UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 1, 2016

ConAgra Foods, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

1-7275 |

|

47-0248710 |

| (State of

Incorporation) |

|

(Commission

File No.) |

|

(I.R.S. Employer

Identification No.) |

|

|

| One ConAgra Drive

Omaha, NE |

|

68102 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(402) 240-4000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

EXPLANATORY NOTE

This Amendment No. 1 to the Current Report on Form 8-K, which was originally filed with the Securities and Exchange Commission on

February 1, 2016 (the “Original 8-K”), amends and restates in its entirety Item 9.01 of the Original 8-K to include the pro forma financial information required by Item 9.01 of Form 8-K with respect to the sale by ConAgra

Foods, Inc. (the “Company”) of its private label operations to TreeHouse Foods, Inc. on February 1, 2016. The remainder of the information contained in the Original 8-K is not hereby amended.

Item 9.01 Financial Statements and Exhibits.

| (b) |

Pro Forma Financial Information |

The unaudited pro forma condensed consolidated

financial information of the Company as of November 29, 2015 and for the fiscal years ended May 31, 2015, May 25, 2014, and May 26, 2013, and notes thereto, is attached as Exhibit 99.2 to this Form 8-K and is incorporated in

this Item 9.01(b) by reference.

|

|

|

|

|

| 99.1* |

|

Press Release of ConAgra Foods, Inc., dated February 1, 2016. |

|

|

| 99.2 |

|

ConAgra Foods, Inc. Unaudited Pro Forma Condensed Consolidated Financial Information as of November 29, 2015 and for the fiscal years ended May 31, 2015, May 25, 2014, and May 26, 2013. |

| * |

Previously filed with Form 8-K filed on February 1, 2016 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

CONAGRA FOODS, INC. |

|

|

|

| Date: February 5, 2016 |

|

By: |

|

/s/ Lyneth Rhoten |

|

|

|

|

Name: |

|

Lyneth Rhoten |

|

|

|

|

Title: |

|

Vice President, Securities Counsel and Assistant Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1* |

|

Press Release of ConAgra Foods, Inc., dated February 1, 2016. |

|

|

| 99.2 |

|

ConAgra Foods, Inc. Unaudited Pro Forma Condensed Consolidated Financial Information as of November 29, 2015 and for the fiscal years ended May 31, 2015, May 25, 2014, and May 26, 2013. |

| * |

Previously filed with Form 8-K filed on February 1, 2016 |

Exhibit 99.2

Unaudited Pro Forma Condensed Consolidated Financial Information

The unaudited pro forma condensed consolidated financial information is provided for informational purposes only and relate to the disposition of the

Company’s private label operations (the “Business”) to TreeHouse Foods, Inc. (“TreeHouse”) pursuant to the Stock Purchase Agreement dated as of November 1, 2015 (the “Agreement”), by and

between the Company and TreeHouse (the “Transaction”). The unaudited pro forma condensed consolidated financial information is not necessarily indicative of operating results that would have been achieved had the Transaction been

completed as of the beginning of the earliest fiscal year presented and does not intend to project the future financial results of the Company after the Transaction. The unaudited pro forma condensed consolidated balance sheet information does not

purport to reflect what our financial condition would have been had the Transaction closed on November 29, 2015 or for any future or historical period. The Company’s previously filed unaudited interim financial statements for the

twenty-six weeks ended November 29, 2015 reflect the Business as discontinued operations, and, accordingly, additional pro forma information relating to this period is not required to be included herein.

The unaudited pro forma condensed consolidated financial information should be read in conjunction with the following information:

| |

• |

|

Notes to the unaudited pro forma condensed consolidated financial information. |

| |

• |

|

Unaudited interim financial statements of the Company as of and for the twenty-six weeks ended November 29, 2015 which are included in the Company’s Quarterly Report on Form 10-Q for the twenty-six weeks ended

November 29, 2015, as filed with the Securities and Exchange Commission (the “SEC”). |

| |

• |

|

Audited financial statements of the Company as of and for the fiscal years ended May 31, 2015, May 25, 2014, and May 26, 2013, which are included in the Company’s Annual Report on Form 10-K for

the year ended May 31, 2015, as filed with the SEC. |

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Fiscal Year Ended May 31, 2015

(in

millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

ConAgra

Foods

Historical |

|

|

Pro Forma

Adjustments

(Note 3) |

|

|

Pro

Forma |

|

| Net sales |

|

$ |

15,833 |

|

|

$ |

(3,895 |

) |

|

$ |

11,938 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

12,524 |

|

|

$ |

(3,462 |

) |

|

|

9,062 |

|

| Selling, general and administrative expense |

|

|

3,472 |

|

|

|

(1,927 |

) |

|

|

1,545 |

|

| Interest expense, net |

|

|

332 |

|

|

|

(2 |

) |

|

|

330 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations before income taxes and equity method investment earnings |

|

|

(495 |

) |

|

|

1,496 |

|

|

|

1,001 |

|

| Income tax expense |

|

|

234 |

|

|

|

126 |

|

|

|

360 |

|

| Equity method investment earnings |

|

|

122 |

|

|

|

— |

|

|

|

122 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations |

|

$ |

(607 |

) |

|

$ |

1,370 |

|

|

$ |

763 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests |

|

|

12 |

|

|

|

— |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations attributable to ConAgra Foods, Inc. |

|

$ |

(619 |

) |

|

$ |

1,370 |

|

|

$ |

751 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(1.46 |

) |

|

|

|

|

|

$ |

1.76 |

|

| Diluted |

|

$ |

(1.46 |

) |

|

|

|

|

|

$ |

1.74 |

|

| Average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

426 |

|

|

|

|

|

|

|

426 |

|

| Diluted |

|

|

426 |

|

|

|

|

|

|

|

431 |

|

See accompanying notes to the Unaudited Pro Forma Condensed Consolidated Financial Information.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Fiscal Year Ended May 25, 2014

