By Dan Strumpf

U.S. stocks finished lower but pared their steepest intraday

declines, as worries over slowing global growth lingered.

Stocks remain stuck in low gear following a late August selloff,

and last week's decision by the Federal Reserve to keep rates near

zero affirmed investor fears that growth had hit a rough patch.

A selloff in shares of Caterpillar Inc. weighed on broad indexes

after the industrial bellwether issued a deep cut to its revenue

forecast for the year, citing a downturn in its mining and energy

businesses.

U.S. shares pulled back from their deepest intraday declines.

The Dow Jones Industrial Average fell 78.57 points, or 0.5%, to

16201.32, bouncing back from a loss of as much as 264 points

earlier in the session.

"We're very much counseling caution and patience right here,"

said Willie Delwiche, investment strategist at Baird's $152 billion

private wealth management business.

The S&P 500 lost 6.52 points, or 0.3%, to 1932.24, while the

Nasdaq Composite shed 18.27 points, or 0.4%, to 4734.48.

Bond prices rose, sending the yield on the 10-year Treasury note

to 2.125% from 2.144% Wednesday. The yield on the benchmark note

earlier sank to its lowest level in nearly a month.

Other haven assets rallied. Gold futures rose 2% to $1,153.80 a

troy ounce, notching its biggest two-day percentage gain since Aug.

21.

Traders said the selloff in Caterpillar shares was a major focus

for many investors on Thursday. The company's business lines, from

construction to energy to commodities, are closely linked to the

global economy, particularly demand from China.

"They're such a large company--how do you miss that badly?" said

Justin Wiggs, managing director of equity trading at Stifel

Nicolaus. "And how does everyone else dodge that?"

Caterpillar shares fell $4.40, or 6.3%, to $65.80, notching the

biggest loss in the Dow. Industrial companies in the S&P 500

fell 0.7%.

But other sectors were higher. Energy shares in the S&P 500

added 0.4% as oil prices reversed earlier losses. U.S. crude-oil

futures rose 1% to $44.91 a barrel.

U.S. stocks have seen wide swings in recent sessions since a

late August slide sent major indexes into "correction" territory,

marked by a decline of 10% or more from a recent peak. Although

near-zero interest rates have helped juice the six-year-old bull

market in stocks, the Fed's announcement last week to keep rates

unchanged left many investors unnerved. The central bank voiced

concerns about a growth slowdown overseas.

Despite worries over global growth, many investors note that, by

many measures, the U.S. economy remains on track. Job growth has

expanded and the unemployment rate is creeping down toward 5%.

Inflation, however, is subdued and corporate profit growth has

slowed drastically. Earnings among S&P 500 companies contracted

in the second quarter for the first time since 2012, falling 0.5%.

Analysts expect profits to fall another 4.5% in the third quarter,

according to FactSet.

"The market is driven by company earnings and company earnings

have not moved forward this year," said Karyn Cavanaugh, senior

market strategist at Voya Investment Management. "We're profit

challenged right now."

Health-care stocks declined as the biotechnology sector notched

another steep loss. The Nasdaq Biotechnology Index fell 2%, its

fifth consecutive loss. Shares of Gilead Sciences Inc. fell 2.98,

or 2.8%, to 102.51. Celgene Corp. lost 3.16, or 2.7%, to

113.88.

In economic news, initial jobless claims rose by 3,000 to

267,000 in the week ended Sept. 19, the Labor Department said

Thursday, a level consistent with an improving labor market.

Economists had expected 275,000 new claims.

Orders for big-ticket items fell in August, a sign that the

strong dollar and economic weakness overseas may be crimping demand

for American goods. New orders for durable goods fell 2% in August

from a month earlier, the Commerce Department said Thursday.

Economists had expected orders to fall 2.5%.

"The uncertainty from the Fed and the lack of confidence in the

U.S. economy speaks volumes," said Mr. Delwiche.

The Stoxx Europe 600 fell 2.1%, dragged down by losses in the

auto sector amid the Volkswagen AG emissions scandal.

Shares in Japan fell sharply as trading resumed after a

three-day holiday. The Nikkei Stock Average closed down 2.8%,

catching up with declines in global markets over recent sessions.

China's Shanghai Composite Index closed 0.9% higher.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

September 24, 2015 17:37 ET (21:37 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

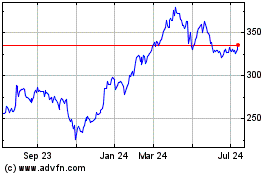

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

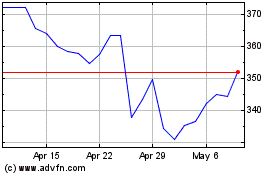

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024