UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 11-K

_______________________________________

(Mark One)

|

|

|

|

|

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2015

OR

|

|

|

|

|

|

[ ]

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File No. 1-7275

_______________________________________

A.

Full title of the Plan and the address of the Plan, if different from that of the issuer named below:

ConAgra Foods Retirement Income Savings Plan for Salaried Employees

ConAgra Foods Retirement Income Savings Plan for Hourly Rate Production Employees

B.

Name of issuer of the securities held pursuant to the Plan and the address of its principal executive office:

ConAgra Foods, Inc.

One ConAgra Drive

Omaha, Nebraska 68102

Contents

|

|

|

|

|

|

|

1-2

|

|

Financial Statements:

|

|

|

|

|

|

Statements of Net Assets Available for Benefits - December 31, 2015 and 2014

|

3-4

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits for the Years Ended December 31, 2015 and 2014

|

5-6

|

|

|

|

|

|

7-19

|

|

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedules H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2015

|

20

|

|

|

|

|

Signatures

|

21

|

|

|

|

|

Exhibit 23.1

|

22

|

|

|

|

All schedules required by Section 2520.103-10 of the United States Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are disclosed separately in a Master Trust report filed with the United States Department of Labor or are omitted because they are not applicable.

Report of Independent Registered Public Accounting Firm

ConAgra Foods, Inc.

Employee Benefits Administrative Committee

We have audited the accompanying statements of net assets available for benefits of the ConAgra Foods Retirement Income Savings Plan for Salaried Employees (the Plan) as of December 31, 2015 and 2014, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the ConAgra Foods Retirement Income Savings Plan for Salaried Employees as of December 31, 2015 and 2014, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2015, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ RSM US LLP

Omaha, Nebraska

June 27, 2016

Report of Independent Registered Public Accounting Firm

ConAgra Foods, Inc.

Employee Benefits Administrative Committee

We have audited the accompanying statements of net assets available for benefits of the ConAgra Foods Retirement Income Savings Plan for Hourly Rate Production Employees (the Plan) as of December 31, 2015 and 2014, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the ConAgra Foods Retirement Income Savings Plan for Hourly Rate Production Employees as of December 31, 2015 and 2014, and the changes in net assets available for benefits for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The supplemental information in the accompanying schedule of Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of December 31, 2015, has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is presented for the purpose of additional analysis and is not a required part of the financial statements but includes supplemental information required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedule, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ RSM US LLP

Omaha, Nebraska

June 27, 2016

|

|

|

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

|

|

|

|

Salaried Employees

|

|

|

|

Hourly Rate Production Employees

|

|

|

|

|

|

|

|

Statement of Net Assets Available for Benefits

|

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

Assets

|

Salary

|

Hourly

|

|

|

|

|

|

Plan interest in Master Trust

|

$

|

1,451,960,708

|

|

$

|

455,071,148

|

|

|

|

|

|

|

Contributions receivable

|

2,379,562

|

|

2,123,171

|

|

|

|

|

|

|

Notes receivable from participants

|

13,588,656

|

|

22,316,286

|

|

|

|

|

|

|

Net assets available for benefits, at fair value

|

1,467,928,926

|

|

479,510,605

|

|

|

|

|

|

|

Adjustment from fair value to contract value for fully

|

|

|

|

benefit-responsive investment contracts

|

(1,423,969

|

)

|

(766,753

|

)

|

|

|

|

|

|

Net assets available for benefits

|

$

|

1,466,504,957

|

|

$

|

478,743,852

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

|

|

|

|

Salaried Employees

|

|

|

|

Hourly Rate Production Employees

|

|

|

|

|

|

|

|

Statement of Net Assets Available for Benefits

|

|

|

|

December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

Assets

|

Salary

|

Hourly

|

|

|

|

|

|

Plan interest in Master Trust

|

$

|

1,477,394,476

|

|

$

|

458,493,551

|

|

|

|

|

|

|

Employer contributions receivable

|

—

|

|

1,499,170

|

|

|

|

|

|

|

Notes receivable from participants

|

14,678,758

|

|

23,903,208

|

|

|

|

|

|

|

Net assets available for benefits, at fair value

|

1,492,073,234

|

|

483,895,929

|

|

|

|

|

|

|

Adjustment from fair value to contract value for fully

|

|

|

|

benefit-responsive investment contracts

|

(2,585,400

|

)

|

(1,331,873

|

)

|

|

|

|

|

|

Net assets available for benefits

|

$

|

1,489,487,834

|

|

$

|

482,564,056

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

|

|

|

|

Salaried Employees

|

|

|

|

Hourly Rate Production Employees

|

|

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

|

|

Year Ended December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

|

Salary

|

Hourly

|

|

Additions to net assets attributed to:

