Caterpillar Pares Guidance Amid Sluggish Demand -- 2nd Update

April 22 2016 - 5:23PM

Dow Jones News

By Bob Tita

Caterpillar Inc. said on Friday that sales of its construction

machinery in China are starting to improve, though still-sluggish

global commodity markets forced the company to cut its full-year

profit and revenue forecasts.

The world's largest heavy-equipment maker and rivals

aggressively expanded production in China after the 2008 recession

on a wave of government-directed construction of highways,

airports, power plants and skyscrapers, only for spending to dry up

in 2012.

Caterpillar Chief Executive Doug Oberhelman, who visited China

last month, said modest government stimulus spending on

infrastructure projects had lifted the company's spring equipment

shipments there for the first time in at least three years.

Equipment demand also is rising ahead of China's new emissions

standards for engines that are expected cause higher prices for

machinery.

"I'm very cautious about how far [the demand] goes," said Mr.

Oberhelman on an investor call. "We're going to have to watch this

month by month."

He said orders at a big annual trade show in Germany last month

were above expectations, and added that feedback from European

clients was much more positive than in recent years.

Caterpillar is facing the fourth straight year of falling sales

of its trademark yellow bulldozers, excavators, mining trucks and

engines. The company is trimming thousands of jobs to cut

costs.

And executives cautioned against interpreting some of the

brighter market signals as evidence of a sustained recovery in the

global equipment market for construction and mining.

Business conditions remain challenging in most of Caterpillar's

markets. The rising volume of commercial and residential

construction in the U.S. typically drive higher demand for

construction machinery, but Caterpillar's North American sales in

the sector fell 18% from a year ago, weighed down by a glut of used

machinery pulled from idle frack oil and natural gas fields.

The recent uptick in commodity prices also hasn't spurred its

mining equipment business, with sales down 26% in the quarter. The

energy slowdown and overcapacity in the U.S. rail industry pushed

its engine sales down by a third.

Caterpillar expects prices for its equipment to fall about 1%

this year, double its previous forecast. With rivals such as Volvo

AB and Komatsu Ltd. struggling against excess inventories and weak

demand as well, Caterpillar said it won't risk losing market share

to rivals.

The company reported a profit of $271 million for the quarter

ended March. 31, compared with $1.25 billion a year earlier. Sales

fell 26% to $9.5 billion.

Caterpillar expects sales this year of $40 billion to $42

billion after chopping $2 billion from the top end of its forecast.

Caterpillar expects per-share profit this year of $3.00, or $3.70

excluding restructuring costs, down from its previous outlook of

$3.50 excluding restructuring expenses.

Its stock price, which has rallied by a third from its January

low, closed Friday at $78.32 a share, down 34 cents, or 0.4%, from

a day earlier.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

April 22, 2016 17:08 ET (21:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

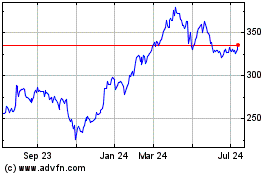

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

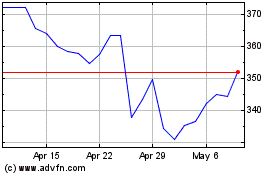

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024