Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

June 17 2015 - 6:02AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration Statement No. 333-190741

Issuer Free Writing Prospectus dated June 16, 2015

Cardinal Health, Inc.

Pricing

Term Sheet

|

|

|

| Issuer: |

|

Cardinal Health, Inc. |

|

|

| Trade Date: |

|

June 16, 2015 |

|

|

| Settlement Date: |

|

T+5; June 23, 2015 |

|

|

| Underwriters: |

|

Joint Book-Running Managers:

Goldman, Sachs & Co. Barclays Capital Inc.

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Mitsubishi UFJ Securities (USA), Inc.

Co-Managers:

Credit Agricole Securities (USA) Inc. HSBC Securities (USA)

Inc. Standard Chartered Bank Wells Fargo Securities,

LLC |

1.950% Notes due 2018

|

|

|

| Aggregate Principal Amount: |

|

$550,000,000 |

|

|

| Maturity Date: |

|

June 15, 2018 |

|

|

| Interest Rate: |

|

1.950% |

|

|

| Issue Price: |

|

99.922% of principal amount |

|

|

| Net Proceeds to Issuer (after Underwriting Discount but before expenses): |

|

$547,096,000 |

|

|

| Benchmark Treasury: |

|

UST 1.125% due June 15, 2018 |

|

|

| Benchmark Treasury Price: |

|

100- 04+ |

|

|

| Benchmark Treasury Yield: |

|

1.077% |

|

|

| Spread to Benchmark Treasury: |

|

90 basis points |

|

|

| Yield to Maturity: |

|

1.977% |

|

|

| Interest Payment Dates: |

|

Semi-annually on June 15 and December 15, commencing December 15, 2015 |

|

|

|

| Make-whole Call: |

|

The notes will be redeemable in whole at any time or, in part from time to time, at the Issuer’s option, at a redemption price equal to

the greater of: (1) 100% of the principal amount of the notes to be redeemed, or

(2) as determined by a quotation agent, the sum of the present values of the remaining

scheduled payments of principal and interest thereon (exclusive of interest accrued to the date of redemption) discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the adjusted

treasury rate plus 15 basis points, plus, in each case, accrued and unpaid interest, if any, on the amount being redeemed to, but excluding, the date of redemption. |

|

|

| Special Mandatory Redemption: |

|

If the Principal Closing of Issuer’s acquisition of Cordis (the “Cordis Acquisition”) does not occur on or prior to March 31,

2016, or the Stock and Asset Purchase Agreement for the Cordis Acquisition (the “Cordis Purchase Agreement”) is terminated, the Issuer will be required to redeem all of the outstanding notes on a special mandatory redemption date at a

redemption price equal to 101% of the aggregate principal amount of the notes, plus accrued and unpaid interest, if any, to, but excluding, the special redemption date.

The term “special redemption date” means the earlier to occur of (1) May 30, 2016, if the Principal Closing of the Cordis Acquisition has not

occurred on or prior to March 31, 2016, or (2) the 60th day (or if such day is not a business day, the first business day thereafter) following the termination of the Cordis Purchase Agreement for any reason. |

|

|

| CUSIP/ISIN: |

|

14149Y BC1 / US14149YBC12 |

3.750% Notes due 2025

|

|

|

| Aggregate Principal Amount: |

|

$500,000,000 |

|

|

| Maturity Date: |

|

September 15, 2025 |

|

|

| Interest Rate: |

|

3.750% |

|

|

| Issue Price: |

|

99.928% of principal amount |

|

|

| Net Proceeds to Issuer (after Underwriting Discount but before expenses): |

|

$496,390,000 |

|

|

| Benchmark Treasury: |

|

UST 2.125% due May 15, 2025 |

|

|

| Benchmark Treasury Price: |

|

98-12 |

|

|

| Benchmark Treasury Yield: |

|

2.309% |

2

|

|

|

| Spread to Benchmark Treasury: |

|

145 basis points |

|

|

| Yield to Maturity: |

|

3.759% |

|

|

| Interest Payment Dates: |

|

Semi-annually on March 15 and September 15, commencing September 15, 2015 |

|

|

| Make-whole Call: |

|

The notes will be redeemable, prior to June 15, 2025 (three months prior to their maturity), in whole at any time or, in part from time to

time, at the Issuer’s option, at a redemption price equal to the greater of: (1)

