Caterpillar Earnings Preview: What to Watch

October 24 2016 - 11:26AM

Dow Jones News

By Andrew Tangel

Caterpillar Inc. is due to report third-quarter earnings on

Tuesday, just over a week after announcing Chairman and Chief

Executive Doug Oberhelman would step down.

The world's largest manufacturer of mining and construction

equipment is wrestling with a downturn in the global commodities

markets and slowing Asian growth that has weighed on the broader

industrial sector. Here's what you need to know:

EARNINGS FORECAST: Wall Street analysts expect earnings per

share of 76 cents, according to Thomson Reuters, compared with 62

cents a share, or 75 cents a share excluding restructuring costs,

in the third quarter of last year. In July, Caterpillar again pared

its full-year outlook to about $2.75 a share, or about $3.55 a

share excluding restructuring costs. The company earned $3.50 per

share in 2015.

REVENUE FORECAST: Analysts expect $9.9 billion of revenue in the

quarter, down 10% from a year earlier. For 2016, Caterpillar said

in July it was predicting revenue of $40 billion to $40.5 billion,

down about 15%.

NEW LEADERSHIP: Investors may get their first sense of the new

era under Jim Umpleby, who is slated to take over as Caterpillar's

CEO on Jan. 1. The company has declined to say whether Mr. Umpleby

will be on a call with analysts after it releases third-quarter

earnings on Tuesday. Nevertheless, Mr. Oberhelman may shed light on

the board's decision to divide the CEO and chairman jobs for the

first time in 26 years. The split suggests the board wants a faster

turnaround of Caterpillar's fortunes, and wants greater

accountability at the top.

GLOBAL ECONOMY: Investors are likely to focus on whether the

company changes its full-year outlook, as well as providing 2017

guidance. This year is already on track to be Caterpillar's fourth

successive year of declining revenue. Caterpillar will offer

glimpses into signals of strength--or continued weakness--in the

construction, mining and energy industries where its hulking

bulldozers, trucks and other heavy machines are put to use.

Caterpillar reported bleak September sales on Monday, saying its

machine sales world-wide were down 18% from the prior year.

Investors will also be looking for any further hit to revenue

wrought by a strong dollar and any unfavorable currency

translations, such as from the British pound that weakened after

Brexit.

FUTURE SHAPE: Caterpillar plans to eliminate 10,000 jobs, about

10% of its workforce, and close or consolidate 20 plants by the end

of the 2018. The company had about 100,000 full-time employees at

the end of the second quarter, down from 111,200 the previous year.

The company has cut more than 5,300 positions so far and announced

the closing of a handful of smaller plants. Further restructuring

plans may not be announced until Mr. Umpleby outlines his strategy

in 2017.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

October 24, 2016 11:11 ET (15:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

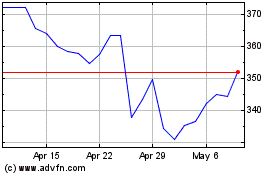

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

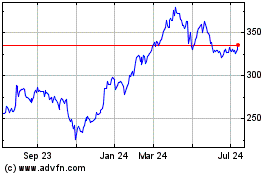

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024