Backlash Against Drug Prices Hit Manufacturers and Middlemen

October 28 2016 - 4:40PM

Dow Jones News

The backlash against the high and rising cost of medicines may

be cracking the foundation of the convoluted U.S. drug-pricing

system, hitting the bottom lines of manufacturers and industry

middlemen that have benefited from increases.

Shares of many drugmakers, wholesale distributors and

pharmacy-benefit managers were battered Friday on new evidence in

corporate earnings reports that drugmakers' ability to raise prices

has weakened. McKesson Corp., one of the largest wholesale drug

distributors, shed a quarter of its market value after disclosing

that competition and a slowdown in price inflation for brand-name

drugs would reduce its profits for its current fiscal year.

Amgen Inc. shares dropped 10% after the company late Thursday

flagged diminished pricing power next year for its blockbuster

rheumatoid-arthritis treatment Enbrel, after several years of sales

gains fueled by repeated price hikes. The Nasdaq Biotechnology

Index fell 2% Friday.

The prospect of price moderation—while good for patients and

insurers—spooked analysts and investors concerned about the profits

of drug companies and middlemen. "There is tremendous concern in

the marketplace about structural change to pricing," Goldman Sachs

analyst Jami Rubin said on a conference call with executives of

drugmaker AbbVie Inc. on Friday.

Drugmakers in recent years have repeatedly boosted prices for

many drugs at rates well above the broader rate of inflation, and

have introduced new drugs at prices that can top $100,000 a year

per patient.

The rising cost burden has triggered a backlash from patients,

doctors and insurers, who say the costs put drugs out of reach for

some patients and strain health-care budgets. High-profile actions

including Mylan NV's repeated price hikes for the emergency allergy

treatment EpiPen have triggered investigations by members of

Congress and the Justice Department.

Companies and organizations that pay for portions of their

employees' health care have become emboldened by the public

backlash and are pushing back against drug-price increases via the

pharmacy-benefit managers, or PBMs, that administer employee

benefits, said Ronny Gal, an analyst with Sanford C. Bernstein.

"There's just less money to go around," he said.

McKesson said it has been forced to lower the prices it charges

to independently owned pharmacies to match the prices charged by

competing wholesalers aiming to steal market share. "We have made a

very significant change in our pricing practice to match where the

market is today," McKesson Chief Executive John H. Hammergren told

analysts on a conference call on Thursday.

McKesson contracts with manufacturers to distribute drugs to

customers including retail pharmacies and hospitals. Some of its

contracts allow McKesson to benefit when manufacturers increase

prices, by selling its inventory of a drug at the new, higher

price. A slowdown in price increases is beginning to hurt its

profit margins.

McKesson's stock plunge on Friday erased about $9 billion in

market value, while shares of the company's main rivals,

AmerisourceBergen Corp. and Cardinal Health, declined 13% and 12%

respectively.

Drugmakers say they are facing more intense pricing pressure in

the U.S. this year in certain treatment areas. Novo Nordisk A/S's

American depositary receipts tumbled 13% after the Danish company

cut its 2016 sales and profit forecast, citing U.S. pricing

pressure primarily for its insulin drugs for people with

diabetes.

"The competitive environment in the U.S. within both diabetes

care and biopharmaceuticals has become more challenging, negatively

impacting the price of our products," Novo Chief Executive Lars

Rebein Sorensen said on a conference call with analysts.

Companies including Novo have actually boosted list prices for

insulin in the U.S. in recent years, but much of it has been

funneled back in the form of rebates to PBMs. Still, the increased

prevalence of high-deductible health plans means that some patients

must pay the full list price themselves for at least part of the

year.

The pricing pressure may now be hitting another lucrative class:

so-called TNF inhibitors, which treat rheumatoid arthritis and

other autoimmune diseases.

Amgen blamed softer pricing for Enbrel next year on the need to

pay higher rebates to the PBMs. Amgen said the higher rebates would

help ensure that drug plans continue to reimburse for patients' use

of Enbrel. "We'll be driving the business on volume, not on net

selling price next year," said Anthony Hooper, chief of Amgen's

commercial operations Thursday.

The concerns spilled over to Amgen's rival, AbbVie, whose drug

Humira is in the same category as Enbrel. AbbVie on Friday reported

lighter-than-expected sales of Humira for the third quarter. AbbVie

Chief Executive Richard Gonzalez told analysts there was little

change in the net price of Humira—after rebates and discounts—in

the supply contracts that AbbVie has negotiated with payers for

2017 and 2018, compared with this year.

AbbVie shares dropped 6.2%.

Jonathan D. Rockoff and Joseph Walker contributed to this

article.

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

October 28, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

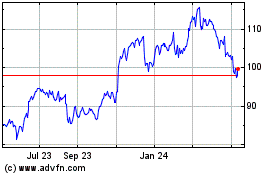

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024