Cardinal Health Warns Over Drug Pricing

October 31 2016 - 8:50AM

Dow Jones News

Cardinal Health Inc. became the latest drug distributor to warn

that the slowing pace of drug-price increases would hurt

results.

Chief Executive George Barrett said Monday that "short-term

headwinds, particularly around pharmaceuticals, are quite

challenging." Cardinal lowered its profit guidance for the year,

citing generic pharmaceutical pricing and reduced levels of branded

drug price increases.

The company now expects generic drug prices to fall in the

mid-to-high single digits while expecting branded drugs to increase

7% to 9% in the year. It now forecasts annual earnings adjusted

earnings per share of between $5.40 to $5.60, down from $5.48 to

$5.73 previously.

Shares of many drugmakers, wholesale distributors and

pharmacy-benefit managers were battered Friday as evidence emerged

that drug companies aren't increasing prices as sharply as in

previous years. Cardinal shares were inactive in premarket trading

Monday after falling sharply on Friday along with the rest of the

sector.

For the period ended Sept. 30, Cardinal Health reported a profit

of $309 million, or 96 cents a share, down from $383 million, or

$1.15 a share, a year prior. Excluding certain items, per-share

earnings fell to $1.24 from $1.38.

Revenue increased 14% to $32.04 billion.

Analysts polled by Thomson Reuters expected per-share profit of

$1.21 and revenue of $31.04 billion.

Pharmaceutical segment revenue climbed 15% to $28.80 billion,

while medical segment revenue grew 14% to $3.3 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 31, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

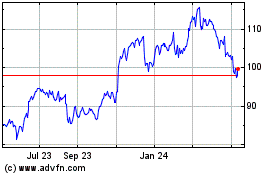

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024