Tough Choices for Caterpillar CEO -- WSJ

October 20 2016 - 3:03AM

Dow Jones News

Equipment maker's next boss must tackle unfinished downsizing as

global rivals rise

By Bob Tita and Andrew Tangel

Among Jim Umpleby's first tasks as Caterpillar Inc.'s chief

executive will be cleaning up the fallout from his predecessor's

expansion plans.

Doug Oberhelman, who is leaving the top job at the end of this

year after big money investments ran afoul of the global

commodities bust, has embarked on a cost cuts aiming to pare 10,000

jobs, $1.5 billion in annual expenses, and up to 20 plants through

2018.

Mr. Umpleby will preside in his first months as CEO over a

downsizing expected to last through next year. The 58-year-old

Caterpillar veteran also faces contract negotiations ahead of a

March 1 deadline with the equipment maker's United Auto Workers

union.

Those cutbacks and negotiations will set the stage for decisions

on how aggressively Caterpillar will chase the next boom in

construction and mining, or whether it will narrow the equipment

giant's focus to less-risky projects and higher-profit business

lines.

Caterpillar's sales of bulldozers, excavators, mining shovels

and huge dump trucks have declined for four consecutive years. Many

analysts expect them to fall again in 2017. Caterpillar faces a

tougher set of competitors in China and Japan that are ratcheting

up product lines and quality in expectation of a market

rebound.

Since 2013, Mr. Umpleby presided over Caterpillar's engines

business: a low-profile division that recently has been

Caterpillar's most profitable. Engines have accounted for up to

two-thirds of the company's annual operating profit in recent years

and 40% of its equipment sales.

Identifying pockets of strength in Caterpillar's cyclical

markets likely will define Mr. Umpleby's tenure, particularly if

demand for Caterpillar's earth-moving and mining equipment remains

soft.

In its engine business, "they could identify opportunities that

are not immediately obvious now," said Joe O'Dea, an analyst for

Vertical Research Partners LLC.

Despite 35 years at Caterpillar, Mr. Umpleby isn't well known at

the company's Peoria, Ill., headquarters because he spent most of

his time in San Diego and overseas. His ascent was a surprise to

some.

Mr. Umpleby wasn't available for comment. A Caterpillar

spokeswoman declined to say whether he would speak with analysts

next week after the company releases its third-quarter results.

The spokeswoman said Mr. Umpleby will be reviewing the company's

strategy with Caterpillar's leadership team in coming weeks. "You

should expect to hear more about the strategy in early 2017," she

said in an email, noting Messrs. Oberhelman and Umpleby will remain

in their current positions through the end of the year. "We're all

focused on finishing the year strong."

Colleagues described Mr. Umpleby, son of a steel mill foreman in

Highland, Ind., as a methodical manager and careful listener. Don

Ings, a former Caterpillar executive who has known Mr. Umpleby for

more than 30 years, said the company's fortunes may turn up during

his tenure.

"Doug was dealt a deck of cards," Mr. Ings said of Mr.

Oberhelman. "Jim's going to be lucky enough that his deck of cards

is going to include the upcycle [for machinery] and Caterpillar is

very, very-well positioned to achieve greatness during that

cycle."

Mr. Umpleby joined Caterpillar in 1981 through its acquisition

of Solar Turbines, a subsidiary prized for its high margins. He

later served as the San Diego-based business unit's president. The

oil-price decline has damped Solar's sales recently, but the

division hasn't slipped as much as other units.

"Those gas turbines continue to operate on offshore facilities,

oil and gas pipelines," Mr. Umpleby told investors at a conference

in August. "We're pleased with where we are at this point in the

year."

Mr. Umpleby will report to Dave Calhoun, an executive at

private-equity firm Blackstone Group LP who will replace Mr.

Oberhelman as board chairman at the end of March. It is the first

time Caterpillar will have a separate chairman and CEO in 26

years.

"If I had to pick a chairman of any company that needed turning

around, I'd pick Dave," said Jim Kilts, former Nielsen Holdings

chairman when Mr. Calhoun was its CEO.

Write to Bob Tita at robert.tita@wsj.com and Andrew Tangel at

Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

October 20, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

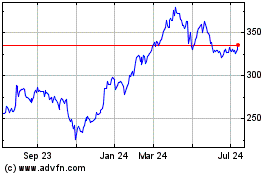

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

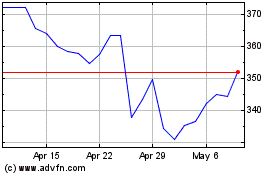

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024