Caterpillar CEO's 2015 Pay Package Reached $17.9 Million -- Update

April 25 2016 - 11:39AM

Dow Jones News

By Tess Stynes and Bob Tita

Caterpillar Inc. said Chief Executive Doug Oberhelman's

compensation for 2015 rose 4.5% to $17.9 million, but his

performance-based pay plunged as the construction equipment maker's

sales and profit fell in the face of weak markets.

Mr. Oberhelman's non-equity incentive pay for 2015 dropped to

$822,804 last year from $4.9 million in 2014, according to the

company's annual proxy statement. Other top executives received

sharply lower incentive pay as well "based primarily on severe

market downturns in mining, energy and oil and gas" and the

company's declining performance in recent years, the proxy

said.

The Peoria, Ill.-based company's annual sales have contracted

for three straight years and the company is forecasting lower sales

for 2016 as well. The company on Friday lowered its outlook for

2016 amid ongoing sales weakness in key markets. Caterpillar now

expects revenue of $40 billion to $42 billion this year after

chopping $2 billion from the top end of its earlier revenue range.

Caterpillar expects per-share profit this year of $3.00, or $3.70

excluding restructuring costs, down from its previous outlook of

$3.50, or $4.00 without restructuring expenses.

Mr. Oberhelman's base salary last year was flat with 2014 at

$1.6 million. His overall compensation increased because of larger

awards of stock and options. He received stock and options worth

$13 million when they were issued, compared with $8.4 million in

2014 when he received only options.

Mr. Oberhelman has served as CEO since July 2010. Executive pay

at Caterpillar has come under scrutiny. Last year, proxy advisers

Glass Lewis & Co. and Institutional Shareholder Services Inc.,

along with the union-affiliated CtW Investment Group, had urged

shareholders to vote against Caterpillar's compensation

policies.

In an unusually stinging rebuke, around a third of the votes

cast by Caterpillar shareholders at the annual meeting in June

rejected the heavy-equipment maker's executive-compensation

policies. The company defended its pay policies, saying that it

tied compensation closely to performance and that executives

deserved raises because they reduced costs and gained market

share.

Write to Tess Stynes at tess.stynes@wsj.com and Bob Tita at

robert.tita@wsj.com

(END) Dow Jones Newswires

April 25, 2016 11:24 ET (15:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

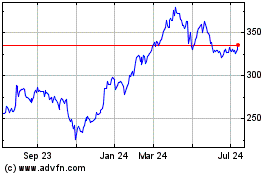

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

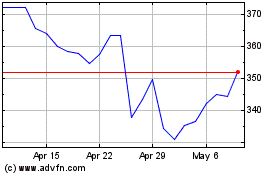

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024