Caterpillar Says Sales Woes Could Linger -- 2nd Update

October 25 2016 - 12:04PM

Dow Jones News

By Andrew Tangel

Caterpillar Inc., the world's largest maker of mining and

construction equipment, said it predicts 2017 will be as rough as

this year as the company suffers in the global commodities

bust.

The Peoria, Ill.-based manufacturing giant said Tuesday it

expects next year's revenue from sales of its hulking yellow

bulldozers, trucks and other heavy machines won't be "significantly

different" from the about $39 billion in sales it expects for all

of 2016, its fourth-straight year of declining revenue. The company

previously said it expected $40 billion to $40.5 billion in revenue

for 2016.

"Economic weakness throughout much of the world persists and, as

a result, most of our end markets remain challenged," Caterpillar

Chairman and Chief Executive Officer Doug Oberhelman said in a

prepared statement. The company indicated it could report a loss

for all of 2016 because of an expected accounting adjustment in the

fourth quarter related to pension and postretirement benefit

costs.

It would be Caterpillar's first annual loss since 1992,

according to a Caterpillar spokeswoman.

Caterpillar's outlook for 2017 provides the first glimpse into

the company's fortunes in the tenure of incoming CEO Jim Umpleby,

who is slated to take over Jan. 1. Caterpillar last week announced

Mr. Oberhelman would step down as the company reels from his bold

bet on the global commodities boom that ultimately backfired.

The company said the accounting adjustment could amount to a hit

of $2 billion, or $3.50 a share, to this year's posttax earnings.

The Caterpillar spokeswoman noted changing interest rates and

investment returns could affect the ultimate size of the expected

fourth-quarter adjustment.

Caterpillar also trimmed its profit outlook for the year, saying

it expects earnings per share of $2.35, or $3.25 excluding

restructuring costs. That forecast doesn't include the looming

adjustment.

Trouble continued for Caterpillar in the third quarter, with

revenue plunging 16% to $9.2 billion from the prior year as sales

of construction, mining and oil equipment remained weak. Mr.

Oberhelman cited an abundance of used construction equipment and

idle locomotives in North America, and idle mining trucks around

the globe.

Without an increase in orders, the company said the downturn

could stretch into the first half of next year. If commodity prices

stabilize or rise that could make for a rosier second half, it

said.

Caterpillar pointed to indications of hope: commodity prices off

their recent lows, signs of improvement in the Chinese construction

market and the likely bottoming of construction sales in Russia and

Brazil.

But the company said it hasn't seen an increase in orders for

new equipment. Construction activity and equipment sales in North

America also fell short of predictions, and there is continued

uncertainty in Europe in the wake of the U.K.'s Brexit vote.

"We remain cautious as we look ahead to 2017, but are hopeful as

the year unfolds we will begin to see more positive momentum," Mr.

Oberhelman said in the statement.

Over all for the third quarter, Caterpillar reported a profit of

$283 million, or 48 cents a share, down from $559 million, or 94

cents a share, a year earlier. Excluding restructuring costs,

earnings per share fell to 85 cents from $1.05 a year ago.

The company is splitting its top jobs and named Dave Calhoun, an

executive at a New York private-equity firm, as Caterpillar's next

chairman when Mr. Oberhelman steps down from that role at the end

of March.

Mr. Oberhelman embarked on an ambitious expansion that included

building new plants, beefing up the company's ranks and, in 2011,

buying Milwaukee mining-equipment maker Bucyrus International Inc.

in an $8.8 billion-deal, Caterpillar's largest.

But demand has dropped for Caterpillar's heavy machines around

the world. The company is in the midst of a restructuring that will

close or consolidate 20 plants by the end of 2018.

Caterpillar continued to shrink its workforce in the third

quarter, to 97,100 full-time employees, down from 100,000 three

months ago and significantly lower than the 108,900 full-time

employees it had a year ago.

Caterpillar's stock price has suffered. Shares are about flat

over the last five years, compared with a 75% rise by the broader

S&P 500. Caterpillar shares were down less than a percent to

$85.73 midday Tuesday.

Joshua Jamerson contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

October 25, 2016 11:49 ET (15:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

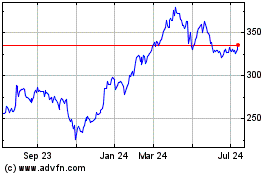

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

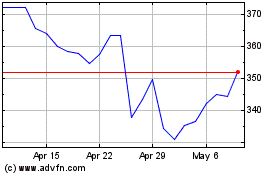

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024