|

| |

| |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 |

FORM 11-K |

(Mark One) | |

[X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 |

OR |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________. |

Commission File No. 1-768 |

CATERPILLAR RAIL DIVISION RETIREMENT SAVINGS PLAN FOR COLLECTIVELY BARGAINED EMPLOYEES (Full title of the plan and the address of the plan, if different from that of the issuer named below) |

CATERPILLAR INC. 100 NE Adams Street, Peoria, Illinois 61629 (Name of issuer of the securities held pursuant to the plan and the address of its principal executive office) |

|

Caterpillar Rail Division Retirement

Savings Plan for Collectively

Bargained Employees

Financial Statements and Supplemental Schedule

December 31, 2014 and 2013

|

| | |

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees | |

Index | |

| |

| Page(s) |

Report of Independent Registered Public Accounting Firm | |

Financial Statements | |

| |

| |

| |

Supplemental Schedule | |

| |

| |

Exhibit Index | |

23.1 - Consent of Independent Registered Public Accounting Firm | |

| |

Note: Other schedules required by 29 CFR 2520.103-10 of the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted because they are not applicable. | |

Report of Independent Registered Public Accounting Firm

To the Participants, Plan Administrator

and Benefit Funds Committee of the

Caterpillar Rail Division Retirement

Savings Plan for Collectively Bargained

Employees

In our opinion, the accompanying statements of net assets available for benefits and the related statement of changes in net assets available for benefits present fairly, in all material respects, the net assets available for benefits of the Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees (the “Plan”) at December 31, 2014 and 2013, and the changes in net assets available for benefits for the year ended December 31, 2014 in conformity with accounting principles generally accepted in the United States of America. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

The supplemental Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2014 has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2014 is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ PricewaterhouseCoopers LLP

Peoria, Illinois

June 26, 2015

|

| | | | | | | | |

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees |

Statements of Net Assets Available for Benefits December 31, 2014 and 2013 |

| | | | |

(in thousands of dollars) | | 2014 | | 2013 |

Investments | | | | |

Interest in the Master Trust | | $ | 24,044 |

| | $ | — |

|

Fixed income investment contract | | — |

| | 1,270 |

|

Total investments | | 24,044 |

| | 1,270 |

|

Receivables | | | | |

Notes receivable from participants | | 1,696 |

| | 1,375 |

|

Participant contributions receivable | | 39 |

| | 91 |

|

Employer contributions receivable | | 1,343 |

| | 1,624 |

|

Total receivables | | 3,078 |

| | 3,090 |

|

| | | | |

Cash | | 57 |

| | 19,172 |

|

| | | | |

Total assets | | 27,179 |

| | 23,532 |

|

Liabilities | | | | |

Excess contributions due to participants | | — |

| | (24 | ) |

Excess contributions due to employer | | — |

| | (8 | ) |

Total liabilities | | — |

| | (32 | ) |

| | | | |

Net assets available for benefits, at fair value | | 27,179 |

| | 23,500 |

|

Adjustment from fair value to contract value for the Master Trust's investment in fully benefit-responsive synthetic guaranteed investment contracts | | (2 | ) | | — |

|

Net assets available for benefits | | $ | 27,177 |

| | $ | 23,500 |

|

| | | | |

The accompanying notes are an integral part of these financial statements. |

|

| | | | | | |

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees |

Statement of Changes in Net Assets Available for Benefits Year Ended December 31, 2014 |

| | | | |

(in thousands of dollars) | | | | 2014 |

Investment income (loss) | | | | |

Plan interest in net investment income (loss) of the Master Trust | | | | $ | 1,281 |

|

Interest income | | | | |

Notes receivable from participants | | | | 51 |

|

Contributions | | | | |

Participant | | | | 2,451 |

|

Employer | | | | 2,041 |

|

Total contributions | | | | 4,492 |

|

Deductions | | | | |

Participant withdrawals | | | | (2,083 | ) |

Administrative expenses | | | | (64 | ) |

Total deductions | | | | (2,147 | ) |

| | | | |

Net increase (decrease) in net assets available for benefits | | | | 3,677 |

|

Net assets available for benefits | | | | |

Beginning of year | | | | 23,500 |

|

End of year | | | | $ | 27,177 |

|

| | | |

|

The accompanying notes are an integral part of these financial statements. |

|

|

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees |

Notes to Financial Statements December 31, 2014 and 2013 |

The following description of the Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees (the "Plan") (f/k/a the Electro-Motive Diesel, Inc. Personal Savings Plan and Trust for Hourly-Rate Employees) provides only general information. Participants should refer to the Plan documents for more complete information regarding the Plan.

Effective December 31, 2013, the Progress Rail Services Corporation - Bargaining Unit 401(k) Plan and the Electro-Motive Diesel, Inc. Personal Savings Plan and Trust for Legacy Employees were merged with and into the Plan and $9.5 million of net assets available for benefits were transferred to the Plan.

Effective January 1, 2014, the Plan was amended, restated and renamed the Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees. In addition, the Plan became a participating plan in the Caterpillar Investment Trust, and as a result, The Northern Trust Company (the "Trustee") serves as trustee of the Plan. On January 2, 2014, $20.5 million of net assets of the Plan, consisting of $19.2 million of cash and $1.3 million of investments, were transferred to the Trustee.

General

The Plan is a profit sharing plan that includes a cash or deferred arrangement under Section 401(k) of the Internal Revenue Code ("IRC") and is an "employee stock ownership plan", within the meaning of IRC Section 4975(e)(7). The Plan is sponsored by Electro-Motive Diesel, Inc. ("EMD"), a 100 percent-owned subsidiary of Caterpillar Inc., and it enables eligible employees of EMD and EMD's subsidiaries and affiliates that adopt the Plan (the “participating employers”) to accumulate funds for retirement. The Plan is governed by the provisions of the Employee Retirement Income Security Act, as amended (“ERISA”).