100% of the principal amount of the notes to be redeemed, or (2) as determined by a

quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due if the notes of such series matured on June 15, 2025, (exclusive of interest accrued to the date of redemption)

discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the adjusted treasury rate plus 25 basis points, plus, in each case, accrued and unpaid interest, if any, on the amount being

redeemed to, but excluding, the date of redemption. The Issuer may also redeem some or

all of the notes on or after June 15, 2025 (three months prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption

date. |

|

|

| CUSIP/ISIN: |

|

14149Y BE7 / US14149YBE77 |

4.900% Notes due 2045

|

|

|

| Aggregate Principal Amount: |

|

$450,000,000 |

|

|

| Maturity Date: |

|

September 15, 2045 |

|

|

| Interest Rate: |

|

4.900% |

|

|

| Issue Price: |

|

99.898% of principal amount |

|

|

| Net Proceeds to Issuer (after Underwriting Discount but before expenses): |

|

$445,603,500 |

|

|

| Benchmark Treasury: |

|

UST 2.500% due February 15, 2045 |

|

|

| Benchmark Treasury Price: |

|

89-06 |

|

|

| Benchmark Treasury Yield: |

|

3.057% |

|

|

| Spread to Benchmark Treasury: |

|

185 basis points |

3

|

|

|

| Yield to Maturity: |

|

4.907% |

|

|

| Interest Payment Dates: |

|

Semi-annually on March 15 and September 15, commencing September 15, 2015 |

|

|

| Make-whole Call: |

|

The notes will be redeemable, prior to March 15, 2045 (six months prior to their maturity), in whole at any time or, in part from time to

time, at the Issuer’s option, at a redemption price equal to the greater of: (1)

100% of the principal amount of the notes to be redeemed, or (2) as determined by a

quotation agent, the sum of the present values of the remaining scheduled payments of principal and interest thereon that would be due if the notes of such series matured on March 15, 2045 (exclusive of interest accrued to the date of redemption)

discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the adjusted treasury rate plus 30 basis points, plus, in each case, accrued and unpaid interest, if any, on the amount being

redeemed to, but excluding, the date of redemption. The Issuer may also redeem some or

all of the notes on or after March 15, 2045 (six months prior to their maturity), at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption

date. |

|

|

| Special Mandatory Redemption: |

|

If the Principal Closing of Issuer’s acquisition of Cordis (the “Cordis Acquisition”) does not occur on or prior to March 31,

2016, or the Stock and Asset Purchase Agreement for the Cordis Acquisition (the “Cordis Purchase Agreement”) is terminated, the Issuer will be required to redeem all of the outstanding notes on a special mandatory redemption date at a

redemption price equal to 101% of the aggregate principal amount of the notes, plus accrued and unpaid interest, if any, to, but excluding, the special redemption date.

The term “special redemption date” means the earlier to occur of (1) May 30, 2016, if the Principal Closing of the Cordis Acquisition has not

occurred on or prior to March 31, 2016, or (2) the 60th day (or if such day is not a business day, the first business day thereafter) following the termination of the Cordis Purchase Agreement for any reason. |

|

|

| CUSIP/ISIN: |

|

14149Y BD9 / US14149YBD94 |

| * |

We expect that delivery of the notes will be made to investors on or about the 5th business

day following the date of this prospectus supplement (such settlement being referred to as ‘‘T+5’’). Under Rule 15c6-1 under the Securities Exchange Act of 1934, trades in the secondary market are required to settle in three

business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade notes on the date of pricing or the next four succeeding business days will be required, by virtue of the fact that the notes

initially settle in T+5, to specify an alternate settlement arrangement at the time of any |

4

| |

such trade to prevent a failed settlement. Purchasers of the notes who wish to trade the notes prior to their date of delivery hereunder should consult their advisors. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on

the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Goldman, Sachs & Co. at 1-201-793-5170, Barclays

Capital Inc. at 1-888-603-5847, Merrill Lynch, Pierce, Fenner & Smith Incorporated at t 1-800-294-1322 or emailing dg.prospectus_requests@baml.com, and Mitsubishi UFJ Securities (USA), Inc. at 877-649-6848.

5

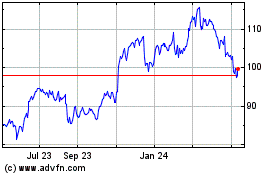

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024