|

|

|

|

Investment income from Master Trust:

|

|

|

|

Interest and dividends

|

$

|

30,721,215

|

|

$

|

10,616,265

|

|

|

Net appreciation (depreciation) in fair value of investments

|

8,552,043

|

|

(1,668,270

|

)

|

|

Interest income on notes receivable from participants

|

596,460

|

|

922,737

|

|

|

|

39,869,718

|

|

9,870,732

|

|

|

|

|

|

|

Contributions:

|

|

|

|

Employee

|

59,457,326

|

|

26,674,193

|

|

|

Employer

|

29,877,677

|

|

10,944,951

|

|

|

|

89,335,003

|

|

37,619,144

|

|

|

|

|

|

|

Total additions

|

129,204,721

|

|

47,489,876

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

Benefits paid to participants

|

150,695,867

|

|

48,688,768

|

|

|

Administrative expenses

|

3,089,078

|

|

1,023,965

|

|

|

Total deductions

|

153,784,945

|

|

49,712,733

|

|

|

|

|

|

|

Decrease in net assets

|

(24,580,224

|

)

|

(2,222,857

|

)

|

|

|

|

|

|

Net Master Trust transfers

|

1,597,347

|

|

(1,597,347

|

)

|

|

|

|

|

|

Net assets available for benefits,

|

|

|

|

Beginning of year

|

1,489,487,834

|

|

482,564,056

|

|

|

End of year

|

$

|

1,466,504,957

|

|

$

|

478,743,852

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

|

|

|

|

Salaried Employees

|

|

|

|

Hourly Rate Production Employees

|

|

|

|

|

|

|

|

Statement of Changes in Net Assets Available for Benefits

|

|

|

|

Year Ended December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

|

Salary

|

Hourly

|

|

Additions to net assets attributed to:

|

|

|

|

Investment income from Master Trust:

|

|

|

|

Interest and dividends

|

$

|

35,895,843

|

|

$

|

12,561,606

|

|

|

Net appreciation in fair value of investments

|

72,588,006

|

|

17,680,114

|

|

|

Interest income on notes receivable from participants

|

625,387

|

|

1,046,758

|

|

|

|

109,109,236

|

|

31,288,478

|

|

|

|

|

|

|

Contributions:

|

|

|

|

Employee

|

56,160,950

|

|

25,979,515

|

|

|

Employer

|

28,222,521

|

|

12,308,721

|

|

|

|

84,383,471

|

|

38,288,236

|

|

|

|

|

|

|

Total additions

|

193,492,707

|

|

69,576,714

|

|

|

|

|

|

|

Deductions from net assets attributed to:

|

|

|

|

Benefits paid to participants

|

215,004,877

|

|

58,159,471

|

|

|

Administrative expenses

|

3,188,293

|

|

974,480

|

|

|

Total deductions

|

218,193,170

|

|

59,133,951

|

|

|

|

|

|

|

Increase (decrease) in net assets

|

(24,700,463

|

)

|

10,442,763

|

|

|

|

|

|

|

Net Master Trust transfers

|

1,257,560

|

|

(1,257,560

|

)

|

|

|

|

|

|

Net assets available for benefits,

|

|

|

|

Beginning of year

|

1,512,930,737

|

|

473,378,853

|

|

|

End of year

|

$

|

1,489,487,834

|

|

$

|

482,564,056

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the financial statements.

|

|

|

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 1.

|

Description of the Plans

|

General

: The ConAgra Foods Retirement Income Savings Plans (CRISP) (collectively, the Plans and each, a Plan) are defined contribution savings plans sponsored by ConAgra Foods, Inc. (the Company). The Plans were established to provide certain employees with a formal plan under which their savings are supplemented by Company contributions. There are two separate plans; one for salaried employees (ConAgra Foods Retirement Income Savings Plan for Salaried Employees, or CRISP Salary) and one for hourly employees (ConAgra Foods Retirement Income Savings Plan for Hourly Rate Production Employees, or CRISP Hourly). The Plans have different eligibility requirements, contribution limitations and provisions. The Plans are subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). The ConAgra Foods Employee Benefits Administrative Committee (the Committee) manages the operation and administration of the Plans as the Plan Administrator, as defined in Section 3(16) of ERISA. The following brief description of the Plans is provided for information purposes only and describes the Plans as amended. Participants should refer to the CRISP Salary and CRISP Hourly plan documents for more complete information.