Participation

The Plan is for the benefit of certain collectively bargained employees of EMD, Chemetron Railway Products, Inc. ("Chemetron"), United Industries Corporation ("UNI"), Progress Metal Reclamation ("PMR") and certain employees of their subsidiaries and affiliates that adopt the Plan. Participating eligible employees (the "participants") may elect to defer a portion of their eligible compensation through pre-tax contributions and in certain circumstances after-tax contributions. Eligibility to participate in the Plan varies based upon the terms of the applicable collective bargaining agreements. Participants should refer to the applicable supplement to the Plan document for further information.

Changes to Investment Options

On December 15, 2014, the core investment options and the model portfolios available under the Plan were replaced with a series of custom target date retirement funds (the “Target Retirement Funds”) and a new menu of core investment options. A re-election window was provided to allow participants to make an active election to direct how existing balances and future contributions would be invested in the new investment option line-up. On December 15, 2014, existing balances and future contributions were automatically invested in the Target Retirement Fund closest to the year in which the participant turns age 65, unless a different investment election was made by the participant during the re-election window. Existing balances and future contributions in the Caterpillar Stock Fund were not subject to the default investment option and remained in the respective accounts. See Note 3 for further information on the investment options.

Contributions

All active Plan participants may elect to have a portion of their eligible compensation (as defined by the applicable supplement to the Plan document) contributed to the Plan as a pre-tax 401(k) contribution. Also, certain participants may elect to designate contributions as after-tax Roth 401(k) contributions and/or after-tax contributions. Participants who are at least 50 years old by the end of the calendar year are allowed to make a catch-up contribution for that year. Contributions are subject to certain limitations set by the IRC. The eligibility for the various contributions is based on the applicable collective bargaining agreements, as described below.

| |

• | EMD participants: Eligible to contribute up to 60 percent of eligible compensation as a pre-tax 401(k) contribution, after-tax Roth 401(k) contribution and/or after-tax contribution. |

| |

• | Chemetron and UNI participants: Eligible to contribute up to 70 percent of eligible compensation as a pre-tax 401(k) contribution. |

| |

• | PMR participants: Eligible to contribute up to 16 percent of eligible compensation as a pre-tax 401(k) contribution. |

All Plan participants are eligible for employer matching contributions based on the applicable collective bargaining agreements, as described below.

| |

• | EMD participants: Equal to 50 percent of the participant's 401(k) contributions and after-tax contributions up to a maximum of 6 percent of eligible compensation. Matching contributions are not made on catch-up contributions. |

| |

• | Chemetron participants: Equal to 50 percent of the participant's 401(k) contributions up to a maximum of 3 percent of eligible compensation. Matching contributions are not made on catch-up contributions. |

| |

• | UNI participants: Equal to 65 percent of the participant's 401(k) contributions up to a maximum of 6 percent of eligible compensation or 50 percent of the participants 401(k) contributions up to a maximum of 5 percent of eligible compensation. Participants should refer to their applicable supplement to the Plan document to determine which matching contribution they are eligible for. Matching contributions are not made on catch-up contributions. |

| |

• | PMR participants: Equal to 70 percent of the participant's 401(k) contributions up to a maximum of 5 percent of eligible compensation. Matching contributions are not made on catch-up contributions. |

In addition, EMD participants also are eligible for an annual employer non-elective contribution equal to 4.5 percent of the participant's eligible compensation to be made after the close of the Plan year. In order to receive the annual non-elective contribution, the participant must earn a 1,000 hours of service during the Plan year and be employed by EMD on the last day of the Plan year. The adopting employer may also make a discretionary employer non-elective contribution to the Plan for the Chemetron, UNI and PMR participants. The employers did not make any discretionary non-elective contribution for the 2014 Plan year. The EMD non-elective contribution is included as an Employer contributions receivable on the Statements of Net Assets Available for Benefits and was $1.3 million and $1.6 million for the 2014 and 2013 Plan years, respectively.

Participants direct the investment of their contributions, employer matching and employer non-elective contributions into various investment options offered by the Plan as discussed in Note 3. Participants generally may change their contribution elections and prospective investment elections on a daily basis and reallocate the investment of their existing account balance either daily or every seven business days (if subject to applicable trading restrictions) depending on the investment.

Participant Accounts

Accounts are separately maintained for each participant. The participant's account is credited with the participant's contributions, employer matching contributions, employer non-elective contributions, Plan earnings/losses and charged with administrative expenses. Participants are entitled to the benefit that can be provided from the participant's vested account.

Vesting and Distribution Provisions

Participants are fully vested in their participant contributions and earnings thereon. Employer matching contributions, employer non-elective contributions and the related earnings thereon have varying vesting schedules, as described below.

| |

• | EMD participants: Shall vest under the following schedule; provided, however, a participant becomes fully vested if he retires after incurring a disability, dies while actively employed by the adopting employer, dies while performing qualified military service, or terminates employment after attaining age 65. |

|

| |

Years of Service | Percentage Vested |

Less than 3 | 0% |

3 and more | 100% |

| |

• | All other Plan participants: Shall vest under the following schedule; provided, however, a participant becomes fully vested if he incurs a disability, dies while actively employed by the adopting employer, dies while performing qualified military service, or terminates employment after attaining age 65. |

|

| |

Years of Service | Percentage Vested |

Less than 1 | 0% |

1 | 20% |

2 | 40% |

3 | 60% |

4 | 80% |

5 and more | 100% |

Upon termination of employment for any reason, including death or retirement, the balance in participants' accounts is distributable in a single lump sum cash payment unless the participant (or beneficiary) elects to receive periodic withdrawals. Participants also have the option to leave their vested account balance in the Plan, subject to certain limitations. A participant also may elect to receive a distribution of shares of Caterpillar Inc. stock up to the amount of the participant's balance in the Caterpillar Stock Fund. The value of any full or fractional shares paid in cash will be based upon the average price per share the Trustee receives from sales of shares of Caterpillar Inc. stock for the purpose of making the distribution.

