UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 14, 2015

Crown Castle International Corp.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-16441 |

|

76-0470458 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

1220 Augusta Drive

Suite 600

Houston, TX

77057

(Address of Principal Executive Office)

Registrant’s telephone number, including area code: (713) 570-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 — ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On May 14, 2015, Crown Castle International Corp., a Delaware corporation (“Crown Castle”), and Crown Castle Operating

LLC, a Delaware limited liability company and wholly owned subsidiary of Crown Castle (“CCOL”), entered into a definitive agreement with The Trust Company (Nominees) Limited, Todd International Investments Limited, Oceania Capital

Limited, Birdsong Capital Limited, Baytown Investments Limited and Heritage PTC LLC (collectively and, together with CCOL, the “Sellers”), Turri Finance Pty Ltd, a corporation organized under the laws of Australia, and Turri Bidco

Pty Ltd, a corporation organized under the laws of Australia that is controlled by a consortium of investors led by Macquarie Infrastructure and Real Assets (“Buyer”), pursuant to which Buyer will purchase all of the issued and

outstanding shares of Crown Castle Australia Holdings Pty Ltd, a corporation organized under the laws of Australia and a subsidiary of Crown Castle and CCOL (“CCAH”). CCOL owns approximately 77.59% of CCAH’s outstanding shares.

Subject to the terms of the Agreement for the Sale and Purchase of the Shares of Crown Castle Australia Holdings Pty Ltd (“Share

Purchase Agreement”), the aggregate purchase price payable to Crown Castle and the Sellers is approximately A$2.0 billion in cash or approximately US $1.6 billion assuming an exchange rate of 0.80 US dollars to 1.0 Australian dollar. Upon

consummation of the transaction, Crown Castle expects to receive net proceeds, payable to CCOL, of approximately US $1.3 billion after accounting for its ownership interest, repayment of intercompany debt owed to it by CCAH and estimated transaction

fees and expenses. Actual cash proceeds are subject to customary working capital adjustments pursuant to the Share Purchase Agreement.

The Share Purchase Agreement contains customary warranties and covenants. The closing of the transaction is subject to customary closing

conditions and is expected to occur during the second quarter of 2015.

Assuming consummation of the transaction, Crown Castle expects to

designate a significant portion of its dividend distributions paid to its common and preferred stockholders during 2015 as capital gain dividends, which are generally taxed to U.S. stockholders as long-term capital gains. Crown Castle anticipates

utilizing a portion of its net operating losses to offset its gain on the anticipated sale of CCAH.

The foregoing summary is qualified in

its entirety by the full text of the Share Purchase Agreement, which Crown Castle expects to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2015.

ITEM 7.01 — REGULATION FD DISCLOSURE

On May 14, 2015, Crown Castle issued a press release announcing Crown Castle’s entering into the Share Purchase Agreement. The

May 14, 2015 press release is furnished herewith as Exhibit 99.1.

ITEM 9.01 — FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

As described in Item 7.01 of

this Report, the following exhibit is furnished as part of this Current Report on Form 8-K:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated May 14, 2015 |

The information in Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

| CROWN CASTLE INTERNATIONAL CORP. |

|

|

| By: |

|

/s/ E. Blake Hawk |

|

|

Name: |

|

E. Blake Hawk |

|

|

Title: |

|

Executive Vice President and General

Counsel |

Date: May 19, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated May 14, 2015 |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

|

|

NEWS RELEASE May 14, 2015 |

|

|

|

|

|

|

|

Contacts: |

|

Jay Brown, CFO |

|

|

|

|

Son Nguyen, VP - Corporate Finance |

| FOR IMMEDIATE RELEASE |

|

|

|

Crown Castle International Corp. |

|

|

|

|

713-570-3050 |

CROWN CASTLE ANNOUNCES

SALE OF AUSTRALIAN SUBSIDIARY

May 14, 2015 - HOUSTON, TEXAS - Crown Castle International Corp. (NYSE: CCI) (“Crown Castle”) announced today that it has

signed a definitive agreement to sell its Australian subsidiary (“CCAL”) to a consortium of investors led by Macquarie Infrastructure and Real Assets for an aggregate purchase price of approximately A$2.0 billion in cash

(“Transaction”), or approximately US$1.6 billion assuming an exchange rate of 0.80 US dollars to 1.0 Australian dollar. CCAL is 77.6% owned by Crown Castle. Upon consummation of the Transaction, Crown Castle expects to receive net proceeds

of approximately US$1.3 billion after accounting for its ownership interest, repayment of intercompany debt owed to it by CCAL and estimated transaction fees and expenses. The Transaction is expected to close during the second quarter of 2015. Crown

Castle expects to use the net proceeds from the Transaction to finance its previously announced acquisition of Sunesys and for general corporate purposes, including the repayment of certain of its indebtedness.