Participants may direct their investment into one or more of the following investment options within the ConAgra Foods Retirement Income Savings Master Trust (the Master Trust):

•

Small-Cap Index Fund (Vanguard Small-Cap Index Fund)

•

International Equity Growth Fund (Vanguard International Growth Fund)

•

Large-Cap Growth Stock Fund (T. Rowe Price Large Cap Growth Stock Fund)

•

Mid-Cap Index Fund (Vanguard Mid-Cap Index Fund)

|

|

|

|

•

|

One of twelve Target Date Retirement Funds (Vanguard Retirement Income Fund - 2060 Target Date Funds)

|

|

|

|

|

•

|

Inflation Protection Securities Fund (Vanguard Inflation Protected Securities Fund)

|

|

|

|

|

•

|

International Value Fund (Vanguard Value Fund)

|

|

|

|

|

•

|

Large-Cap Value Fund (Vanguard Equity Income Fund)

|

|

|

|

|

•

|

Equity Index Fund (Vanguard Institutional Index Fund)

|

|

|

|

|

•

|

Investment Allocation Fund (Fidelity Asset Manager Fund)

|

|

|

|

|

•

|

Longer-Term Fixed Income Fund (Vanguard Total Bond Market Index Fund)

|

|

|

|

|

•

|

Shorter-Term Fixed Income Fund (Fidelity Interest Income Fund)

|

|

|

|

|

•

|

Equity Index Fund (Vanguard Equity Index Fund)

|

In addition, certain participants hold investments in the Company’s stock fund. Dividends associated with the Company’s stock in this fund are distributed either in cash or reinvested at the discretion of the respective participants. Other than dividend reinvestment, deferrals into this stock fund are not currently allowed.

Contributions and vesting:

Qualifying salaried and hourly employees of the Company are eligible to participate in the Plans upon employment, or once they have met the eligibility requirements for the supplement under the plan in which they participate. Participation is voluntary and contributions are made through payroll deductions. Contributions of 1 percent to 50 percent of cash compensation may be made on a pre-tax or Roth basis for each of the Plans and of 1 percent to 10 percent and 1 percent to 21 percent on an after-tax basis for CRISP Salary and CRISP Hourly, respectively. Participants who have attained age 50 before the end of the Plan year are eligible to

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 1.

|

Description of the Plans (Continued)

|

make catch-up contributions as set forth in the Internal Revenue Code (the Code). Total contributions by a participant for any year may not exceed 60 percent of eligible compensation for CRISP Salary and CRISP Hourly and are subject to the maximum contribution limitations under ERISA and the Code. Certain supplements within the Plans have various contribution limits that may differ from those listed above. Due to limitations of the Code and ERISA, contributions by “highly compensated” participants are restricted. Employee contributions and earnings thereon vest immediately.

The Company makes matching contributions to the Plans based on the applicable plan supplement in which they participate. The various matching contributions range from 50 percent to 100 percent for salaried participants and from 10 percent to 66 2/3 percent for hourly participants of the employee’s deferral up to 4 percent to 6 percent of the employee’s annual cash compensation depending upon which plan in which the employee participates. Effective January 1, 2014, a three percent guaranteed Company contribution was added to the CRISP Salary for new hires.

Company contributions and earnings thereon generally vest 20 percent per year of continuous service, with full vesting occurring after five years. Full vesting also occurs if the participant becomes totally and permanently disabled, dies, or reaches the normal retirement age of 65.

Participant accounts

: Individual accounts are maintained for each Plan participant. Each participant’s account is credited with the participant’s contribution, allocations of the Company’s applicable matching contribution, the Company’s discretionary contributions, if any, and the plan earnings. The participant’s account is also charged with an allocation of plan losses and administrative expenses.

Allocations are based on participant earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

Forfeitures

: At December 31, 2015, the CRISP Salary forfeited non-vested accounts totaled $2,824,368 and the CRISP Hourly forfeited non-vested accounts totaled $423,532. At December 31, 2014, the CRISP Salary forfeited non-vested accounts totaled $2,098,593 and the CRISP Hourly forfeited non-vested accounts totaled $585,840. These accounts are used to reduce future Company contributions. In 2015 and 2014, Company contributions to the CRISP Salary were reduced by $1,473,781 and $1,127,258, respectively. Additionally, in 2015 and 2014, Company contributions to the CRISP Hourly were reduced by $675,993 and $392,282, respectively.