Employer contributions forfeited by terminated participants are used to reduce future employer contributions to the Plan. The amount forfeited and used to reduce future employer contributions for the year ended December 31, 2014 was approximately $190 thousand. As of December 31, 2014 and 2013 there were $57 thousand of forfeited account balances available to reduce future Company contributions.

Notes Receivable from Participants

The Plan provides for participant loans against eligible participant account balances. Eligible participants obtain loans by filing a loan application with the Plan's recordkeeper and receiving all requisite approvals. Loan amounts are generally limited to the lesser of $50,000, 50 percent of the individual participant's vested account balance or the sum of the participant's 401(k) contributions account, Roth 401(k) contributions account, after-tax contributions account, after-tax rollover account, rollover account, and Roth rollover account as of the inception date of the loan, with certain regulatory restrictions. Each loan specifies a repayment period that cannot extend beyond five years. However, the five-year limit shall not apply to any loan used to acquire any dwelling unit which within a reasonable time is to be used (determined at the time the loan is made) as the principal residence of the participant. Loans bear interest at the prime interest rate, as determined at the time of loan origination. Loans that transferred to the Plan due to acquisitions are based upon the terms of the plan agreement in effect at the time of loan origination. Repayments, including interest, are made through payroll deductions and are credited to the individual participant's account balance. Participant loans are measured at their unpaid principal balance plus any accrued but unpaid interest.

Administration

The Plan is administered by Caterpillar Inc. Pursuant to procedures adopted by Caterpillar Inc., responsibility for the Plan's non-financial matters has been delegated to the U.S. Benefits Manager and responsibility for the Plan's financial matters has been delegated to the Caterpillar Inc. Benefit Funds Committee. Caterpillar Inc., as sponsor of the Caterpillar Investment Trust, and the Benefit Funds Committee have entered into a trust agreement with The Northern Trust Company (the “Trustee”) to receive contributions, administer the assets of the Plan and distribute withdrawals pursuant to the Plan.

Plan Termination

EMD, as Plan sponsor, and Caterpillar Inc., as EMD's corporate parent, have the right under the Plan at any time to terminate the Plan, subject to provisions of ERISA and the terms of any applicable collective bargaining agreements. In the event of Plan termination, participants will become fully vested in all benefits which have been accrued up to date of termination and Plan assets will be distributed in accordance with the provisions of the Plan.

Plan Qualification

The Plan obtained its latest determination letter on March 23, 2015, in which the Internal Revenue Service ("IRS") stated that the Plan and related trust, as then designed, were in compliance with the applicable requirements of the IRC. Although the Plan has been amended subsequent to the period covered by the determination letter, the Plan Administrator and the Plan's counsel believe that the Plan is designed and is currently being operated in compliance with the applicable requirements of the IRC, and therefore, believe that the Plan is qualified and the related trust is tax-exempt.

Accounting principles generally accepted in the United States of America require management to evaluate tax positions taken by the Plan and recognize a tax liability if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. EMD has analyzed the tax positions taken by the Plan and has concluded that, as of December 31, 2014 and 2013, there are no uncertain positions taken or expected to be taken that would require recognition of a liability or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. EMD believes the Plan is no longer subject to income tax examinations for years prior to 2010.

| |

2. | Summary of Significant Accounting Policies |

New Accounting Guidance

Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or Its Equivalent) - In May 2015, the Financial Accounting Standards Board ("FASB") issued accounting guidance on disclosures for investments for which fair value is measured at net asset value (or its equivalent) using the practical expedient. The guidance removes the requirement to categorize in the fair value hierarchy investments for which fair value is measured at net asset value using the practical expedient. This guidance is effective for the Plan year ending December 31, 2016, with retrospective application required. The Plan’s management is currently reviewing the impact of this guidance on the Plan’s financial statements and notes to financial statements.

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Investments

The Plan's interest in the Master Trust is valued as described in Note 4. Interest on investments is recorded as earned. Dividends are recorded on the ex-dividend date. Purchases and sales of securities are recorded on a trade-date basis.

Administrative Expenses

In 2014, the Plan charged a $5 per month per participant fee, which is transferred monthly from the Caterpillar Investment Trust into a holding account to pay expenses as they come due. The amount accumulated in the holding account is used to pay certain administrative expenses that have been approved by the Benefit Funds Committee including recordkeeping fees, trustee fees, plan education and audit fees. Caterpillar Inc. pays any administrative expenses, excluding applicable expenses paid directly from participant accounts described below, which exceed amounts collected from participants annually by the Plan. If amounts collected from participants exceed certain administrative expenses, the Plan administrator determines whether a corrective action is appropriate which could include a reallocation of funds back to participant accounts or a structural change to the participant fees.

In addition, certain administrative expenses are paid directly from participant accounts. These administrative expenses include quarterly fees for participants that utilize managed account services and processing fees for qualified domestic relations orders.

Participant Withdrawals

Participant withdrawals are recorded when paid.

Use of Estimates in the Preparation of Financial Statements

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates. EMD believes the techniques and assumptions used in establishing these amounts are appropriate.

Risks and Uncertainties

The Plan invests in a combination of stocks, bonds, fixed income securities, mutual funds and other investment securities. Investment securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities could occur in the near term and that such changes could materially affect participant account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

As discussed in Note 1, the core investment options and the model portfolios were replaced with Target Retirement Funds and a new menu of core investment options. Investment options that are currently available to participants consist of three main categories: Target Retirement Funds, core investment options (including the Caterpillar Stock Fund) and a participant directed brokerage option. There were no participants using the participant directed brokerage option as of December 31, 2014.

