Caterpillar Says Sales Woes Could Linger -- 4th Update

October 25 2016 - 4:42PM

Dow Jones News

By Andrew Tangel

Caterpillar Inc., the world's largest maker of mining and

construction equipment, is predicting another tough year in 2017 as

the company deals with the fallout from the global commodities bust

and prepares for a transition in top leadership.

The Peoria, Ill.-based manufacturing giant said Tuesday that

next year's revenue from sales of its hulking yellow bulldozers,

trucks and other heavy machines won't be "significantly different"

from the about $39 billion in sales expected for all of 2016, its

fourth straight year of declines.

Executives pointed to persistent weak demand for its

construction, mining and oil equipment around the world amid a

continued slump in commodities prices, idle locomotives and trucks

and a glut of used machines.

"We've been through an awful, rough period the last four years,"

said Caterpillar Chairman and Chief Executive Doug Oberhelman, who

last week said he would step down. "But I do think we're set up for

the future."

Caterpillar's travails are likely to continue well into the

tenure of Jim Umpleby, who is slated to take over as CEO in

January.

But the company pointed to optimistic signs for the latter half

of 2017: commodity prices are off their lows, there are signs of

improvement in the Chinese construction market, and construction

sales in Russia and Brazil are likely bottoming. Caterpillar's

stock price has outperformed in 2016, with shares up about 24% so

far this year compared with about 5% for the broader S&P 500.

Caterpillar shares fell about 2% to $84.48 in Tuesday trading.

Construction activity and equipment sales in North America are

expected to continue falling short of predictions, and there is

continued uncertainty in Europe in the wake of the U.K.'s Brexit

vote.

In the third quarter, the company said revenue fell 16% to $9.2

billion from the prior year. The company faces potential noncash

hits to earnings in the final quarter of the year that could lead

the company to report its first full-year loss since 1992.

When Mr. Oberhelman steps down as CEO next year, his role will

be split into two. With Mr. Umpleby as CEO, Dave Calhoun, a New

York private-equity executive, will become chairman when Mr.

Oberhelman steps down from that role at the end of March.

Mr. Oberhelman noted there was shareholder support for splitting

the top jobs in a Tuesday call with analysts. He also said there

was "no drama" over the leadership transition, adding that he

picked the timing of his retirement and new management structure,

which he referred to as "just a different way of doing things." Mr.

Oberhelman didn't elaborate on why the board decided to split the

jobs.

Mr. Umpleby, for his part, said he would "pull together a team

of leaders that will refresh our enterprise strategy in the coming

months." He didn't take questions.

Overall for the third quarter, Caterpillar reported a profit of

$283 million, or 48 cents a share, down from $559 million, or 94

cents a share, a year earlier. Excluding restructuring costs,

earnings per share fell to 85 cents from $1.05 a year ago.

Caterpillar on Tuesday also trimmed its profit outlook for the

year, saying it expects earnings per share of $2.35, or $3.25

excluding restructuring costs.

The company indicated it could report a loss for all of 2016

because of an expected accounting adjustment in the fourth quarter

related to pension and postretirement benefit costs. The company

said the adjustment, which wasn't included in this year's outlook,

could amount to a hit of $2 billion to this year's posttax

earnings, according to the company.

Executives said Caterpillar may face a fourth-quarter write-down

of goodwill related to the company's 2011 purchase of Milwaukee

mining-equipment maker Bucyrus International Inc. in an $8.8

billion-deal, Caterpillar's largest.

But they said impairment charge would likely be limited to a

$1.2 billion portion of Bucyrus-related goodwill estimated at $3.6

billion.

The company is in the midst of a restructuring that is expected

to result in the closure of consolidation of 20 plants by the end

of 2018.

Caterpillar continued to shrink its workforce in the third

quarter, to 97,100 full-time employees, down from the 108,900

full-time employees it had a year ago.

Joshua Jamerson contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

October 25, 2016 16:27 ET (20:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

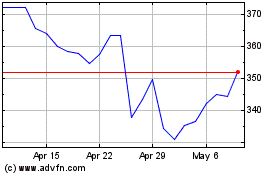

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

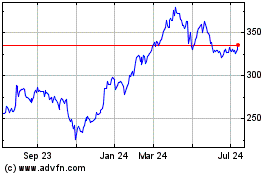

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024