CRISP Hourly participants

: Participation in the CRISP Hourly is governed by either the collective bargaining agreements of the participating locations or the general plan provisions for any non-union employees. The amounts contributed by the employees are subject to the terms of the various collective bargaining agreements, and the contribution limitations set forth under the plan, ERISA and the Code. Company contributions and vesting are also set forth in the various collective bargaining agreements or the general plan provisions for any non-union employees.

Notes receivable from participants and withdrawals

: Based on various applicable plan supplements, CRISP Salary and non-union CRISP Hourly participants may borrow up to 50 percent of their vested account balance up to $50,000. The notes evidencing the amounts borrowed are repaid through payroll deductions within five years, unless the note proceeds are used to purchase a primary residence, in which case the note may be repaid within ten years. The notes carry a market rate of interest as determined by the Plan Administrator, currently ranging from 3.25 percent to 10 percent. The minimum amount that may be borrowed is $1,000. The Plans allow for hardship withdrawals of pre-tax or after-tax account balances and for general withdrawals of after-tax amounts. Balances may also be withdrawn after the participant reaches the age of fifty-nine and a half or upon the termination of employment, death,

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 1.

|

Description of the Plans (Continued)

|

long-term disability, or retirement of the employee. Restrictions and available forms of the payouts are detailed in the respective plan documents.

Plan termination

: The term of the Plans are indefinite, but may be amended, modified or terminated at any time by the Company. Regardless of such actions, the principal and income of the Plans remain for the exclusive benefit of the Plans’ participants and beneficiaries. In the event the Plans are terminated, each participant’s Company contribution becomes fully vested. The Company may direct State Street Bank and Trust Company (the Trustee) either to distribute the Plans’ assets to the participants, or to continue the trust and distribute benefits as though the Plans had not been terminated.

|

|

|

|

Note 2.

|

Summary of Significant Accounting Policies

|

Basis of accounting

: The financial statements include the CRISP Salary and the CRISP Hourly Plans. The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Investment contracts held by a defined contribution plan are required to be reported at fair value. However, contract value is the relevant measurement attribute for the portion of the net assets available for benefits of a defined contribution plan attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plans. The Plans invest in investment contracts through a master trust. The statement of net assets available for benefits presents the underlying fair value of the investment contracts as well as the adjustment from fair value to contract value relating to the investment contracts. The statement of changes in net assets available for benefits is prepared on a contract value basis.

Investment valuation and income recognition

: Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Plans’ investments are reported at fair value and are categorized using defined hierarchical levels directly related to the amount of subjectivity associated with the inputs to fair value measurement, as follows:

Level 1 - Quoted prices in active markets for identical assets or liabilities;

Level 2 - Observable inputs other than those included in Level 1 including quoted prices for similar assets or liabilities in active markets or quoted prices for identical assets or liabilities in inactive markets;

Level 3 - Unobservable inputs reflecting management’s own assumptions about the inputs used in pricing the assets or liabilities.

Net appreciation or depreciation in the fair value of investments, including realized gains (losses) on sales of investments, is based upon the fair value as determined by quoted market prices of the security at the beginning of the year or on an average cost basis relating to securities acquired during the year.

Interest and dividend income are recorded on the accrual basis. Security transactions are recorded as of the trade date.

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 2.

|

Summary of Significant Accounting Policies (Continued)

|

Notes receivable from participants

: Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Delinquent notes receivable are reclassified as benefits paid to participants based upon the terms of the Plans.

Administrative expenses

: Fees, brokerage commissions and expenses that are incurred directly in the interest of the Plans are charged to the Plans.

Payment of benefits

: Benefits are recorded when paid.

Use of estimates

: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and changes therein, and disclosure of contingent assets and liabilities. Actual results could differ from those estimates.

Recent accounting pronouncement

: In July 2015, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) 2015-12. This ASU simplifies several aspects of plan accounting, including updates to fully benefit-responsive investment contracts, plan investment disclosures and the measurement date practical expedient. The ASU is effective for fiscal years beginning after December 15, 2015. The adoption of this ASU is not expected to have a material impact on the Plans' financial statements.

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 3.

|

Interest in Master Trust

|

Substantially all of the Plans’ investment assets are held in a trust account at the Trustee and consist of an interest in an investment account of the Master Trust, which is a master trust established by the Company and administered by the Trustee. Use of the Master Trust permits the commingling of trust assets of the CRISP Salary and CRISP Hourly for investment and administrative purposes. Although assets of the Plans are commingled in the Master Trust, the Plans’ record-keeper maintains supporting records for the purpose of allocating the net gain or loss of the investment account to the participating Plans.

The net investment income of the investment assets is allocated by the Plans’ record-keeper to each participating plan based on the relationship of an individual plan interest to the total of the interests of the Plans.

