President-elect Donald Trump threatened Thursday to punish U.S.

companies that shift jobs overseas as he praised a deal that would

save about 800 factory jobs in Indiana.

"Companies are not going to leave the U.S. anymore without

consequences," Mr. Trump said at a Carrier Corp. furnace plant in

Indianapolis. "Leaving the country is going to be very, very

difficult."

After receiving a phone call from Mr. Trump and a package of $7

million in state tax breaks, Carrier's parent, United Technologies

Corp., agreed to keep open the furnace factory it had planned to

move to Mexico and retain another 300 research and management

workers in the state.

Carrier had been a frequent target of Mr. Trump on the campaign

trail, where he promised to protect American jobs. He also during

the race castigated Mondelez International Inc. for moving some

Oreo cookie production to Mexico, and Apple Inc. for making many of

its devices abroad. Apple said it works with more than 8,000 U.S.

suppliers and is "investing heavily in American jobs and

innovation." Mondelez said it has had no contact with the Trump

transition team, and added that it does still make Oreos at other

sites in the U.S.

Mr. Trump used the Carrier announcement to repeat his criticism

of the North American Free Trade Agreement and his promise to

revise the agreement.

He offered a carrot-and-stick approach to enticing companies to

remain—a plan to lower the corporate tax rate to 15% from the

current 35%; a drastic cutback in regulations; and steep penalties

such as import tariffs for companies that move jobs out of the

U.S.

Like presidents including Ronald Reagan and Barack Obama before

him, Mr. Trump is trying to take credit for using the leverage of

the government to save industrial jobs. But Mr. Trump's gambit is

unusual, both for the way he zeroed in on a single company, and the

fact that the inducement will be provided by the state of Indiana,

before his term even begins.

What Mr. Trump described as his ability to bring outsourcing

corporations to heel has emerged as a compromise that will see a

break on corporate taxes in exchange for a commitment to keep some,

but not all, manufacturing jobs from leaving.

"CEOs are trying to figure it out," said Hal Sirkin, a senior

partner at Boston Consulting Group in Chicago, adding he had

discussed with half a dozen executives how Mr. Trump's

administration might affect their plans to move production outside

the U.S.

Many firms are likely to take their chances for the cost savings

of cheap labor and robust supply chains in Mexico, China and

elsewhere. Several companies—including at least three with plants

in Indiana—this year have announced plans to lay off workers or

phase out factories to move production abroad.

It is unlikely that these firms would change their plans,

according to Jeffrey Hammond, an industrial sector analyst for

KeyBanc Capital Markets. "The labor cost savings are significant

and the disincentive to not move would have to be pretty good," he

said.

Sen. Bernie Sanders said Mr. Trump "has signaled to every

corporation in America that they can threaten to offshore jobs in

exchange for business-friendly tax benefits and incentives."

Government and union officials say Carrier has previously said

it expected to save about $65 million a year by shifting the

Indianapolis plant's operations to Monterrey, in the state of Nuevo

Leon, where wages average about $11 a day. The average wage of the

Indiana jobs that will be retained is more than $30 an hour,

according to a document reviewed by the Journal.

Caterpillar Inc. is moving forward with a plan to cut 230 jobs

by 2018 at the Joliet, Ill., factory where workers make oil pumps

and valves, a spokeswoman said. Some of the plant's production has

been slated to move to Mexico.

Industrial conglomerate Rexnord Corp., commercial kitchen

equipment maker Manitowoc Foodservice Inc. and electronics

component maker CTS Corp. have announced plans this year to move

some operations abroad from Indiana. Rexnord intends to move

production of industrial bearings from Indianapolis to Monterrey.

The move, expected by the middle of next year, would eliminate

about 300 jobs in Indianapolis.

The United Steelworkers union, which represents hourly workers

at the plant, said Rexnord rejected the union's proposals for wage

freezes and other concessions to lower costs. The union said the

hourly wages at the plant, which currently range from $18.82 to

$30.81, would have to drop below the U.S. minimum to match the

company's estimated costs savings in Mexico. Rexnord didn't respond

to requests for comment.

