By Ellie Ismailidou and Sara Sjolin, MarketWatch

San Francisco Fed's Williams says he backs rate increase 'sooner

rather than later'

U.S. stocks on Wednesday afternoon turned lower as investors

focused on a product announcement by Apple Inc. ahead of a key

report on U.S. economic conditions, which could help gauge the

Federal Reserve's next steps on U.S. interest rates.

The S&P 500 was down 5 points, or 0.2%, at 2,181, buoyed by

gains in energy shares, which were boosted by a rise oil prices

(http://www.marketwatch.com/story/oil-rallies-as-traders-brace-for-supply-data-2016-09-07).

But a 1% drop in consumer-staples stock weighed on the large-cap

gauge, led by a 13% drop in Sprouts Farmers Market Inc.(SFM), which

tumbled after it cut its quarterly and 2016 guidance

(http://www.marketwatch.com/story/sprouts-farmers-market-warns-on-outlook-2016-09-07).

The sharp dropped pulled other grocery retailers lower, most

notably Whole Foods Market Inc.(WFM) and Kroger Co.(KR).

The Dow Jones Industrial Average lost 45 points, or 0.2%, to

18,493, pressured by a 1.2% drop in Home Depot Inc.(HD) but boosted

by a 1.6% gain in Caterpillar Inc.(CAT).

And the tech-heavy Nasdaq Composite Index erased early gains to

turn negative, down 8 points, or 0.2%, at 5,267.

On the corporate front, all eyes were on Apple(AAPL) as it was

set to unveil its iPhone 7 at an event in San Francisco.

Apple shares were down 0.5% minutes ahead of the event. An

analysis from UBS found that the tech major's stock tends to trade

lower leading into its flagship September event, then rebounds in

the run-up to the actual release

(http://www.marketwatch.com/story/how-apples-stock-tends-to-trade-around-its-september-event-2016-09-06)

of the new hardware a few weeks later.

Read:How to get Apple's new iPhone 7 free

(http://www.marketwatch.com/story/how-to-get-apples-new-iphone-7-for-free-2016-09-03)

But overall, the market was largely"aimless" on Wednesday, said

Mike Antonelli, equity sales trader at Robert W. Baird & Co.,

leading investors to focus on "worries about the Fed" ahead of the

central bank's report on economic conditions, the so-called Beige

Book, scheduled for 2 p.m.

"When there's a distinct lack of catalyst, [the market] falls

back to thoughts about Fed action. That is the default state,"

Antonelli said.

Wednesday's muted action came after U.S. stocks logged small

gains on Tuesday

(http://www.marketwatch.com/story/us-stocks-set-to-open-higher-as-traders-return-from-holiday-2016-09-06)

when a disappointing services-sector report fueled expectations the

Fed won't raise interest rates at its Sept. 20-21 meeting.

San Francisco Fed President John Williams late Tuesday said he

still backs a rate increase "sooner rather than later,"

(http://www.marketwatch.com/story/feds-williams-still-backs-rate-hike-sooner-rather-than-later-2016-09-06)

repeating comments he made before the release of the disappointing

August jobs report.

(http://www.marketwatch.com/story/economy-adds-151000-new-jobs-in-august-2016-09-02)

(http://www.marketwatch.com/story/economy-adds-151000-new-jobs-in-august-2016-09-02)On

a more positive note, the Labor Department said on Wednesday that

job openings soared to an all-time high

(http://www.marketwatch.com/story/job-openings-soar-to-all-time-high-of-59-million-in-july-2016-09-07)of

5.9 million in July, a sign that the labor market is more

fluid.

Still, many investors were reluctant to believe that an

interest-rate hike was imminent. "I would discount what the Fed

governors are saying," said James Abate, chief investment officer

at Centre Asset Management LLC.

Recent data, including weak reports on gross-domestic-product

growth, industrial productions and capital spending, suggest that

"the Fed is in the box," as policy makers are hinting at a

potential rate hike, which the economic cycle is "in a period of

deceleration.

"Given the declines in both the ISM factory and services surveys

in August, comments from regional Fed banks about the degree of

cooling in those sectors could aid in determining whether the weak

ISM prints in August truly reflect weaker conditions," , Société

Générale analysts said in a note.

But regardless of what the Fed does, there is ample bearishness

among investors based on the usual suspects of ultraloose monetary

policy by dovish central banks across the world, investor

complacency and suppressed volatility, said Kent Engelke, chief

economic strategist at Capitol Securities Management.

In this context, a 25-basis-point interest rate hike wouldn't be

a fundamental reason for a market collapse--but rather an emotional

trigger for investors, Engelke added.

Movers and shakers:Chipotle Mexican Grill Inc.(CMG) jumped 4.7%

after Bill Ackman's Pershing Square Capital Management LP late

Tuesday disclosed it has bought a 9.9% stake in the fast food chain

(http://www.marketwatch.com/story/bill-ackmans-pershing-square-takes-big-stake-in-chipotle-2016-09-06).

Advanced Micro Devices Inc.(AMD) lost 5.9%, after late Tuesday

announcing plans to raise more than $1 billion

(http://www.marketwatch.com/story/amd-plans-stock-offering-while-trading-near-5-year-high-shares-drop-2016-09-06)

through a stock and debt offering.

Other markets: Stocks in Asia closed mixed

(http://www.marketwatch.com/story/asian-stocks-make-gains-though-soaring-yen-weighs-on-nikkei-2016-09-07),

but Japan's Nikkei was shoved 0.4% lower, pressured by a stronger

yen.

European markets

(http://www.marketwatch.com/story/european-stocks-seesaw-after-german-industrial-data-disappoint-2016-09-07)

were mostly higher, but struggled for firm direction.

Gold moved lower, while the dollar traded mixed against other

major currencies

(http://www.marketwatch.com/story/dollar-slides-against-yen-on-boj-easing-skepticism-2016-09-07)

(http://www.marketwatch.com/story/dollar-slides-against-yen-on-boj-easing-skepticism-2016-09-07)but

fell markedly against the yen on growing skepticism that the Bank

of Japan may not be able to take aggressive easing measures at its

policy meeting later this month.

(END) Dow Jones Newswires

September 07, 2016 13:10 ET (17:10 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

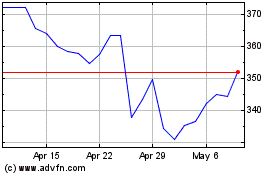

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

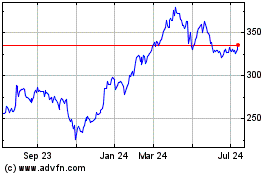

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024