UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 29, 2015

Crown Castle International Corp.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-16441 |

|

76-0470458 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

1220 Augusta Drive

Suite 600

Houston, TX

77057

(Address of Principal Executive Office)

Registrant’s telephone number, including area code: (713) 570-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 — ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On April 29, 2015, Crown Castle International Corp., a Delaware corporation (“Crown Castle”), CC SCN Fiber LLC, a Delaware

limited liability company and wholly owned subsidiary of Crown Castle (“CC Fiber”), and Quanta Services, Inc., a Delaware corporation (“Quanta”), entered into a Stock Purchase Agreement (“Purchase Agreement”), pursuant

to which CC Fiber will purchase all of the issued and outstanding equity interests of Quanta Fiber Networks, Inc., a Delaware corporation and wholly owned subsidiary of Quanta (“Sunesys”).

Subject to the terms of the Purchase Agreement, Crown Castle will pay (or cause to be paid) an aggregate purchase price of $1.0 billion in

cash, subject to limited adjustments based on (i) Sunesys’ outstanding indebtedness as of the closing, (ii) Sunesys’ capital expenditures made prior to the closing and (iii) certain other reimbursable expenses, including the

payment of Sunesys’ transaction expenses and certain change of control payments that may be due to employees of Sunesys.

Completion

of the transaction is subject to customary closing conditions, including (i) the absence of certain government proceedings or litigation related to the transaction, (ii) the receipt of governmental approvals, if required, with respect to

the expiration or termination of any waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and (iii) the attainment of certain regulatory approvals from the Federal Communications Commission and applicable state public

service or public utilities commissions. Completion of the transaction does not require the approval of Crown Castle’s stockholders and is not conditioned upon Crown Castle’s ability to obtain acquisition financing.

The Purchase Agreement contains customary representations and warranties, and Crown Castle, CC Fiber and Quanta have agreed to certain

customary covenants and indemnification obligations.

The foregoing summary is qualified in its entirety by the full text of the Purchase

Agreement, which Crown Castle expects to file as an exhibit to its Quarterly Report on Form 10-Q for the quarter ended March 31, 2015.

ITEM 7.01 — REGULATION FD DISCLOSURE

On April 30, 2015, Crown Castle issued a press release announcing Crown Castle’s entering into the Purchase Agreement. The

April 30, 2015 press release is furnished herewith as Exhibit 99.1.

ITEM 9.01 — FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

As described in Item 7.01 of

this Report, the following exhibit is furnished as part of this Current Report on Form 8-K:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated April 30, 2015 |

The information in Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| CROWN CASTLE INTERNATIONAL CORP. |

|

|

|

| By: |

|

/s/ E. Blake Hawk |

|

|

|

|

Name: |

|

E. Blake Hawk |

|

|

|

|

Title: |

|

Executive Vice President and

General Counsel |

Date: April 30, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated April 30, 2015 |

Exhibit 99.1

|

|

|

|

|

|

|

|

|

NEWS RELEASE

April 30, 2015 |

|

|

|

|

|

|

|

Contacts: |

|

Jay Brown, CFO |

|

|

|

|

Son Nguyen, VP - Corporate Finance |

| FOR IMMEDIATE RELEASE |

|

|

|

Crown Castle International Corp. |

|

|

|

|

713-570-3050 |

CROWN CASTLE ANNOUNCES AGREEMENT

TO ACQUIRE SUNESYS

April

30, 2015 - HOUSTON, TEXAS - Crown Castle International Corp. (NYSE: CCI) (“Crown Castle”) announced today that it has entered into a definitive agreement to acquire Quanta Fiber Networks, Inc. (“Sunesys”) for approximately $1.0

billion in cash (subject to certain limited adjustments). Sunesys, a wholly owned subsidiary of Quanta Services, Inc. (NYSE: PWR), is a fiber services provider that owns or has rights to nearly 10,000 miles of fiber in major metropolitan markets

across the United States, including Los Angeles, Philadelphia, Chicago, Atlanta, Silicon Valley, and northern New Jersey, with approximately 60% of Sunesys’ fiber miles located in the top 10 basic trading areas (“BTAs”).