The Target Retirement Funds are portfolios created primarily from the Plan’s core investment options. The goal of these funds is to give participants investment options that provide an age appropriate asset allocation. Each Target Retirement Fund contains a blend of stock and bond investments. The proportion of stocks and bonds in each fund is based on an anticipated retirement date and will change over time. These funds automatically change the asset allocation over time to maintain an appropriate level of risk for the retirement horizon. Below are the Target Retirement Funds for participants based upon their birth year with the assumption that participants will retire at the age of 65.

|

| | |

Target Retirement Funds | Birth Years | Asset Allocation |

Target Retirement Income Fund | Before 1954 | 37% stocks, 53% bonds and 10% cash equivalents |

Target Retirement 2020 Fund | 1954-1958 | 55% stocks and 45% bonds |

Target Retirement 2025 Fund | 1959-1963 | 65% stocks and 35% bonds |

Target Retirement 2030 Fund | 1964-1968 | 75% stocks and 25% bonds |

Target Retirement 2035 Fund | 1969-1973 | 82% stocks and 18% bonds |

Target Retirement 2040 Fund | 1974-1978 | 86% stocks and 14% bonds |

Target Retirement 2045 Fund | 1979-1983 | 86% stocks and 14% bonds |

Target Retirement 2050 Fund | 1984-1988 | 86% stocks and 14% bonds |

Target Retirement 2055 Fund | After 1988 | 86% stocks and 14% bonds |

Prior to December 15, 2014, participants had the option to invest in model portfolios (versus the Target Retirement Funds), which contained a specific mix of the Plan's core investments. The targeted percentages of stocks and bonds in each of the model portfolios were as follows:

|

| | | |

* | Conservative | | 20% stocks and 80% bonds |

* | Moderately Conservative | | 40% stocks and 60% bonds |

* | Moderately Aggressive | | 60% stocks and 40% bonds |

* | Aggressive | | 80% stocks and 20% bonds |

In addition to the newly created Target Retirement Funds, the core investment options were changed on December 15, 2014 to consolidate actively managed investment funds and offer more index funds that are intended to provide plan participants with quality investment options that meet their needs. A multi-manager approach is taken to manage the actively managed investment funds.

|

| |

Menu of Core Investment Options Before December 15, 2014 | Menu of Core Investment Options On and After

December 15, 2014 |

U.S. Large Cap Equity Funds | U.S. Large Cap Equity Funds |

1 Caterpillar Stock Fund 2 Large Cap Growth Equity Fund 3 Large Cap Value Equity Fund 4 Large Cap Blend Equity Fund 5 U.S. Equity Broad Index Fund | 1 Caterpillar Stock Fund 2 U.S. Large Cap Equity Fund 3 U.S. Large Cap Equity Index Fund |

U.S. Small/Mid Cap Equity Funds | U.S. Small/Mid Cap Equity Funds |

6 Mid Cap Equity Fund 7 Small Cap Equity Fund | 4 U.S. Small/Mid Cap Equity Fund 5 U.S. Small/Mid Cap Index Fund |

International Equity Funds | International Equity Funds |

8 International Equity Fund 9 International Equity Broad Index Fund | 6 International Equity Fund 7 International Equity Index Fund |

Capital Preservation Funds | Capital Preservation Funds |

10 Stable Principal Fund | 8 Stable Principal Fund 9 Money Market Fund |

Fixed Income Fund | Fixed Income Fund |

11 Bond Fund 12 Bond Index Fund | 10 Bond Fund 11 Bond Index Fund |

The Caterpillar Stock Fund consists of Caterpillar Inc. common stock and a small amount of cash and/or cash equivalents.

The participant directed brokerage option allows participants to invest outside of the standard Plan options. Hewitt Financial Services is the custodian for funds invested through this participant directed brokerage option. The types of investments offered through the participant directed brokerage option are individual company stocks (excluding Caterpillar Inc. common stock), exchange traded funds, registered investment companies and fixed income securities such as bonds.

Participants also have the option to enroll in professional account management through the Plan’s recordkeeper for additional, separately charged fees.

As discussed in Note 1, the Plan became a participating plan within the Caterpillar Investment Trust in January 2014. All of the Plan's investments are held in the Caterpillar Investment Trust, which was established for the investment of the Plan and other Caterpillar Inc. sponsored retirement plans. The Northern Trust Company is the Trustee of the Caterpillar Investment Trust and the custodian for funds invested through the core investments and the Target Retirement Funds (the funds invested through the core investments and the Target Retirement Funds are referred to as the “Master Trust” herein). Prior to December 15, 2014, the funds invested through the core investments and the model portfolios were considered the "Master Trust". The Plan and the other Caterpillar Inc. sponsored retirement plans pool their investments in the Master Trust in exchange for a percentage of participation in the Master Trust.

The percentage of the Plan's participation in the Master Trust was determined based on the December 31, 2014 net asset values for the investment fund options chosen by participants of each plan. At December 31, 2014, the Plan's interest in the net assets of the Master Trust was 0.28 percent.

The following table presents the net assets of the Master Trust as of December 31, 2014. Investments that represent 5 percent or more of the Master Trust's net assets are individually identified.

|

| | | | | | |

(in thousands of dollars) | | | | 2014 |

ASSETS | | | | |

Investments, at fair value | | | | |

Caterpillar Inc. common stock | | | | $ | 2,402,654 |

|

Common stocks | | | | 2,185,040 |

|

Preferred stocks | | | | 13,512 |

|

Preferred corporate bonds and notes | | | | 143,578 |

|

Other corporate bonds and notes | | | | 390,430 |

|

U.S. government securities | | | | 541,224 |

|

Fully benefit-responsive synthetic guaranteed investment contracts 1 | | | | 334,368 |