“The sale of CCAL allows us to redeploy capital towards our growing small cell networks, which we expect will be accretive to our

long-term AFFO and dividend per share growth rates,” stated Ben Moreland, Crown Castle’s President and Chief Executive Officer. “We believe we are in the early stages of small cells deployment and are excited by the opportunities that

we see ahead of us. While CCAL has been a great contributor to our business, our decision to divest this business is opportunistic and allows us to re-allocate capital to growth enhancing initiatives in the US

market, which we believe is the most attractive wireless market in the world for wireless investment. I would like to thank our friends and colleagues at CCAL who, since CCAL’s establishment in 2000, have built CCAL into the leading tower

operator in Australia.”

The Foundation for a

Wireless World.

CrownCastle.com

|

|

|

| News Release continued: |

|

Page

2

|

CCAL was expected to contribute approximately US$97 million to US$102 million to Crown

Castle’s previously provided full year 2015 Outlook for Adjusted EBITDA of $2.145 billion to $2.160 billion. Further, CCAL was expected to contribute approximately US$58 million to US$63 million to Crown Castle’s previously provided full

year 2015 Outlook for Adjusted Funds from Operations of $1.450 billion to $1.465 billion, respectively. Crown Castle’s full year 2015 Outlook was previously provided on April 22, 2015 and assumed an exchange rate of 0.76 US dollars to 1.0

Australian dollar for the second, third and fourth quarter of 2015.

ABOUT CCAL

Since its establishment in 2000, CCAL has grown to become the largest independent tower operator in Australia with a nationwide portfolio of

approximately 1,800 sites providing significant wireless communications coverage to substantially all Australians throughout all States and Territories. Crown Castle Australia’s customers include major mobile telecommunications carriers such as

Optus, Telstra and Vodafone Hutchison Australia; wireless broadband service providers such as NBN Co.; and key emergency service network providers.

ABOUT CROWN CASTLE

Crown Castle provides

wireless carriers with the infrastructure they need to keep people connected and businesses running. With approximately 40,000 towers and 14,000 small cell nodes supported by approximately 7,000 miles of fiber, Crown Castle is the nation’s

largest provider of shared wireless infrastructure with a significant presence in the top 100 US markets. In addition, Crown Castle operates approximately 1,800 towers in Australia. For more information on Crown Castle, please visit

www.crowncastle.com.

Cautionary Language Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based on Crown Castle management’s expectations. Such statements include

plans, projections and estimates regarding (1) the Transaction, (2) anticipated Transaction proceeds, use of Transaction proceeds and benefits which may be derived therefrom, (3) timing of the Transaction, (4) US dollar to

Australia dollar exchange rates, (5) demand for, growth of and opportunities relating to small cells, (6) the US wireless market, (7) CCAL’s contribution to Crown Castle’s financial or operating results, (8) Adjusted

EBITDA, and (9) Adjusted Funds from Operations. Such forward-looking statements are subject to certain risks, uncertainties and assumptions, including prevailing market conditions and other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

The Foundation for a

Wireless World.

CrownCastle.com

|

|

|

| News Release continued: |

|

Page

3

|

materially from those expected. More information about potential risk factors that could affect Crown Castle and its results is included in Crown Castle’s filings with the Securities and

Exchange Commission. The term “including,” and any variation thereof, means “including, without limitation.”

Non-GAAP Financial

Measures and Other Calculations

This press release includes presentations of Adjusted EBITDA and Adjusted Funds from Operations

(“AFFO”), which are non-GAAP financial measures. These non-GAAP financial measures are not intended as alternative measures of operating results or cash flow from operations (as determined in

accordance with Generally Accepted Accounting Principles (“GAAP”)). Each of the amounts included in the calculation of Adjusted EBITDA and AFFO are computed in accordance with GAAP, with the exception of: (1) sustaining capital

expenditures, which is not defined under GAAP and (2) our adjustment to the income tax provision in calculations of AFFO for periods prior to our REIT conversion.

Our measures of Adjusted EBITDA and AFFO may not be comparable to similarly titled measures of other companies, including other companies in

the tower sector or those reported by other REITs. Our AFFO may not be comparable to those reported in accordance with National Association of Real Estate Investment Trusts, including with respect to the impact of income taxes for periods prior to

our REIT conversion.

Adjusted EBITDA and AFFO are presented as additional information because management believes these measures are

useful indicators of the financial performance of our core businesses. In addition, Adjusted EBITDA is a measure of current financial performance used in our debt covenant calculations.

