximately 40,000 towers and 15,000 small cell

nodes supported by approximately 16,000 miles of fiber, Crown

Castle is the nation’s largest provider of shared wireless

infrastructure with a significant presence in the top 100 U.S.

markets. For more information on Crown Castle, please visit

www.crowncastle.com.

| Contacts: |

Jay Brown, CFO |

|

|

Son Nguyen, VP -

Corporate Finance |

|

|

Crown Castle

International Corp. |

|

|

713-570-3050 |

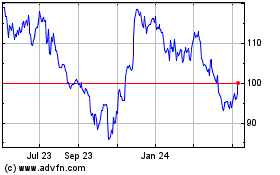

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

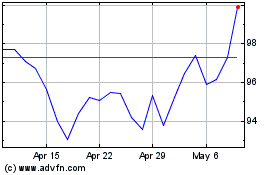

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024