The acquisition of Sunesys is expected to further strengthen Crown Castle’s leading position in small cell networks by more than doubling

Crown Castle’s fiber footprint available for small cell deployments and expanding Crown Castle’s presence in many of the top U.S. metropolitan markets. Small cells represent a network of antennas, or nodes, connected by fiber and designed

to facilitate wireless communications services for multiple operators that are focused on augmenting their network capacity. Today, Crown Castle owns or has rights to approximately 7,000 miles of fiber supporting approximately 14,000 nodes, which

contribute 7% to each of Crown Castle’s site rental revenues and site rental gross margin. Pro forma for the proposed acquisition, Crown Castle will own or have rights to more than 16,000 miles of fiber.

“We are thrilled with the agreement we have reached to acquire Sunesys,” said Ben Moreland, Crown Castle’s President and Chief

Executive Officer. “We pursued this transaction based on our view that the unique location of Sunesys’ high-quality fiber assets will help to accelerate and extend the runway of growth in our small cell deployments. Small cells are playing

an increasingly critical role as wireless carriers pursue fiber-fed deployments to add capacity and density to their networks to accommodate the significant growth in mobile data. The Sunesys fiber assets are both complementary to our existing

footprint and located where we expect to see significant investment by wireless carriers. Based on current small cell activity, including awarded and proposed small cell deployments, we have visibility into more than 3,500 small cell opportunities

on or near the Sunesys fiber. Given the seemingly limitless consumer demand for mobile data and the wireless carriers’ need to meet such demand, we believe there is a significant opportunity for us to grow small cells well beyond the activity

we see today.”

The Foundation for a Wireless World.

CrownCastle.com

|

|

|

|

|

| News Release continued: |

|

|

|

Page

2

|

Crown Castle expects the acquisition to close by the end of 2015 and to be immediately

accretive to Adjusted Funds from Operations (“AFFO”) per share upon closing. The transaction is expected to contribute approximately $80 to $85 million to gross margin with approximately $20 million of general and administrative expenses

in the first year of Crown Castle’s ownership. Supplemental materials related to the transaction have been posted on the Crown Castle website at http://investor.crowncastle.com.

ABOUT CROWN CASTLE

Crown Castle provides

wireless carriers with the infrastructure they need to keep people connected and businesses running. With approximately 40,000 towers and 14,000 small cell nodes supported by approximately 7,000 miles of fiber, Crown Castle is the nation’s

largest provider of shared wireless infrastructure with a significant presence in the top 100 U.S. markets. In addition, Crown Castle operates approximately 1,800 towers in Australia. For more information on Crown Castle, please visit

www.crowncastle.com.

Cautionary Language Regarding Forward-Looking Statements

This press release contains forward-looking statements that are based on Crown Castle management’s expectations. Such statements include

plans, projections and estimates regarding (1) the anticipated Sunesys acquisition, including timing, (2) potential benefits of the Sunesys acquisition, including with respect to Crown Castle’s competitive position and the contribution to or

impact on Crown Castle’s financial or operating results, including AFFO per share, revenues, gross margin, and general and administrative expenses, (3) Crown Castle’s fiber assets, (4) the role of and demand for small cells, (5) wireless

carrier network deployments, investment and expenditures, (6) mobile data demand and growth and (7) demand for, potential growth of and opportunities which may be derived from the Sunesys assets. Such forward-looking statements are subject to

certain risks, uncertainties and assumptions, including prevailing market conditions and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary

materially from those expected. More information about potential risk factors that could affect Crown Castle and its results is included in Crown Castle’s filings with the Securities and Exchange Commission. The term “including,” and

any variation thereof, means “including, without limitation.”

The Foundation for a Wireless World.

CrownCastle.com

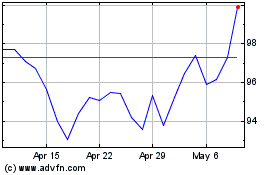

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

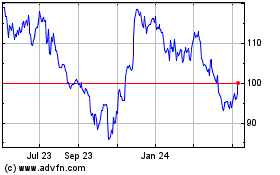

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024