U.S. Hot Stocks: Hot Stocks to Watch

June 30 2016 - 9:39AM

Dow Jones News

Among the companies with shares expected to trade actively in

Thursday's session are Newmont Mining Corp. (NEM), McCormick &

Co. (MKC) and InterOil Corp. (IOC).

Newmont Mining Corp. said Thursday that it would sell its stake

in an Indonesian copper and gold mine for $920 million and

contingent payments of up to $403 million. Shares rose 0.93% to

$38.04 in premarket trading.

Spice maker McCormick & Co. said profit climbed 11% in the

latest period as sales were again helped by acquisitions. Shares

fell 2.54% to $100.10 premarket.

InterOil Corp. said Thursday that it has received a third party

offer, potentially disrupting Oil Search Ltd.'s deal to acquire the

midsize energy company. Share rose 7.63% to $45.27 premarket.

Darden Restaurants Inc. (DRI) on Thursday said profit climbed

33% in the latest period as same-store sales rose, but the company

gave a soft forecast for earnings in its new year. Shares fell

4.17% to $63.21 premarket.

ConAgra Foods Inc. (CAG) reported a steeper-than-expected sales

decline in its latest quarter, dragged by weakness in consumer

brands as it continues to reshape its business. Shares fell 3.36%

to $46.00 premarket.

Constellation Brands Inc. (STZ) on Thursday posted profit and

revenue as a number of acquisitions continue to boost the beer and

wine distributor. Shares rose 1.7% to $162.10 premarket.

All but two of 33 big U.S. banks won permission from regulators

on Wednesday to boost dividends and buybacks as they passed the

Federal Reserve's annual "stress tests," a gauge of how the banks

would fare during a financial crisis. U.S. banking units of

Deutsche Bank AG and Banco Santander SA failed, due to Fed concerns

about their ability to measure risks, while Morgan Stanley (MS)

received a conditional approval and was asked to submit a revised

capital plan.

Alliant Energy Corp. (LNT) will replace AGL Resources Inc. (GAS)

in the S&P 500 index after the close of trading on June 30,

according to S&P Dow Jones Indices. With Madison, Wis.-based

Alliant Energy moving to the S&P 500, Southwest Gas Corp. (SWX)

will take its spot in the S&P MidCap 400 and Shutterstock Inc.

(SSTK) will replace Southwest Gas in the S&P SmallCap 600.

Federal regulators on Wednesday accused BancorpSouth Bank (BXS)

of discriminatory mortgage lending practices, or "redlining,"

against African-Americans and other minority borrowers.

A private-equity fund backed by Google parent company Alphabet

Inc. has invested $46.4 million in Care.com Inc., making Alphabet

its largest shareholder, Care.com said Wednesday.

U.S. health regulators on Wednesday approved Cepheid's (CPHD)

screening test to help detect bacteria resistant to a common

antibiotic used to treat severe infections.

CIT Group Inc. (CIT) is selling its Canadian business to

Laurentian Bank of Canada as part of a turnaround plan to focus on

domestic banking. The latest deal, expected to close in the fourth

quarter, involves CIT's Canadian equipment finance and corporate

finance portfolio, with more than $700 million in assets. Financial

terms weren't disclosed, but Laurentian Bank said it would

partially finance the deal through a 135 million Canadian dollar

offering of subscription receipts.

Pier 1 Imports Inc. (PIR) swung to a deeper-than-projected loss

in the first quarter on a sales slowdown that is projected to

contract annual sales 1% to 3%. The retailer warned on Wednesday

that the sales contraction and higher spending may push it into

another loss in the current quarter.

Progress Software Corp.'s (PRGS) second-quarter results beat

projections as higher sales offset the impact of currency

fluctuations. Still, Progress cut further its revenue projection

for the year that ends in November.

Seagate Technology PLC (STX) plans to eliminate some 1,600 jobs,

or about 3% of its workforce, targeting about $100 million in

savings a year. The latest cuts follow disappointing results in the

most recent quarter.

Tractor Supply Co. (TSCO) on Wednesday gave downbeat

second-quarter guidance and lowered its outlook for the year citing

weakness in many of the retailer's big-ticket and seasonal

categories.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

June 30, 2016 09:24 ET (13:24 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

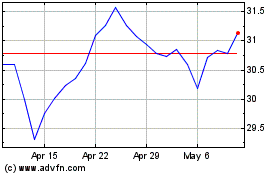

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024