(in

millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

ConAgra

Foods

Historical |

|

|

Pro Forma

Adjustments

(Note 3) |

|

|

Pro

Forma |

|

| Net sales |

|

$ |

15,844 |

|

|

$ |

(4,006 |

) |

|

$ |

11,838 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

12,332 |

|

|

$ |

(3,421 |

) |

|

|

8,911 |

|

| Selling, general and administrative expense |

|

|

2,771 |

|

|

|

(1,001 |

) |

|

|

1,770 |

|

| Interest expense, net |

|

|

380 |

|

|

|

(2 |

) |

|

|

378 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from continuing operations before income taxes and equity method investment earnings |

|

|

361 |

|

|

|

418 |

|

|

|

779 |

|

| Income tax expense |

|

|

220 |

|

|

|

(39 |

) |

|

|

181 |

|

| Equity method investment earnings |

|

|

33 |

|

|

|

— |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

174 |

|

|

$ |

457 |

|

|

$ |

631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests |

|

|

12 |

|

|

|

— |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations attributable to ConAgra Foods, Inc. |

|

$ |

162 |

|

|

$ |

457 |

|

|

$ |

619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.38 |

|

|

|

|

|

|

$ |

1.46 |

|

| Diluted |

|

$ |

0.37 |

|

|

|

|

|

|

$ |

1.44 |

|

| Average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

421 |

|

|

|

|

|

|

|

421 |

|

| Diluted |

|

|

428 |

|

|

|

|

|

|

|

428 |

|

See accompanying notes to the Unaudited Pro Forma Condensed Consolidated Financial

Information.

Unaudited Pro Forma Condensed Consolidated Statement of Operations

For the Fiscal Year Ended May 26, 2013

(in

millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

ConAgra

Foods

Historical |

|

|

Pro Forma

Adjustments

(Note 3) |

|

|

Pro

Forma |

|

| Net sales |

|

$ |

13,469 |

|

|

$ |

(1,626 |

) |

|

$ |

11,843 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods sold |

|

|

10,104 |

|

|

$ |

(1,383 |

) |

|

|

8,721 |

|

| Selling, general and administrative expense |

|

|

2,066 |

|

|

|

(186 |

) |

|

|

1,880 |

|

| Interest expense, net |

|

|

276 |

|

|

|

(1 |

) |

|

|

275 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income taxes and equity method investment earnings |

|

|

1,023 |

|

|

|

(56 |

) |

|

|

967 |

|

| Income tax expense |

|

|

362 |

|

|

|

(32 |

) |

|

|

330 |

|

| Equity method investment earnings |

|

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

698 |

|

|

$ |

(24 |

) |

|

$ |

674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests |

|

|

12 |

|

|

|

— |

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations attributable to ConAgra Foods, Inc. |

|

$ |

686 |

|

|

$ |

(24 |

) |

|

$ |

662 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.67 |

|

|

|

|

|

|

$ |

1.61 |

|

| Diluted |

|

$ |

1.64 |

|

|

|

|

|

|

$ |

1.58 |

|

| Average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

411 |

|

|

|

|

|

|

|

411 |

|

| Diluted |

|

|

418 |

|

|

|

|

|

|

|

418 |

|

See accompanying notes to the Unaudited Pro Forma Condensed Consolidated Financial Information.

Notes to Unaudited Pro Forma Condensed Consolidated Financial Information

1. Basis of Presentation

The unaudited pro forma

condensed consolidated financial information presented here is based on the historical consolidated financial information of the Company, as previously provided in or derived from filings with the SEC. The unaudited pro forma condensed consolidated

statements of operations for the fiscal years ended May 31, 2015, May 25, 2014, and May 26, 2013 assume the Transaction was consummated as of the beginning of the earliest fiscal year presented.

2. Unaudited Pro Forma Condensed Consolidated Balance Sheet Information

The Business has been reflected as discontinued operations in the Company’s previously filed unaudited interim financial statements as of for the

twenty-six weeks ended November 29, 2015. The related assets and liabilities of the Business are reflected in the November 29, 2015 unaudited condensed balance sheet as assets/liabilities held for sale. In connection with the completion of

the Transaction, the related amounts will be eliminated from, and the net proceeds received ($2.7 billion) will be reflected in, the Company’s balance sheet. The net proceeds are subject to working capital and other adjustments pursuant to the

terms of the Transaction.

The Company has separately announced plans to use a significant portion of the net proceeds to effect the retirement or

repurchase of certain existing debt. The outcome of these actions is uncertain at this time.

3. Unaudited Pro Forma Condensed Consolidated Statements

of Operations

The unaudited pro forma condensed consolidated statements of operations include adjustments made to historical financial information

that were determined assuming the Transaction had been completed as of the beginning of the periods presented. These adjustments reflect the elimination of the results of operations of the Business as a result of the Transaction, as well as the

results of operations of certain minor private label operations that were not included in the Transaction, but which the Company expects to dispose of within the next several months. The unaudited pro forma condensed consolidated financial

information does not include the impact of potential cost savings, other operating efficiencies or other operating dis-synergies that could result from the Transaction. Furthermore, no allocation of the Company’s corporate interest costs have

been made to the divested Business and no assumed application of the net proceeds from the Transaction have been assumed for purposes of the presentation of unaudited pro forma condensed consolidated statements of operations included herein.

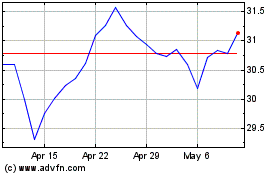

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024