Adjusted EBITDA. Crown Castle defines Adjusted EBITDA as net income (loss) plus restructuring charges (credits), asset write-down

charges, acquisition and integration costs, depreciation, amortization and accretion, amortization of prepaid lease purchase price adjustments, interest expense and amortization of deferred financing costs, gains (losses) on retirement of long-term

obligations, net gain (loss) on interest rate swaps, impairment of available-for-sale securities, interest income, other income (expense), benefit (provision) for income taxes, cumulative effect of change in accounting principle, income (loss) from

discontinued operations, and stock-based compensation expense.

Funds from Operations (“FFO”). Crown Castle defines Funds

from Operations as net income plus real estate related depreciation, amortization and accretion and asset write-down charges, less noncontrolling interest and cash paid for preferred stock dividends, and is a measure of funds from operations

attributable to CCIC common stockholders.

The Foundation for a

Wireless World.

CrownCastle.com

|

|

|

| News Release continued: |

|

Page

4

|

Adjusted Funds from Operations (“AFFO”). Crown Castle defines Adjusted Funds

from Operations as FFO before straight-line revenue, straight-line expense, stock-based compensation expense, non-cash portion of tax provision, non-real estate related depreciation, amortization and accretion, amortization of non-cash interest

expense, other (income) expense, gain (loss) on retirement of long-term obligations, net gain (loss) on interest rate swaps, acquisition and integration costs, and adjustments for noncontrolling interests, and less capital improvement capital

expenditures and corporate capital expenditures.

Sustaining capital expenditures. Crown Castle defines sustaining capital

expenditures as either (1) corporate related capital improvements, such as buildings, information technology equipment and office equipment or (2) capital improvements to tower sites that enable our customers’ ongoing quiet enjoyment

of the tower.

Tables reconciling these non-GAAP financial measures are shown below. The components in these tables may not sum to the

total due to rounding.

CCAL Adjusted EBITDA for the year ending December 31, 2015 is forecasted as follows:

|

|

|

| (in millions) |

|

Full Year 2015

Outlook |

| Net income (loss) (a) |

|

$41 to $67 |

| Adjustments to increase (decrease) net income (loss): |

|

|

| Asset write-down charges |

|

$0 to $1 |

| Depreciation, amortization and accretion |

|

$19 to $29 |

| Interest Income |

|

$0 to $1 |

| Benefit (provision) for income taxes |

|

$15 to $20 |

| Stock-based compensation expense |

|

$1 to $5 |

|

|

|

| Adjusted EBITDA (b) |

|

$97 to $102 |

|

|

|

| (a) |

Exclusive of the intercompany interest expense |

| (b) |

The above reconciliation excludes line items included in our Adjusted EBITDA definition which are not applicable for the periods shown. |

The Foundation for a

Wireless World.

CrownCastle.com

|

|

|

| News Release continued: |

|

Page

5

|

CCAL FFO and AFFO for the year ending December 31, 2015 are forecasted as follows:

|

|

|

| (in millions) |

|

Full Year 2015

Outlook |

| Net income (a) |

|

$41 to $67 |

| Real estate related depreciation, amortization and accretion |

|

$17 to $23 |

| Asset write-down charges |

|

$0 to $1 |

| Adjustment for noncontrolling interest (c) |

|

$(13) to $(6) |

|

|

|

| FFO |

|

$61 to $66 |

|

|

|

|

|

| FFO (from above) |

|

$61 to $66 |

| Adjustments to increase (decrease) FFO: |

|

|

| Straight-line revenue |

|

$(30) to $(20) |

| Straight-line expense |

|

$1 to $5 |

| Stock-based compensation expense |

|

$1 to $5 |

| Non-cash portion of tax provision |

|

$4 to $14 |

| Non-real estate related depreciation, amortization and accretion |

|

$2 to $6 |

| Adjustment for noncontrolling interest |

|

$13 to $6 |

| Capital improvement capital expenditures |

|

$(2) to $(1) |

| Corporate capital expenditures |

|

$(6) to $(4) |

|

|

|

| AFFO (b) |

|

$58 to $63 |

|

|

|

| (a) |

Exclusive of the intercompany interest expense |

| (b) |

The above reconciliation excludes line items included in our AFFO definition which are not applicable for the periods shown. |

| (c) |

Inclusive of the noncontrolling interest related to real estate related depreciation, amortization and accretion and asset write downs. |

The Foundation for a

Wireless World.

CrownCastle.com

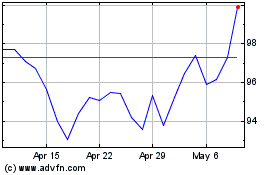

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

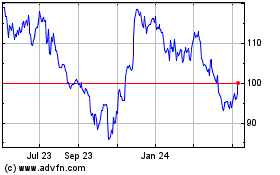

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024