The net assets in the Master Trust at December 31, 2015 and 2014, are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Assets:

|

|

|

|

Investment at fair value:

|

|

|

|

Common stock

|

$

|

358,525,407

|

|

$

|

342,517,102

|

|

|

Mutual funds

|

976,081,623

|

|

1,049,759,568

|

|

|

Guaranteed investment contracts

|

227,602,304

|

|

242,700,179

|

|

|

Common investment trusts

|

338,115,604

|

|

—

|

|

|

Invested cash

|

6,361,164

|

|

2,567,178

|

|

|

Total investments, at fair value

|

1,906,686,102

|

|

1,637,544,027

|

|

|

|

|

|

|

Adjustments from fair value to contract value for

|

|

|

|

fully benefit-responsive investment contracts

|

(2,190,722

|

)

|

(3,917,273

|

)

|

|

Due from broker from securities sold

|

—

|

|

298,436,496

|

|

|

Interest and dividends receivable

|

839,174

|

|

925,921

|

|

|

Total assets

|

1,905,334,554

|

|

1,932,989,171

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

Other liabilities

|

493,420

|

|

1,018,417

|

|

|

|

|

|

|

Net assets available in the Master Trust

|

1,904,841,134

|

|

$

|

1,931,970,754

|

|

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 3.

|

Interest in Master Trust (Continued)

|

The Plans’ interest in the underlying investments of the Master Trust at December 31, 2015

is summarized as follows:

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

|

Salary

|

Hourly

|

|

Assets:

|

|

|

|

Investment at fair value

|

|

|

|

Common stock

|

82%

|

18%

|

|

Mutual funds

|

77%

|

23%

|

|

Guaranteed investment contracts

|

65%

|

35%

|

|

Common investment trusts

|

73%

|

27%

|

|

Invested cash

|

76%

|

24%

|

The Plans’ interest in the underlying investments of the Master Trust at December 31, 2014 is summarized as follows:

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

|

Salary

|

Hourly

|

|

Assets:

|

|

|

|

Investment at fair value

|

|

|

|

Common stock

|

83%

|

17%

|

|

Mutual funds

|

77%

|

23%

|

|

Guaranteed investment contracts

|

66%

|

34%

|

|

Invested cash

|

78%

|

22%

|

The Plans' interest in the Master Trust, as a percentage of net assets available in the Master Trust, was approximately 76 percent for CRISP Salary and 24 percent for CRISP Hourly at both December 31, 2015 and 2014. While the Plans participate in the Master Trust, each participant's account is allocated earnings (or losses) consistent with the performance of the funds in which the participant has elected to invest in. Therefore, the Master Trust investment income/(loss) may not be allocated evenly among the Plans participating in the Master Trust.

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 3.

|

Interest in Master Trust (Continued)

|

The net investment income of the Master Trust for the years ending December 31, 2015 and 2014 is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Interest and dividends

|

$

|

41,337,480

|

|

$

|

48,457,449

|

|

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments:

|

|

|

|

Common stock

|

44,355,918

|

|

25,964,583

|

|

|

Mutual funds

|

(33,363,615

|

)

|

42,235,994

|

|

|

Common investment trusts

|

(4,108,530

|

)

|

22,067,543

|

|

|

|

6,883,773

|

|

90,268,120

|

|

|

|

|

|

|

Net investment income

|

$

|

48,221,253

|

|

$

|

138,725,569

|

|

The following presents the CRISP Salary’s investments, including underlying investments of the Master Trust, that represent 5 percent of more of the CRISP Salary’s net assets as of December 31, 2015 and 2014:

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Vanguard Equity Income Fund

|

$

|

88,394,273

|

|

$

|

90,745,092

|

|

|

Fidelity Interest Income Fund

|

148,187,874

|

|

158,200,540

|

|

|

Vanguard Total Bond Market Index Fund

|

85,076,949

|

|

87,763,010

|

|

|

Fidelity Asset Manager Fund

|

114,531,254

|

|

128,167,178

|

|

|

Vanguard Institutional Index Fund

|

193,418,402

|

|

202,658,698

|

|

|

T. Rowe Price Large Cap Growth Stock Fund

|

163,622,210

|

|

153,401,281

|

|

|

ConAgra Foods, Inc. Common Stock Fund

|

135,706,060

|

|

130,282,796

|

|

|

Vanguard Mid-Cap Index Fund

|

111,088,285

|

|

117,831,733

|

|

|

|

|

|

The following presents the CRISP Hourly’s investments, including underlying investments of the Master Trust, that represent 5 percent of more of the CRISP Hourly’s net assets as of December 31, 2015 and 2014:

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Fidelity Interest Income Fund

|

$

|

79,308,684

|

|

$

|

81,647,428

|

|

|

Vanguard Total Bond Market Index Fund

|

29,456,293

|

|

31,128,016

|

|

|

Fidelity Asset Manager Fund

|

65,284,091

|

|

72,639,887

|

|

|

Vanguard Institutional Index Fund

|

53,793,928

|

|

57,864,146

|

|

|

T. Rowe Price Large Cap Growth Stock Fund

|

36,188,887

|

|

32,895,250

|

|

|

ConAgra Foods, Inc. Common Stock Fund

|

27,532,820

|

|

27,240,248

|

|

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 5.

|

Fair Value Measurements

|

The Fair Value Measurements and Disclosures Topic of the Financial Accounting Standards Board Accounting Standards Codification defines fair value, establishes a framework for measuring fair value and requires disclosure of fair value measurements. The framework establishes a three-level fair value hierarchy based upon the assumptions (inputs) used to price assets or liabilities.

The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs.

There have been no changes in the methodologies used at December 31, 2015 and 2014, nor have there been any transfers between levels for the years ending December 31, 2015 and 2014. The following is a description of the valuation methodologies used for assets measured at fair value.

Common stocks:

Valued at the closing price reported on the active market on which the individual securities are traded.

Mutual funds:

Valued at quoted market prices, which represents the net asset values of securities held in such funds.

Guaranteed investment contracts:

Valued at the fair value of the underlying debt securities which consist primarily of governmental and asset-backed securities, collateralized mortgage obligations, and corporate bonds. The underlying debt securities are valued at quoted prices in active markets for identical or similar assets.

Common investment trusts:

Valued at the net asset value as a readily determinable fair value which is based on the fair value of the investments in the respective trusts at year-end.

Invested cash:

Valued at cost which approximates fair value.

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plans believe its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different measurement at the reporting date.

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 5.

|

Fair Value Measurements (Continued)

|

The following table sets forth by level, within the fair value hierarchy, the Plans’ assets at fair value as of December 31, 2015:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2015

|

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Investments in the Master Trust:

|

|

|

|

|

|

Company common stock

|

$

|

163,249,886

|

|

$

|

—

|

|

$

|

—

|

|

$

|

163,249,886

|

|

|

Large Cap common stock

|

195,275,521

|

|

—

|

|

—

|

|

195,275,521

|

|

|

Mutual funds:

|

|

|

|

|

|

Index funds

|

688,702,651

|

|

—

|

|

—

|

|

688,702,651

|

|

|

Value funds

|

107,412,695

|

|

—

|

|

—

|

|

107,412,695

|

|

|

Balanced funds

|

179,966,277

|

|

—

|

|

—

|

|

179,966,277

|

|

|

Guaranteed investment contracts

|

—

|

|

227,602,304

|

|

—

|

|

227,602,304

|

|

|

Common investment trusts

|

—

|

|

338,115,604

|

|

—

|

|

338,115,604

|

|

|

Invested cash

|

—

|

|

6,361,164

|

|

—

|

|

6,361,164

|

|

|

|

|

|

|

|

|

Total assets at fair value

|

$

|

1,334,607,030

|

|

$

|

572,079,072

|

|

$

|

—

|

|

$

|

1,906,686,102

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

Note 5.

|

Fair Value Measurements (Continued)

|

The following table sets forth by level, within the fair value hierarchy, the Plans’ assets at fair value as of December 31, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at Fair Value as of December 31, 2014

|

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Investments in the Master Trust:

|

|

|

|

|

|

Company common stock

|

$

|

157,523,044

|

|

$

|

—

|

|

$

|

—

|

|

$

|

157,523,044

|

|

|

Large Cap common stock

|

184,994,058

|

|

—

|

|

—

|

|

184,994,058

|

|

|

Mutual funds:

|

|

|

|

|

|

Index funds

|

737,126,803

|

|

—

|

|

—

|

|

737,126,803

|

|

|

Value funds

|

111,744,900

|

|

—

|

|

—

|

|

111,744,900

|

|

|

Balanced funds

|

200,887,865

|

|

—

|

|

—

|

|

200,887,865

|

|

|

Guaranteed investment contracts

|

—

|

|

242,700,179

|

|

—

|

|

242,700,179

|

|

|

Invested cash

|

—

|

|

2,567,178

|

|

—

|

|

2,567,178

|

|

|

Total assets at fair value

|

$

|

1,392,276,670

|

|

$

|

245,267,357

|

|

$

|

—

|

|

$

|

1,637,544,027

|

|

|

|

|

|

|

|

|

|

|

|

Note 6.