Manitowoc is moving production from a plant in Clark County,

Ind., to Mexico. About 84 jobs will be eliminated by early next

year. Manitowoc, which split from its Wisconsin-based construction

crane parent early this year, is consolidating plants throughout

the world. The company declined to comment.

Mr. Obama has defended his administration's bailout of the auto

industry as a keystone of his economic legacy, and suggested it

preserved millions of jobs. Mr. Reagan slapped a tariff increase on

foreign-built motorcycles in 1983, aiding Harley-Davidson Motor

Co., then the only domestic motorcycle manufacturer.

As much as Mr. Trump celebrated Carrier's decision to keep jobs

in the U.S., the president-elect didn't back down from his tough

talk on the campaign trail over penalizing companies that move

offshore. He said Thursday he would seek to heavily tax companies

that fire U.S. workers, move production offshore and try to import

goods across the border.

Some economists called Mr. Trump's actions, including an earlier

agreement with Ford Motor Co. to keep some production at a Kentucky

plant, an unsustainable intervention in the economy.

"If this is what the Trump team thinks macroeconomic policy is,

then they don't understand the scale of the economy," said Justin

Wolfers, a professor of economics and public policy at the

University of Michigan.

The economy currently loses nearly 7 million jobs a quarter

through the churn of companies failing, closing or leaving the

U.S., Mr. Wolfers said, citing data from the Bureau of Labor

Statistics. "Firms contracting or leaving a market is the natural

state of business."

The more pressing issue for the incoming administration would be

to find ways to encourage more private job creation, rather than

trying to intervene to prevent individual firms from leaving or

shutting down. "Deal-making is not macroeconomic policy," Mr.

Wolfers said. "We should understand it's politics, not

economics."

"I want to tell all of the other companies—know that we are

going to do great things for businesses," he said. There is "no

reason for them to leave anymore."

While the incoming administration has stopped about 800 Carrier

jobs from moving to Mexico, it would have to stop 14,000 additional

jobs from leaving the country this year to reverse the effects of

Nafta.

A study published by the Peterson Institute for International

Economics estimated that imports from Mexico have displaced 203,000

jobs a year, but the two-way trade has also supported 188,000 jobs

due to U.S. exports headed to Mexico. That's a net 15,000 jobs lost

annually—a tiny fraction of U.S. employment, according to the 2014

study.

Some economists, pointing to the $61 billion U.S. trade deficit

with Mexico, say Nafta is responsible for a higher number of job

losses. But most agree that imports from China, where the trade

deficit measured $367 billion last year, are a bigger problem for

the U.S. economy.

"If this is a sign of enforcement of trade laws and wanting to

have domestic manufacturing, we welcome it," said Leo Gerard,

president of the United Steelworkers union, in an interview late

Wednesday. Mr. Gerard said the union kept the planned Carrier plant

closing "as a hot-potato political issue."

Democratic Sen. Joe Donnelly of Indiana said the company was

seeking cheaper labor—not relief from regulation—when it decided to

close the Carrier factory. Mr. Donnelly said he called Carrier

executives the day the closure was announced, after seeing press

reports that said the closure was driven by unhappiness over

government regulation.

"I had never gotten a call from anybody in the company about any

regulation problems or any issues they had regarding regulations,"

Mr. Donnelly said. "It was basically an excuse that was used. This

has been about chasing three-dollar-an-hour wages in Mexico from

the start."

Bob Tita, Andrew Tangel and Will Mauldin contributed to this

article.

Write to Ted Mann at ted.mann@wsj.com, Damian Paletta at

damian.paletta@wsj.com and Andrew Tangel at

Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

December 02, 2016 01:55 ET (06:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

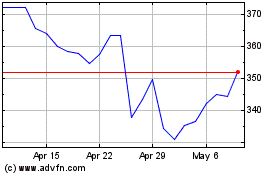

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

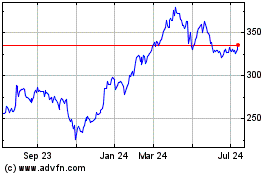

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024