|

Common collective trusts: | | | | |

NT Collective Russell 1000 Index Fund - Non-Lending | | | | 1,150,476 |

|

NT Collective All Country World - Ex-US IMI Fund - Non-Lending | | | | 701,296 |

|

Other | | | | 774,672 |

|

Registered investment companies | | | | 37,832 |

|

Interest bearing cash | | | | 105,007 |

|

Other investments, net | | | | 98,038 |

|

| | | | 8,878,127 |

|

| | | | |

Other assets | | | | |

Cash | | | | 978 |

|

Receivables for securities sold | | | | 81,521 |

|

Accrued income | | | | 11,895 |

|

| | | | 94,394 |

|

| | | | |

Total Master Trust assets | | | | 8,972,521 |

|

| | | | |

LIABILITIES | | | | |

Payables for securities purchased | | | | (244,917 | ) |

| | | | |

Net Master Trust assets, at fair value | | | | 8,727,604 |

|

| | | | |

Adjustment from fair value to contract value for fully benefit-responsive synthetic guaranteed investment contracts | | | | (1,159 | ) |

| | | | |

Net Master Trust assets | | | | $ | 8,726,445 |

|

| | | | |

Plan’s interest in net Master Trust assets with fully benefit-responsive synthetic guaranteed investment contracts at contract value | | | | $ | 24,042 |

|

| | | | |

1 In 2014, includes ($47,590) thousand of payables for securities purchased and $18,938 thousand of receivables for securities sold. |

As the Plan has a specific interest in the Master Trust, the below table provides the investment risk specific to the Plan based upon the investment programs available to participants as of December 31, 2014.

|

| | | | |

Investment Program | | | | 2014 |

Caterpillar Stock Fund | | | | 0.7% |

U.S. Large Cap Equity Funds | | | | 6.5% |

U.S. Small / Mid Cap Equity Funds | | | | 2.4% |

International Equity Funds | | | | 4.0% |

Capital Preservation Funds | | | | 2.8% |

Fixed Income Funds | | | | 3.4% |

Target Retirement Funds | | | | 80.2% |

Investments are stated at fair value and are valued as described below:

| |

• | Common and preferred stocks: Primarily valued at quoted market prices. |

| |

• | Preferred and other corporate bonds and notes: Valued based on matrices or models from reputable pricing vendors and may be determined by factors which include, but are not limited to market quotations, yields, maturities, call features, ratings, institutional size trading in similar groups of securities and developments related to specific securities. |

| |

• | U.S. government securities: Valued based on matrices or models from reputable pricing vendors. |

| |

• | Fully benefit-responsive guaranteed investment contracts: Valued based upon the type of underlying investment: 1) Corporate and government bonds and mortgaged and asset backed securities are valued based on matrices or models from reputable pricing vendors; 2) Common collective trusts are stated at net asset value, which represents the fair value of the underlying investments; and 3) the value of the wrap contracts, if any. |

| |

• | Common collective trusts: Primarily stated at net asset value, which represents the fair value of the underlying investments. |

| |

• | Registered investment companies: Valued at quoted market prices that represent the net asset value of shares held by the Master Trust. |

| |

• | Interest bearing cash: Stated at cost which approximates fair value. |

| |

• | Other investments, net: Primarily valued at quoted market prices, when available, or are valued based on matrices or models from reputable pricing vendors. |

The preceding methods may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although EMD believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

The following table summarizes investments measured at fair value based on net asset value per share and other investments that have unfunded commitments or redemption restrictions as of December 31, 2014.

|

| | | | | | | | |

(in thousands of dollars) | | | | | |

December 31, 2014 | Fair Value | Unfunded Commitments | Redemption Restrictions | Redemption Frequency (if currently eligible) | Redemption Notice Period |

Common collective trusts: | | | | | |

Stocks: | | | | | |

U.S. | $ | 1,156,371 |

| — |

| None | Daily | None |

Non-U.S. | $ | 702,367 |

| — |

| None | Daily | None |

Short-term investments | $ | 379,505 |

| — |

| None | Daily | None |

U.S. government securities | $ | 366,017 |

| — |

| None | Daily | None |

Private placement - Mortgages | $ | 22,184 |

| — |

| Yes 1 | Monthly 1 | Yes 1 |

| | | | | |

Fully benefit-responsive synthetic guaranteed investment contracts: | | | | | |

Common collective trusts: | | | | | |

Short-term investments | $ | 44,225 |

| — |

| None | Daily | None |

| | | | | |

1 Redemptions allowed once per month and restricted to available cash on hand as determined by the trustee of the fund. A notice of redemption is required five days prior to the last business day of the month. |

During 2014, the Master Trust's investments (including investments bought and sold, as well as held during the year) appreciated (depreciated) as follows:

|

| | | | | | |

(in thousands of dollars) | | | | 2014 |

Net appreciation (depreciation) in fair value of investments: | | | | |

Caterpillar Inc. common stock | | | | $ | 48,975 |

|

Common stocks | | | | 154,135 |

|

Preferred stocks | | | | (1,075 | ) |

Preferred corporate bonds and notes | | | | 2,673 |

|

Other corporate bonds and notes | | | | 6,526 |

|

U.S. government securities | | | | 9,724 |

|

Common collective trusts: | | | | |

NT Collective Russell 1000 Index Fund - Non-Lending | | | | 27,523 |

|

NT Collective All Country World - Ex-US IMI Fund - Non-Lending | | | | (16,559 | ) |

Other | | | | 79,386 |

|

Registered investment companies | | | | (276 | ) |

Other investments, net | | | | (9,529 | ) |

Net appreciation (depreciation) in fair value of investments | | | | $ | 301,503 |

|

The following table presents the changes in net assets for the Master Trust for the year ended December 31, 2014.

|

| | | | | | |

(in thousands of dollars) | | | | 2014 |

Changes in Net Assets: | | | | |

Net appreciation (depreciation) in fair value of investments | | | | $ | 301,503 |

|

Interest | | | | 40,517 |

|

Caterpillar Inc. common stock dividends | | | | 71,928 |

|

Dividends | | | | 46,511 |

|

Other income | | | | 1,320 |

|

Net investment income (loss) | | | | 461,779 |

|

| | | | |

Transfers, net 1 | | | | (175,666 | ) |

Administrative expenses not directly allocated to the plans and other expenses 2 | | | | (13,970 | ) |

Net increase (decrease) in net assets | | | | 272,143 |

|

| | | | |

Net assets | | | | |

Beginning of the year | | | | 8,454,302 |

|

End of the year | | | | $ | 8,726,445 |

|

| | | | |

1 Represents items recorded at the plan level such as contributions, benefit payments, plan transfers and plan specific administrative expenses. |

2 Primarily related to fees and expenses paid to professional money managers who manage the investment funds. |

Dividend income is recorded as of the ex-dividend date. Interest is recorded daily as earned. The Master Trust presents in Net investment income (loss), the net appreciation (depreciation) in the fair value of its investments which consists of the realized gains (losses) and the unrealized appreciation (depreciation) on those investments. Purchases and sales of securities are recorded on a trade-date basis.