|

Synthetic Guaranteed Investment Contracts

|

The Master Trust holds investments in Synthetic Guaranteed Investment Contracts (Synthetic GICs). Synthetic GICs consist of an asset or collection of assets that are owned by the Fidelity Interest Income Fund, and benefit-responsive contract value wrap guarantee agreements purchased for the portfolio. The underlying collection of assets is presented at fair value in Note 5. In determining the net assets available for benefits at December 31, 2015 and 2014, the Synthetic GICs are recorded at their contract value of $225,411,582 and $238,782,906, respectively. Investment contracts such as these are generally valued at the contract value rather than fair value to the extent they are fully benefit-responsive.

The series of wrap guarantee agreements with insurance companies that the Master Trust holds can be utilized in the event the issuer of the Synthetic GICs falls below certain credit rating criteria or fails to meet benefit obligations per the terms of the contract. Contract value represent contributions made under the contract plus accrued interest less participant withdrawals.

Participants may ordinarily direct the withdrawal of transfer of all or a portion of their investment at contract value. The crediting interest rate of the contract is set at the state of the contract and is reset quarterly.

There are no reserves against contract value for credit risk of the contract issuers or otherwise.

Certain events limit the ability of the Plans to transact at contract value with the contract issuers. Such events include the following: (i) amendments to the Plans’ documents (including complete or partial termination or merger with another plan); (ii) changes to the Plans’ prohibition on competing investment options or deletion of equity wash provisions; (iii) bankruptcy of the Company or other Company events (e.g., divestitures or spin-offs of a subsidiary) which cause a significant withdrawal from the Plans or (iv) the failure of the Master Trust to qualify for exemption from federal income taxes or any required prohibited transaction exemption under ERISA. The Plan Administrator does not believe that the

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

occurrence of any such event, which would limit the Plans’ ability to transact at contract value with participants, is probable.

The Synthetic GICs do not permit the insurance companies to terminate prior to the scheduled maturity.

The average yield of the Synthetic GICs based on actual earnings was approximately 1.55 percent and 1.25 percent at December 31, 2015 and 2014, respectively. The average yield of the Synthetic GICs based on the interest rate credited to participants was approximately 1.53 percent and 1.43 percent at December 31, 2015 and 2014, respectively.

|

|

|

|

Note 7.

|

Federal Income Tax Status

|

The Internal Revenue Service (the IRS) has determined and has informed the Company by letters to the Plans dated September 28, 2012, that the respective Plans were designed in accordance with the applicable regulations of the Code. The Plans have been amended since receiving these letters. However, the Company and the Plan Administrator believe that the Plans are currently designed and operated in compliance with the applicable requirements of the Code and the Plans and related trusts continue to be tax-exempt.

Accounting principles generally accepted in the United States of America require plan management to evaluate tax positions taken by the Plans and recognize a tax liability (or asset) if the Plans have taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plans, and has concluded that as of December 31, 2015 and 2014, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plans are subject to routine audits by taxing jurisdictions and currently have audits in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2012.

A participant’s basic and supplemental contributions (excluding Roth) are made on pre-tax basis, i.e., excluded from gross income for tax purposes, but such contributions are subject to social security taxes. These contributions will be taxed to the participant upon receipt. Amounts contributed by the Company are currently deductible by the Company. The tax consequences of distributions to participants will vary depending on the circumstances at the time of distribution.

|

|

|

|

Note 8.

|

Related Party Transactions

|

The Master Trust investments include 3,872,151 and 4,341,870 shares of ConAgra Foods, Inc. common stock with a fair value of $163,249,886 and $157,523,044 at December 31, 2015 and 2014, respectively. The Company is the sponsor of the Plans and the Master Trust and, therefore, these transactions qualify as related party transactions.

Invested cash balances of $6,361,164 and $2,567,178 at December 31, 2015 and 2014, respectively are managed by State Street Bank and Trust Company. State Street Bank and Trust Company is the Trustee as defined by the Plans and, therefore, these transactions qualify as party-in-interest transactions.

