By Ellie Ismailidou and Sara Sjolin, MarketWatch

Facebook, Under Armour leap on strong earnings

U.S. stocks dipped in and out of positive territory Thursday as

early oil-fueled gains melted and investors a weaker-than-expected

reading on the U.S. economy.

The S&P 500 was down 1 point or less than 0.1%, at 1,881,

after briefly hitting the psychologically important level of 1,900

in early trade. The Dow Jones Industrial Average was down 45

points, or 0.3%, at 15,895, after an early gain of 120 points. The

Nasdaq Composite rose 8 points, or 0.2%, at 4,475.

Stocks rallied at the open as crude oil futures leapt more than

7% following unconfirmed reports that Russia and the Organization

of the Petroleum Exporting Countries may cut output. But after a

news report

(http://www.marketwatch.com/story/oil-pushes-lower-again-as-us-crude-inventories-jump-2016-01-28)that

said OPEC officials denied plans for a meeting with Russia over

potential output cuts, both stocks and oil prices gave up gains.

While stocks now hover around break-even, oil prices are still

higher for the day.

Watch this MarketWatch video chat: How to know when oil has hit

bottom?

(http://www.marketwatch.com/story/how-to-know-when-oil-has-hit-bottom-live-video-chat-with-experts-2016-01-27)

The heightened volatility in the equity market reflects that

"there are a lot of variables in play and different investors tease

out the data that will support their thesis," said Dan Farley, an

investment strategist at U.S. Bank Wealth Management.

One drag on stocks is a steeper-than-expected slide in orders

for durable goods that could mean the economy shrank

(http://www.marketwatch.com/story/durable-goods-orders-decline-could-mean-economy-shrank-in-fourth-quarter-2016-01-28)

in fourth quarter. Orders for long-lasting goods slid 5.1% in

December

(http://www.marketwatch.com/story/durable-goods-orders-slide-51-in-december-2016-01-28),

well below the 1.5% forecasted decline. That data come a day after

the Federal Reserve recognized a slowdown in the global

economy.

Still, oil's rebound gave a boost to energy companies' stocks,

and the energy sector led the S&P 500 early afternoon with a

1.9% gain. Chevron Corp. (CVX), up 1.5% and Exxon Mobil Corp.

(XOM), up 0.7%, were among the Dow's best performers.

Heavy-machinery maker Caterpillar Inc. (CAT), whose product

lines include equipment for the oil and gas industry, climbed 2.5%.

The company on Thursday reported fourth-quarter earnings that beat

expectations, but its sales fell short

(http://www.marketwatch.com/story/caterpillar-shares-rise-on-fourth-quarter-earnings-beat-2016-01-28).

Among other big moves in individual stocks, a 13.4% jump for

Facebook Inc. (FB) on the back of a well-received earnings report

(http://www.marketwatch.com/story/facebook-shares-surge-as-quarterly-profit-tops-1-billion-2016-01-27)

helped lift the Nasdaq. And shares of Under Armour Inc. (UA) jumped

19.5% after the athletic apparel company beat fourth-quarter profit

and revenue expectations

(http://www.marketwatch.com/story/under-armours-stock-soars-after-results-beat-expectations-upbeat-outlook-2016-01-28).

Read:It's 'impossible to deny Facebook's momentum'

(http://www.marketwatch.com/story/its-impossible-to-deny-facebooks-momentum-analyst-2016-01-28)

U.S. stocks throughout January have moved mostly in lockstep

with swings in oil as the ultralow prices were feared to trigger

defaults in the energy sector, freeze credit lines and destroy

wealth in emerging markets, such as Russia, Saudi Arabia and

Brazil.

"There's two key factors driving markets at the moment, the Fed

and oil," said Craig Erlam, senior market analyst at Oanda, in

emailed comments.

"As we've seen a lot this year already, oil can be quite

volatile and should we see it take a turn for the worse, I would

expect U.S. indexes won't be far behind," he said.