Investment Contracts

The Master Trust holds fixed income fully benefit-responsive investment contracts, referred to as synthetic guaranteed investment contracts (“synthetic GICs”), in which an investment contract is issued by an insurance company or a financial services institution (American General Life Insurance Company, Monumental Life Insurance Company and State Street Bank and Trust Company). The synthetic GICs, designed to help preserve principal and provide a stable crediting rate of interest, are fully benefit-responsive and provide that plan participant initiated withdrawals will be paid at contract value. The synthetic GICs are primarily backed by a portfolio of fixed income investments, which are effectively owned by the Plan. The assets underlying the synthetic GICs are maintained by a third party custodian, separate from the contract issuer's general assets. In 2014, the underlying investments of the portfolio consisted of corporate and government bonds ($191.3 million), mortgaged and asset backed securities ($127.6 million) and a common collective trust fund ($44.2 million) consisting of short-term investments. The synthetic GICs are obligated to provide an interest rate not less than zero. These contracts provide that realized and unrealized gains and losses of the underlying assets are not reflected immediately in the assets of the fund, but rather are amortized, usually over the duration of the underlying assets, through adjustments to the future interest crediting rate. The future interest crediting rate can be adjusted periodically and is primarily based on the current yield-to-maturity of the covered investment, plus or minus amortization of the difference between the market value and contract value of the covered investment over the duration of the covered investment at the time of computation. The issuers guarantee that all qualified participant withdrawals will occur at contract value. There are no reserves against contract value for credit risks of the contract issuers or otherwise.

Employer initiated events, if material, may affect the underlying economics of the investment contracts. These events include plant closings, layoffs, plan termination, bankruptcy or reorganization, merger, early retirement incentive programs, tax disqualification of a trust or other events. The occurrence of one or more employer initiated events could limit the Plan's ability to transact at contract value with the issuers. Except for the employer initiated events above, the synthetic GICs do not permit the issuers to terminate the agreement prior to the scheduled maturity date at an amount different from contract value. As of December 31, 2014, EMD does not believe that the occurrence of an event that would limit the ability of the Plan to transact at contract value with the issuers is probable.

A summary of the average yields for the synthetic GICs are as follows:

|

| | | | | |

| Average Yields | | | | December 31, 2014 |

| Based on actual income | | | | 1.55% |

| Based on interest rate credited to participants | | | | 1.69% |

The guidance on reporting of fully benefit-responsive investment contracts requires the Statements of Net Assets Available for Benefits to present the fair value of the synthetic GICs, as well as an adjustment of the fully benefit-responsive synthetic GICs from fair value to contract value.

In addition to the investment contracts discussed above, the Plan held a fixed income investment contract with Great-West Life & Annuity Insurance Company. This was a general account product. The methodology for calculating the interest crediting rate was based on the earnings of the underlying assets in the portfolio compared to the minimum interest crediting rate, as stated in the contract, and prevailing market conditions. The interest crediting rate was reset quarterly.

Contract value was the relevant measurement attribute for that portion of the net assets available for benefits attributable to the group annuity contract since the contract was determined to be fully benefit-responsive. The contract was included in the financial statements at fair value which approximates contract value. The account was credited with earnings on the underlying investments and charged for participant withdrawals and administrative expenses. Contract value represents contributions made under the contract, plus earnings, less participant withdrawals and administrative expenses. As the significant inputs, including the crediting interest rates, were provided by the issuer of the contract and were based upon factors determined by the issuer, the inputs were considered to be unobservable and, therefore, the investment was classified as a Level 3 investment. Participants could ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. The guaranteed investment contract issuer was contractually obligated to repay the principal and a specified interest rate that was guaranteed to the Plan.

There were no reserves against contract value for credit risk of the contract issuer or otherwise. The investment contract was not held as of December 31, 2014. The fair value of the investment contract at December 31, 2013 was $1.3 million. The crediting interest was based on a formula agreed upon with the issuer but could not be less than zero percent. Such interest rates were reviewed on a quarterly basis for resetting.

Certain events could of limited the ability of the Plan to transact at contract value with the issuer. Such events include the following: (a) amendments to the Plan document (including complete or partial Plan termination or merger with another plan), (b) changes to the Plan's prohibition on competing investment options or deletion of equity wash provisions, (c) bankruptcy of the Plan sponsor or other Plan sponsor events that cause a significant withdrawal from the Plan or (d) the failure of the trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA.

The below table is a summary of the average yields as of December 31, 2013.

|

| | | | | |

| Average Yields | | | | December 31, 2013 |

| Based on actual income | | | | 1.26% |

| Based on interest rate credited to participants | | | | 1.26% |

Fair Value Measurements

The guidance on fair value measurements defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants. This guidance also specifies a fair value hierarchy based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market data obtained from independent sources, while unobservable inputs (lowest level) reflect internally-developed market assumptions. In accordance with this guidance, fair value measurements are classified under the following hierarchy:

| |

• | Level 1 - Quoted prices for identical instruments in active markets. |

| |

• | Level 2 - Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are not active; and model-derived valuations in which all significant inputs or significant value-drivers are observable in active markets. |

| |

• | Level 3 - Model-derived valuations in which one or more significant inputs or significant value-drivers are unobservable. |

When available, quoted market prices are used to determine fair value and such measurements are classified within Level 1. In some cases where market prices are not available, observable market based inputs are used to calculate fair value, in which case the measurements are classified within Level 2. If quoted or observable market prices are not available, fair value is based upon internally developed models that use, where possible, current market-based parameters such as interest rates, yield curves and currency rates. These measurements are classified within Level 3.