Note 9. Reconciliations of Financial Statements to Form 5500s

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31, 2015 and 2014 for the CRISP Salary:

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Net assets available for benefits per the financial statements

|

1,466,504,957

|

|

1,489,487,834

|

|

|

Less accrued benefits paid to participants

|

5,806,807

|

|

2,999,985

|

|

|

|

|

|

|

Net assets available for benefits per the Form 5500

|

$

|

1,460,698,150

|

|

$

|

1,486,487,849

|

|

|

|

|

|

The following is a reconciliation of net assets available for benefits per the financial statements to the Form 5500 as of December 31, 2015 and 2014 for the CRISP Hourly:

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

2014

|

|

Net assets available for benefits per the financial statements

|

$

|

478,743,852

|

|

$

|

482,564,056

|

|

|

Less accrued benefits paid to participants

|

1,422,289

|

|

635,323

|

|

|

|

|

|

|

Net assets available for benefits per the Form 5500

|

$

|

477,321,563

|

|

$

|

481,928,733

|

|

The following is a reconciliation of benefits paid to participants per the financial statements to the Form 5500 for the year ended December 31, 2015 for the CRISP Salary:

|

|

|

|

|

|

|

|

|

2015

|

|

Benefits paid to participants per the financial statements

|

$

|

150,695,867

|

|

|

Add accrued benefits paid to participants at

|

|

|

December 31, 2015

|

5,806,807

|

|

|

Less accrued benefits paid to participants at

|

|

|

December 31, 2014

|

2,999,985

|

|

|

Benefits paid to participants per the Form 5500

|

$

|

153,502,689

|

|

|

|

|

The following is a reconciliation of benefits paid to participants per the financial statements to the Form 5500 for the year ended December 31, 2015

for the CRISP Hourly:

|

|

|

|

|

|

|

|

|

2015

|

|

Benefits paid to participants per the financial statements

|

$

|

48,688,768

|

|

|

Add accrued benefits paid to participants at

|

|

|

December 31, 2015

|

1,422,289

|

|

|

Less accrued benefits paid to participants at

|

|

|

December 31, 2014

|

635,323

|

|

|

Benefits paid to participants per the Form 5500

|

$

|

49,475,734

|

|

|

|

|

Note 10. Risk and Uncertainties

The Plans invest in various investment securities. Investment securities are exposed to various risks, such as interest rate, credit, and overall market volatility. Due to the level of risk associated with certain investment securities, it is reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect the amounts reported in the statement of net assets available for benefit.

ConAgra Foods Retirement Income Savings Plans

Salaried Employees

Hourly Rate Production Employees

Notes to Financial Statements

Years Ended December 31, 2015 and 2014

Note 11. Subsequent Events

On February 1, 2016, the Company completed the disposition of their Private Brands operations to Treehouse Foods, Inc. As the result of this transaction, the Plans’ net assets associated with the participants of the Private Brands operations were transferred out of the Plans in May 2016. Net assets in the amount of approximately $192.1 million were transferred out of the CRISP Salary Plan and net assets totaling approximately $155.7 million were transferred out of the CRISP Hourly Plan.

The Plan Administrator has evaluated subsequent events through the date and time the financial statements were issued.

|

|

|

|

|

|

|

|

|

|

|

ConAgra Foods Retirement Income Savings Plans

|

|

|

|

Salaried Employees

|

|

|

|

Hourly Rate Production Employees

|

|

|

|

|

|

|

|

Form 5500, Schedules H, Line 4i

|

|

|

|

Schedule of Assets (Held at End of Year)

|

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

CRISP

|

CRISP

|

|

Assets

|

Salary

|

Hourly

|

|

|

|

|

|

Plan interest in Master Trust

|

$

|

1,451,960,708

|

|

$

|

455,071,148

|

|

|

|

|

|

|

Notes receivable from participants, with interest rates

|

|

|

|

ranging from 4.25% to 10.00% with various maturity dates

|

13,588,656

|

|

22,316,286

|

|

|

|

|

|

|

Total assets

|

$

|

1,465,549,364

|

|

$

|

477,387,434

|

|

|

|

|

|

|

|

|

|

|

See accompanying reports of Independent Registered Public Accounting Firm.

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

ConAgra Foods Retirement Income Savings Plan For Salaried Employees

|

|

|

|

|

|

|

Date: June 27, 2016

|

By

|

/s/ Charisse Brock

|

|

|

|

Charisse Brock

|

|

|

|

ConAgra Foods Employee Benefits Administrative Committee

|

ConAgra Foods Retirement Income Savings Plan For Hourly Rate Production Employees

|

|

|

|

|

|

|

Date: June 27, 2016

|

By

|

/s/ Charisse Brock

|

|

|

|

Charisse Brock

|

|

|

|

ConAgra Foods Employee Benefits Administrative Committee

|

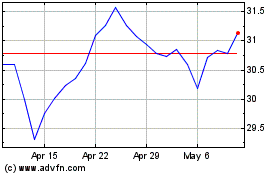

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024