On Wednesday, U.S. stocks diverted from oil's direction and

ended lower after the latest Federal Reserve decision

(http://www.marketwatch.com/story/us-stocks-set-to-open-lower-as-investors-wait-for-fed-rate-call-2016-01-27).

The central bank, in its Wednesday policy statement, left the

door open for an interest-rate increase in March, but still hinted

that it isn't likely to tighten policy again so soon in the mist of

global economic turmoil. Investors lowered their bets of a March

rate rise after the meeting, with the CME Group federal-fund

futures

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html)indicating

a 25% likelihood of a March hike on Thursday, down from 34% ahead

of the Fed's statement on Wednesday.

Economic data:Pending home sales eked out a small gain in

December

(http://www.marketwatch.com/story/pending-home-sales-inch-up-01-in-december-2016-01-28),

signaling moderate homebuying activity ahead, but falling short of

economists' expectations. The labor market, however, continues to

do fairly well. Initial jobless claims fell last week

(http://www.marketwatch.com/story/us-jobless-claims-fall-16000-to-278000-2016-01-28)

after touching a seven-month high earlier in January.

Movers and shakers: eBay Inc. (EBAY) tumbled 13.3% after the

online marketplace late Wednesday reported a drop in sales

(http://www.marketwatch.com/story/ebay-reports-another-drop-in-revenue-2016-01-27-164853749).

Apple Inc. (AAPL) dropped 0.4% following a 6.6% slump on

Wednesday that came after the quarterly earnings report showed

slower iPhone sales growth

(http://www.marketwatch.com/story/iphone-sales-slip-as-apples-growth-boom-ends-2016-01-26).

Alibaba Group Holding Ltd. (BABA) reversed premarket gains and

tumbled 1.4% after the open. The China-based e-commerce giant

reported fiscal third-quarter profit and sales that rose above

expectations

(http://www.marketwatch.com/story/alibabas-stock-surges-after-profit-sales-beat-2016-01-28).

(http://www.marketwatch.com/story/caterpillar-shares-rise-on-fourth-quarter-earnings-beat-2016-01-28)Time

Warner Cable Inc. (TWC) was up 1.2% after the company reported

sales and profit that bested expectations.

Drugmaker Eli Lilly & Co. (LLY) was down 2.7% after the

drugmaker reported adjusted earnings that met Wall Street's

forecast

(http://www.marketwatch.com/story/eli-lilly-meets-earnings-forecasts-sticks-to-2016-guidelines-2016-01-28),

though revenue fell slightly short.

Ford Motor Co. (F) shares reversed premarket gains to trade down

3%. The car maker reported it swung to a profit

(http://www.marketwatch.com/story/ford-swings-to-profit-on-strength-in-namerica-2016-01-28)

in the fourth quarter.

After the closing bell, Amazon.com Inc. (AMZN), Visa Inc. (V)

and Microsoft Corp. (MSFT) are expected to report earnings.

Other markets: Chinese stocks closed at the lowest level in over

a year, as investors digested the Fed statement. Other Asian

markets closed mixed

(http://www.marketwatch.com/story/asian-stocks-unsettled-as-markets-ponder-fed-statement-2016-01-27).

Markets in Europe

(http://www.marketwatch.com/story/european-stocks-fall-as-earnings-fed-weigh-2016-01-28)

were covered in a sea of red, with several heavyweight companies

adding pressure after announcing results.

Gold wavered, while the dollar dropped against most other

currencies.

(http://www.marketwatch.com/story/dollar-could-head-towards-116-if-bank-of-japan-does-nothing-friday-2016-01-28)

(END) Dow Jones Newswires

January 28, 2016 12:19 ET (17:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

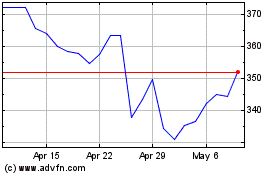

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

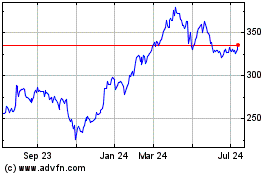

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024