Fair value measurements are classified according to the lowest level input or value-driver that is significant to the valuation. A measurement may therefore be classified within Level 3 even though there may be significant inputs that are readily observable.

The availability of observable market data is monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. In such instances, the transfer is reported at the end of the reporting period.

The significance of transfers between levels was evaluated based upon the nature of the financial instrument and size of the transfer relative to total net Master Trust assets. For the year ended December 31, 2014, there were no transfers in or out of Levels 1, 2 or 3.

Master Trust assets that are measured at fair value as of December 31, 2014 are summarized below:

|

| | | | | | | | | | | | | |

| | | Fair Value Measurements as of December 31, 2014 |

| (in thousands of dollars) | | Level 1 | | Level 2 | | Total |

| Stocks: | | | | | | |

| U.S. | | $ | 4,040,548 |

| | $ | 4 |

| | $ | 4,040,552 |

|

| Non-U.S. | | 558,502 |

| | 2,152 |

| | 560,654 |

|

| Corporate bonds and notes: | | | | | | |

| U.S. | | — |

| | 441,159 |

| | 441,159 |

|

| Non-U.S. | | — |

| | 92,849 |

| | 92,849 |

|

| U.S. government securities: | | | | | | |

| Agency mortgage-backed securities | | — |

| | 288,538 |

| | 288,538 |

|

| Bonds | | — |

| | 252,686 |

| | 252,686 |

|

| Fully benefit-responsive synthetic guaranteed investment contracts 1 | | — |

| | 334,368 |

| | 334,368 |

|

| Common collective trusts: | | | | | | |

| Stocks | | — |

| | 1,858,738 |

| | 1,858,738 |

|

| Short-term investments | | — |

| | 379,505 |

| | 379,505 |

|

| U.S. government securities | | — |

| | 366,017 |

| | 366,017 |

|

| Private placement - Mortgages | | — |

| | 22,184 |

| | 22,184 |

|

| Registered investment companies | | 37,832 |

| | — |

| | 37,832 |

|

| Interest bearing cash | | 105,007 |

| | — |

| | 105,007 |

|

| Other investments, net | | 43,610 |

| | 54,428 |

| | 98,038 |

|

| Total assets | | $ | 4,785,499 |

| | $ | 4,092,628 |

| | $ | 8,878,127 |

|

| | | | | | | |

| 1 Includes ($47,950) thousand of payables for securities purchased and $18,938 thousand of receivables for securities sold. |

The Plan's assets as of December 31, 2013 primarily consisted of cash in order to facilitate the Plan's transition into the Master Trust, except for the Plan's fixed income investment contract with Great-West Life & Annuity Insurance Company. As the significant inputs, including the crediting interest rates, are provided by the issuer of the contract and are based upon factors determined by the issuer, the inputs are considered to be unobservable and, therefore, the investment was classified as a Level 3 investment. The fair value of the investment contract was $1,270 thousand as of December 31, 2013. The Plan did not hold an investment in the fixed income investment contract as of December 31, 2014.

The below table is a roll-forward of assets measured at fair value using Level 3 inputs as of December 31, 2014.

|

| | | | | |

(in thousands of dollars) | | |

Beginning balance at January 1, 2014 | | $ | 1,270 |

|

Interest | | | 16 |

|

Sales | | | (1,286 | ) |

Ending balance at December 31, 2014 | | $ | — |

|

Unobservable (Level 3) Inputs

The following table presents quantitative information about unobservable inputs used in recurring Level 3 fair value measurements.

|

| | | | | | |

(in thousands of dollars) | | | | |

Fund Name | Fair Value December 31, 2013 | Valuation Technique | Unobservable Inputs | Range (Weighted Average) |

Fixed income investment contract | $ | 1,270 |

| Contract Value | Contractual interest rate | 1.26% |

Sensitivity of Significant Unobservable Inputs

The following is a discussion of the sensitivity of significant unobservable inputs, the interrelationships between those inputs and other unobservable inputs used in recurring fair value measurement and of how those inputs might magnify or mitigate the effect of changes in the unobservable inputs on the fair value measurement.

The significant unobservable input used in the fair value measurement of the Plan’s investment contract with an insurance company was the interest rate of the investment contract. Changes in the contractual interest rate would result in a significant change in fair value to the extent the change deviates from changes in market interest rates. Generally, an increase (decrease) in the difference between the contractual interest rate and the market interest rate was accompanied by a directionally opposed change in the fair value.

Derivatives

Within the Master Trust, certain investment managers may use derivative financial instruments to meet fund objectives and manage exposure to foreign currency, interest rate and market fluctuations. The following is a description of the types of derivative contracts the Master Trust may use:

| |

• | Credit contracts: Credit default swaps are used to manage exposure to credit risk. A credit default swap is a contract in which, for a fee, a protection seller agrees to pay a protection buyer an amount resulting from a credit event on a reference entity. If there is no credit default event or settlement trigger, as defined by the contract, then the protection seller makes no payment to the protection buyer and receives only the contractually specified fee. However, if a credit event occurs, the protection seller will be required to make a payment to the protection buyer. |

| |

• | Equity contracts: Equity index futures contracts are used by investment managers to invest excess cash into equity benchmarks, such as the MSCI EAFE and S&P 500. These contracts are settled in cash daily. Investment managers may also invest in equity rights and warrants which gives the holder the right to purchase securities from the issuer at a specific price within a certain time frame. |

| |

• | Foreign exchange contracts: Foreign currency exchange rate movements create a degree of risk by affecting the U.S. dollar value of instruments denominated in foreign currencies. Forward contracts are used by investment managers to manage foreign exchange rate risks associated with certain investments. These contracts are presented gross (buy side of the contract as a receivable and sell side of the contract as a payable) in the Net Master Trust assets. |

| |

• | Interest rate contracts: Interest rate movements create a degree of risk by affecting the amount of interest payments and the value of debt instruments. Investment managers use interest rate swaps, total return swaps, futures contracts, options and swaptions to manage interest rate risk. |

The fair value of these derivative contracts are included in Other investments, net, Receivables for securities sold and Payables for securities purchased in the Net Master Trust assets. The related appreciation (depreciation) is included in Other investments, net in the Net investment income (loss) of the Master Trust. As of December 31, 2014, the fair value of these derivative financial instruments was $467 thousand. In 2014, the effect of these derivatives on Net investment income (loss) of the Master Trust was $2 million, which is primarily related to equity contracts.

The Trustee is authorized, under contract provisions and by exemption under 29 CFR 408(b) of ERISA regulations, to invest in securities under its control and in securities of Caterpillar Inc.

The investment options available to the participants, as summarized in Note 3, include the Caterpillar Stock Fund. The Master Trust also invests in the U.S. Large Cap Equity Index Fund, U.S. Small/Mid Cap Index Fund, International Equity Index Fund, Money Market Fund, and the Bond Index Fund, which are sponsored and managed by The Northern Trust Company, the Trustee for the Master Trust. Prior to December 15, 2014, the Trustee sponsored the U.S Equity Broad Index Fund, International Equity Broad Index Fund, and the Bond Index Fund. The Northern Trust Company also invests excess cash in equitization accounts and manages liquidity pools for the actively managed investment funds. These transactions, as well as participant loans, qualify as exempt party-in-interest transactions.

| |

6. | Reconciliation of Financial Statements to Form 5500 |

The following table reconciles the Net assets available for benefits per the audited financial statements to the Form 5500 Annual Report:

|

| | | | | | | | | |

| (in thousands of dollars) | | 2014 | | 2013 |

| Net assets available for benefits per financial statements | | $ | 27,177 |

| | $ | 23,500 |

|

| Certain deemed distributions of participant loans | | (114 | ) | | — |

|

| Adjustment from contract value to fair value for fully benefit-responsive synthetic guaranteed investment contracts | | 2 |

| | — |

|

| Net assets per Form 5500 | | $ | 27,065 |

| | $ | 23,500 |

|

The following table reconciles the Plan's Net increase (decrease) in net assets available for benefits per the audited financial statements to the Form 5500 Annual Report:

|

| | | | | | | |

| (in thousands of dollars) | | | | 2014 |

| Plan's net increase (decrease) in net assets available for benefits per financial statements | | | | $ | 3,677 |

|

| Change in certain deemed distributions of participant loans | | | | (114 | ) |

| Change in adjustment from contract value to fair value for fully benefit-responsive synthetic guaranteed investment contracts | | | | 2 |

|

| Net income (loss) per Form 5500 | | | | $ | 3,565 |

|

On February 20, 2015, the Plan was amended and the following changes were made to the Plan.

| |

• | UNI participants covered by the collective bargaining agreements between UNI and the International Brotherhood of Electrical Engineers and the International Association of Machinists and Aerospace Workers employer matching contributions increased from 65 percent of the participant's 401(k) contributions up to a maximum of 6 percent of eligible compensation to 75 percent up to a maximum of 6 percent of eligible compensation. This was effective January 1, 2015. |

| |

• | PMR participants compensation that may be contributed to the Plan as a pre-tax 401(k) contribution increased from 16 percent of eligible compensation to 70 percent of eligible compensation. In addition, the employer matching contributions increased from 70 percent of the participant's 401(k) contributions up to a maximum of 5 percent of eligible compensation to 70 percent up to a maximum of 6 percent of eligible compensation. These changes are effective January 1, 2016. |

The impact of these amendments are not reflected in the financial statements as of December 31, 2014.

Supplemental Schedule

|

| | | | | | | | | | |

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees

|

EIN 37-0602744 Schedule H, Line 4i - Schedule of Assets (Held at End of Year) December 31, 2014 |

(a) | | (b) | | (c) | | (d) | | (e) |

| | Identity of issue, borrower, lessor or similar party | | Description of investment, including maturity date, rate of interest, collateral, par or maturity value | | Cost | | Current value |

* | | Plan's interest in the Caterpillar Investment Trust | | Master Trust – at fair value | | ** | | $ | 24,043,618 |

|

* | | Notes receivable from participants | | Participant loans net of deemed distributions (various maturity dates through November 22, 2024, various interest rates ranging from 3.25% to 9.25%) | | — | | 1,581,949 |

|

| | | | Total Investments | | | | $ | 25,625,567 |

|

* Denotes party in interest. |

** Cost information is not applicable for participant directed investments. |

|

| | | | |

SIGNATURES |

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees

|

| | | |

June 26, 2015 | | By: | /s/LeAnne K. Moritz |

| | | Name: | LeAnne K. Moritz |

| | | Title: | Plan Administrator |

EXHIBIT INDEX

|

| | | | |

Exhibit No. | Description |

| | | | |

23.1 | Consent of Independent Registered Public Accounting Firm |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We hereby consent to the incorporation by reference in the Registration Statements on Form S-8 (No. 333-192766) of Caterpillar Inc. of our report dated June 26, 2015 relating to the financial statements of the Caterpillar Rail Division Retirement Savings Plan for Collectively Bargained Employees, which appears in this Form 11-K.

/s/ PricewaterhouseCoopers LLP

Peoria, Illinois

June 26, 2015

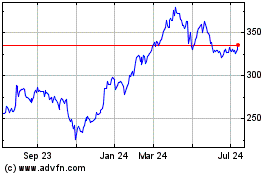

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

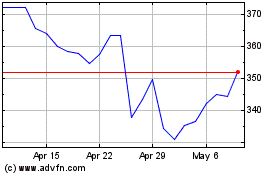

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024